Outline

advertisement

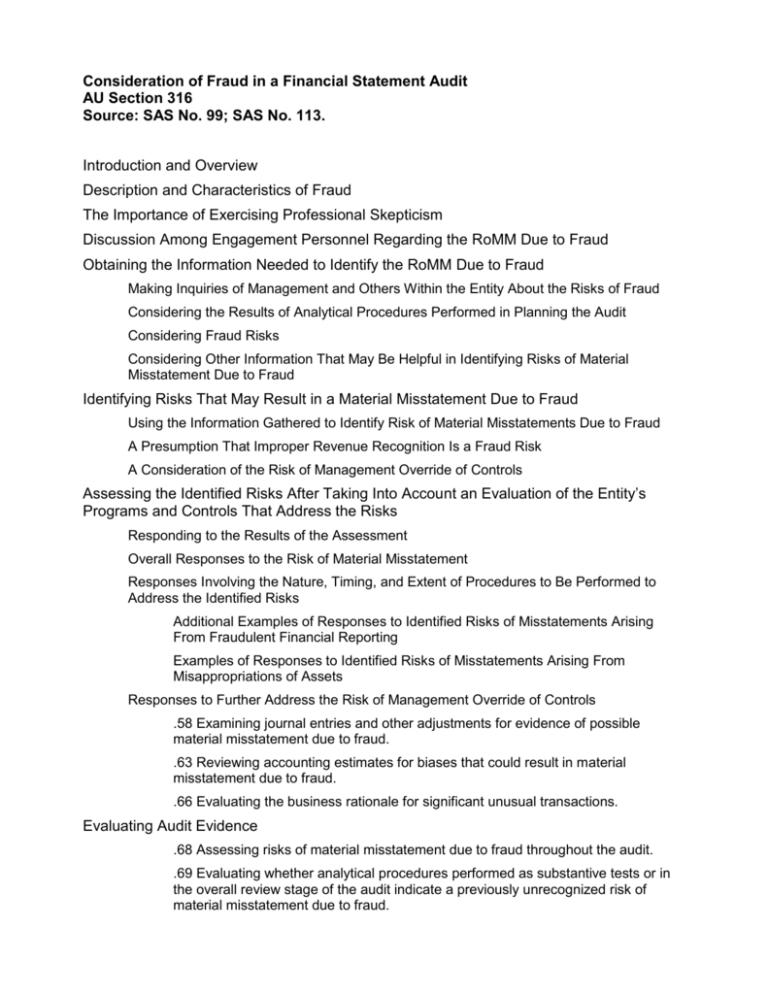

Consideration of Fraud in a Financial Statement Audit AU Section 316 Source: SAS No. 99; SAS No. 113. Introduction and Overview Description and Characteristics of Fraud The Importance of Exercising Professional Skepticism Discussion Among Engagement Personnel Regarding the RoMM Due to Fraud Obtaining the Information Needed to Identify the RoMM Due to Fraud Making Inquiries of Management and Others Within the Entity About the Risks of Fraud Considering the Results of Analytical Procedures Performed in Planning the Audit Considering Fraud Risks Considering Other Information That May Be Helpful in Identifying Risks of Material Misstatement Due to Fraud Identifying Risks That May Result in a Material Misstatement Due to Fraud Using the Information Gathered to Identify Risk of Material Misstatements Due to Fraud A Presumption That Improper Revenue Recognition Is a Fraud Risk A Consideration of the Risk of Management Override of Controls Assessing the Identified Risks After Taking Into Account an Evaluation of the Entity’s Programs and Controls That Address the Risks Responding to the Results of the Assessment Overall Responses to the Risk of Material Misstatement Responses Involving the Nature, Timing, and Extent of Procedures to Be Performed to Address the Identified Risks Additional Examples of Responses to Identified Risks of Misstatements Arising From Fraudulent Financial Reporting Examples of Responses to Identified Risks of Misstatements Arising From Misappropriations of Assets Responses to Further Address the Risk of Management Override of Controls .58 Examining journal entries and other adjustments for evidence of possible material misstatement due to fraud. .63 Reviewing accounting estimates for biases that could result in material misstatement due to fraud. .66 Evaluating the business rationale for significant unusual transactions. Evaluating Audit Evidence .68 Assessing risks of material misstatement due to fraud throughout the audit. .69 Evaluating whether analytical procedures performed as substantive tests or in the overall review stage of the audit indicate a previously unrecognized risk of material misstatement due to fraud. .74 Evaluating the risks of material misstatement due to fraud at or near the date of the auditor’s report. .75 Responding to misstatements that may be the result of fraud. Communicating About Possible Fraud to Management, Those Charged With Governance, and Others Documenting the Auditor’s Consideration of Fraud Effective Date Appendix Examples of Fraud Risk Factors Risk Factors Relating to Misstatements Arising From Fraudulent Financial Reporting Incentives/Pressures Opportunities Attitudes/Rationalizations Risk Factors Relating to Misstatements Arising From Misappropriation of Assets Incentives/Pressures Opportunities Attitudes/Rationalizations Exhibit Management Antifraud Programs and Controls Guidance to Help Prevent, Deter, and Detect Fraud Preface Introduction Creating a Culture of Honesty and High Ethics Setting the Tone at the Top Creating a Positive Workplace Environment Hiring and Promoting Appropriate Employees Training Confirmation Discipline Evaluating Antifraud Processes and Controls Identifying and Measuring Fraud Risks Mitigating Fraud Risks Implementing and Monitoring Appropriate Internal Controls Developing an Appropriate Oversight Process Audit Committee or Those Charged With Governance Management Internal Auditors Independent Auditors Certified Fraud Examiners Other Information Attachment 1: AICPA ”CPA’s Handbook of Fraud and Commercial Crime Prevention,” An Organizational Code of Conduct