Finance Exam 1 Spring 2015 Key

advertisement

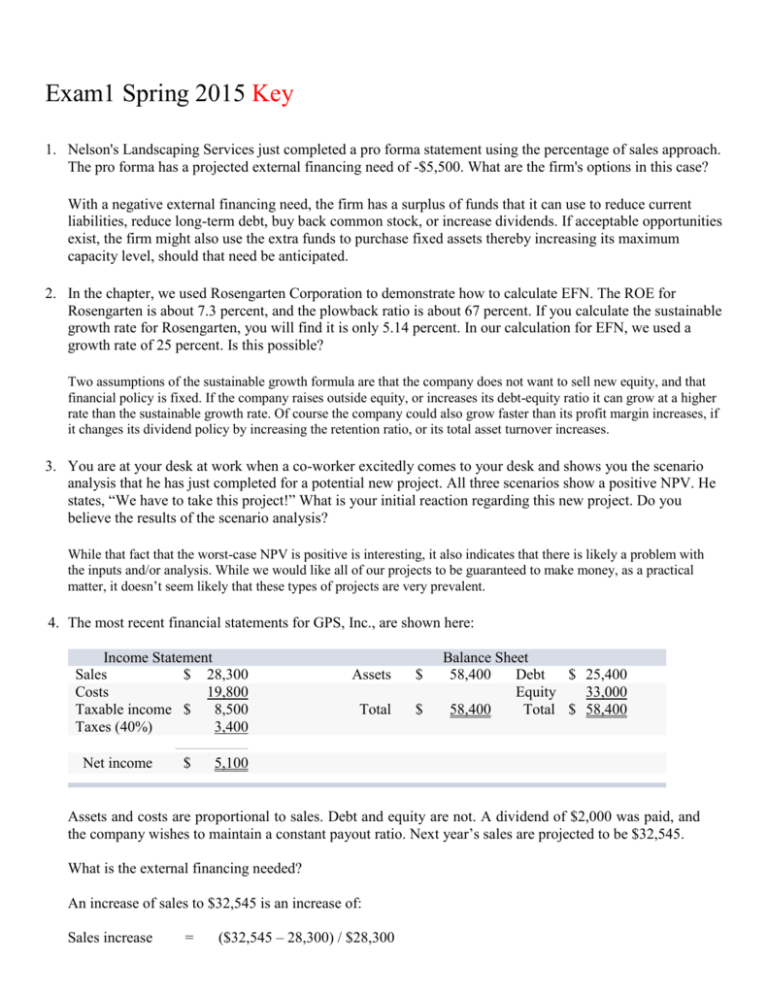

Exam1 Spring 2015 Key 1. Nelson's Landscaping Services just completed a pro forma statement using the percentage of sales approach. The pro forma has a projected external financing need of -$5,500. What are the firm's options in this case? With a negative external financing need, the firm has a surplus of funds that it can use to reduce current liabilities, reduce long-term debt, buy back common stock, or increase dividends. If acceptable opportunities exist, the firm might also use the extra funds to purchase fixed assets thereby increasing its maximum capacity level, should that need be anticipated. 2. In the chapter, we used Rosengarten Corporation to demonstrate how to calculate EFN. The ROE for Rosengarten is about 7.3 percent, and the plowback ratio is about 67 percent. If you calculate the sustainable growth rate for Rosengarten, you will find it is only 5.14 percent. In our calculation for EFN, we used a growth rate of 25 percent. Is this possible? Two assumptions of the sustainable growth formula are that the company does not want to sell new equity, and that financial policy is fixed. If the company raises outside equity, or increases its debt-equity ratio it can grow at a higher rate than the sustainable growth rate. Of course the company could also grow faster than its profit margin increases, if it changes its dividend policy by increasing the retention ratio, or its total asset turnover increases. 3. You are at your desk at work when a co-worker excitedly comes to your desk and shows you the scenario analysis that he has just completed for a potential new project. All three scenarios show a positive NPV. He states, “We have to take this project!” What is your initial reaction regarding this new project. Do you believe the results of the scenario analysis? While that fact that the worst-case NPV is positive is interesting, it also indicates that there is likely a problem with the inputs and/or analysis. While we would like all of our projects to be guaranteed to make money, as a practical matter, it doesn’t seem likely that these types of projects are very prevalent. 4. The most recent financial statements for GPS, Inc., are shown here: Income Statement Sales $ 28,300 Costs 19,800 Taxable income $ 8,500 Taxes (40%) 3,400 Net income $ Assets $ Total $ Balance Sheet 58,400 Debt $ 25,400 Equity 33,000 58,400 Total $ 58,400 5,100 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,000 was paid, and the company wishes to maintain a constant payout ratio. Next year’s sales are projected to be $32,545. What is the external financing needed? An increase of sales to $32,545 is an increase of: Sales increase = ($32,545 – 28,300) / $28,300 Sales increase = 0.15, or 15% Assuming costs and assets increase proportionally, the pro forma financial statements will look like this: Pro forma income statement Sales $ Costs EBIT $ Taxes (40%) Net income $ Pro forma balance sheet 32,545 22,770 9,775 3,910 Assets $ 67,160 Total $ 67,160 Debt Equity Total $ 25,400 36,565 $ 61,965 5,865 The payout ratio is constant, so the dividends paid this year is the payout ratio from last year times net income, or: Dividends = ($2,000 / $5,100)($5,865) Dividends = $2,300 The addition to retained earnings is: Addition to retained earnings Addition to retained earnings = = $5,865 – 2,300 $3,565 And the new equity balance is: Equity = $33,000 + 3,565 Equity = $36,565 So the EFN is: EFN= Total assets – Total liabilities and equity EFN= $67,160 – 61,965 EFN= $5,195 5. This problem concerns the effect of taxes on the various break-even measures. Consider a project to supply Detroit with 40,000 tons of machine screws annually for automobile production. You will need an initial $5,800,000 investment in threading equipment to get the project started; the project will last for six years. The accounting department estimates that annual fixed costs will be $600,000 and that variable costs should be $250 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the six-year project life. It also estimates a salvage value of $450,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $340 per ton. The engineering department estimates you will need an initial net working capital investment of $560,000. You require a 14 percent return and face a marginal tax rate of 30 percent on this project. Calculate the accounting, cash, and financial break-even quantities. At the cash break-even, the OCF is zero. Setting the tax shield equation equal to zero and solving for the quantity, we get: OCF = 0 = [($340 – 250)QC – $600,000](0.70) + 0.30($5,800,000/6) QC= 2,063 The accounting breakeven is: QA= [$600,000 + ($5,800,000/6)]/($340 – 250) QA= 17,407 Using the tax shield approach, the OCF is: OCF = [($340 – 250)(40,000) – $600,000](0.70) + 0.30($5,800,000/6) OCF = $2,390,000 And the NPV is: NPV = –$5,800,000 – 560,000 + $2,390,000(PVIFA14%,6) + [$560,000 + $450,000(1 – .30)]/1.146 NPV = $3,332,553.59 To calculate the sensitivity to changes in quantity sold, we will choose a quantity of 41,000. The OCF at this level of sale is: OCF = [($340 – 250)(41,000) – $600,000](0.70) + 0.30($5,800,000/6) OCF = $2,453,000 The sensitivity of changes in the OCF to quantity sold is: ΔOCF/ΔQ = ($2,390,000 – 2,453,000)/(40,000 – 41,000) ΔOCF/ΔQ = +$63.00 The NPV at this level of sales is: NPV = –$5,800,000 – $560,000 + $2,453,000(PVIFA14%,6) + [$560,000 + $450,000(1 – 0.30)]/1.146 NPV = $3,577,539.65 And the sensitivity of NPV to changes in the quantity sold is: ΔNPV/ΔQ = ($3,332,553.59 – 3,577,539.65))/(40,000 – 41,000) ΔNPV/ΔQ = +$244.99 You wouldn’t want the quantity to fall below the point where the NPV is zero. We know the NPV changes $244.99 for every unit sold, so we can divide the NPV for 40,000 units by the sensitivity to get a change in quantity. Doing so, we get: $3,332,553.59 = $244.99(ΔQ) ΔQ = 13,603 For a zero NPV, we need to decrease sales by 13,603 units, so the minimum quantity is: QF = 40,000 – 13,603 QF = 26,397 6. What is forecasting risk and why is it important to the analysis of capital expenditure projects? What methods can be used to reduce this risk? Forecasting risk is the possibility that errors in projected cash flows will lead to incorrect decisions. Projects are generally accepted when they have positive NPVs and rejected when they have negative NPVs. If the cash inflows of a project are overestimated, the NPV will be overstated potentially resulting in an incorrect acceptance of the project. On the other hand, if cash inflows are underestimated, a good project might be erroneously rejected. To offset some of this risk, managers should employ sensitivity and scenario analysis as well as break-even analysis to better understand the potential outcomes associated with the project. 7. What are some advantages of the subjective approach to determining the cost of capital and why do you think that approach is utilized? The subjective approach allows management to adjust a firm's overall cost of capital for individual divisions based upon its evaluation of the risks associated with each division as compared to the overall risk level of the firm. This risk adjustment is based on the wisdom, knowledge, and experiences of the managers. To try and determine a more accurate estimate of the appropriate discount rate might encounter costs that would outweigh any potential benefit. Thus, the subjective approach is useful because it adjusts discount rates in a cost effective and efficient manner. 8. Under what circumstances would it be appropriate for a firm to use different costs of capital for its different operating divisions? If the overall firm WACC were used as the hurdle rate for all divisions, would the riskier divisions or the more conservative divisions tend to get most of the investment projects? Why? If you were to try to estimate the appropriate cost of capital for different divisions, what problems might you encounter? What are two techniques you could use to develop a rough estimate for each division’s cost of capital? If the different operating divisions were in much different risk classes, then separate cost of capital figures should be used for the different divisions; the use of a single, overall cost of capital would be inappropriate. If the single hurdle rate were used, riskier divisions would tend to receive more funds for investment projects, since their return would exceed the hurdle rate despite the fact that they may actually plot below the SML and, hence, be unprofitable projects on a risk-adjusted basis. The typical problem encountered in estimating the cost of capital for a division is that it rarely has its own securities traded on the market, so it is difficult to observe the market’s valuation of the risk of the division. Two typical ways around this are to use a pure play proxy for the division, or to use subjective adjustments of the overall firm hurdle rate based on the perceived risk of the division. 9. In the aggregate, debt offerings are much more common than equity offerings and typically much larger as well. Why? A company’s internally generated cash flow provides a source of equity financing. For a profitable company, outside equity may never be needed. Debt issues are larger because large companies have the greatest access to public debt markets (small companies tend to borrow more from private lenders). Equity issuers are frequently small companies going public; such issues are often quite small. 10. Lorre, Inc., recently issued new securities to finance a new TV show. The project cost $14.6 million, and the company paid $785,000 in flotation costs. In addition, the equity issued had a flotation cost of 7.6 percent of the amount raised, whereas the debt issued had a flotation cost of 3.6 percent of the amount raised. If the company issued new securities in the same proportion as its target capital structure, what is the company’s target debt–equity ratio? The total cost including flotation costs was: Total costs = $14,600,000 + 785,000 = $15,385,000 Using the equation to calculate the total cost including flotation costs, we get: Amount raised(1 – fT) = Amount needed after flotation costs $15,385,000(1 – fT) = $14,600,000 fT = 0.0510, or 5.10% Now, we know the weighted average flotation cost. The equation to calculate the percentage flotation costs is: fT = 0.0510 = 0.076(E/V) + 0.036(D/V) We can solve this equation to find the debt-equity ratio as follows: 0.0510(V/E) = 0.076 + 0.036(D/E) We must recognize that the V/E term is the equity multiplier, which is (1 + D/E), so: 0.0510(D/E + 1) = 0.076 + 0.036(D/E) D/E = 1.6625 11. Roth Corp. wants to raise $3.1 million via a rights offering. The company currently has 410,000 shares of common stock outstanding that sell for $50 per share. Its underwriter has set a subscription price of $20 per share and will charge the company a spread of 3 percent. If you currently own 5,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? The net proceeds to the company on a per share basis is the subscription price times one minus the underwriter spread, so: Net proceeds to the company = $20(1 – 0.03) = $19.40 per share So, to raise the required funds, the company must sell: New shares offered = $3,100,000/$19.40 = 159,793.81 The number of rights needed per share is the current number of shares outstanding divided by the new shares offered, or: Number of rights needed = 410,000 old shares/159,793.81 new shares Number of rights needed = 2.57 rights per share The ex-rights stock price will be: PX = [NPRO + PS]/(N + 1) PX = [2.57($50) + 20]/(2.57 + 1) = $41.59 So, the value of a right is: Value of a right = $50 – 41.59 = $8.41 And your proceeds from selling your rights will be: Proceeds from selling rights = 5,000($8.41) = $42,066.22 12. Explain what is meant by business risk and financial risk. Suppose Firm A has greater business risk than Firm B. Is it true that Firm A also has a higher cost of equity capital? Explain. Business risk is the equity risk arising from the nature of the firm’s operating activity and is directly related to the systematic risk of the firm’s assets. Financial risk is the equity risk that is due entirely to the firm’s chosen capital structure. As financial leverage, or the use of debt financing, increases, so does financial risk and, hence, the overall risk of the equity. Thus, Firm B could have a higher cost of equity if it uses greater leverage. 13. What is the impact of a stock repurchase on a company's debt ratio? Does this suggest another use for excess cash? A stock repurchase reduces equity while leaving debt unchanged. The debt ratio rises. A firm could, if desired, use excess cash to reduce debt instead. This is a capital structure decision. 14. Steve is the founder of Jefferson & Westover. Recently, the firm decided to issue an IPO with Steve retaining 30 percent ownership of the firm. The IPO agreement contained both a Green Shoe provision and a 6-month lockup agreement. Steve's cost basis per share is $15. The offering price for the IPO was $16. On the first day of trading, the market price per share rose to $28.20 and closed for the day at $25.60. Now, six months after the IPO release, the stock is valued at $15.40 a share. Explain who benefited the most during the lockup period, an outside investor or Steve, and why. As a company insider, the lockup agreement has prevented Steve from selling any of his shares and benefiting from the substantial price increase to $28.20 a share. Thus, Steve still owns all of his shares and has a current profit of $0.40 a share. Meanwhile, Outside Investor A could have purchased shares for $16 and sold them at $28.20 each. Outside Investor B, could have bought the shares at $28.20 and suffered a loss since the shares have declined in value since that point. Thus, who is better off depends upon the price at which the outside investor purchased shares. 15. Based on the M & M propositions with and without taxes, how much time should a financial manager spend analyzing the capital structure of a firm? What if the analysis is based on the static theory? Under either M & M scenario, a financial manager should not spend time analyzing the firm's capital structure. With no taxes, capital structure is irrelevant. With taxes, M & M says a firm will maximize its value by using 100 percent debt. In both cases, the manager has nothing to decide. With the static theory, however, the manager must determine the optimal amount of debt and equity by analyzing the tradeoff between the benefits of the interest tax shield versus the financial distress costs. Finding the optimal capital structure is challenging in this case. 16. You are the CFO of a non-dividend paying firm that currently has excess cash reserves. You are preparing for an internal management meeting where dividends are on the agenda. You know that the CEO favors the commencement of a dividend program. You, however, oppose any dividend plan at this time. Write a good argument that you can use in the meeting to support your position. While it is true that the firm currently has excess cash reserves, those reserves can best be utilized to fund positive NPV projects which will increase the value of the firm and thus, the value of the shares held by our current shareholders. This increase in value does not create any tax liability for those shareholders until or unless they opt to sell their shares. Dividends on the other hand, will create an immediate tax liability for the majority of our shareholders, who don't need or prefer dividend income at this time. If we commence a dividend program, we may find that our clientele changes, which is not one of our current goals. In addition, once we pay a dividend, we need to be prepared to maintain that dividend, as any decrease in the dividend at a later date would send the wrong message to our shareholders and to the market. Lastly, should we deplete our excess cash reserves by implementing a dividend program, we might find ourselves in the uncomfortable position of seeking additional equity financing which would be expensive and possibly also dilutive to our shareholders. 17. Mudpack, Inc., a prominent consumer products firm, is debating whether to convert its all-equity capital structure to one that is 30 percent debt. Currently, there are 14,000 shares outstanding, and the price per share is $63. EBIT is expected to remain at $77,000 per year forever. The interest rate on new debt is 7 percent, and there are no taxes. Allison, a shareholder of the firm, owns 250 shares of stock. What is her cash flow under the current capital structure, assuming the firm has a dividend payout rate of 100 percent? What will Allison’s cash flow be under the proposed capital structure of the firm? Assume she keeps all 250 of her shares. Assume that Allison unlevers her shares and re-creates the original capital structure. What is her cash flow now? The earnings per share are: EPS = $77,000/14,000 shares EPS = $5.50 So, the cash flow for the investor is: Cash flow = $5.50(250 shares) Cash flow = $1,375.00 To determine the cash flow to the shareholder, we need to determine the EPS of the firm under the proposed capital structure. The market value of the firm is: V = $63(14,000) V = $882,000 Under the proposed capital structure, the firm will raise new debt in the amount of: D = 0.30($882,000) D = $264,600 This means the number of shares repurchased will be: Shares repurchased = $264,600/$63 Shares repurchased = 4,200 Under the new capital structure, the company will have to make an interest payment on the new debt. The net income with the interest payment will be: NI = $77,000 – 0.070($264,600) NI = $58,478.00 This means the EPS under the new capital structure will be: EPS = $58,478.00/(14,000 – 4,200) shares EPS = $5.9671 Since all earnings are paid as dividends, the shareholder will receive: Shareholder cash flow = $5.9671(250 shares) Shareholder cash flow = $1,491.79 To replicate the proposed capital structure, the shareholder should sell 30 percent of her shares, or 75 shares, and lend the proceeds at 7 percent. The shareholder will have an interest cash flow of: Interest cash flow = 75($63)(0.070) Interest cash flow = $330.75 The shareholder will receive dividend payments on the remaining 175 shares, so the dividends received will be: Dividends received = $5.9671(175 shares) Dividends received = $1,044.25 The total cash flow for the shareholder under these assumptions will be: Total cash flow = $330.75 + 1,044.25 Total cash flow = $1,375.00 18. The Gecko Company and the Gordon Company are two firms whose business risk is the same but that have different dividend policies. Gecko pays no dividend, whereas Gordon has an expected dividend yield of 4 percent. Suppose the capital gains tax rate is zero, whereas the income tax rate is 30 percent. Gecko has an expected earnings growth rate of 16 percent annually, and its stock price is expected to grow at this same rate. The aftertax expected returns on the two stocks are equal (because they are in the same risk class). What is the pretax required return on Gordon’s stock? Assuming no capital gains tax, the aftertax return for the Gordon Company is the capital gains growth rate, plus the dividend yield times 1 minus the tax rate. Using the constant growth dividend model, we get: Aftertax return = g + D(1 – t) = 0.16 Solving for g, we get: 0.16 = g + 0.04(1 – 0.30) g = 0.1320 The equivalent pretax return for Gordon Company is: Pretax return = g + D = 0.1320 + 0.04 = 0.1720, or 17.20%