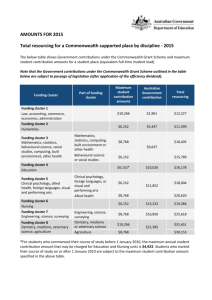

Commonwealth Supported Places (CSP) and Higher

advertisement