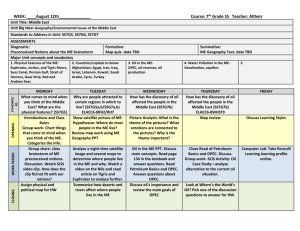

Knowledge Capsule Sheikh vs Shale: Slide 1: Now who thinks that

advertisement

Sheikh vs Shale: Slide 1: Now who thinks that the fall in petroleum price is because of our PM Modi? Well, this presentation is going to change your notions. Our topic for the day is Sheikh vs. Shale. We all know who a sheikh is. But, we hardly know what Shale is. Don’t worry. We’ll soon come to know about it. Slide 2: Here , you can see how oil was discovered in different parts of the world, starting from Persia. Slide 3: Now, have any of you heard what OPEC is? As you can read, OPEC stands for Organisation of the Petroleum Exporting Countries. It was formed in 1960. It does not consist of ALL the oil exporting countries of the world, but yes, it does consist of some of the major countries. Thus, making it the LARGEST producer of crude oil in the world. Slide 4: It comprises of 12 member countries, namely: Saudi Arabia, Iran, Iraq, Kuwait, Venezuela, Qatar, Ecuador, Libya, Algeria, Nigeria, Angola and UAE. And Saudi Arabia among these, is the Big Boss. Well, I know you won’t be able to remember all the names. I can’t remember them myself. So, let’s just stick to OPEC. Slide 5: OPEC has 80 percent of world crude oil reserve and supplies about 40 percent of the world’s oil. Slide 6: As you can see in the graph, crude oil prices have hardly dipped below $100/barrel in the past few years. Slide 7: This happened because as soon the price fell below $100, OPEC used to lower its production in order to increase the price level. If supply reduces, then price increases. For example, if rainfall was deficient last year, then there was less production of mangoes. So, supply reduced which caused mangoes to be expensive. When production went down, prices went up. Slide 8: But, the year 2014 saw an unusual drop in the price of crude oil. Earlier people took it lightly thinking it’s the same old game – Price fall means production would be cut. But From being priced at $100-95 in June, the oil prices started falling and came down to a staggering $48 in the month of December. Now just think. When there was a slight fall in oil prices, OPEC directly cut down its production. Now, the prices almost halved. Was OPEC sleeping?! Slide 9: Let’s have a look at what OPEC had to say about the declining prices. From June to November, they were basically saying that the fall in price level was in the interest of producers and consumers, to make THEM happy and it’s not a big issue, since prices always fluctuate. On December 22nd, the Saudi oil minister said that he didn’t care even if the prices fell to as low as $20. Slide 10: Now, you must be thinking why are they doing this. They can easily lower their production, right? Who do you think is the biggest loser if the prices fall?? PRODUCERS OF OIL!! i.e., OPEC.So, even after facing huge losses, why did OPEC not stop the production? But as we have heard, Haar ke jeetne wale ko baazigar kehte hai. Let’s see how OPEC was the Baazigar in this case! Slide 11: By now, it is given that OPEC didn’t cut down its production which is why there was a fall in the crude oil prices. There could have been some other reasons as well. There is a slowdown in China’s economy, which is the largest importer of crude oil. Since, China started importing less oil, therefore there was more surplus. BUT the MOST important point- USA is using more shale oil. Slide 12: I mentioned shale gas in the 1st slide. Shale gas is a natural gas trapped within shale formations which are fine-grained sedimentary rocks that can be rich resources of petroleum and natural gas. Slide 13: The major producers of shale gas are America and Canada. Slide 14: Shale gas is an alternative to crude oil. America has increased Shale production by over 70 percent and has reduced its oil import from OPEC by 50 percent. And, it is said that USA will have enough production to be self-sufficient that means it won’t require crude oil from ANY country. Slide 15: OPEC obviously sensed the threat posed by shale gas. If people start buying shale gas, their business will be a flop. Thus, they secretly laid a trap for their rivals to eliminate them from the market. Slide 16: So you can see that the rapid fall in the price of crude oil was actually a well-planned strategy of OPEC to shut down the factories of shale gas in America and Canada. Slide 17: We have been going on about Sheikh vs. shale for so long. But, what EXACTLY is the Sheikh vs Shale game? Sheikh basically symbolizes OPEC and shale is its US Competitor. OPEC is the world’s largest producer of crude oil and it has a considerable effect on the price of the crude oil. On seeing that shale gas production in USA & Canada booming, it developed a strategy to protect its markets share and destroy shale gas production Slide 18: The entire game boiled down to OPEC decreasing the price of crude oil, till the shale oil producers were forced to stop its production. Thus, OPEC will emerge as the ultimate winner. Slide 19: To produce one barrel of crude oil, it takes about $10-$20. But to produce one barrel of shale gas it takes approx. $6o-$80. So, if the prices drop to even $20, it wouldn’t be a problem for Saudi Arabia. It would still be in profit. Slide 20: When the price of crude oil fell to $50, it was impossible for the shale oil producers to keep up with the competition. They would start incurring losses and thus they had to shut down production losing out to the competition. Slide 21: But, as we all know that the world is no less than an Ekta Kapoor serial, minus the large bindis and heavy sarees. Facts are much stranger than fiction. There’s someone else who has fallen prey to this conspiracy and has ended up being the biggest loser of all.