FIN 357 - Business Finance - Kang 03640

advertisement

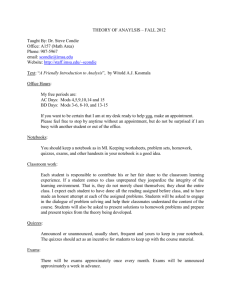

FIN 357 – BUSINESS FINANCE FALL 2014 MW 9:30 AM – 10:45 AM, UTC 4.110 (SECTION 03640) Professor Office Office Hours E-Mail Course Web Page Ari Kang CBA 6.230 Wednesday 11 am – 12 pm; 2 pm – 3 pm ari.kang@mccombs.utexas.edu via Canvas Head TA Gonzalo Maturana Gonzalo.Maturana@phd.mccombs.utexas.edu Ben Zhang Miao.zhang@phd.mccombs.utexas.edu Kerri Murphy Kerri.Murphy@mba15.mccombs.utexas.edu TA Course Objectives Business Finance is designed to introduce students to the three basic ideas underpinning finance: the time value of money, risk and return, and value creation. The aim of the course is to provide students with introductory exposure to (1) present value and capital budgeting techniques, (2) asset valuation and the trade-off between risk and return, and (3) the financing decisions of the firm. It provides students with a solid foundation that is subsequently built upon in subsequent courses in corporate finance, security analysis, investment management, fixed income securities, derivative markets, and real estate finance. Since the emphasis is on the fundamental concepts underlying corporate finance, the approach will be analytical and rigorous and requires some familiarity with accounting, mathematical, and statistical tools. After completing the course, you should be able to understand and critically evaluate the discussion of financial issues in the popular press and have a framework for analyzing the major types of financial decisions made by corporations. FIN 357 – Business Finance – Fall 2014 Ari Kang Course Material/Requirements Required Text Jonathan Berk, Peter DeMarzo and Jarrad Harford, Fundamentals of Corporate Finance (3rd ed.), Boston, MA, Pearson, Inc., 2014. Establish a MyFinanceLab account: You can gain access by registering at the following class section URL: http://www.pearsonmylabandmastering.com/northamerica/ Suggested Materials Subscription to the Wall Street Journal. We will cover the conceptual material to help you think through financial decisions, however, details of a particular issue I might ask your thoughts on may come from the press. Calculator You will probably need a calculator for the homework, quizzes, and exams. I recommend a scientific calculator; you will not be able to use a graphing calculator. A financial calculator is permitted, but I do not use financial calculators so you are on your own with them. Also, you will not get credit on quizzes or exams for simply writing down the inputs and outputs from the financial calculator, so it may be more of a hindrance than a help. I strongly recommend doing your homework using both Excel and a scientific calculator. Course Webpage The course webpage via Canvas will serve as the primary mechanism for communicating course-related information. A PowerPoint file containing the overhead transparencies for the next class will be available at least 24 hours before the scheduled class meeting. You are responsible for getting a copy of the file and bringing it to class. Adobe Acrobat PDF files of the course syllabus, class schedule and the solutions to the end-of-chapter problems are available on the course web page. The solutions to the end-of-chapter problems have been prepared by the publisher of the textbook. Please inform me or my TA if you feel you have found a mistake in any of these documents. Adobe Acrobat PDF files containing all class assignments (quizzes, exams, case questions and homework) will be available to download from the web page throughout the course. page 2 Ari Kang FIN 357 – Business Finance – Fall 2014 Course Requirements and Grading Your grade in the course will be determined as follows: Homework Participation Quizzes Exam I Exam II Exam III Points 10 5 25 20 20 20 100 Class assignments: See Calendar or Syllabus on Canvas for class assignments, as well as dates for all course requirements (quizzes, exams, and homework). Homework: Homework assignments for each chapter will be available on MyFinanceLab. All help tools will be turned on for these assignments and you will be able to rework the problems that you get wrong for (full) credit. You should complete the assignments by the due date; otherwise you will likely perform poorly on the quizzes and exams. However, you will be able to rework incorrect problems without a deadline, up to the day of the last exam. Quizzes: Quizzes are administered in class (approximately 20 minutes) and consist of a maximum of 10 questions/problems. Four quizzes will be given. Conflicts between the scheduled quizzes and other academic or work requirements should be resolved by the student. There are no make-ups for the quizzes; however, only the best 3 of 4 scores will be counted. Exams: The exams can be a mixture of multiple choice, short answer and problems. Alternate exam dates are not an option. Conflicts between the scheduled exams and other academic or work requirements should be resolved by the student. Exams are scheduled in the evening. The class period immediately before the exam will be used for additional office hours rather than lecture. MAKE SURE YOU ARRANGE YOUR SCHEDULE TO BE AVAILABLE DURING THE EXAM. Attending the exam must be your highest priority and non-academic scheduling conflicts will not in general be taken into account. Please bring any scheduling issues to the attention of the head TA as soon as possible. There will not be a “final” exam during the exam period. Due to the nature of the course all exams are effectively cumulative; however, this caveat applies primarily to the problems rather than the multiple choice and short answer questions. Calculators may be used when taking an exam. You cannot share calculators with others during the exam. Be sure to learn how to use your calculator and make sure the batteries have sufficient power before the scheduled exam. page 3 FIN 357 – Business Finance – Fall 2014 Ari Kang page 4 Missing Exams/Quizzes If you must miss an exam for illness or another emergency, you must go through student emergency services. Once you have the appropriate documentation, you will need to coordinate a makeup with the Head TA. Grading Curve: Grading will be based on a hybrid curve. Any student can guarantee himself or herself at least the grade given by the cutoffs below by reaching the relevant percentage score. If the exams/quizzes turn out to be harder than anticipated, however, the class will be curved to produce the grade distribution that follows. Grade Score Threshold A 92 A- 89 B+ 87 B 83 B- 79 C+ 77 C 73 C- 69 D+ 67 D 63 D- 59 Minimum share at or above 35% 70% 90% 95% Learning Catalytics I will be using the “Learning Catalytics” software from Pearson on a trial basis in this class. This software is effectively a “bring your own device” version of iClicker. You will answer questions from your smartphone, tablet, or a laptop. Halfway through the class I will likely hold a referendum on whether to continue using this tool, and I welcome feedback on this system at any point in the class. Note that this system requires a permissive technology policy; you can bring and use pretty much any device. If you really must use your phone or laptop for entertainment during lectures, please do so in a way that minimizes the disruption to other students. Ari Kang FIN 357 – Business Finance – Fall 2014 Conduct of the Course and Academic Requirements Class lectures are an important part of the course. Reading assignments from the textbook are required. It should be noted that class attendance is considered essential for passing performance in the course. In addition, student participation is expected. This involves being prepared when called on in class to discuss any assigned material and/or to work assigned problems. Please note dates and times for exams and quizzes are provided in the course schedule distributed on the first day of class. Both the syllabus and course schedule are available on the course web page. If you miss a class, it is your responsibility to determine what was covered including any administrative announcements. Expect that some of the material covered on exams will not be in the text. Hence, you are urged to attend class regularly. Make-up or extra work to improve your grade is not possible. Your final letter grade is determined by the criteria set forth in the student evaluation section of this syllabus. Office hours for the teaching assistant will be distributed once the semester has begun. Office hours may change during the semester. Such changes will be announced in class and /or posted on the course web page. Additional hours will be scheduled during exam weeks. Should you have to leave class early, please extend the courtesy of informing the instructor before the beginning of the period and leave quietly so as not to disturb the other members of the class. page 5 Ari Kang FIN 357 – Business Finance – Fall 2014 University Policies Affecting the Course Students with Disabilities: Students with disabilities may request appropriate academic accommodations from the Division of Diversity and Community Engagement, Services for Students with Disabilities, 512-471-6259, http://www.utexas.edu/diversity/ddce/ssd. Religious Holy Days: By UT Austin policy, you must notify me of your pending absence at least fourteen days prior to the date of observance of a religious holy day. If you must miss a class, an examination, a work assignment, or a project in order to observe a religious holy day, you will be given an opportunity to complete the missed work within a reasonable time after the absence. Campus Safety: Please note the following recommendations regarding emergency evacuation from the Office of Campus Safety and Security, 512-471-5767, http://www.utexas.edu/safety/ : Occupants of buildings on The University of Texas at Austin campus are required to evacuate buildings when a fire alarm is activated. Alarm activation or announcement requires exiting and assembling outside. Familiarize yourself with all exit doors of each classroom and building you may occupy. Remember that the nearest exit door may not be the one you used when entering the building. Students requiring assistance in evacuation should inform their instructor in writing during the first week of class. In the event of an evacuation, follow the instruction of faculty or class instructors. Do not re-enter a building unless given instructions by the following: Austin Fire Department, The University of Texas at Austin Police Department, or Fire Prevention Services office. Behavior Concerns Advice Line (BCAL): 512-232-5050 Further information regarding emergency evacuation routes and emergency procedures can be found at: www.utexas.edu/emergency. page 6 FIN 357 – Business Finance – Fall 2014 Ari Kang page 7 FIN 357 – Business Finance – Spring 2014 Class Schedule* Date Class BD&H Chapter Assignments Due 27-Aug 1-Sep 3-Sep 8-Sep 10-Sep 15-Sep 17-Sep 22-Sep W M W M W M W M 1 1 2 3 4 5 6 7 3 4 5 6 7 HW1 HW2 Quiz 1 HW3 HW4 HW5 24-Sep 29-Sep 1-Oct 6-Oct 8-Oct 13-Oct 15-Oct 20-Oct 22-Oct 27-Oct 29-Oct 3-Nov 5-Nov 10-Nov 12-Nov 17-Nov 19-Nov 24-Nov 26-Nov 1-Dec 3-Dec W M W M W M W M W M W M W M W M W M W M W 8 9 8 Quiz 2 HW6 Exam 10 11 12 13 14 15 16 9 9 10 11 12 12 17 18 19 20 21 22 23 13 13 11-13 14 15 16 * Subject to change 24 HW7 HW8 Quiz 3 HW9 HW10 HW11 Exam HW12 Quiz 4 HW13 HW14 HW15 HW16 Exam Topics & Assignments Course Introduction and an Introduction to Financial Markets NO CLASS: LABOR DAY HOLIDAY Time Value of Money I Time Value of Money II Time Value of Money – Bond Valuation I Time Value of Money – Bond Valuation II Time Value of Money – Stock Valuation I Time Value of Money – Stock Valuation II Time Value of Money – Making Investment Decisions Time Value of Money –Review Exam I (evening) Cash flows and capital budgeting Analyzing the project Stock valuation revisited Risk and Return Capital Asset Pricing Model (CAPM) I Capital Asset Pricing Model (CAPM) II Exam II review Exam II (evening) Cost of Capital I Cost of Capital II Cost of Capital: Application and review How Firms Raise Capital Capital Structure Policy Capital Structure Policy II Further Topics/course review NO CLASS: THANKSGIVING Exam review Exam III (evening)