Click here to read more - Charter Wealth Management Inc.

advertisement

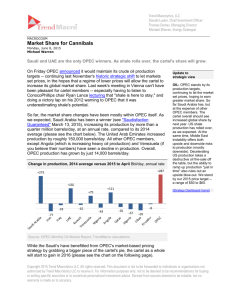

Don’t let a good oil crisis go to waste http://www.advisor.ca/investments/market-insights/dont-let-a-good-oil-crisis-go-to-waste-192413 D. Mason Granger / October 16, 2015 The oil and gas sector is based around a largely undifferentiated commodity. Companies in each energy subsector compete for their share of the economic rent associated with the extraction of the natural resource at each part of the value chain. These subsectors include the upstream exploration and production companies, as well as the oilfield services companies like drillers, refiners and pipelines. The government also has a significant hand in the economic cookie jar, and warrants mention for its ill-timed royalty and tax reviews of the sector, especially during times of duress on producers. The OPEC cartel, Saudi Arabia in particular, kept the price of crude oil at US$93 per barrel from 2010 to mid-2014. But the collapse in global crude oil prices has created a reckoning in the North American oil industry. It is a crisis that OPEC engineered with its shift from focusing on maximizing revenue to regaining lost market share to shale oil. And, it’s caused a massive adjustment in the oil business on this continent. The cost of capital for producers has soared as players grapple with crushing debt burdens. Service companies have also been struggling with reduced activity levels. The adjustment process is causing the entire industry to reset its cost structure. And it behooves us, as investors, not to pause and take stock of this process. A crisis is upon us, so don’t let it go to waste. Sliding breakevens in North American shale oil The renaissance of the North American oil industry has been nothing short of impressive. North American technology has bucked recent trends by introducing multi-stage fracking so that horizontal wells can access previously uneconomic resources. Ten years ago, only a handful of horizontal wells existed in shale formations. Two billion feet—enough to circle the earth more than 25 times—have since been drilled horizontally, in hundreds of thousands of wells in U.S. shale fields. Incremental and dramatic improvements will continue in all aspects of the technologies used in shale production, including logistics, planning, seismic imaging, well spacing, fluid and sand handling, chemistry, drilling speed, pumping efficiency, instrumentation and sensors. EOG Resources is regarded as one of the best operators in the U.S., and is deploying 80% of its capital in three of the best plays in the country—one of which is the prolific Eagle Ford play (see Chart 1, below). Capex deflation The economic rent earned by services companies has been significant during the commodity super cycle. As a Calgary CEO recently pointed out, labour costs have gone up for 17 years straight, rising from 20% to 25% up to the current level of 60% to 65% of total service costs. Labour costs have risen much faster than the overall Canadian economy, and contributed to the country’s rise in real estate prices and the wages of many ancillary businesses. The current crisis has slammed the brakes on this rise. The Canadian Association of Petroleum Producers notes that, to date, there have been approximately 35,000 job losses, including 25,000 in the oilservices sector and another 10,000 in exploration and production. These job losses will accelerate now that summer holidays have drawn to a close and companies are forced to make some tough decisions, particularly as hedging programs for the balance of 2015 wind down. Some estimates put the total losses as high as 150,000 to 180,000 people by year-end. Ultimately, a return to upward pressure on labour rates won’t occur until there’s a durable recovery. Chart 2 compares the current environment to the 1986 collapse, when OPEC last prioritized market share. Upstream companies come back leaner One of the conclusions from the annual Peters & Co. Energy Conference in Toronto in September was the dramatic reduction in the break even crude-oil price. Many producers touted being able to renegotiate service costs down by 20% to 30%, with a commensurate decrease in well costs and overall reductions in the price at which companies could achieve an acceptable rate of return on capital employed. In some instances, management teams suggested that, all else being equal, savings in this environment amounted to as much as a C$25 per-barrel reduction in the break even oil price. While we do not expect these savings will be sustainable under a recovery scenario, producers have now become more competitive. OPEC market share conundrum There is considerable pessimism about a return to US$100 per-barrel oil. After all, the Saudis seem to be showing significant resolve in keeping the market oversupplied in order to achieve their goal of re-establishing market-share dominance. With most OPEC producers requiring prices in the US$90 to US$100 per-barrel range to make their respective fiscal balances go around, the pain is particularly manifest for the financially weaker members of the cartel, like Venezuela and Nigeria. The optimistic case for global producers is that the steep cuts to global investment may pay significant dividends, with the potential for an overshoot on prices in 2017 to 2018. One thing’s certain: the North American upstream producers are not dead and will almost certainly re-emerge from the oil price rout stronger, with an improved cost structure born out of the current doldrums. Chart 3 shows the gradual erosion of return on equity for producers through periods of higher oil prices. When commodity prices were at approximately equivalent levels in 2003 (in line with the last few years), producer ROEs were substantially higher than the more recent experience, and we have cheap credit and cost escalation to thank for this. We expect a reversal of fortune as the industry cost structure resets in the current environment. For OPEC, the stakes have never been higher as the wholesale reboot of the North American sector almost certainly portends a leaner, meaner competitor down the road. In this difficult market, investors should remain cautious of companies with unmanageable leverage ratios, as well as low-quality assets. Investors should instead focus on stronger companies with access to capital, cost structures that are sustainable during the downturn, and that can use this environment as an opportunity to strengthen their businesses. by D. Mason Granger, P.Eng., MBA, CFA, portfolio manager, Sentry Investments.