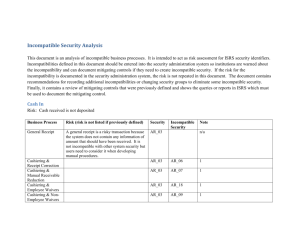

Incompatible Security Analysis

advertisement

Incompatible Security Analysis This document is an analysis of incompatible security identifiers in the ISRS system. Some of them were previously defined and have been entered into the security administration module. Others need to be added if agreed that they are incompatible. The document also contains recommendations for changes in security groups that would eliminate some incompatible security. Finally, it contains a review of mitigating controls that were previously defined and shows the queries or reports in ISRS which must be used to document the mitigating control. Cash In Risk: Cash received is not deposited Business Process Risk (risk is not listed if previously defined) Security General Receipt A general receipt is a risky transaction because the system does not contain any information of amount that should have been received. It is not incompatible with other system security but users need to consider it when developing manual procedures. AR_03 Receipt Correction Employee Waivers Non-Employee Waivers Write-Off Collections Deferment Manual Receivable Reduction Incorrectly record market rate tuition Record Application Fee as Paid Back-Dated Drop Student Residency Billing Residency The applicant system allows a user to mark an application fee as paid. If a user can do it and receive cash, they could disguise the theft of cash. Incompatible Security N ot e AR_03 AR_03 AR_03 AR_06 AR_18 AR_09 1 1 1 AR_03 AR_03 AR_03 AR_03 AR_25 AR_24M AR_11H AR_07 1 1 1 1 AR_03 AR_17 1 AR_03 ST_06L ST_06M ST_06H ST_07L ST_07M ST_07H ST_08L ST_08M ST_08H RG_05H ST_15M AR_08H 1 1 1 AR_03 AR_03 AR_03 Business Process Change Course Fees Change Tuition or Standard Fee Rates Income Contracts Externally Billed Inventory Job Externally Billed Cost Allocation Change Housing Room Type Risk (risk is not listed if previously defined) Changing these rates would re-calculate every student in these groups. The impact would be fairly evident so it may not merit an incompatibility Customized training can enter their income contracts into the system. If a user can enter or modify the income amount and takes in cash receipts, they can disguise theft of cash. The Consumable Inventory module has the capability to charge the issue to an external party which creates an Accounts Receivable in the system. A person that can cancel or adjust the issue and receive cash could disguise theft of cash. Only Mn Southwest State has used this feature of the system and total records are 352. The Cost Allocation module has the capability to charge the allocation to an external party which creates an Accounts Receivable in the system. A person that can cancel or adjust the allocation and receive cash could disguise theft of cash. Only Mn Southwest State has used this feature of the system and total records are 1,311. If a room type is changed, it will cause the system to re-calculate charges for a student in the room. If a user can perform this function and receives cash, they could calculate a lower amount and keep part of a payment. Security Incompatible Security AR_03 AR_03 AR_23H AR_01H AR_03 CN_04H AR_03 CI_05H AR_03 CA_05H AR_03 SH_01H Fictitious Expense Voucher AC_TRAN_J OURNAL_V OUCHER 1 – Incompatibility is defined in the current A/R grid Cash Out Risk: Cash disbursed is not a payment to a customer interacting with the college or university Business Process Risk Direct Payment Voucher incompatibilities defined and loaded into the Security Admin system – there are more identifiers that allow changing of address than the ones listed in the system incompatibilities defined and loaded into P.O. Pay-off Security Incompatible Security Note N ot e 1 1 Expense Voucher Employee Payroll Student Payroll (2) Student Payroll Refunds Refunds Financial Aid Overage Financial Aid Overage Financial Aid Overage (4) the Security Admin system see Cash In section HR has defined incompatibilities and they are loaded in the system. defined problem between student payroll processing and direct deposit setup The person that can create a work authorization and enter time should not be able to print checks. They could create a fictitious payroll and generate a check for it without detection. The system calculates the refund so the risk is that it is not delivered to the correct party. The current grid defines incompatibilities with some of the identifiers that allow address change, but not all of them. Refund process should also be incompatible with Direct Deposit set-up because the user could change the bank account for the deposit. One incapability was defined where a user could award financial aid and change an address. It only addresses one identifier that can change an address. If a user can change direct deposit information, they could redirect an overage to their bank account The person making the award should not be writing checks or they could create a fictitious award and take the check. AC_TRA N_JOUR NAL_VO UCHER AR_03 PR_02(H, M,L) PR_02(H, M,L) AP_03H AR_12H AR_03, ADDRESS_H IGH, ADDRESS_M ED AR_12H AP_03H FA_14 AR_03 FA_14 AP_03H FA_14 AP_02(H,M,L ) – (3) In System AP_02(H,M,L ) – (3) In System In System Short-Term Loans 2 – The PR_01 and PR_02 groups allow a user the ability to setup a work authorization and enter timesheets. In essence, they are performing the HR and payroll functions. These groups should be reviewed. The groups should be renamed into something that better describes their function. 3 -- The functions in the AP high, medium, and low groups should be reviewed. Also, the groups should be renamed to better describe their function. 4 – Other financial aid identifiers should be examined to understand their function better. Equipment The goal is to protect against the risks of unauthorized purchase, use, or disposal. Another risk is that it is not properly recorded in the system. Key internal control over the purchasing is to ensure proper authorization. The owner of the cost center or one of their delegates should authorize the purchase. Purchasing and payment separation have been addressed. Protecting the asset from authorized use or disposal requires that physical inventory counts be done by someone other than the custodian of the asset. While an important separation of duties, it does not impact ISRS security. The security group EQ_02 includes both the recordkeeping function and the running of the reconciliation report. We may want to put them in separate identifiers so a college can separate these functions. EQ_03 can also run the reconciliation report. Recommendations 1. Remove Address update capabilities from AR_03 (Cashier). This would eliminate the incompatibility between AR_03 and AR_12H AR_03 and AR_16 AR_03 and FA_14. Also remove from AR_32H (A/R Special Comments Maintenance) because it is not necessary for the job function. This change requires a special version of AR1000UG without the address tab. 2. AR_03 and AR_01H are not incompatible. Changing tuition and fee rates would be obvious and a very slight risk of causing an undetected theft of receipts. 3. Create incompatibilities for AR_03 with CN_04H, CI_05H, CA_05H, and SH_01H. They could be used to disguise theft of cash, but risk is low. 4. Do not split the group PR_02H into separate security groups. Although it allows entry of work authorization and time, they do create a risk if the person does not have access to cash. It is already defined as being incompatible with AP_02H. Create an additional incompatibility with AP_03H. 5. Create an incompatibility between AR_12H and AP_03H. 6. FA_14 is incompatible with AP_01H and AP_03H. 7. Remove the equipment reconciliation report from EQ_02. Leave it in EQ_03 and or create a new group for the report . Mark it as incompatible with EQ_02. Mitigating Control Analysis Web Role/Uniface Group Incompatible Web Incompatible Reason Role/Uniface Group AC_TRAN_PAYMENT_ Detection may occur with a VOUCHER the cost center budget or an i review of payment vouchers AR_03 - Cashiering A mitigating control is an in review of cash receipt correc expense vouchers. 1. AC_TRAN_BUDGET 2. AC_TRAN_JOURNAL_VOUCHER 3. 4. AC_TRAN_JOURNAL_VOUCHER AC_TRAN_PAYMENT_VOUCHER AR_10 - Head Cashier AP_01H - Accounts Payable Supervisor 5. AC_TRAN_PAYMENT_VOUCHER 6. AC_TRAN_PAYMENT_VOUCHER 7. AC_TRAN_PAYMENT_VOUCHER AP_01L - Accounts Payable Clerk AP_01M - Accounts Payable Incharge AP_02 - Bank Reconciliation 8. AC_TRAN_PAYMENT_VOUCHER AR_03 - Cashiering 9. AC_TRAN_PAYMENT_VOUCHER 10. AC_TRAN_PAYMENT_VOUCHER 11. AC_TRAN_PAYMENT_VOUCHER AR_04 - Receivables AR_16 - 3rd Party BUSMGR - Business Manager 12. AC_TRAN_PAYMENT_VOUCHER DEPTHEAD Department Head HR_SUPERUSER 13. AC_TRAN_PAYMENT_VOUCHER same as #2 A more timely mitigating co independent review of local canceled checks. same as #4 except that the re should include the state treas same as #4 except that the re should include the state treas A mitigating control is an in review of vendor name on lo A mitigating control would b of changes to person informa review of local checks to per same as #8 same as #8 Detection may occur with a the cost center budget or an i review of payment vouchers same as #11 same as #11 14. AC_TRAN_PAYMENT_VOUCHER 15. AC_TRAN_PAYMENT_VOUCHER 16. AC_TRAN_PAYMENT_VOUCHER 17. ADDRESS_HIGH - Address Maint HR_SYSTEMWIDE_SU PERUSER PURCLERK Purchasing Clerk PURHEAD - Purchasing Director AR_06 - Receipt Corrections same as #11 same as #11 same as #11 Mitigating controls are (1) R refund checks prior to mailin Review address change activ for unusual activity, (3) Lim by requiring students to com address changes on-line, or ( students to pick up refund ch A mitigating control would b independent review of all ref activity." 18. ADDRESS_HIGH - Address Maint AR_12H - Refunds 19. ADDRESS_HIGH - Address Maint AR_16 - 3rd Party A mitigating control would b independent review of all ov payments." 20. ADDRESS_HIGH - Address Maint FA_14 - Maintenance Award A mitigating control would b independent review of all ov payments." 21. ADDRESS_MED - Address Maint (no delete) AR_06 - Receipt Corrections AR_12H – Refunds AR_16 - 3rd Party FA_14 - Maintenance Award AP_02 - Bank Reconciliation same as #17 22. ADDRESS_MED - Address Maint (no delete) 23. ADDRESS_MED - Address Maint (no delete) 24. ADDRESS_MED - Address Maint (no delete) 25. AP_01H - Accounts Payable Supervisor 26. AP_01L - Accounts Payable Clerk 27. AP_01M - Accounts Payable Incharge 28. AP_03H - Direct Deposit High AP_02 - Bank Reconciliation AP_02 - Bank Reconciliation PR_02H - Payroll Controller same as #18 same as #19 same as #20 It would show on AP0140CP report which displays except check status is missing a tran type expected for that status cancel status looks for a PV, and XD.). Mitigating control independent review of local independent review and auth checks with status codes voi canceled or unclaimed." same as #25 same as #25 A mitigating control is an in review of the AP_DD_ACC table. 29. AP_03H - Direct Deposit High 30. AP_03H - Direct Deposit High 31. AR_03 - Cashiering 32. AR_03 - Cashiering 33. AR_03 - Cashiering PR_02L - Payroll Clerk PR_02M - Payroll Process Incharge AR_06 - Receipt Corrections same as #28 same as #28 AR_07 - Receivable Corr/Adjusts AR_08H - Billing Residency No ISRS report shows this a must be done with an ad hoc A mitigating control would b independent review of the au and verifying that changes h documentation. A mitigating control is an in review of waivers. A mitigating control is an in review of deferment report a to back-up documentation. C could require students to sign promissory notes that studen acknowledges deferment and owed. Compare promissory deferment report. Ensure end set for deferments." A mitigating control would b independent review of all ref activity." A mitigating control would b independent review of all ov payments." A mitigating control is an in review of all discounted tuiti A mitigating control is an in review of waivers. A mitigating control is a rev audit report which would sho change in the fee. 34. aAR_03 - Cashiering r 35. AR_03 - Cashiering AR_09 - A/R Customer Waiver and Corrections AR_11H - Deferments 36. AR_03 - Cashiering AR_12H - Refunds 37. AR_03 - Cashiering AR_16 - 3rd Party 38. AR_03 - Cashiering AR_17 - Customized Training AR_18 - A/R Employee Waivers AR_23H - Course Fee Tables 39. AR_03 - Cashiering 40. AR_03 - Cashiering 41. AR_03 - Cashiering 42. AR_03 - Cashiering AR_24M - Collections AR_25 - Write-offs 43. AR_03 - Cashiering FA_14 - Maintenance Award A mitigating control is an in review of receipt corrections A mitigating control is an in review of write-offs. same as #37 44. AR_03 - Cashiering RG_05H - Student Registration 45. AR_03 - Cashiering ST_15H - Student Residency Maint w/del 46. AR_03 - Cashiering ST_15M - Student Residency Status Maintenance DEPTHEAD Department Head 47. BUSMGR - Business Manager 48. BUSMGR - Business Manager REQNORGN - PO Originator A mitigating control would b independent review of the A for Back Dated Drops report verifying that changes had p documentation. A mitigating control would b independent review of the au and verifying that changes h documentation. same as #45. Another mitigating control is of AC0530CP for transaction processed for the time period incompatibility exists. same as #47