File - Department of Electrical and Systems Engineering

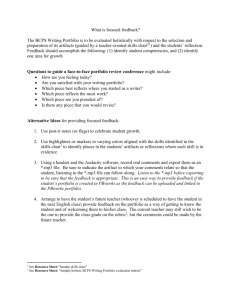

advertisement

The Black-Litterman Model

1

The Black Litterman Model for Portfolio Optimization and Analysis

Samuel Wood

Washington University in St. Louis

Department of Electrical and Systems Engineering

The Black-Litterman Model

2

ABSTRACT

The Black-Litterman model for risky asset allocation attempts to improve on the portfolio

optimization techniques defined under Modern Portfolio Theory first proposed by Henry

Markowitz in the 1950s. In this paper, I attempt to explain the model and construct an

experiment to test its effectiveness in both establishing a benchmark and expressing views by

comparing it to a portfolio weighted using market capitalization and a portfolio constructed using

the mean-variance optimizations methods from Markowitz. The experiment was conducted in a

blind round and a non-blind round using historical data and different sets of portfolio assets.

Through this experiment I learned about poor implementations of the model and how they can

affect results negatively. Even though my results were not impressive, I was able to establish

that with the proper understanding and forecasting ability, the Black-Litterman model can be an

improved alternative to the original portfolio optimization methods.

The Black-Litterman Model

3

Table of Contents

Introduction and Background ......................................................................................................... 4

Problem Statement and Objectives ................................................................................................. 5

Methods........................................................................................................................................... 6

Results ........................................................................................................................................... 12

Discussion ..................................................................................................................................... 13

Conclusions ................................................................................................................................... 13

References ..................................................................................................................................... 16

Appendix A ................................................................................................................................... 17

Appendix B ................................................................................................................................... 19

Appendix C ................................................................................................................................... 21

The Black-Litterman Model

4

Introduction and Background

In March of 1952, Harry Markowitz published the paper “Portfolio Selection” in The Journal of

Finance. In it, he outlines a method for portfolio marking the inception of Modern Portfolio

Theory in finance. The method attempts to maximize portfolio expected return given a certain

level of risk using the mean and variance of expected returns for individual assets.

This paper,

along with two others, outline one of the most significant contributions to modern day finance

and earned Markowitz a Nobel Prize in economics. While mean-variance optimization might be

the best structured theory we have for optimizing portfolios it is difficult to implement in

practice. The output asset weights are extremely sensitive to inputs and the inputs are extremely

difficult to obtain. It also is not possible for investors to express their opinions on relative asset

performance and their confidence in their selected expected asset returns. There are several

methods beyond Markowitz that use its basic structure but attempt to address its major

implementation problems.

One notable method that attempts to improve upon the standard mean-variance optimization

model is the Black-Litterman model for portfolio allocation. It was first created in 1990 at

Goldman Sachs by Fischer Black and Robert Litterman and published in the paper “Global

Portfolio Optimization” published in 1992 September/October edition of Financial Analysts

Journal. In it they outline a model that provides a better method asset return generation than

estimating returns and a method that provides and intuitive and clear way for investors to

express, or on the contrary not express, their relative views on future asset performance. Their

method for asset return generation attempts to create a starting point for shrinkage of the

covariance matrix by using reverse optimization to back into distributions of returns from the

equilibrium market portfolio. From this equilibrium distribution, investors views, both partial

The Black-Litterman Model

5

and complete, are allowed to be combined with prior information generating adjusted returns that

are incorporated into the mean-variance optimization model.

After the Black-Litterman method was published in 1992 many other versions of the

method were created some being more mathematically sound that others. One partial reason for

the variation of methods is that a complete mathematical representation was not published in the

initial article. Only framework for the method along with a difficult worked example based on

the global equilibrium. Many of the methods published include incorrect speculations and

mathematically unsound adjustments. This includes many so called “Beyond Black-Litterman”

models that attempt to remove some of the canonical structures. Many of these have been

debunked as useful models. Many legitimate extensions to the Black-Litterman model have been

created some of which are not consistent with the original. Models truly based of BlackLitterman must have its estimates as distributions and include the parameter Tau.

Problem Statement and Objectives

I would like to implement the Black-Litterman model for asset allocation in its canonical form

and test its performance in comparison with the market and the original mean-variance

optimization method. Investors have been searching for an improved method of portfolio

optimization for years. There is much discrepancy in the effectiveness of certain methods of

portfolio optimization because of the inability in reproducing a consistent test experiment. I will

use various methods for portfolio comparison to test multiple portfolios against each other using

sets of historical data obtained from Yahoo finance.

My first objective will to be to set up a portfolio construction tool using MATLAB that

will take in names of stocks and a historical time horizons and generate a portfolio with weights

based on market capitalization during the first date of the horizon. Functions included in the tool

The Black-Litterman Model

6

will calculated portfolio performance measures based on risk, return, and the risk return trade

off. The portfolio tool will also include functions that reallocate weights based on different both

traditional mean-variance optimization and the Black-Litterman model for asset allocation.

My second objective will to be to test the Black-Litterman model against the market

weighted portfolio and the traditional mean-variance optimization method. This may be difficult

because experiments are impossible to be completely controlled and opinions of future stock

performance may be incorrect or they may change during the course of the horizon period. As

the portfolio will not be rebalanced because of assumptions that it is costly, this could have an

effect on the overall portfolio performance. Models will be evaluated on both risk and return but

most importantly their risk-return trade off.

Methods

MATLAB Portfolio Implementation

The main purpose of this paper was to compare different methods of portfolio optimization,

specifically the Black-Litterman model, but in order to test these models an implementation

framework was required. I chose to use MATLAB as the computing program for the

implementation of my experiment. It is easy to use, allows for object oriented programing and

allows for simple access to historical data on companies through Yahoo Finance. The portfolios

were constructed using the Cell Array class and filled with stocks represented by using the

Structures class. Functions were made to pull stock information and implant it into stocks,

organize them into portfolios, optimize weights, and measure performance. I was going to use

the object-oriented interface in MATLAB for the basis of the portfolio construction, but the other

method was simpler to implement and accomplishes the same task. Normally, I would be

The Black-Litterman Model

7

concerned with the speed and overall organization of the program but because this is only meant

to explore historical data and will not be used in the future I don’t see it as a problem.

Explanation of Markowitz and CAPM

Basic Markowitz portfolio optimization uses linear algebra and statistical assumptions of future

asset returns to create optimal weights for asset allocation. The optimal portfolio is based off of

the interpretation that risk is represented by volatility and the method minimizes a portfolios

standard deviation while maximizing its expected return. It makes the assumption that all

investors are risk averse, meaning that given two different portfolios of with the same expected

return, the portfolio with less risk will be chosen. Investors are assumed to only take higher risks

if it pays off with a higher expected return. First, an ordered vector of individual asset expected

returns1. is constructed. A covariance matrix2 comparing all assets is then constructed which is

equal to the variance matrix for the portfolio. This is important because its non-diagonal entries

represent the correlations between each asset and the diagonal entries represent the variance of

each asset. The correlations are used to minimize the idiosyncratic risk of the portfolio by

minimizing the overall correlation between stocks used and thus minimizing the portfolio

variance. Unfortunately, we are not able to get rid of all the portfolio risk. The idiosyncratic risk

is lowered by portfolio diversification. Even when all non-systematic risk is diversified away the

systematic remains. The efficient frontier of portfolios for a set of risky assets is the portfolios

that contain combinations of these assets with the best possible expected return for each given

level of risk. Markowitz’s method weights the assets so it is the efficient portfolio for the given

level of risk or target return. The portfolio with the greatest risk-return trade of on the efficient

frontier is called the tangency portfolio3..

The Black-Litterman Model

8

The capital asset pricing model4. (CAPM) is a model used to determine the theoretically

appropriate required rate of return on an asset. It only considers the systematic risk of an asset

because it assumes the asset is being added to a portfolio with its idiosyncratic risk diversified

away. The linear models inputs are the assets sensitivity to non-systematic risk, or beta, and the

expected return of the market and the risk free rate. The CAPM assumes that the sensitivity to

systematic risk with respect to the market determines the required return of on the asset.

Portfolio Performance and Risk Measures

The three performance measures that I used in analyzing the portfolios was the Sharpe ratio, the

Modigliani- Modigliani measure (M Squared) and Jensen’s alpha. The Sharpe ratio5. is a

performance measure that takes the return on an investment and then adjusts it for its underlying

risk. It allows for the ranking of portfolios that take different levels of risk. For instance, one

portfolio might have a high return might have a lower Sharpe ratio than a portfolio that gives

medium returns but takes on a significantly lower amount of risk. The second measure is the M

Squared measure6.. It is the Sharp ratio adjusted into units of percent return compared to a

benchmark. This gives a significant advantage over the traditional Sharpe ratio which is unitless

and abstract. The last measure of portfolio performance is Jensen’s alpha7.. Alpha represents the

abnormal returns of an asset or a group of assets over the expected returns. The expected returns

for an asset or portfolio are usually calculated using the CAPM.

The three risk metrics that I used to measure the different underlying risks of the tested portfolios

are the portfolio beta, volatility, and the value at risk (VaR.) The portfolio beta8. is the measure

of a its exposure to systematic risk. As mentioned before, systematic risk is the risk arising from

general exposure to the stock market and it cannot be diversified away. The beta measure is

calculated using a set of benchmark returns representing the market portfolio and compares them

The Black-Litterman Model

9

to the returns of an asset. A beta greater than zero but less than one indicates an asset that trends

with the market with smaller movements. A beta of one indicates an asset trends with the market

with the same amount of movement. A beta greater than one indicates an asset trends with the

market, but with larger movement. A portfolio beta is calculated using a weighted average of the

asset betas. The volatility9. of an asset is a measure of the variation or standard deviation in its

price over a period of time. In financial theory, it is the most quantifiable measure of an asset or

a group of assets risk. A portfolios VaR is the risk of loss on a specific portfolio of assets. If a

stock has a one-week 10% VaR of $1 thousand then there is a ten percent chance that the

portfolio will fall in value by more than $1 thousand in a week’s period. VaR can be calculated

using a set of historical returns based off the period length that is in order. Then the lowest

percent of the histogram equal to the percent VaR is market and the closest return is multiplied

by the portfolio to get the historical VaR.

Explanation of Black-Litterman

Two of the most significant contributions of the Black-Litterman model to portfolio optimization

are its intuitive prior distribution17. and its method for specify investor’s views on returns

represented as a conditional distribution16.. The model seeks to improve on the unintuitive and

input-sensitive nature of the mean variance optimization model.

The Black-Litterman model begins by solving for the prior distribution of return by using

weights based on market capitalization. This gives a neutral and effective platform for

expressing our views. The implied risk aversion coefficient10. is solved by dividing the expected

Sharpe Ratio of the market capitalization portfolio by the variance of the market capitalization

portfolio. The covariance matrix is solved is found using the same method used by mean-

The Black-Litterman Model

10

variance optimization. Reverse optimization is used to solve for the Implied Equilibrium Return

Vector11. which is the estimate for the unknown mean of the expected returns.

Next, we solve for the conditional distribution that will store relative and absolute views on

assets. When defining views in the Black-Litterman model K represents the number of views

and N the number of assets. K can be less than or equal to the number of assets N. Views are

expressed in the P12. matrix by rows that assign numbers corresponding assets that are

represented by columns. Asset will correspond to the number column that is the same as its

order in the rest of the model inputs. The Q matrix then corresponds to the expected returns that

correspond to each view. Views can be relative in which case the sum of the row will be zero, or

absolute where it will be represented by a one in a single column. The Omega matrix

corresponds to the covariance of the views or the relative confidence associated with the view.

The most intuitive way to calculate the elements of Omega13.15. is by specifying a confidence14.

associated with the view and solving backwards using Idzorek’s extension. The extension uses

the Alternative Reference Model which drops and allows us to drop the factor Tau.

The prior and conditional distributions are then combined to eventually solve for the final

portfolio weights using mean-variance optimization and Bayesian Probability18.. First, the

posterior estimate distribution of the expected returns is solved for using Bayes Theorem19.. A

posterior distribution is a probability distribution of an unknown quantity that is treated as a

random variable and is conditional on prior or experimental data. The posterior probability is the

probability or the parameter given the evidence while the likelihood function in contrast is the

probability of the evidence give the parameter. The mean return20. and variance21. of the

posterior distribution are solved for. The posterior covariance23. of returns is solved for by

adding the variance of the estimate about the mean to the variance of the posterior distribution.

The Black-Litterman Model

11

The final weights24. can then be solved using the posterior estimates for the mean and variance of

the returns.

Experiment Setup Details

In order to test the Black-Litterman model I used historical data of large companies from the

S&P 500 stock index. The S&P 500 is one of the best representations of the status of the United

States equities market. This is because it consists of equity for large publically traded companies

sold on the New York Stock Exchange or the NASDAQ weighted based on market

capitalization. For each portfolio I constructed I used twenty different stocks from different

sectors of the economy. I used equity because it is the best representation of a risky asset.

Twenty large stocks were used because I wanted to diversify much of the idiosyncratic risk out

of the portfolio but I also wanted to minimize the number of expected returns I would have to

predict. Ideally, I would have include fifty stocks to minimize the idiosyncratic risk.

Three portfolios were considered. Each portfolio will consist of the same sets of stocks but

different weights. The first portfolio was weighted using the period’s initial market caps. This is

a decent baseline because it behaves much like the S&P 500. The biggest differences are its

asset count and the lack of free-floating weights. This unfortunately could not be dealt with and

so must be taken into consideration when used as a benchmark. The second portfolio used has

weights based on traditional mean-variance optimizations. This portfolio’s weights were not

readjusted during the test period. The input expected asset returns will be predicted based on

financial return data from the previous years. The last portfolio had weights based on the BlackLitterman model. The inputs to this model came from my opinions on some stocks for the period

and historical data prior to the test period.

The Black-Litterman Model

12

Test periods were three years in length. This is enough to see results in the true performance of

the portfolios. This was be done fifteen times for each portfolio in two rounds. The first round

consisted of a blind study of ten different combinations for stock sets during the early eighties. I

expect that the three portfolios will perform very similarly as I don’t think I will be able to

correctly and consistently speculate the performance of the individual assets. The second round

consisted of the same study but knowing the outcome of the stocks of the S&P during the period.

I expect that because I know the outcome of the individual assets the expected returns of the

assets will be much easier to obtain and thus the Black-Litterman model portfolio model will

perform the best followed by the mean-variance portfolio and then the market capitalization

weighed portfolio. The data used for the prediction period will be from three years prior to the

investment period for all inputs except for the individual stock beta and volatility values. Those

values will be calculated using five years prior.

Results

For the most part, the results turned out as expected. For the first round, the Sharpe ratios for the

optimization methods hovered slightly higher than the market capitalized portfolio sharp of .58.

The beta for the market capitalization portfolio was around 1.2, the beta for the mean-variance

optimization portfolio was around 1.4 and the beta for the Black-Litterman method was around

.9. They have volatilities and VaRs that ranked in the same order. The VaR and volatility for

the Markowitz method were substantially higher than the others. For the second round, the

Sharpe ratios for the Black-Litterman was around 1.13 and the Markowitz and market portfolios

were close to or the same as in the first round. The returns of each were different but the betas of

each were also very different. The beta for the market capitalization portfolio was around 1.2,

the beta for the mean-variance optimization portfolio was around .86 and the beta for the Black-

The Black-Litterman Model

13

Litterman method was around 2.46. They have volatilities and VaRs that ranked in the same

order. The VaR and volatility for the Markowitz method and Black-Litterman Model were

substantially higher than the others.

Discussion

The results of the experiment shed light on the quality of the Black-Litterman model in

comparison with the original mean-variance optimization model. I tested the Black-Litterman

model to see if I could identify it as a relative success in the field of portfolio optimization. The

biggest advantage I could see from using the Black-Litterman model was having the ability to

adjust expected returns from a base line and weighting them based on confidence. This is what I

would be focusing on when testing. During the analysis, I did not thoroughly look into the

alphas and M Squared measures of performance even though I included them. In comparing

portfolios together, the alpha is difficult to interpret and the M Squared measure displays the

same information as the Sharpe ratio. The most important evaluation of the relative success of a

portfolio is the Sharpe measure.

In the blind round, I was only able to look at financial information for the portfolio companies

before the start of the testing period. Although, because I was testing historical period, the

blindness of the experiment was not perfect. That being said, I tried not to incorporate any

obvious outcome views into my expected return predictions. The results of this experiment were

performances slightly higher for optimized portfolios than I previously expected. This may have

resulted from including knowledge of the economy in general during the period in question. It

was difficult to not include this information because of some knowledge of previous market

performance. The risk measures for the mean-variance portfolio turned out to all be high which

The Black-Litterman Model

14

may stem from the difficulty in expressing weights and there are indications of high amounts of

idiosyncratic risk taken when comparing the size of the value at risk and the beta. The inputs to

the Black-Litterman model were all conservative this round which is reflected in the lower-thanmarket risk measures.

In the un-blind round, I was able to look at the financial performance for the portfolio companies

during the period in question. That being said, I restricted myself to only simple and short

estimation calculations to save time. The results of this experiment were similar to the first

round with the exception of the risk metrics of the mean-optimized portfolio and the higher

performance of the Black-Litterman model. The market capitalization portfolio remained

constant as it should. The mean-variance model turned out to have a slightly lower Sharpe and

beta but a higher volatility and value at risk. This may have been a result of my inability to

successfully identify proper expected returns for all twenty assets in the portfolio. The

performance of the Black-Litterman model was greater in the second round. This could be due

to me using expected returns for stocks that I was sure of. The risk measures for the BlackLitterman model were also substantially higher than in the first round. This would most likely be

explained by the overweighting of individual stocks and the portfolio in general. This is due to

specifying much higher confidences.

Conclusions

The experiments performed, both blind and un-blind, were revealing to the relative performance

of the Black-Litterman model. It seems to be the superior model to the mean-variance

optimization model in many ways, it is still difficult to use and only produces results if you can

predict some expected returns. The lack of complete documentation of the original model when

it was announced resulted in a multitude of confusing and sometimes incorrect versions of the

The Black-Litterman Model

15

model presented in literature. There are also many different correct variations of the model that

improve upon it. It is difficult to tell the difference between the two which poses a potential

problem. Although all of my model is correct, some of the chosen methods seem to have been

substantially less superior to others later found in literature. I am specifically referring to

specifying the correlation matrix of the investor’s views. I used Idzorek’s method from

supplying confidences which was arbitrary and difficult to use. It would have been wiser for me

to use a different method such as a proportion to the variance of the prior distribution or the

method for supplying specific confidence intervals. This would have resulted in more reasonable

weights for views that I expected a high confidence in. Even with these added weights, the

Black-Litterman model performed significantly better in the second round showing that my

estimated views helped with the overall performance. The Black-Litterman model is most useful

to an investor that is able to optimize the variations of the model to his advantage, understands its

complexities, and is able to successfully predict the expected return for a small number of assets.

The Black-Litterman Model

16

References

[1] R. C. Merton, “An Intertemporal Capital Asset Pricing Model,” Econometrica, vol. 41, no.

5, pp. 867–887, Sep. 1973.

[2] F. Black and R. Litterman, “Global Portfolio Optimization,” Financial Analysts Journal,

vol. 48, no. 5, pp. 28–43, Sep. 1992.

[3] W. F. Sharpe, “Mutual Fund Performance,” The Journal of Business, vol. 39, no. 1, pp.

119–138, Jan. 1966.

[4] H. Markowitz, “Portfolio Selection*,” The Journal of Finance, vol. 7, no. 1, pp. 77–91,

Mar. 1952.

[5] A. J. McNeil, R. Frey, and P. Embrechts, Quantitative Risk Management: Concepts,

Techniques, and Tools: Concepts, Techniques, and Tools. Princeton University Press, 2010.

[6] C. F. A. Walters, “The Black-Litterman Model in Detail,” Social Science Research

Network, Rochester, NY, SSRN Scholarly Paper ID 1314585, Jun. 2014.

[7] C. Mankert, “The Black-Litterman Model : mathematical and behavioral finance

approaches towards its use in practice,” 2006.

[8] C. Mankert, “The Black-Litterman Model : mathematical and behavioral finance

approaches towards its use in practice,” 2006.

[9] M. C. Jensen, F. Black, and M. S. Scholes, “The Capital Asset Pricing Model: Some

Empirical Tests,” Social Science Research Network, Rochester, NY, SSRN Scholarly Paper

ID 908569, Jun. 2006.

[10] J. T. Chong, Y. Jin, and G. M. Phillips, “The Entrepreneur’s Cost of Capital: Incorporating

Downside Risk,” Business Valuation Review, vol. 33, no. 3, pp. 81–91, Sep. 2014.

[11] C. F. A. Walters, “The Factor Tau in the Black-Litterman Model,” Social Science Research

Network, Rochester, NY, SSRN Scholarly Paper ID 1701467, Oct. 2013.

[12] M. C. Jensen, “The Performance of Mutual Funds in the Period 1945-1964,” Social Science

Research Network, Rochester, NY, SSRN Scholarly Paper ID 244153, May 1967.

[13] P. Jorion, Value at Risk: The New Benchmark for Managing Financial Risk, 3rd Edition,

3rd edition. New York: McGraw-Hill, 2006.

The Black-Litterman Model

Appendix A: Equations

References to equations in the main portion of the paper will be marked with a superscript

corresponding ordering of equations below.

Markowitz and CAPM

1.

2.

3.

4.

Portfolio Performance and Risk Metrics

5.

6.

7.

8.

9.

Black-Litterman Model

10.

17

The Black-Litterman Model

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

18

The Black-Litterman Model

22.

23.

24.

19

The Black-Litterman Model

Appendix B: Portfolio Results

Blind Test Results

Un-Blind Test Results

20

The Black-Litterman Model

21

Appendix C: MATLAB Code

Functions for the Creation and Analysis of Portfolios

function [portfolio] = AddStocks(portfolio, stocks)

%Adds a list of stocks to input portfolio cell array. Socks are set up

%as structures and asigned ticker symbols based on the input cell array of

%stock tickers

[n, m] = size(stocks);

if n == 1

n = m;

end

if ~(iscellstr(stocks))

error('Error: stocks attempting to be added are not in cell array or

string')

end

for i = 2:(n+1)

portfolio{i} = struct('Weights',0,'Ticker',stocks{(i-1)},

'MarketCapital',0,'Historical_Prices',[],

'Historical_Returns',[],'Volume',0,'Value',0,

'First_HDate','','Last_HDate','','Beta',0,'Volatility',0);

end

end

function [ portfolio, pmeasures ] = CreatePortfolio()

%Function creates a cell array of structures called the portfolio and adds

%the S&P 500 index fund in the form of a structure to the first positions

%in the portfolio. The index is only used as a benchmark for the rest of

%the stocks in the portfolio. The a structure of portfolio measures is also

%created to store relevant portfolio data.

if (nargin == 0)

pmeasures =

struct('StartingValue',0,'PWeights',[],'Historical_Value',[],'Returns',[],

'AverageReturns',0,'STDReturns',0,'RiskFree',0,'Beta',0,'Volatility',

0,'Sharpe',0,'Alpha',0,'MSquared',0,'hVaR',[],'hVaRD',0,'TotalValue',0);

portfolio = cell(1,1);

portfolio{1} = struct('Weights',0,'Ticker','^GSPC','MarketCapital',0,

'Historical_Prices',[], 'Historical_Returns',[],'Volume',0,'Value',0,

'First_HDate','','Last_HDate','','Beta',0,'Volatility',0);

else

error('Error 1: Wrong Amount Of Inputs')

end

end

function [pmeasures] = H_Var( pmeasures, percentage)

% Calculates the historical Value at Risk for a portfolio given a certain

% input VaR percentage. It puts the portfolio returns in numerical order

The Black-Litterman Model

% and then multiplies the starting value of the portfolio by the return

% that corresponds to the entry closest to the VaR percentage on the tail

% of the histogram of returns. This represents the lowest value that

% should be lost 1-VaR% of the time for the return period.

[n m] = size(pmeasures.Returns);

returnsinorder = sort(pmeasures.Returns);

VaR = [];

x = floor(n*percentage);

for i = 1:x

VaR(i) = returnsinorder(i);

end

pmeasures.hVaRD = VaR(x)*pmeasures.StartingValue;

pmeasures.hVaR = VaR;

end

function [pmeasures] = MSquared(portfolio,pmeasures)

%M Squared measure calculated

period = pmeasures.Period;

if period == 'm'

mult = sqrt(12);

elseif period == 'w'

mult = sqrt(52);

elseif period == 'd'

mult = sqrt(252);

end

sharpe = pmeasures.Sharpe;

rf = pmeasures.RiskFree;

market = (portfolio{1}.Historical_Returns - rf);

stdmarket = std(market);

msquared = mult*(sharpe*stdmarket + rf);

pmeasures.MSquared = msquared;

end

function [pmeasures] = PortfolioAlpha(portfolio, pmeasures)

%Jensen's alpha is output.

period = pmeasures.Period;

if period == 'm'

mult = sqrt(12);

elseif period == 'w'

mult = sqrt(52);

elseif period == 'd'

mult = sqrt(252);

end

market = mean(portfolio{1}.Historical_Returns);

22

The Black-Litterman Model

pmeasures.Alpha = ...

mult*(pmeasures.AverageReturns - ((pmeasures.Beta)*(

market - pmeasures.RiskFree)));

23

...

end

function [pmeasures] = PortfolioBeta( portfolio, pmeasures )

%Portfolio Beta is calculated using a weighted average of the portfolio

%weights and individual sset betas.

[n, m] = size(portfolio);

if n == 1

n = m;

end

weights = pmeasures.PWeights;

[z, w] = size(weights);

if z < w

weights = transpose(weights);

end

beta = 0;

for i = 2:n

beta = beta + ((weights(i-1))*(portfolio{i}.Beta));

end

pmeasures.Beta = beta;

end

function [pmeasures] = PortfolioReturns(portfolio, pmeasures)

%takes an weighted average of individual asset returns and outputs

%portfolio returns. Also calculates the excess returns and average of the

%excess returns using a set risk free rate.

rf = pmeasures.RiskFree;

[n, m] = size(portfolio);

if n == 1

n = m;

end

[x, y] = size(portfolio{1}.Historical_Returns);

if x == 1

x = y;

end

returns = zeros(x,1);

The Black-Litterman Model

weights = pmeasures.PWeights;

[z, w] = size(weights);

if z < w

weights = transpose(weights);

end

for i = 2:n

returns = returns + (weights(i-1)*portfolio{i}.Historical_Returns);

end

pmeasures.Returns = returns;

exreturns = returns - rf;

pmeasures.AverageReturns = mean(exreturns);

pmeasures.STDReturns = std(exreturns);

end

function [pmeasures] = PortfolioSharpe(pmeasures)

%Outputs portfolio Sharpe

period = pmeasures.Period;

if period == 'm'

mult = sqrt(12);

elseif period == 'w'

mult = sqrt(52);

elseif period == 'd'

mult = sqrt(252);

end

pmeasures.Sharpe = (mult*(pmeasures.AverageReturns))/pmeasures.STDReturns;

end

function [portfolio, pmeasures] = PortfolioValue(portfolio,pmeasures)

%Portfolio value is calulated by multiplying the individual asset prices

%the initial volume.

[n, m] = size(portfolio);

value = 0;

if n == 1

n = m;

end

for i = 2:n

price = portfolio{i}.Historical_Prices;

volume = portfolio{i}.Volume;

portfolio{i}.Value = price*volume;

value = value + (price*volume);

end

pmeasures.Historical_Value = value;

end

24

The Black-Litterman Model

function [pmeasures] = PortfolioVolatility(portfolio,pmeasures)

%Weighted average of asset volatilties.

[n, m] = size(portfolio);

if n == 1

n = m;

end

weights = pmeasures.PWeights;

[z, w] = size(weights);

if z < w

weights = transpose(weights);

end

volatility = 0;

for i = 2:n

volatility = volatility + (weights(i-1)*portfolio{i}.Volatility);

end

pmeasures.Volatility = volatility;

end

function [ pmeasures ] = SetRiskFree( pmeasures,rf,period )

%Sets the risk free rate and the period length.

pmeasures.Period = period;

pmeasures.RiskFree = rf;

end

function [ pmeasures ] = SetStartingValue(pmeasures,value)

%Sets the staring value of the portfolio

pmeasures.StartingValue = value;

end

function [portfolio] = UpdateBeta(portfolio)

%Updates the beta for each indiviual asset in a portfolio for a time

%horizon

[n, m] = size(portfolio);

if n == 1

n = m;

end

SandPreturns = portfolio{1}.Historical_Returns;

25

The Black-Litterman Model

for i = 1:n

returns = portfolio{i}.Historical_Returns;

%check if cov is right later

covar = cov(SandPreturns,returns,0);

portfolio{i}.Beta = (covar(1,2)/var(SandPreturns));

end

end

function [portfolio, pmeasures] = UpdateHorizon(c,portfolio,pmeasures,

firstdate, lastdate, period)

%Updates the time horizon, and retreives prices for individual assets.

%These historical values are used to to calulate volumes and market caps.

%Calculates the total value of the portfolio using the market caps.

[n, m] = size(portfolio);

if n == 1

n = m;

end

for i = 1:n

portfolio{i}.First_HDate = firstdate;

portfolio{i}.Last_HDate = lastdate;

ticker = portfolio{i}.Ticker;

prices = flipud(fetch(c,ticker,'Adj Close',firstdate,lastdate,period));

portfolio{i}.Historical_Prices = prices(:,2);

if ~(i == 1)

volume = fetch(c,ticker,'Volume',firstdate);

portfolio{i}.MarketCapital = volume(2)*prices(1,2);

end

end

tvalue = 0;

for i = 2:n

tvalue = tvalue + portfolio{i}.MarketCapital;

end

pmeasures.TotalValue = tvalue;

end

function [portfolio] = UpdateReturns(portfolio)

%Updates the historical returns of individual assets.

[n, m] = size(portfolio);

if n == 1

n = m;

end

z = portfolio{1}.Historical_Prices;

26

The Black-Litterman Model

[x, y] = size(z);

if x == 1

x = y;

end

for i = 1:n

prices = portfolio{i}.Historical_Prices;

for j = 1:(x-1)

returns(j,1) = (prices(j+1)-prices(j))/prices(j);

end

portfolio{i}.Historical_Returns = returns;

end

end

function [portfolio] = UpdateVolatility(portfolio, period)

%Calculates the volatility of individual assets of a portfolio.

[n, m] = size(portfolio);

if n == 1

n = m;

end

if period == 'w'

%check annualized number

annualizer = sqrt(52);

elseif period == 'd'

annualizer = sqrt(252);

else

error('period is neither weekly or daily or is in improper format')

end

for i = 1:n

returns = portfolio{i}.Historical_Returns;

portfolio{i}.Volatility = std(returns)*annualizer;

end

end

function [portfolio] = UpdateVolume(portfolio,pmeasures)

%Updates the volume of individual assets in the portfoli using the starting

%value weighted and and historical prices

[n, m] = size(portfolio);

if n == 1

n = m;

end

27

The Black-Litterman Model

tvalue = pmeasures.StartingValue;

for i = 2:n

weight = portfolio{i}.Weights;

value = tvalue*weight;

price = portfolio{i}.Historical_Prices(1);

portfolio{i}.Volume = value/price;

end

end

function [portfolio,pmeasures] = UpdateWeights(portfolio,pmeasures)

%Updates portfolio weights using stock market capitalization

[n, m] = size(portfolio);

if n == 1

n = m;

end

value = pmeasures.TotalValue;

for i = 2:n

stockvalue = portfolio{i}.MarketCapital;

portfolio{i}.Weights = (stockvalue/value);

pmeasures.PWeights(i-1) = (stockvalue/value);

end

end

Functions for Optimizing Portfolio

function [pmeasures] = Markowitz( portfolio, pmeasures,mean)

%Calculates weights using the mean-variance optimization method.

[n, m] = size(portfolio);

if n == 1

n = m;

end

covariance = [];

s = [];

rf = pmeasures.RiskFree;

for i = 2:n

covariance = ...

[covariance portfolio{i}.Historical_Returns];

s = [s 1];

end

sigma = cov(covariance);

invsigma = inv(sigma);

expected = (mean-rf);

28

The Black-Litterman Model

num = invsigma*expected;

den = s*num;

t = num/den;

pmeasures.PWeights = t;

for i = 2:n

portfolio{i}.Weights = t(i-1);

end

end

function [views] = MakeViews(P,Q,Confidence)

%Adding views for Black-Litterman model to a structure.

[n, m] = size(P);

if n > m

P = transpose(P);

end

[x, y] = size(Q);

if x < y

Q = transpose(Q);

end

views = struct('P',P,'Q',Q,'Confidence',Confidence);

end

function [pmeasures] = BlackLitterman(portfolio,pmeasures,views)

%Calclates portfolio weights using the Black-Litterman model.

covariance = [];

[n, m] = size(portfolio);

if n == 1

n = m;

end

sharpe = .5;

P = views.P;

Q = views.Q;

Confidence = views.Confidence;

rf = pmeasures.RiskFree;

weights_mc = transpose(pmeasures.PWeights);

for i = 2:n

covariance = [covariance (portfolio{i}.Historical_Returns-rf)];

end

29

The Black-Litterman Model

30

Sigma = cov(covariance);

std_m = sqrt(transpose(weights_mc)*Sigma*weights_mc);

delta = (sharpe)/std_m;

alpha = (1-Confidence)./Confidence;

Omega = diag(alpha*P*Sigma*transpose(P));

Pie = delta*Sigma*weights_mc;

Postest = Pie + Sigma*transpose(P)*inv(( ...

P*Sigma*transpose(P)) + Omega)*(Q-P*Pie);

M = Sigma + Sigma*transpose(P)*inv(( ...

P*Sigma*transpose(P)) + Omega)*(P*Sigma);

Sigmap = Sigma+M;

weights = transpose(Postest)*inv(delta*Sigmap);

pmeasures.PWeights = weights;

for i = 2:n

portfolio{i}.Weights = weights(i-1);

end

end

Example Portfolio Creation Script

%script runs 3 portfolio models all with the same starting value and set of

%stocks. This example script was not used in the testing.

c = yahoo;

Stocks = {'T','BA','C','COKE',

'GE','XOM','JPM','PFE',

'PG','HPQ','CAT','INTC',

'MCD','AA','DIS','MSFT',

'MMM','HON','DD','PEP'};

%[AT&T, Boeing, Citi, Coke, GE, Exxon, JPMorgan, Pfitzer

%P&G, HP, Caterpillar, Intel, McDonalds, Alcoa, WaltDisney

%Microsoft, 3m, Honeywell, duPont,]

P = [1 0 0

0 0 0

0 0 0

0 0 0

0 0 0

Q = [.3

.07

.2

.09

.2];

0

1

0

0

0

0

0

0

0

0

0

0

1

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1

0

0

0

0

0

0

0

0

0

0

1

0

0

0

0

0

0

0

0

0

0];

The Black-Litterman Model

Confidence = [.10 .2 .3 .09 .09];

mean = [.07;.12;.06; .08;

.08;.09;.09;.06;

.10;.14;.10;.13;

.02;.07;.01;.16;

.03;.06;.06;.07;];

views = MakeViews(P,Q,Confidence);

[market, marketMeasures] = CreatePortfolio();

[markowitz, markowitzMeasures] = CreatePortfolio();

[blacklitterman, blacklittermanMeasures] = CreatePortfolio();

Bstart = '01/03/2000';

Bend = '01/03/2004';

pstart = '01/03/2005';

pend = '01/03/2008';

market = AddStocks(market, Stocks);

markowitz = AddStocks(markowitz, Stocks);

blacklitterman = AddStocks(blacklitterman, Stocks);

marketMeasures = SetRiskFree(marketMeasures,0.0005,'w');

markowitzMeasures = SetRiskFree(markowitzMeasures,0.0005,'w');

blacklittermanMeasures = SetRiskFree(blacklittermanMeasures,0.0005,'w');

marketMeasures = SetStartingValue(marketMeasures,10000);

markowitzMeasures = SetStartingValue(markowitzMeasures,10000);

blacklittermanMeasures = SetStartingValue(blacklittermanMeasures,10000);

[market, marketMeasures] =

UpdateHorizon(c,market,marketMeasures,Bstart,Bend,'w');

[markowitz, markowitzMeasures] =

UpdateHorizon(c,markowitz,markowitzMeasures,Bstart,Bend,'w');

[blacklitterman, blacklittermanMeasures] =

UpdateHorizon(c,blacklitterman,blacklittermanMeasures,Bstart,Bend,'w');

market = UpdateReturns(market);

markowitz = UpdateReturns(markowitz);

blacklitterman = UpdateReturns(blacklitterman);

market = UpdateBeta(market);

markowitz = UpdateBeta(markowitz);

blacklitterman = UpdateBeta(blacklitterman);

market = UpdateVolatility(market,'w');

markowitz = UpdateVolatility(markowitz,'w');

blacklitterman = UpdateVolatility(blacklitterman,'w');

[market, marketMeasures] = UpdateWeights(market,marketMeasures);

[markowitz, markowitzMeasures] = UpdateWeights(markowitz,markowitzMeasures);

31

The Black-Litterman Model

32

[blacklitterman, blacklittermanMeasures] =

UpdateWeights(blacklitterman,blacklittermanMeasures);

markowitzMeasures = Markowitz(markowitz,markowitzMeasures,mean);

blacklittermanMeasures =

BlackLitterman(blacklitterman,blacklittermanMeasures,views);

[market, marketMeasures] =

UpdateHorizon(c,market,marketMeasures,pstart,pend,'w');

[markowitz, markowitzMeasures] =

UpdateHorizon(c,markowitz,markowitzMeasures,pstart,pend,'w');

[blacklitterman, blacklittermanMeasures] =

UpdateHorizon(c,blacklitterman,blacklittermanMeasures,pstart,pend,'w');

market = UpdateReturns(market);

markowitz = UpdateReturns(markowitz);

blacklitterman = UpdateReturns(blacklitterman);

market = UpdateVolume(market,marketMeasures);

markowitz = UpdateVolume(markowitz,markowitzMeasures);

blacklitterman = UpdateVolume(blacklitterman,blacklittermanMeasures);

[market, marketMeasures] = PortfolioValue(market,marketMeasures);

[markowitz, markowitzMeasures] = PortfolioValue(markowitz,markowitzMeasures);

[blacklitterman, blacklittermanMeasures] =

PortfolioValue(blacklitterman,blacklittermanMeasures);

marketMeasures = PortfolioBeta(market,marketMeasures);

markowitzMeasures = PortfolioBeta(markowitz,markowitzMeasures);

blacklittermanMeasures =

PortfolioBeta(blacklitterman,blacklittermanMeasures);

marketMeasures = PortfolioVolatility(market, marketMeasures);

markowitzMeasures = PortfolioVolatility(markowitz,markowitzMeasures);

blacklittermanMeasures =

PortfolioVolatility(blacklitterman,blacklittermanMeasures);

marketMeasures = PortfolioReturns(market,marketMeasures);

markowitzMeasures = PortfolioReturns(markowitz,markowitzMeasures);

blacklittermanMeasures =

PortfolioReturns(blacklitterman,blacklittermanMeasures);

marketMeasures = PortfolioSharpe(marketMeasures);

markowitzMeasures = PortfolioSharpe(markowitzMeasures);

blacklittermanMeasures = PortfolioSharpe(blacklittermanMeasures);

marketMeasures = PortfolioAlpha(market,marketMeasures);

markowitzMeasures = PortfolioAlpha(markowitz,markowitzMeasures);

blacklittermanMeasures =

PortfolioAlpha(blacklitterman,blacklittermanMeasures);

marketMeasures = MSquared(market,marketMeasures);

markowitzMeasures = MSquared(markowitz,markowitzMeasures);

blacklittermanMeasures = MSquared(blacklitterman,blacklittermanMeasures);

The Black-Litterman Model

marketMeasures = H_Var(marketMeasures,.05);

markowitzMeasures = H_Var(markowitzMeasures,.05);

blacklittermanMeasures = H_Var(blacklittermanMeasures,.05);

33