Alumni Chapter Finances - BYU Alumni

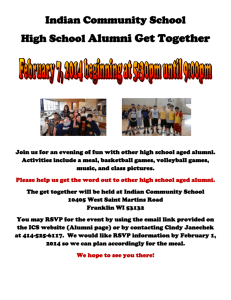

advertisement

Alumni Chapter Finances All financial operations of chapters in the United States are governed by the 501(c)(3) IRS status granted to Brigham Young University. This allows the operation of educational activities to go without assessment of corporate federal income taxes and also grants exemption from payment of sales tax in Utah and Hawaii. Each chapter is to be self-supporting and operate on a breakeven basis. BYU Alumni does not provide any direct financial support to its chapters. Chapter Financial Responsibilities Chapters are expected to pay for: 1. All event-related expenses a. Cost of reserving a facility b. Food and beverage costs c. Taxes and gratuity d. Costs associated with a guest speaker, performer or group including travel, lodging, event admissions etc. e. Advertising 2. Postage costs for fliers or newsletters a. One free mailing will be provided annually by BYU Alumni (bulk rate). b. The chapter will receive an invoice from BYU Alumni for the amount of postage for any additional mailings. c. New chapters will have additional help as needed. 3. Ongoing and miscellaneous needs of the chapter a. Stamps, envelopes, stationary, gifts, decorations, etc. 4. Annual chapter leadership conference registration costs for additional members of the chapter (beyond the two that are complimentary). Establishing a Local Chapter Bank Account 1. Tax laws in various states are becoming increasingly complicated. BYU has determined that we will not be opening new accounts in states where state requirements exceed a reasonable accommodation. 2. When a new account can be opened, follow these general instructions. A bank or credit union account (checking or savings) may be opened in the name of the chapter. Each account must be coordinated with the BYU treasurer by following these steps: a. Obtain account forms from your local bank or credit union. Try to find an alumnus who works in the banking industry that might waive the fees for a chapter account, or seek an institution that will waive the fees for a small, non-profit entity. b. An IRS letter establishing the non-profit status of Brigham Young University may be available to chapters for this purpose. Contact the alumni staff. c. Fill out the forms as much as you can. The account title must include BYU. There should be three signers on the account, we suggest: (1) chair, (2) vice- chair, and (3) chapter treasurer. d. Never place chapter funds in a personal account e. A financial evaluation and statement is due to the alumni activities office by August 31 of each year. (See the sample report Page 42) Assuming all transactions have taken place from the chapter banking account, bank or credit union statements are acceptable. Replenishment Grants 1. Funds accumulated for a chapter replenishment grant will be housed in a BYU financial services account at BYU. This account is tracked by the alumni staff. 2. To deposit money in your chapter’s replenishment grant fund: a. Make all checks payable to BYU and add the chapter’s name in the memo line. b. Clearly distinguish individual donations from funds generated by event proceeds. c. Individual donations included in a check from the chapter must be identified by: i. Name and address of individual donors ii. Check number (a copy of the check is preferred) iii. Amount d. Mail all funds to the alumni activities office and to no other location. The money will be deposited to your chapter’s replenishment grant fund. 3. Donations you receive for Replenishment Grants are sent to the alumni staff. They will make sure that LDSP receives and receipts the donation. Fund-Raising to Support Alumni Chapters 1. Event Fees – Ticket prices for any activity involving food, recreation, or entertainment should cover all expenses for the activity and allow for a small surplus. 2. Business Underwriters or Contributors (Sponsors) – Be aware of alumni whose businesses are willing to help defray the costs of an event, totally underwrite the costs, or provide other services. Also, it may be possible for a business to sponsor a mailing, but certain requirements must be met. Contact the alumni relations staff with questions. 3. Individual Donations – Chapters may ask local alumni for donations to help cover chapter expenses. These donations may be tax deductible; however tax laws regarding charitable donations are increasingly complicated, so chapter leaders are encouraged to consult with alumni staff or LDS Philanthropies before soliciting donations. a. Donors receive no goods or services in exchange for the donations. b. The chapter is to keep detailed records of such donations; name of donor, date of donation, address, phone, amount, check # (a copy of the check is preferred) c. All of this information must be submitted through the alumni office to LDS Philanthropies. d. These funds are to be kept in a chapter account and accounted for in the yearend report. Keep in mind that occasionally alumni appreciate an event that has no costs involved. It is better to make big amounts of money at one time than nickels and dimes at every activity.