Department of Finance Heritage Strategy

advertisement

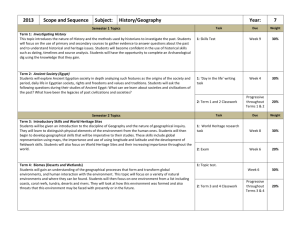

Department of Finance Heritage Strategy Delivering sustainable heritage outcomes for Commonwealth property managed by Finance on behalf of current and future generations Copyright Notice ISBN: 978-1-922096-83-8 (online) ISBN: 978-1-922096-84-5 (print) The document must be attributed as the Department of Finance Heritage Strategy. This Department of Finance Heritage Strategy is protected by copyright. Copyright in this publication is owned by the Commonwealth of Australia. With the exception of the Commonwealth Coat of Arms, the Department of Finance logo and some photographs, all material presented in this publication is provided under a Creative Commons Attribution 3.0 licence. A summary of the licence terms is available on the Creative Commons website http://creativecommons.org/licenses/by/3.0/au/legalcode. Attribution Except where otherwise noted, any reference to, use or distribution of all or part of this publication must include the following attribution: © Commonwealth of Australia 2012. Use of the Coat of Arms The terms under which the Coat of Arms can be used are detailed on the ‘It’s an Honour’ website www.itsanhonour.gov.au/coat-arms. Contact us Inquiries about the licence and any use of this publication can be sent to: Property and Construction Division Department of Finance Treasury Building, 8 Parkes Place West, Parkes, ACT 2600 Telephone: (02) 6215 3486 Email: environment&heritage@finance.gov.au Internet: www.finance.gov.au Accessing this report online For further information about the Department of Finance or to access the online version of the Department of Finance Heritage Strategy, please visit www.finance.gov.au. Finance Heritage Strategy | 3 Department of Finance Heritage Strategy Delivering sustainable heritage outcomes for Commonwealth property managed by Finance on behalf of current and future generations 'Djakaldjirrparr' mural by Johnny Bulun Bulun, located in the Communications Centre, John Gorton Building, King Edward Terrace, Parkes, ACT. Source: Department of the Environment, 2012. Finance Heritage Strategy | 4 Glossary AM Asset Management CEH Compliance, Environment and Heritage CHL Commonwealth Heritage List EPBC Act Environment Protection and Biodiversity Conservation Act 1999 HESS Heritage, Environment and Sustainability Services HMP Heritage Management Plan ICRMF Integrated Compliance and Risk Management Framework PCD Property and Construction Division PDB Project Delivery Branch POB Property Operations Branch PPB Portfolio Planning Branch WOAG Whole-of-Australian-Government OPENING OF THE ROYAL AUSTRALIAN MINT BY HIS ROYAL HIGHNESS THE DUKE OF EDINBURGH 22 February 1965. Denison Street, Deakin ACT Source: The Mint Collection, 1965. Finance Heritage Strategy | 5 Contents Glossary 4 Foreword 7 1. Executive summary 8 2. Heritage in the Finance context: setting the scene 11 2.1 Legislative context 11 2.2 Whole-of-Australian-Government role 11 2.3 Finance-managed and controlled portfolio 11 3. Finance heritage aspects of the ICRMF 16 3.1 Integrating heritage across the Portfolio 16 3.2 Framework 16 4. Finance Heritage Policy 24 4.1 Asset Management Policy 24 4.2 Compliance 26 4.3 Due diligence and consistency with recognised industry practices 21 4.4 Full integration of heritage into business processes 22 4.5 Reputation 22 5. Finance Heritage Programme 30 5.1 Heritage training and awareness 31 5.2 Identification and assessment of heritage values 32 5.3 Heritage Register 35 5.4 Heritage impact assessment and management planning 36 5.5 Heritage interpretation and communication 46 5.6 Condition reporting and monitoring of heritage values 48 6. Implementation and compliance checklists 50 6.1 Implementation 50 6.2 Heritage Strategy commitments summary 52 6.3 Compliance checklist for heritage strategies 60 Finance Heritage Strategy | 6 COMMONWEALTH OFFICES BUILDING 4 Treasury Place, East Melbourne, Victoria. Source: GML Heritage, 2014 Finance Heritage Strategy | 7 Foreword I am pleased to endorse the Department of Finance Heritage Strategy, which outlines how the Department of Finance will manage its heritage obligations under the Environment Protection and Biodiversity Conservation Act 1999. As a central agency of the Australian Government, the Department of Finance plays a key role in supporting the Government across a wide range of policy areas, including strategically managing Commonwealth property. The Department of Finance is also responsible for the project management of major, high-risk or complex capital works as determined by the Australian Government, and manages a portfolio of properties to support Government objectives. The Finance-managed property portfolio is diverse and includes many places that are significant for their Indigenous, historic, natural or social heritage values. These places are not only important to the Australian Government, but are valued by the Australian community for their role in continuing to tell the stories that have shaped our nation. Each heritage place is unique and connects us to our shared national history of past land uses and cultural practices, remarkable natural landscape features, technical advancements, and the role of Government in the administration of a nation. The Department of Finance recognises its responsibility as the custodian of these heritage values. This Heritage Strategy promotes a practical approach to managing heritage through considering heritage values in all relevant aspects of the property life cycle, including acquisition, asset planning, contract management, property maintenance, works projects and divestment. This Heritage Strategy will be integrated into Finance’s core management frameworks and business processes for property and construction activities. The Department of Finance is committed to delivering sustainable heritage outcomes for Commonwealth property on behalf of current and future generations, and I am confident that we are well placed to achieve these outcomes. <<Insert signature>> Professor Jane Halton PSM Secretary Department of Finance Finance Heritage Strategy | 8 1. Executive summary The Department of Finance (Finance) is responsible for many aspects of Australian Government property. At a Whole-of-Australian-Government (WOAG) level, Finance provides advice on property policy and administers several key pieces of legislation. As well as managing the Finance-owned and controlled property portfolio (the Portfolio), Finance also manages construction projects on behalf of other Australian Government departments and agencies as required. These activities are managed in accordance with the Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act). The EPBC Act requires each Australian Government department and agency to prepare and implement a Heritage Strategy and to review and regularly report on its progress. Finance prepared and implemented its first Heritage Strategy in 2005 in accordance with the requirements of the EPBC Act. Finance has reviewed its Heritage Strategy and has made steady progress on several commitments. Finance’s revised Heritage Strategy builds upon the work commenced in 2005, and seeks to achieve a sustainable and integrated approach to heritage management. Going forward, Finance will focus on achieving full heritage compliance across the Portfolio, with particular emphasis on integrating heritage considerations into the relevant aspects of portfolio management, contract management, planned works and the project life cycle. This revised Heritage Strategy outlines the approach to integrated compliance, continued development of Heritage Assessments and Heritage Management Plans (HMPs), and a robust approach to evaluate compliance with our heritage commitments. A range of tools and procedures, established under Property and Construction Division’s (PCD) Integrated Compliance and Risk Management Framework (ICRMF), have been developed to support the Heritage Strategy. The ICRMF focuses on effectively managing risk to comply with Finance’s legislative obligations, including its heritage responsibilities under the EPBC Act. Through implementing the ICRMF and the Heritage Strategy, Finance will seek to exemplify leadership in managing the heritage values of the Commonwealth properties it manages. Finance will build on the practical measures and procedures already established to manage heritage matters across the Portfolio, to ensure compliance, consistency and an integrated business approach. Finance Heritage Strategy | 9 1.1 How to use this Heritage Strategy Table 1.1 provides a summary of sections within the Strategy Section 1 Executive summary Section 2 Legislative context, Finance’s roles and responsibilities and the Finance Portfolio Section 3 Heritage aspects of the ICRMF including the Heritage Strategy's vision and objectives Section 4 Finance’s heritage policies Section 5 Finance’s Heritage Programme and commitments including training, heritage assessments, heritage register and management planning Section 6 Implementation, EPBC Act compliance checklists and a summary of the Heritage Strategy commitments Finance Heritage Strategy | 10 2. Heritage in the Finance context: setting the scene 2.1 Legislative context Finance supports the Minister for Finance with administering several pieces of Commonwealth legislation. Legislation pertinent to implementing the Heritage Strategy and for which Finance has administrative responsibility includes: Australian Capital Territory (Planning and Land Management) Act 1988 Lands Acquisition Act 1989 Lands Acquisition (Northern Territory Pastoral Leases) Act 1981 Lands Acquisition (Repeal and Consequential Provisions) Act 1989 National Land Ordinance 1989 Public Works Committee Act 1969 Public Governance, Performance and Accountability Act 2013 In addition to the EPBC Act, the Northern Territory (Commonwealth Lands) Act 1980 is also relevant to the Heritage Strategy, but is not administered by Finance. 2.2 Whole-of-Australian-Government role As a central agency of the Australian Government, Finance plays a key role in assisting government across a wide range of policy areas to ensure its outcomes are met, particularly regarding expenditure, financial management, and the operations of Government. Finance supports the government to achieve its policy objectives by contributing to three key outcomes: Informed decisions on government finances through: policy advice; implementing frameworks; and providing financial advice, guidance and assurance Effective government policy advice, administration and operations through: oversight of Government Business Enterprises; Commonwealth property management and construction; risk management; and providing ICT services Support for parliamentarians, others with entitlements and organisations as approved by government through the delivery of entitlement and targeted 1 assistance. When providing property advice to other Australian Government departments and agencies, Finance may point out obligations under the EPBC Act; however, departments and agencies remain responsible for their own compliance, including undertaking their own due diligence and obtaining relevant specialist heritage advice. 1 Finance Annual Report 2012-13: iii Finance Heritage Strategy | 11 2.3 Finance-managed and controlled property portfolio In addition to Finance’s WOAG role, Finance manages a portfolio of approximately 104 properties across Australia. The number of Finance owned and controlled properties changes each year through divestment and acquisition activities. The Portfolio comprises a diverse range of properties including office buildings, special purpose facilities, heritage assets, vacant land and contaminated sites. The heritage values currently identified across the Portfolio include natural heritage areas, Indigenous heritage sites and artefacts, historic buildings and landscapes. The diversity of heritage values and issues to be managed across the Portfolio present many opportunities and challenges, and Finance continues to demonstrate strong leadership for the Australian Government in its proactive and due diligence approach. 2.3.1 Asset Management Policy Finance’s Asset Management Policy (AM Policy), drives effective, efficient and sustainable property outcomes for Finance. The AM Policy outlines Finance’s commitment to improving its asset management practices, and aligns Finance business with relevant legislation and government policies. Under the AM Policy, Finance is committed to: continuously improving asset management capability by establishing and adhering to effective and efficient asset management processes and practices ensuring that operational activities are aligned with asset management strategies ensuring that workforce planning is aligned to asset management objectives. Implementing the Heritage Strategy is a key output of the AM Policy. 2.3.2 Property management Finance provides a variety of property management services to the Australian Government. These range from developing and implementing WOAG policies and frameworks to assisting other departments and agencies with their asset and property management requirements, and managing a portfolio of real property assets. Finance also provides advice and assistance to relevant departments and agencies undertaking whole-of-life cost-benefit-analysis under the Commonwealth Property Management Framework. Finance’s responsibilities include: administering the Commonwealth Property Policy Framework for managing Commonwealth owned or leased property. This includes administering legislation and policy for acquiring, disposing of and managing property interests managing the Portfolio, including construction, major refurbishment, sustainability, acquisition, ownership and disposal of real property owning and managing the special purpose properties owning and managing the Prime Minister’s official establishments. Finance Heritage Strategy | 12 Finance’s is required to: provide property services to departments and agencies on a WOAG basis increase the level of ownership where supported by sound cost-benefit analysis and value for money decisions manage legislative compliance, contractual, financial, security, social, heritage, environmental and post-divestment liability risks in accordance with the ICRMF minimise costs commensurate with the established level of service enhance asset value and leverage property opportunities (including treating planning irregularities) generate revenue to support Finance’s objectives for the Portfolio. Outsourced property service provider The Australian Government, represented by Finance, has a contract with an outsourced property service provider for a range of management services across the Portfolio. The current contract with Five D Holdings Pty Ltd (Five D) commenced on 1 July 2013 with an initial term of four years and a two-year option to extend. Under the contract, Five D manages estates, facilities, capital works programmes, and provides valuation services for Finance. KIRRIBILLI HOUSE 111 Kirribilli Avenue, Kirribilli, Sydney, NSW Source: Department of Finance, 2012. Official establishments Ownership and responsibility for managing the Prime Minister’s official residences was transferred from the Department of the Prime Minister and Cabinet to Finance in September 2010. Finance Heritage Strategy | 13 Portfolio planning Finance is responsible for strategic property planning and implementing the ICRMF. This function within Finance also develops the AMPs and the 10 year planned works programme for the Portfolio. Finance heritage managers and coordinators Finance has a dedicated Compliance, Environment and Heritage (CEH) team, comprising of members with specialist tertiary qualifications and industry experience in managing heritage places. The CEH team works closely with Finance managers, property managers, tenants and Five D for assessment planning, maintenance and major project delivery to ensure that heritage values are addressed appropriately in all decision-making processes. The CEH team also delivers the Environment and Heritage Assessment and Planning Programme, which includes prioritised Heritage Assessments and HMPs for the Portfolio. 2.3.3 Divestment, acquisitions and leasing Finance implements government policy to sell or transfer surplus properties where there are no public interest reasons to retain them. The Special Minister of State is responsible for approving disposals under the Commonwealth Property Disposals Policy. Finance is responsible for identifying and addressing any heritage or environmental concerns to ensure that property sales comply with the requirements of the EPBC Act. Finance provides leasing and property-related advice to departments and agencies undertaking leasing negotiations and market testing. Finance also assists with property acquisition and, in some instances, does so on behalf of other departments and agencies. Under the Commonwealth Property Management Framework, departments and agencies must seek endorsement from the Secretary of Finance prior to entering into certain property lease arrangements. When acquiring property on behalf of the Government, Finance ensures compliance and oversees the due diligence process for identifying key issues and constraints. This includes managing compensation issues arising from acquisitions and overseeing post-acquisition licensing arrangements where necessary. Finance is responsible for administering Crown Leases, where the underlying land remains in Commonwealth ownership post-sale. Finance reviews lessee development proposals to ensure compliance with the terms of the Crown Lease. Where appropriate, and consistent with the terms of the Crown Lease for a Commonwealth Heritage place, Finance will ask a lessee to demonstrate that it has considered its compliance obligations under the EPBC Act to ensure heritage values are protected. Finance Heritage Strategy | 14 2.3.4 Major projects Finance manages major capital works projects on behalf of the Australian Government and some departments and agencies. Finance oversees the two-stage approval process for capital works and is responsible for the construction and delivery of domestic non-Defence major capital works projects following completion of the Public Works Committee process. Finance is also responsible for sustainable improvement in the construction of major, high-risk or complex capital works projects as determined by the Australian Government. It delivers allocated projects and provides advice to some departments and agencies on construction and related matters. FACADE CONSERVATION WORKS John Gorton Building, King Edward Terrace, Parkes, ACT Source: Department of Finance, 2014. Finance Heritage Strategy | 15 3. Finance heritage aspects of the ICRMF 3.1 Integrating heritage across the Portfolio Clear expectations, strategic direction and practical implementation tools are required to ensure best practice heritage management is integrated across the Portfolio. This section of the Heritage Strategy provides a specific heritage framework that is part of the ICRMF. The ICRMF and its heritage aspects formalise several existing administrative arrangements, supplemented with additional tools and guidance where necessary, to ensure best practice and compliance. 3.2 Framework 3.2.1 ICRMF Finance is proactively managing compliance across the Portfolio. The ICRMF aims to integrate compliance requirements, including heritage requirements, into the dayto-day business of PCD. 3.2.2 Framework overview The ICRMF includes heritage aspects that comprise this Heritage Strategy and implementation tools. The heritage aspects are integrated into the ICRMF, but are documented and highlighted here to meet the requirements of Section 341ZA of the EPBC Act. The structure of the ICRMF is shown in Figure 3.1 and Table 3.1 respectively. 3.2.3 Heritage vision statement To deliver sustainable heritage outcomes for Commonwealth property managed by Finance on behalf of current and future generations 3.2.4 Objectives The objectives of the Heritage Strategy and framework are to: ensure compliance with the heritage requirements of the EPBC Act ensure sustainable heritage outcomes are aligned with the Finance Asset Management Policy, including its outputs such as AM Plans and the Planned Works Programme apply due diligence and effectively manage risk regarding heritage values of the Portfolio fully integrate heritage considerations into portfolio management establish and maintain relationships with departments, agencies, state government and non-government entities with heritage responsibilities build upon Finance’s reputation as a leader in managing the heritage aspects of Commonwealth property. Finance Heritage Strategy | 16 Legislation, Regulations, policies, codes and standards ICRMF diagram Site values, characteristics and condition Site planning Property management activities Projects Organisations Identifying the hazards Assessing the risks Controlling the risks Emergency Preparedness Compliance monitoring, reporting and review PCD Internal Committee - compliance auditing and corrective actions Tasks Individuals Responsibility, Accountability, Training, Awareness Figure 3.1 Finance Heritage Strategy | 17 Table 3.1: Finance heritage aspects of the ICRMF Policies and Legislation Programme strategic direction EPBC Act Heritage training and awareness programme Commonwealth Heritage Management Principles Burra Charter Department of the Environment guidelines: - 2010 Guide for assessing significance - Ask First Natural Heritage Charter Asset Management Policy Department of Finance Heritage Strategy ICRMF Due diligence and best practice protocols Identification and assessment of heritage values programmes Heritage Register Heritage management planning Heritage impact assessment planning Heritage interpretation and communication programmes Condition reporting and monitoring on heritage values Compliance reporting and review Other relevant Australian International Council on Monuments and Sites guidelines LONDON BRIDGE NATURAL ARCH London Bridge Road, Googong Foreshore, NSW Source: Department of the Environment, 2010. Finance Heritage Strategy | 18 Implementation tools procedures Implementation tools information solutions Property management Property Management Information System Training and awareness checklists Identification and assessment checklist, heritage assessment format guideline, significance ranking guideline Conflict resolution process Heritage Register Reporting checklist Training induction records Heritage Register HMP upload Risk register by property Incident register Property contributory elements HMP format guideline Work order special instructions HMP review checklist Property works record HMP public comment and notification procedure Inspection condition reports Minimum standards of maintenance and repairs Building owner approval process Asset management plans – checklist Condition reporting procedure Works request proforma Consultation procedure including Indigenous consultation Archival recording guidelines Divestment Acquisitions Checklists Major Projects Self-assessment procedure EPBC referral instructions Commitments checklist Project control group agenda items Project close out checklist Finance Heritage Strategy | 19 4. Finance Heritage Policy 4.1 Asset Management Policy The AM Policy outlines Finance’s commitment to improving its asset management practices and capabilities, and aligns Finance business with relevant legislation and government policies. Implementing the Heritage Strategy is a key output of the AM Policy. The AM Policy is therefore the overarching policy for managing heritage across the Finance Portfolio. THE LODGE 5 Adelaide Avenue, Deakin, ACT. Source: Department of the Environment, date unknown. The guiding principles for asset management practices are quoted below: Optimal Identifying the best value for money options by assessing competing lifecycle factors, such as the performance, environment, cost and risk associated with the Portfolio Integrated Asset planning and management decisions consider the strategic direction of PCD, Finance and the Government Holistic Asset planning decisions are based on the evaluation of options encompassing asset lifecycle Accountability for asset condition, use and performance Governance An effective governance structure is established to support asset management decision making Continuous improvement Regular review of AM plans, processes and procedures Systematic Applying a methodical management approach to promote consistent and auditable actions. Finance Heritage Strategy | 20 Policy 1: Finance will ensure the AM Policy practices are applied to the heritage management of its Portfolio. 4.2 Compliance The ICRMF provides a strategic framework for compliance across the Portfolio. The ICRMF is consistent with risk management standards as set out by the International Organization for Standardization and Standards Australia. The ICRMF and the AM Policy outline Finance’s commitment to adhere to the legislative compliance requirements established in the Australian Government Property Management Framework. Policy 2: Finance will manage its portfolio in accordance with the heritage requirements of the EPBC Act. Finance will seek to meet the intent of state and territory heritage requirements where these do not conflict with Commonwealth legislation. MALABAR HEADLAND South of the central business district of Sydney, NSW. Source: Department of Finance, 2010 Finance Heritage Strategy | 21 4.3 Due diligence and consistency with recognised industry practices The AM Policy establishes Finance’s commitment to excellence in its AM practices. To ensure legislative compliance and to support Finance’s role as a leader in sustainable heritage management, due diligence and consistency with recognised industry practices are essential when managing heritage assets and issues. Policy 3: Finance will seek to ensure it manages its heritage properties and projects consistent with current heritage industry standards and guidelines, and that any changes proposed for its heritage properties are planned and implemented with due diligence against legislative requirements. 4.4 Full integration of heritage into Finance business processes This Heritage Strategy seeks to support existing processes and, where necessary, implement new procedures to integrate heritage considerations into Finance business. Achieving full integration will be primarily facilitated with the ICRMF Finance Heritage Tools, which provide guides, templates and checklists for various aspects of Finance business. The ICRMF Heritage Tools will allow Finance personnel, tenants and service providers to consider and appropriately address heritage issues in the day-to-day management of properties and projects. Policy 4: Finance will familiarise its personnel, contractors and tenants with key heritage considerations and the Finance Heritage Tools to integrate heritage matters into Finance business. 4.5 Reputation Finance has a strong reputation for environment and heritage stewardship for its property portfolio, both within Government and in the wider community. Continuing to achieve legislative compliance will build on this reputation and provide leadership for other departments and agencies in managing heritage places for current and future generations. Policy 5: Finance will continue to build on its reputation as a leader in managing the heritage of Commonwealth property by maintaining a focus on compliance assurance and current industry standards, and increasing visibility of heritage management practices within and external to Finance. Finance Heritage Strategy | 22 WEST PORTAL CAFETERIA Constitution Avenue, Parkes, ACT Source: Department of the Environment, 2002. TREASURY BUILDING Parkes Places, Parkes, ACT Source: Department of Finance, 2012 Finance Heritage Strategy | 23 5. Finance Heritage Programme Established in the first Finance Heritage Strategy (2005), the Finance Heritage Programme (the Programme) implements a range of Australian Government requirements under the EPBC Act. The Programme aims to ensure compliance with the heritage requirements of the EPBC Act and support integration of heritage considerations into Finance business. The Programme comprises the following components: heritage training and awareness identification and assessment of heritage values Heritage Register heritage management planning heritage impact assessment and management heritage interpretation and communication condition reporting and monitoring of heritage values compliance reporting and review. An overview of each component of the Programme, along with commitments to ensure appropriate implementation is provided in the following section. 5.1 Heritage training and awareness 5.1.1 Overview All new Finance staff responsible for property management and/or heritage matters are required to undergo a targeted induction training programme, which is provided by Finance’s CEH team. The programme includes information and instructions regarding Finance’s environment and heritage procedures and legislative requirements specific to their role. Detailed inductions for representatives of Finance’s outsourced property service provider are delivered as necessary. 5.1.2 Commitments No. Commitment Timeframe Leader 1 Finance staff responsible for property and construction matters will receive induction training on EPBC Act requirements and expected heritage practice upon commencement of the position. Ongoing (within three months of commencing the role) PPB 2 Finance staff responsible for property and construction matters will receive in-house refresher training on a regular basis. At least every three years PPB 3 Finance’s outsourced property service provider will receive detailed inductions upon commencement and refresher training on a regular basis. PPB As required – refresher training at least every three years Finance Heritage Strategy | 24 5.2 Identification and assessment of heritage values 5.2.1 Overview Identification and assessment programme Finance has made steady progress identifying and assessing Commonwealth Heritage values within the Portfolio. The Programme of identification and assessment will continue to be subject to changes to the Portfolio as properties are divested or transferred to Finance. The process of identifying and assessing Commonwealth Heritage values for the Portfolio will include the following steps to ensure consistency with EPBC Act s341ZB and Regulation 10.03G: consider natural and cultural heritage values recognise Indigenous people as the primary source of information on the significance of their heritage and their participation as necessary to identify and assess Indigenous heritage values identify values against the Commonwealth Heritage Criteria use expert heritage advice to ensure that levels of documentary and field research are appropriate to support best practice assessment and management of heritage values use a comparative and thematic approach consult, as appropriate, with other government departments and agencies, site stakeholders and the local community. Finance has developed a robust Heritage Assessment Format (included in the Finance Heritage Tools in the ICRMF) to ensure all assessments of properties are consistent and comply with the requirements of the EPBC Act and Regulations. SURVEY MARKER ACT/NSW BORDER Top of Pleasant Hill, ACT/NSW border Source: Biosis Research Pty Ltd. 2014. Finance Heritage Strategy | 25 Conflict resolution in the Finance heritage framework Heritage values are not always readily understood or accepted. Matters that may require resolution include: determining whether a heritage value exists and meets the threshold for the CHL conflict between heritage values and contamination remediation requirements, hazardous materials management and safety issues in the same location managing heritage values in the context of conflicting use or activity. Conflict does not usually occur between natural and built heritage values as it is unlikely for them to occur within the same location for the Portfolio. Specialist heritage service providers, appointed to the Heritage, Environment and Sustainability Services (HESS) panel, independently identify and assess heritage values on behalf of Finance and are guided by: the EPBC Act and Regulations best practice standards such as the Burra Charter, Ask First and the Natural Heritage Charter the Finance Heritage Assessment Format and significance ranking guideline. The implications of heritage values and formal inclusion on the CHL are addressed in a HMP prepared by a HESS panel heritage services provider. Finance’s CEH team commissions these HMPs and provides guidance on heritage issues and listing implications. Where necessary, and in an effort to complement heritage advice, expert advice is sought from a range of independent sources including contamination, hazardous materials and safety experts. The HESS panel, the Department of the Environment and the Australian Heritage Council also provide additional advice. The procedure for managing conflicting heritage issues and values is included in the ICRMF Heritage Tools, as outlined in this section. Finance Heritage Strategy | 26 5.2.2 Commitments No. Commitment Timeframe Leader 4 Ongoing The identification and assessment process will be undertaken in accordance with EPBC Act Section 341ZB, Regulation 10.03G, industry expected practice and the Finance Heritage Tools in the ICRMF. PPB 5 The assessment of Commonwealth Heritage values of the current (1 July 2014) Portfolio will be completed by 30 June 2018. By end of 2017/18 PPB 6 The assessment of properties added to the Portfolio from 1 July 2014 will be completed prior to decisionmaking regarding changes of use, divestment, development or potentially significant modifications to fabric/ values. Ongoing PPB 7 Heritage assessments will be undertaken in accordance with Finance’s Heritage Assessment format and by a suitably qualified heritage specialist. Finance will nominate places in its Portfolio assessed as having Commonwealth Heritage values to the Australian Heritage Council for possible inclusion on the Commonwealth Heritage List as Heritage Assessments are finalised and accepted by Finance. Ongoing PPB Ongoing PPB 8 9 Where required, Finance will seek expert advice from Ongoing the HESS panel, other industry specialists, the Department of the Environment and the Australian Heritage Council to assist with resolving conflicts over heritage values. The conflict resolution procedure in the ICRMF Heritage Tools will be implemented. PPB and PDB Finance Heritage Strategy | 27 5.3 Heritage Register 5.3.1 Overview The Finance Heritage Register was published online in December 2013. It includes information about the heritage values for the 20 properties in the Portfolio currently included on, or nominated to, the CHL. The Finance Heritage Register can be accessed on the Finance website at: finance.gov.au/property/heritage/register.html#register The Finance Heritage Register is maintained by the CEH team and will be updated on a regular basis and in accordance with the requirements of the EPBC Act and Regulations. The Register contains information for each place against the following fields: Property name Finance ID number CHL Place ID number Ownership Location Landscape setting Description of the place History and summary uses of the place Statutory heritage values CHL statement of significance Gazetted values for Non-statutory each of the CHL heritage listings criteria Property or information access restrictions or requirements (if any) Conservation documents of references Record last updated Report on Heritage Register Finance is required to prepare a report for the Minister for the Environment on the Finance Heritage Register in accordance with EPBC Act S341ZB (2) (c) and Regulation 10.03G (3). The first report is in progress and will be completed by December 2014. Finance's Heritage Register will be reviewed in the same cycle as the three yearly review of the Finance Heritage Strategy. The next review of the Register will be prepared in 2017-18. Finance Heritage Strategy | 28 5.3.2 Commitments No. Commitment Timeframe Leader 10 The Finance Heritage Register will be updated regularly. Updates are to include changes to property use and new information as a result of Heritage Assessments and Management Plans. Ongoing updates to be undertaken at least annually PPB 11 The first report on the Finance Heritage Register will be submitted to the Minister for the Environment in 2014. By December 2014 PPB 12 The Finance Heritage Register will be reviewed and reported on in accordance with the EPBC Act and Regulations. Every three years PPB 13 Ongoing Finance will implement recommended changes to the Register arising from the review within 12 months of accepting the review report. PPB 14 New entries to the Finance Heritage Register will Ongoing be prepared within 12 months of acceptance of a final Heritage Assessment. PPB Finance Heritage Strategy | 29 5.4 Heritage impact assessment and management planning 5.4.1 Overview Finance’s properties with identified heritage values are used for a range of functions including residences, government and commercial offices, mixed uses, training facilities, as well as vacant land. Finance manages its heritage properties in accordance with the requirements of the EPBC Act and Regulations, which include the preparation of HMPs, maintenance and development planning. Heritage Management Plans Since 2005, Finance has made steady progress with its HMPs for items with identified Commonwealth heritage values. The programme for preparing HMPs will be subject to changes to the portfolio as properties are divested or transferred to Finance. HMPs have been prepared or are currently being developed for high risk properties. Finance Commonwealth Heritage Properties were identified as high risk and prioritised accordingly where the site: did not have an existing Conservation Management Plan or HMP is / was scheduled for divestment is / was scheduled for refurbishment or major maintenance works. Finance HMPs are prepared in accordance with the EPBC Act and Regulations. The HMPs reflect the criteria for the CHL and address the requirements for preparing management plans for properties with Commonwealth heritage values and the Commonwealth Heritage Management Principles. In addition, Finance has developed a robust HMP format (included in the Finance Heritage Tools in the ICRMF) to ensure all HMPs are compliant, consistent, and easy to use. A heritage handbook also accompanies the HMP and offers easy to read guidelines, dos and don’ts for contractors and a quick reference guide for applying the HMP. SNAPPER ISLAND Sydney Harbour, NSW Source: Sydneyforeveryone.com.au, 2014 Finance Heritage Strategy | 30 Public Notification of HMPs Since the first Heritage Strategy, prepared in 2005, Finance has delayed public notification of HMPs under the requirements of the EPBC Act in order to address security requirements for Finance properties. Finance has recently commenced a trial for public notification of a HMP for one of its properties. This will provide a case study to determine the most cost effective process for achieving compliance with the public notification requirements of the EPBC Act. It is anticipated that a public version of a HMP will be provided in order to appropriately manage classified and sensitive information. The first public notification for a Finance HMP will be complete by December 2014. Finance will then determine how new and reviewed HMPs should be prepared to incorporate notification as a final step in completing a HMP. Notification of HMPs prepared to date will be undertaken in conjunction with the five yearly review requirements for HMPs. SWAMP CREEK ARTEFACT Urayarra, ACT/NSW border Source: Biosis Research Pty Ltd., 2014 Finance Heritage Strategy | 31 Reviews of HMPs HMPs will be reviewed and updated at least once every five years from their commencement in accordance with the EPBC Act. Finance has completed or contributed to operational draft HMPs for the following properties in the Portfolio: Property name Property address City / suburb State The Royal Australian Mint & 60 Denison Street 60 - 66 Denison Street Deakin ACT Anzac Park East and West Constitution Ave Parkes ACT Russell Blocks (HMP developed and managed by Department of Defence) Block 4 Section 80 Block 1 Section 85 Block 2 Section 80 Block 3 Section 80 Blocks 2 and 3 Section 84 Russell ACT Alice Springs 13 McMinn St 13 McMinn Street Alice Springs NT Edward Braddon Commonwealth Law Courts Davey Street Hobart TAS Commonwealth Offices 4 Treasury Place Melbourne VIC John Gorton Building King Edward Terrace Parkes ACT Newlands Street and Parkes Place The following HMPs are currently in progress: Parkes ACT Treasury Building Property name Property address City / Suburb State West Portal Cafeteria Constitution Avenue Parkes ACT West Block Queen Victoria Terrace Parkes ACT Customs Depot Lower Ben Boyd Road Neutral Bay NSW Snapper Island Sydney Harbour Sydney NSW Googong Foreshore Lot 8, off Burra Road Googong NSW The Lodge Adelaide Avenue Deakin ACT Kirribilli House Kirribilli Avenue Kirribilli NSW The HMP programme will be subject to change over the life of the Heritage Strategy, and HMPs may be removed or added to this list as appropriate. Heritage maintenance and conservation Finance has an annual maintenance programme for the Portfolio. At a detailed level, maintenance planning is primarily guided by HMPs for Commonwealth heritage properties as part of the Asset Management Plans. Where a property has Commonwealth Heritage values, Finance’s maintenance and planned work programme addresses any conservation objectives of the works that require funding and planning beyond standard operational needs. Funding for maintenance is allocated through the Finance annual portfolio budget process on a risk management and compliance basis. Finance Heritage Strategy | 32 Process for planning and managing changes to heritage properties The ICRMF Heritage Tools provide guidance on the matters to consider when proposing a change to a heritage property, such as capital works, leasing, divestment, refurbishment or works proposals, change of use or sale including for Crown Leases. The process to be followed aims to ensure compliance with the EPBC Act and Regulations. The process assesses potential risks and seeks to minimise any impacts on heritage values. It assists in identifying mitigation measures or management strategies and establishing ongoing heritage protection following divestment. The tools also provide guidance on how to seek approval via EPBC Act referral for activities that may have a significant impact that cannot be avoided or minimised. The key steps of the process involve: early consultation with the CEH team review of the HMP and Heritage User Guide, where possible preparing a self-assessment and/or a Heritage Impact Statement if required seeking advice from CEH team on the procurement strategy and selection criteria where required ensuring procurement and use of specialist contractors with experience in working with original materials and that possess traditional trades skills and techniques that relate to the specific heritage values consulting with the Department of the Environment as appropriate preparing a submission under S341ZE or an EPBC Act referral as appropriate, including supporting documents completing a Finance building owner approval documentation as appropriate compiling a project commitment checklist (major works) or heritage works proforma/change record (minor works) works/project monitoring of compliance with commitments and conditions project close out and compliance review documentation as required. Anticipated development or divestment Finance has a divestment programme for the disposal of properties that are surplus to Commonwealth requirements. Some of these properties may have Commonwealth Heritage significance. Finance acknowledges its obligations to plan for the ongoing protection of heritage property when it is transferred from Finance ownership. Finance operates in accordance with the requirements of the EPBC Act such as notification to the Minister, EPBC Act referral, development of specific sale clause and/or HMPs. Planned divestments cannot be included in the Strategy due to the commercial sensitivities of these transactions. Recent and current works and changes to Finance heritage properties are outlined below. Ownership changes The following properties with Commonwealth heritage values were divested from the Finance portfolio between 2005 and 2013: Mines Cottage Myilly Point, Darwin, NT Burnett Cottage, Myilly Point, Darwin, NT Fort Scratchley, Newcastle, NSW Brisbane Naval Staff Offices, Brisbane, QLD York Park North Tree Plantation, Barton, ACT Cameron Offices, Belconnen, ACT. Finance Heritage Strategy | 33 Management changes Key management changes of relevance to the Commonwealth Heritage properties in the Portfolio during 2005 and 2013 were: Finance’s outsourced property service provider changed from UGL Services to Five D in 2013 Finance and the ACT Government entered into a 150 year lease agreement for Googong Dam and Foreshores in 2011 The management of the base buildings of the Prime Minister’s official establishments transferred from the Department of Prime Minister and Cabinet to Finance in 2010 The contract management arrangement for the special purpose properties were changed to internal management by Finance in 2012. Physical changes Key physical changes completed or in progress, to properties with Commonwealth Heritage values in the Portfolio include: Prior to divestment, Finance oversaw the award-winning restoration and conservation of Fort Scratchley, Newcastle, NSW (completed) Refurbishment of the Royal Australian Mint and 60 Denison Street, Deakin, ACT (completed) Internal refurbishment of the Anzac Park West, Parkes, ACT (completed) Safety and mothballing works for the West Portal Cafeteria, Parkes, ACT (completed) Internal upgrade of security controls and foyer layout in the Treasury Building, Parkes, ACT (completed) Remediation of contaminated land at Malabar Headland, NSW and Cox Peninsula, NT (in progress) The Lodge, Deakin, ACT Refurbishment Project (in progress) Landscaping upgrade at The Lodge, Deakin, ACT (in progress) Landscaping upgrade for Kirribilli House, Kirribilli, NSW (in progress) Sandstone conservation repairs at John Gorton Building, Parkes, ACT (in progress) Refurbishment of services at West Block, Parkes, ACT (planned). Finance Heritage Strategy | 34 SCARRED TREE - BEYOND GOOGONG FORESHORES Source: Environmental Resources Management Australia, 2014. Finance Heritage Strategy | 35 5.4.2 Commitments No. Commitment Timeframe Leader 15 The preparation of Finance HMPs will be undertaken in accordance with EPBC Act Section 341ZS, Regulation 10.03B, Schedule 7A and 7B and undertaken by a suitably qualified heritage specialist in accordance with Finance’s HMP format. Ongoing PPB 16 The preparation of Finance HMPs for the places currently identified (2014) in the property portfolio as having CHL values will be completed by December 2018. By 2018 PPB 17 Operational draft HMPs for properties added to the Finance portfolio from 2014 assessed as having CHL values will be prepared within three years of acceptance of the Heritage Assessment by Finance. Ongoing PPB 18 Finance HMPs will be reviewed five years from the date of completion. Ongoing PPB 19 Ongoing Public notification of HMPs will be incorporated as a final step in the preparation of the HMP, or included in the five year review process, subject to Finance’s satisfaction with the measures to be developed during 2014 to manage classified and sensitive information. PPB 20 HMPs will consider and guide maintenance and minor conservation works. Ongoing PPB 21 Heritage conservation works identified through routine maintenance inspections and the preparation of HMPs will be costed and prioritised as part of the annual Portfolio budgeting process. Ongoing PPB 22 Proposed physical and management changes to heritage properties (works, divestment, major projects) in the Finance portfolio will be undertaken in accordance with the Finance Heritage Tools in the ICRMF, a HMP, Section 341ZE of the EPBC Act or a selfassessment, or EPBC Act referral, as appropriate. Ongoing PPB, POB and PDB 23 Divestments will be conducted in accordance with EPBC Act Section 341ZE, best practice and using due diligence planning. Heritage values will be protected during sale by appropriate means. Ongoing PPB and PDB 24 Major projects, capital works or remediation Ongoing projects will be undertaken in accordance with the Finance Heritage Tools in the ICRMF, a HMP, Section 341ZE of the EPBC Act or a PPB and PDB Finance Heritage Strategy | 36 No. Commitment self-assessment, and comply with agreed mitigation measures or EPBC Act referral commitments. Timeframe Leader 25 Finance contract management will ensure compliance of contractors and use experienced contractors for works. Ongoing PPB and POB 26 A record of change will be maintained for changes to heritage places for management and compliance reporting. Ongoing PPB and POB 27 Any actions that are likely to have a significant impact on heritage values will be referred under the EPBC Act. Ongoing PPB ARTISTS IMPRESSION OF ANZAC PARK PORTAL BUILDINGS Anzac Parade, Parkes, ACT. Source: Photographed by Richard Clough, courtesy of the National Library of Australia (modified to black and white). Finance Heritage Strategy | 37 5.5 Heritage interpretation and communication 5.4.3 Interpretation overview Opportunities for interpretation of heritage properties within the Portfolio are subject to property use (including government business), tenant and security requirements. Finance’s HMP format includes guidance on interpretation options that are customised to each site. Where information about a site’s heritage values can be interpreted within these parameters, Finance has provided exterior interpretive signage. Several properties include interior displays of interpretive information in foyer areas that are accessible to the public, and some properties within the Portfolio conduct open days at least once a year allowing public access to these important heritage buildings and their extensive art collections. The online Finance Heritage Register provides the public with detailed information about the Commonwealth Heritage values currently identified at Finance-owned properties. The Register will be updated regularly, ensuring that current information about the heritage value of the Portfolio is publicly accessible. 5.4.4 Communication overview Finance consults with the Department of the Environment, and other Australian Government departments and agencies to discuss and seek input and advice regarding the management of heritage values at Finance-owned properties. This consultation and liaison happens as required and focuses on compliance with the EPBC Act and Regulations. Finance is not obliged to comply with state and territory heritage legislation or local government heritage related instruments. However, where these do not conflict with Commonwealth legislation Finance will seek to meet the intent of state, territory and local heritage policies, initiatives and legislation. Consultation with the community, including Indigenous stakeholders, is undertaken in relation to specific heritage issues at individual properties as needed. Finance ensures best practice during the preparation of its Heritage Assessments and HMPs through consulting with Traditional Owner representatives, and conducting meetings and site walkovers. Consultation with the community will also occur under the new Finance procedures for the public notification of HMPs. Finance Heritage Strategy | 38 5.4.5 Commitments No. Commitment Timeframe Leader 28 Finance will continue to include heritage interpretation considerations in HMPs for properties within its portfolio. Ongoing PPB 29 Finance will seek to implement onsite and/or online heritage interpretation where security and access requirements allow. Ongoing PPB and POB 30 Finance will regularly update the Finance Heritage Register to ensure public access to current heritage value information continues. Ongoing (Linked to commitment 10) PPB 31 Finance will liaise with the Department of the Environment as needed regarding heritage matters including major projects, Heritage Assessments, HMPs, the public notification process and reviews and reports against Strategy commitments. Ongoing PPB 32 Finance will continue to consult with key stakeholders including Traditional Owners during the preparation of Heritage Assessments and HMPs. Consultation with Traditional Owners is to align with expected Australian Government practice established under the Ask First guideline. Ongoing PPB 5.5 Condition reporting and monitoring on heritage values 5.5.1 Overview Reporting on, reviewing and monitoring the condition of Finance-owned properties assists to ensure continuous improvement and best practice heritage management of the Finance property portfolio. Under EPBC Act S341ZH, a five yearly report is required to be compiled by the Minister for the Environment that reviews the properties included on the CHL. Key inputs to this report are HMPs, HMP reviews and information from the Finance property management records. The first report to address these requirements for the Portfolio is in preparation, and will be completed by December 2014. The Finance property management system, which includes preparing and updating AM Plans, annual property inspections and the property portal, along with preparing and reviewing HMPs, allows Finance to record and monitor condition and works implementation for identified Commonwealth Heritage values. Finance has developed a works proforma for property managers and the outsourced property service provider to assist with capturing and tracking modifications to buildings with Commonwealth Heritage values. This process will continue to be implemented to ensure robust data is recorded and updated for heritage properties in the Portfolio. Finance is also committed to investigating improvements to the property portal to capture records electronically. Finance has recently commenced a programme of AM Plans across its portfolio, which will include updated information on the condition of properties. This information will be used to update the Finance property portal and Finance Heritage Finance Heritage Strategy | 39 Register as it becomes available. Current HMPs will inform the AM Plans as appropriate and new HMPs can draw upon relevant information included in the AM Plans to ensure an integrated approach to managing information about the condition of Commonwealth Heritage values in the Portfolio. 5.5.2 Commitments No. Commitment Timeframe Leader 33 Finance will ensure its property management records system is regularly updated and adjusted as appropriate to track changes to properties with Commonwealth Heritage values. Ongoing, with updates undertaken at least quarterly PPB, Five D 34 Finance will compile the information required as input to the Minister for the Environment’s report under Section 341ZH of the EPBC Act on a five yearly basis as part of monitoring and reporting on the condition of Commonwealth Heritage values within the Portfolio. Every five years PPB 35 Finance AM Plans and HMPs will be prepared to include cross-referencing as appropriate and updated condition information. Ongoing PPB, Five D WEST BLOCK Commonwealth Avenue, Parkes, ACT. Source: Eric Martin and Associates, 2014. Finance Heritage Strategy | 40 6. Implementation and Compliance Checklists To ensure the Finance Heritage Strategy is implemented successfully, Finance supervisors will ensure that all staff with property and construction responsibilities adopts the policies outlined in this Heritage Strategy and deliver on its commitments. Finance will also ensure that robust processes and systems are in place for relevant property and construction contractors and that they too are accountable for contributing to the successful delivery of the Heritage Strategy. Tracking performance against the commitments and ensuring checklists, guidelines and templates provided in the ICRMF Heritage Tools are used, will also be key to success. To ensure progress against this Strategy is on track, this section provides a summary list of commitments to be used to guide, prioritise and monitor implementation on an annual basis. This section also provides checklists to demonstrate that the Strategy complies with the requirements of the EPBC Act and Regulations. 6.1.1 Commitments No. Commitment Timeframe Leader Finance supervisors will ensure their staff with responsibility for property and construction matters are accountable for adoption of Heritage Strategy policies and delivery of Heritage Strategy commitments. Finance will ensure relevant property and construction contractors are accountable for contributing to the successful delivery of Heritage Strategy policies and commitments. Ongoing PCD Ongoing PCD, Five D 38 Finance will regularly track progress and performance against Strategy commitments. At least annually PPB 39 Finance will prepare a review of the Strategy every three years in accordance with the requirements of the EPBC Act and Regulations. Every three years PPB 36 37 Finance Heritage Strategy | 41 REFURBISHED COMMUNICATIONS CENTRE FOYER (ORIGINAL CHROME LEAF CEILING) John Gorton Building, King Edward Terrace, Parkes, ACT Source: Environmental Resources Management Australia, 2013. Finance Heritage Strategy | 42 6.2 Finance Heritage Strategy commitments summary Strategy Ref. Number Detail Timeframe Lead er Section 4.1 Policy 1 Ongoing Finance will ensure the AM Policy practices are applied to the heritage management of its Portfolio. PPB Section 4.2 Policy 2 Ongoing Finance will manage its Portfolio in accordance with the heritage requirements of the EPBC Act. Finance will seek to meet the intent of state and territory heritage requirements where these do not conflict with Commonwealth legislation. PPB Section 4.3 Policy 3 Finance will seek to ensure it manages its heritage properties and projects consistent with current heritage industry standards and guidelines, and that any changes proposed for its heritage properties are planned and implemented with due diligence against legislative requirements. Ongoing PPB Section 4.4 Policy 4 Finance will familiarise its personnel, contractors and tenants with key heritage considerations and the Finance heritage tools to fully integrate heritage matters into Finance business. Ongoing PPB Section 4.5 Policy 5 Finance will continue to build on its reputation as a leader in managing the heritage of Commonwealth property by maintaining a focus on compliance assurance and current industry standards and increasing visibility of heritage management practices within and external to Finance. Ongoing PPB Finance Heritage Strategy | 43 Strategy Ref. Number Detail Timeframe Lead er Section 5.1 Commitment 1 Finance staff responsible for property and construction matters will receive induction training on EPBC Act requirements and expected heritage practice upon commencement of the position. At least every three years PPB Commitment 2 Finance staff responsible for property and construction matters will receive in-house refresher training on a regular basis. At least every three years PPB Commitment 3 Finance’s outsourced property service provider will receive detailed inductions upon commencement and refresher training on a regular basis. As required – refresher training at least every three years PPB Commitment 4 Ongoing The identification and assessment process will be undertaken in accordance with EPBC Act Section 341ZB Regulation 10.03G, industry expected practice and the Finance Heritage Tools in the ICRMF. Commitment 5 The assessment of Commonwealth Heritage values of the current (1 July 2014) Portfolio will be completed by 30 June 2018. By 2017/18 PPB Commitment 6 The assessment of properties added to the Portfolio from 1 July 2014 will be completed prior to decision-making regarding changes of use, divestment, development or potentially significant modifications to fabric/values. Ongoing PPB Commitment 7 Ongoing Heritage assessments will be undertaken in accordance with Finance’s Heritage Assessment format and by a suitably qualified heritage specialist. PPB Commitment 8 Ongoing Finance will nominate places in its Portfolio assessed as having Commonwealth Heritage values to the Australian Heritage Council for possible inclusion on the PPB Section 5.2 PPB Finance Heritage Strategy | 44 Strategy Ref. Number Detail Timeframe Lead er Commonwealth Heritage List as Heritage Assessments are finalised and accepted by Finance. Section 5.3 Section 5.4 Commitment 9 Where required, Finance will seek expert advice from the HESS panel, other industry specialists, the Department of the Environment and the Australian Heritage Council to assist with resolving conflicts over heritage values. The conflict resolution procedure in the ICRMF Heritage Tools will be implemented. Ongoing PPB and PDB Commitment 10 The Finance Heritage Register will be updated regularly. Updates are to include changes to property use and new information as a result of Heritage Assessments and Management Plans. Ongoing updates to be undertaken at least annually. PPB Commitment 11 The first report on the Finance Heritage Register will be submitted to the Minister for the Environment in 2014. By December 2014 PPB Commitment 12 The Finance Heritage Register will be reviewed and reported on in accordance with the EPBC Act and Regulations. Every three years. PPB Commitment 13 Finance will implement recommended changes to the Register arising from the review within 12 months of accepting the review report. Ongoing PPB Commitment 14 New entries to the Finance Heritage Register will be prepared within 12 months of acceptance of a final Heritage Assessment. Ongoing PPB Commitment 15 The preparation of Finance HMPs will be undertaken in accordance with EPBC Act Section 341ZS, Regulation 10.03B, Schedule 7A and 7B and be undertaken by a suitably qualified heritage specialist in accordance with Finance’s HMP format. Ongoing PPB Finance Heritage Strategy | 45 Strategy Ref. Number Detail Timeframe Lead er Commitment 16 The preparation of Finance HMPs for the places currently identified (2014) in the Portfolio as having CHL values will be completed by December 2018. By 2018 PPB Commitment 17 Operational draft HMPs for properties added to the Portfolio from 2014 assessed as having CHL values will be completed within three years of acceptance of the Heritage Assessment by Finance. Ongoing PPB Commitment 18 Finance HMPs will be reviewed five years from the date of completion. Ongoing PPB Commitment 19 Public notification of HMPs will be incorporated as a final step in the preparation of the HMP, or included in the five year review process, subject to Finance’s satisfaction with the measures to be developed during 2014 to manage classified and sensitive information. Ongoing PPB Commitment 20 HMPs will consider and guide maintenance and minor conservation works. Ongoing PPB Commitment 21 Heritage conservation works identified through routine maintenance inspections and the preparation of HMPs will be costed and prioritised as part of the annual Portfolio budgeting process. Ongoing PPB and POB Commitment 22 Ongoing Proposed physical and management changes to heritage properties (works, divestment, major projects) in the Portfolio will be undertaken in accordance with the Finance Heritage Tools in the ICRMF, a HMP, Section 341ZE of the EPBC Act or a self-assessment, or EPBC Act referral, as appropriate. PPB and PDB Finance Heritage Strategy | 46 Strategy Ref. Section 5.5 Number Detail Timeframe Lead er Commitment 23 Divestments will be conducted in accordance with EPBC Act Section 341ZE, best practice and using due diligence planning. Heritage values will be protected during sale by appropriate means. Ongoing PPB Commitment 24 Ongoing Major projects, capital works or remediation projects will be undertaken in accordance with the Finance Heritage Tools in the ICRMF, a HMP, Section 341ZE of the EPBC Act or a self-assessment, and comply with agreed mitigation measures or EPBC Act referral commitments. PPB and PDB Commitment 25 Finance contract management will ensure compliance of contractors and use experienced contractors for works. Ongoing PPB and POB Commitment 26 A record of change will be maintained for changes to heritage places for management and compliance reporting. Ongoing PPB, PDB and POB Commitment 27 Any actions that may have a significant impact on Commonwealth Heritage values will be referred under the EPBC Act. Ongoing PPB Commitment 28 Ongoing Finance will continue to include heritage interpretation considerations in HMPs for properties within its Portfolio. PPB Commitment 29 Finance will seek to implement Ongoing onsite and/or online heritage interpretation where security and access requirements allow. PPB Commitment 30 Finance will regularly update the Finance Heritage Register to ensure public access to current heritage value information continues. PPB Ongoing (Linked to Commitmen t 10) Finance Heritage Strategy | 47 Strategy Ref. Section 5.6 Section 6 Number Detail Timeframe Lead er Commitment 31 Ongoing Finance will liaise with the Department of the Environment as needed regarding heritage matters including major projects, heritage assessments, HMPs, the public notification process and reviews and reports against Strategy commitments. PPB Commitment 32 Ongoing Finance will continue to consult with Traditional Owners during the preparation of heritage assessments and HMPs. Consultation is to align with expected Australian Government practice established under the Ask First guideline. PPB Commitment 33 Finance will ensure its property management records system is regularly updated and adjusted as appropriate to track changes to properties with CHL values. Ongoing, with updates undertaken at least quarterly PPB, Five D Commitment 34 Finance will compile the information required as input to the Minister for the Environment’s report under Section 341ZH of the EPBC Act on a five yearly basis as part of monitoring and reporting on the condition of CHL values within the Portfolio. Every five years PPB Commitment 35 Finance AM Plans and HMPs will be prepared to include cross-referencing as appropriate and updated condition information. Ongoing PPB, Five D Commitment 36 Ongoing Finance supervisors will ensure their staff with responsibility for property and construction matters are accountable for adoption of Heritage Strategy policies and delivery of Heritage Strategy commitments. PCD Finance Heritage Strategy | 48 Strategy Ref. Number Detail Timeframe Lead er Commitment 37 Finance will ensure relevant property and construction contractors are accountable for contributing to the successful delivery of Heritage Strategy policies and commitments. Ongoing PCD Five D Commitment 38 Finance will regularly track progress and performance against Heritage Strategy commitments. At least annually PPB Commitment 39 Finance will prepare a review of the Strategy every three years in accordance with the requirements of the EPBC Act and Regulations. Every three years PPB Customs Marine Depot in the early 1980s. Source: Environmental Resource Management Australia 2014, courtesy of Customs records held on site, NAA File N73-6306 Finance Heritage Strategy | 49 WORLD WAR II BOORA POINT BATTERY OBSERVATION TOWER Malabar Headland, NSW Source: Department of Finance, 2010. Finance Heritage Strategy | 50 6.3 Compliance checklist for heritage strategies Table 6.1: EPBC Regulation 10.03E Schedule 7C compliance checklist Ref. Instruction Included Section 1 A strategy must include general matters, including the following: (a) a statement of the agency’s objective for management of its heritage places Section 3.2 (b) a description of how the heritage strategy operates within the agency’s corporate planning framework Section 2.3 (c) a list of key positions within the agency, the holders of which are responsible for heritage matters Section 2.3.2 (d) an outline of a process for consultation and liaison with other government departments and agencies on heritage matters Section 5.5 (e) an outline of a process for consultation and liaison with the community on heritage matters, including, in particular, a process for consultation and liaison with indigenous stakeholders on indigenous heritage matters Section 5.5 (f) an outline of a process for resolution of conflict arising from the assessment and management of Commonwealth Heritage values Section 5.2 (g) an outline of processes for monitoring, reviewing and reporting on the implementation of an agency’s heritage strategy Section 6 2 A strategy must include matters relating to the identification and assessment of Commonwealth heritage values, including the following: (a) an outline of the process for identifying and assessing the Commonwealth heritage values of all agency property (b) a statement of the timeframes for the completion of: (i) the agency’s heritage identification and assessment programme Section 5.2 (ii) the agency’s register of places and their Commonwealth Heritage values Section 5.2 (iii) the agency’s report to the Minister, that includes details of the programme and a copy of the register Section 5.2 3 A strategy must include matters relating to the management of Section 5.2 Finance Heritage Strategy | 51 Ref. Instruction Included Section Commonwealth heritage values, including the following: (a) a description of how the agency’s heritage places register will be maintained, updated and made accessible to the public Section 5.3 (b) a statement of the time frame for the preparation of management plans for the agency’s Commonwealth Heritage places Section 5.4 (c) an outline of the existing use, by the agency, of places with Commonwealth Heritage values Section 5.4 (d) an outline of current or expected development, works, disposal or other proposals that may affect Commonwealth Heritage values Section 5.4 (e) an outline of the process to ensure that Commonwealth heritage values are considered in the agency’s planning for future development, works, divestment or other proposals Section 5.4 (f) a plan and budget for the maintenance and long-term conservation of Commonwealth heritage values Section 5.4 (g) an outline of the process by which the success of the agency in conserving Commonwealth heritage values will be monitored and reviewed Section 5.6 4 A strategy must include matters relating to Commonwealth Heritage training and promotion, including the following: (a) a programme for the training of agency staff about Commonwealth heritage obligations and best practice heritage management Section 5.1 (b) a programme for promoting community awareness of Commonwealth heritage values, as appropriate Section 5.5 Finance Heritage Strategy | 52 Table 6.2: Commonwealth heritage management principles compliance checklist Ref. Principle and Compliance Response Principle 1 The objective in managing Commonwealth Heritage places is to identify, protect, conserve, present and transmit, to all generations, their Commonwealth Heritage values. Response Addressed in Section 5 Principle 2 The management of Commonwealth Heritage places should use the best available knowledge, skills and standards for those places, and include ongoing technical and community input to decisions and actions that may have a significant impact on their Commonwealth Heritage values. Response Addressed in Section 5 Principle 3 The management of Commonwealth Heritage places should respect all heritage values of the place and seek to integrate, where appropriate, any Commonwealth, state, territory and local government responsibilities for those places. Response Addressed in Section 5 Principle 4 The management of Commonwealth Heritage places should ensure that their use and presentation is consistent with the conservation of their Commonwealth Heritage values. Response Addressed in Section 4 Principle 5 The management of Commonwealth Heritage places should make timely and appropriate provision for community involvement, especially by people who: (a) have a particular interest in, or associations with, the place; and (b) may be affected by the management of the place. Response Addressed in Section 5 Principle 6 Indigenous people are the primary source of information on the value of their heritage and that the active participation of Indigenous people in identification, assessment and management is integral to the effective protection of Indigenous heritage values. Response Addressed in Section 5 Principle 7 The management of Commonwealth Heritage places should provide for regular monitoring, review and reporting on the conservation of Commonwealth Heritage values. Response Addressed in Section 5 Finance Heritage Strategy | 53 EDWARD BRADDON COMMONWEALTH LAW COURTS 39-41 Davey St, Hobart, Tasmania. Source: Environmental Resources Management Australia, 2012. Finance Heritage Strategy | 54