Ten Steps Forward for the Missouri State Vehicle Fleet

advertisement

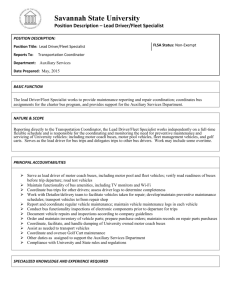

Ten Steps Forward for the Missouri State Vehicle Fleet The State of Missouri has taken several steps forward in statewide fleet management and travel practices since 2002. In a relatively short period of time, Missouri’s State Fleet Management Program has led the charge to transform fleet practices and spearheaded numerous travel cost reduction initiatives saving millions of taxpayer dollars. This white paper will describe the condition of the Missouri fleet ten years ago and several key areas where Missouri has been successful in transforming fleet and travel practices in the state. A Glimpse into Fleet Practices in the Past In 2001, then Missouri State Auditor, Claire McCaskill, issued a critical audit report on the lack of oversight and accounting for state owned vehicles. Each agency operated and managed their fleets independently without any statewide oversight or management. The Auditor’s report cited a number of serious issues including the lack of reliable and comprehensive vehicle data, statewide policies, utilization standards, replacement policies, and more. Following the audit report, the Missouri General Assembly formed a committee to research the state of the fleet. Office of Administration staff worked closely with the legislative committee to draft legislation that was subsequently passed and approved, giving the Office of Administration, the state’s central support agency, authority to take the necessary steps to resolve issues with the state fleet. In 2002, with the enactment of the enabling legislation, the Office of Administration was tasked with establishing the first state fleet management program in the state’s history. Using existing resources, a state fleet manager was named and work began to create a comprehensive fleet management program. An interagency fleet management committee, the Fleet Management Advisory Committee or FleetMac, was formed and proved to be instrumental in creating buy-in to the new program. Fast Forward to 2012 Ten years later, Missouri has an untraditional approach to fleet management. Missouri is unique in that there are only two full time employees in the State Fleet Management office; a small staff spearheading statewide fleet functions and travel initiatives while agencies manage their fleets in conjunction with statewide policies. Upper management support and close coordination between the State Fleet Manager and agency fleet managers have been critical to the success of the program. 1 Ten Key Success Areas 1) Established Statewide Fleet Policy In 2002, a State Vehicle Policy1 was issued and set forth statewide fleet guidelines for all agencies to follow. The policy governs the acquisition, assignment, use, replacement, maintenance and record keeping for all state vehicles and serves as the foundation for fleet management practices in Missouri state government. Key tenants of the policy include: Vehicle usage logs required for each vehicle to include the following: name of driver, dates, beginning and ending odometer, destination and purpose of use State Fleet Manager must pre-approve all agency vehicle purchases. Additional justification is required for fleet expansion, full size sedans, four wheel drive and sport utility vehicles Minimum replacement criteria of 120,000 miles, with certain exceptions Vehicle assignment categories and minimum annual use standards for each Vehicles assigned permanently to an individual are required to drive a minimum of 15,000 miles Vehicles assigned to a pool must average 15,000 miles Vehicles assigned to a function (i.e. facility support vehicles) require an annual justification for each vehicle driven less than 5,000 miles Ban of all ‘reportable commuting’ in state vehicles Appropriate use defined, vehicles can be used only for official business Other standards concerning maintenance, fueling, safety and accident reporting The State Vehicle Policy formed the basis for fleet practices in Missouri state government and continues to guide agencies daily as they manage their fleets. 2) Instituted Fleet Information System Prior to the beginning of the Missouri fleet program, each agency tracked vehicle data in a myriad of separate spreadsheets and databases. Statewide fleet analysis was impossible. One of the first tasks of the new program was to develop specifications for a new fleet information system that would be used by all agencies to capture vehicle data. In 2003, one year after the program began; a web-based State Fleet Information System was developed in-house saving hundreds of thousands of dollars in fleet software acquisition expenses. Most state agencies utilize this system which assists greatly in statewide fleet analysis.2 The fleet system is heavily integrated with state’s financial and HR systems as well as two additional systems in the Missouri Department of Revenue that track driver’s 2 licenses and official license plates. A sub component of the fleet system automated operations for a central maintenance facility. The fleet system is also heavily integrated with a separate web-based, pool vehicle automated reservation system. The fleet system provides for uniform tracking of key fleet data statistics such as the number of active vehicles, fleet costs, utilization, preventative maintenance, driver’s license validation and data repair order processing. Some unique features of the system include: A custom computer program that runs daily to ensure that drivers of state vehicles have a valid driver’s license. Driver’s data from the fleet system is compared to license data from the Missouri Department of Revenue. Any changes in the status of a driver’s license are emailed to the state agency for appropriate action. The costs to operate the program are minimal. Outside vendors offering this service charge for each MVR check, each time for each employee. A license plate reconciliation program between the fleet system and the Missouri Department of Revenue to compare the vehicle identification numbers and license plates between each system. Exception reports are created and errors corrected. This program reduces ‘fleet creep’ by preventing agencies from transferring plates to another vehicle without following proper procedures. 3) Developed Annual Key Fleet and Travel Measures Reliable data is critical in making informed decisions concerning the status of the state vehicle fleet. With the data gathered from the state fleet system, the Missouri fleet management program is able to report on key statistics each year in an annual report. Key measures that are reported each year are listed below: Active licensed vehicle counts by agency Number of vehicles per 100 employees Fleet composition by vehicle category (sedans, trucks, SUV, etc.) Cost per mile Total business miles driven for all travel options by agency (state, rental and personally owned vehicles) Average miles driven based on assignment category (pool, individual or function) Average miles driven based on the primary purpose of the vehicle (employee or client transportation, specially equipped vehicles or task specific vehicles) Average miles driven for all light-duty, passenger vehicles Average miles driven for all medium and heavy-duty vehicles Total expenditures for vehicle acquisition, fuel, maintenance and repair Total mileage reimbursement paid to state employees Fleet condition data which includes: o Average and projected passenger vehicle odometer reading and age o Number of vehicles at or exceeding minimum replacement eligibility 3 State employee driver’s license data, specifically the number of employees that changed from a valid status to an invalid status throughout the fiscal year Vehicle rental contract utilization and savings 4) Established Mechanisms to Control Fleet Size Vehicle Preapproval Process To contain growth in the state fleet, all new or used passenger vehicles must be preapproved before purchase. Agencies must submit a vehicle pre-approval form to the State Fleet Manager for review. The agency must also be compliant with the minimum use standards outlined in the State Vehicle Policy before approval will be granted. The vehicle pre-approval process is an effective tool in managing the size of the state passenger vehicle fleet. Benefits of the process include: Review of appropriateness of vehicle types to be purchased, additional justification required for full size sedans, four-wheel drive vehicles and sport utility vehicles Requests to increase the size of the fleet require additional justification Agencies must identify specific vehicles to be surplused. This facilitates follow-up reviews to ensure that agencies actually dispose of the vehicles. Opportunity to review agency compliance with minimum utilization standards in the State Vehicle Policy prior to approval Quarterly Reconciliation of Official License Plate Data A quarterly reconciliation program between the fleet system and the Missouri Department of Revenue compares the Vehicle Identification Numbers and License plates between each system. Exception reports are created and errors corrected. This program has given credibility to the data maintained in the fleet system and prevents agencies from holding onto additional vehicles without authorization. The State of Missouri has reduced the number of discrepancies from 11.6% down to 1.6% since the reconciliation program began. License Plate Surrender Policy and License Plate Approval Process Missouri state agencies are required to surrender any official vehicle license plates if they will not be used within a 90 day time period. State agencies are also not allowed to receive new official license plates from the Missouri Department of Revenue without prior approval from the State Fleet Manager. This allows the fleet program to verify that a fleet expansion was approved prior to new license plates being issued. 4 5) Increased Travel in State-Owned Vehicles from 77% to 87% For years, Missouri’s State Fleet Management Program has documented that the lowest cost travel option for state employees on a per-mile basis is a state vehicle. A concerted effort to direct business miles to state-owned vehicles has been extremely Travel Options successful. As a result, over 87% of the 168 Cost Per Mile – FY 2011 million business miles traveled each year are driven in state-owned vehicles, an increase State Sedan $.295 from 77% eight years ago. The table at the Rental Vehicle $.36 bottom of this page illustrates the percentage of miles traveled between state, rental and Mileage Reimbursement $.37 personally owned vehicles for each fiscal year (Full Rate) between 2003 and 2011. To increase the use of state-owned vehicles, the fleet program: Educated administration officials about the per mile cost of various travel options Issued the State Vehicular Travel Policy3 that requires employees to utilize the lowest cost travel option or they are only eligible for a reduced mileage reimbursement rate Instituted and required use of the Trip Optimizer4, a web-based, trip-cost estimating calculator, to compare the cost of various travel options. Implemented the Smart Lease Vehicle Program that transferred over 27 million miles from high cost, mileage reimbursement, to lower cost state vehicles, saving almost $5 million annually Instituted a vehicle rental contract to supplement the state vehicle fleet at costs typically lower than personal mileage reimbursement Business Miles Driven by Travel Option Fiscal Year FY 03 145,319,315 FY 04 149,439,637 77 % 78% FY 05 FY 06 FY 07 FY 08 FY 09 FY 10 FY 11 149,627,062 151,025,722 151,256,475 158,400,815 155,216,423 155,449,293 146,556,140 77% 79% 80% 84% 85% 86% 87% State Vehicles Rental Vehicles Mileage Reimbursement5 TOTAL - 0% 43,309,247 23 % 188,628,56 2 481,722 1,042,712 1,588,935 2,640,526 4,190,264 3,118,260 2,143,156 1,825,087 0% 1% 1% 1% 2% 2% 1% 1% 40,885,347 43,698,576 38,866,291 34,806,034 26,861,341 24,486,288 23,241,368 20,028,851 21% 22% 20% 18% 14% 13% 13% 12% 190,806,706 194,368,350 191,480,948 188,703,035 189,452,420 182,820,971 180,833,818 168,410,078 5 6) Eliminated Commuting in State Vehicles For years, ‘reportable commuting’ was allowed for certain state employees. Missouri defines reportable commuting as those instances where an employee travels in an official vehicle to and from work and the value of the commute is required to be reported as an imputed wage for income tax purposes per IRS guidelines. Within a few years of the inception of the Missouri fleet management program, commuting was eliminated in over 200 vehicles by revising the State Vehicle Policy guidelines. Previously, state agencies independently determined who was approved to commute in state vehicles resulting in a lack of consistency between agencies. It was commonplace for some Missouri officials to commute to and from work. In 2008, after additional review, state officials found this practice to be in direct conflict with a state statute6 that required vehicles to be utilized for official purposes only. Reportable commuting was banned with another change to the State Vehicle Policy. The reportable commuting ban has saved thousands of dollars of unnecessary vehicle expenses over the years and eliminated instances where state vehicles could be perceived as ‘perks.’ The State of Missouri utilized IRS guidelines and definitions and developed policy to only allow ‘deminimus commuting’ or commuting in what the IRS defines as a ‘qualified non-personal use’ vehicle. Missouri is unique in this area because the ban applies to all employees subject to the State Vehicle Policy. Many states assign vehicles to high level directors or elected officials and allow for commuting. 6 7) Created the Trip Optimizer One of the statutory requirements for the fleet program was the establishment of a travel cost estimating tool to assist employees in making the most cost effective travel decisions for each trip. What started as a Microsoft Excel spreadsheet posted to a website eventually became a web-based tool that Missouri state employees are required to utilize according to the State Vehicular Travel Policy, SP-12.7 Actual state vehicle cost from the fleet system, rental contract rates, and the latest fuel pricing is updated each week to give employees the most Enter Trip Information accurate cost estimate Total Round Trip Miles (Required):* possible. Employees simply 300 enter trip information and the Total Trip Days (Required):* cost of all options is 2 displayed. Since its exception, multiple states Calculate Clear Send Email have expressed interest in the logic and formulas behind this Trip Cost tool. An abbreviated version Per Mile of the Trip Optimizer is Travel Option Total Cost Cost displayed here. The results of the Trip Optimizer calculations can be printed or emailed for expense account documentation. If a state vehicle or rental vehicle is available and less costly than mileage reimbursement, the employee’s claim on their expense account is limited to a reduced employee mileage reimbursement rate or the projected cost of the rental vehicle. Enterprise Rental Mid-Size Rate - Fuel Included: $108.02 $0.3601 Hertz Rental Mid-Size Rate - Fuel Included: $106.60 $0.3553 State Vehicle Mid-Size Sedan: $89.67 $0.2989 Mileage Reimbursement (Standard Rate): $111.00 $0.3700 Lowest Cost: State Vehicle Next Lowest Cost: Hertz Rental Savings Information Percentage Difference: 18.88% Cost Savings Amount: $16.93 State Vehicle Utilization Review Average Miles/Day: 150.00 Utilization Level: Satisfactory The policy requirement to use the Trip Optimizer has been essential in our effort to educate agencies and employees on the real cost of various travel options. 7 8) Smart Lease Vehicle Program The Missouri State Fleet Management program began implementation of the Smart Lease Vehicle Program in 2006 to generate immediate cost savings within agency operating budgets by transferring business miles for certain employees from mileage reimbursement to a lower cost, lease-purchased vehicle. The statewide Master Lease Contract is utilized to lease-purchase a vehicle at low, tax-exempt interest rates. Agencies save money by directing existing core appropriations to pay the capital lease and operating costs of the Smart Lease vehicle rather than pay mileage reimbursement. Agencies own the vehicle after the final payment, generating even more savings if they continue to operate the vehicle. In 2007, an interagency team was awarded the Missouri Governor’s Award for Quality & Productivity for implementing the program. Prior to the implementation of the Smart Lease Vehicle Program, some agencies such as the Department of Social Services did not have a sufficient number of state vehicles and had little funds to replace existing vehicles let alone purchase additional vehicles. In one instance, an employee was reimbursed for almost 42,000 miles at an annual cost of $15,700. Overall, in FY 2006, over 140 employees across state government were reimbursed in excess of 15,000 miles each year. The Department of Social Services alone spent over $5 million in mileage reimbursement expenditures annually which was approximately one-third of the state total for mileage reimbursement. To date, over 430 vehicles have been added to agency fleets since 2007 transferring over 27 million miles from employee mileage reimbursement to state vehicles resulting in savings of $4.8 million. In FY 2011, only 13 employees were reimbursed in excess of 15,000 miles, a significant reduction since the inception of the Smart Lease Vehicle Program. Smart Lease Vehicle Program Savings to Date 20078 2008 2009 Averag e Cost Per Mile $0.296 $0.245 $0.217 2010 $0.231 $0.408 $0.173 2011 2012 YTD9 Total $0.253 $0.266 $0.370 $0.370 $0.114 $0.100 Fiscal Year Reimburseme nt Rate Savings Per Mile Annual Savings $0.415 $0.455 $0.475 $0.096 $0.210 $0.254 $53,327.46 $865,918.21 $1,441,760.1 3 $1,090,979.5 4 $920,715.12 $410,574.97 295,236 4,019,683 5,630,669 $4,783,275.4 4 27,740,881 8 Miles Transferred 5,911,396 7,896,895 3,987,002 9) Reduced Mileage Reimbursement Expenditures Prior to Fleet Management’s efforts, mileage reimbursement expenditures increased each year as the state’s reimbursement rate was tied to the federal reimbursement rate. With a focused effort to reduce these expenditures, there has been a steady decline in total reimbursement for personally owned vehicles, dropping 51% in FY 2011 from the all time high in FY 2005. In FY 2005, Missouri reimbursed employees over 43.7 million miles at a cost of over $15 million. In FY 2011, Missouri reimbursed only 20 million miles at a cost of $7.4 million, a substantial reduction from six years ago. The following initiatives have all played a factor in reducing employee mileage reimbursement expenditures: State of Missouri State Employee Mileage Reimbursement Data 50 $20 40 $15 30 $10 20 $5 10 0 $0 FY 03 FY 04 FY 05 FY 06 FY 07 FY 08 FY 09 FY 10 FY 11 Miles Reimbursed 9 Expenditures Expenditures (Millions) Issued a statewide travel policy10 that requires employees to utilize the lowest cost travel option or only be eligible for a reduced mileage reimbursement rate Instituted and required use of a Trip Optimizer 11, a web-based, trip-cost estimating calculator, to compare the cost of various travel options Implemented the Smart Lease Vehicle Program that transferred over 27 million miles from higher cost mileage reimbursement to lower cost state vehicles, saving almost $5 million annually Instituted a vehicle rental contract to supplement the state vehicle fleet at costs typically lower that personal mileage reimbursement Reduced employee mileage reimbursement rates in FY 2010 and FY 2011 to generate additional savings. Miles Reimbursed (Millions) 10) Spearheaded Recent Initiatives to Reduce Overall State Travel Expenses In the spring of 2010 amidst another round of state budget cuts, several fleet and travel initiatives were announced, including: Fleet reduction 10% business mile reduction Reduction of the standard mileage reimbursement rate to $.37 per mile Consolidation of pool vehicles in the state capital Fleet Reduction To date, 530 vehicles have been sold resulting in over $1.3 million in one-time sales proceeds. Business Mile Reduction For FY 2011, state agencies were asked to reduce total business miles driven by 10% compared to FY 2009 numbers. Overall, business miles dropped 12.3% for executive branch agencies reporting to the governor. Travel Savings An estimated $6.2 million was saved in as a result of the reductions in business miles driven and mileage reimbursement12. Savings for mileage reimbursement are two-fold. Fewer miles were reimbursed and the mileage reimbursement rate for travel in a personally owned vehicle was reduced by a total of 13 cents per mile over the course of FY 2010. For FY 2011, mileage reimbursement expenditures declined by $3.64 million13, a 30% reduction in expenditures compared to FY 2010 due to the combination of the lower mileage reimbursement rate and 12% fewer miles reimbursed between FY 2010 & FY 2011. Pool Consolidation Pool vehicles assigned to locations in the capital city have been consolidated. Nine agencies and almost 200 vehicles have been brought into a centrally managed pool. Employees now have access to a larger pool of vehicles and the same amount of travel can be accomplished with fewer vehicles. 10 Conclusion The Missouri fleet management program has established sound fleet management practices, clearly defined policies and objectives, controls to manage the size of the fleet, and key metrics to monitor fleet utilization and efficiency. Numerous initiatives to reduce the cost of travel have been instituted and have generated substantial savings. Achieving this success required clear programmatic vision, top management support, comprehensive data collection and analysis and strong policy development and implementation. Agency buy-in was obtained through effective communication and collaboration from the inception of the program and was critical to the realization of fleet management goals. 1 http://oa.mo.gov/co/policies/State_Vehicle_Policy_04.pdf The Departments of Transportation, Conservation and the Missouri State Highway Patrol maintain their own fleet information systems but regularly report key fleet data to the State Fleet Management Program. 3 http://oa.mo.gov/co/policies/sp12vehicular.pdf 4 http://168.166.15.142/Default.aspx 5 State employees only. 2 6 301.260.1 RSMo 7 http://oa.mo.gov/co/policies/sp12vehicular.pdf partial year 9 July – December 2011 10 http://oa.mo.gov/co/policies/sp12vehicular.pdf 11 http://168.166.15.142/Default.aspx 12 State vehicles: $2,490,082.84, Rental Vehicles: $114,504.84, Mileage reimbursement: $ $3,646,389. For state and rental vehicles, the savings were calculated by multiplying the cost per mile for each travel option by the difference in miles between FY 2010 and FY 2011. 13 Included in the $6.2 million savings in the paragraph above. 8 11