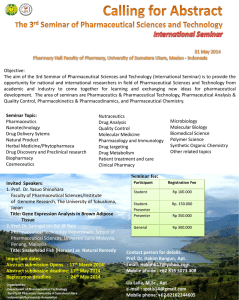

The Acme Laboratories

advertisement