bond market

advertisement

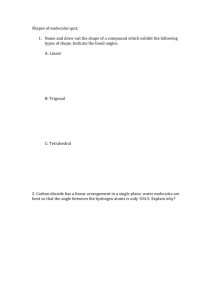

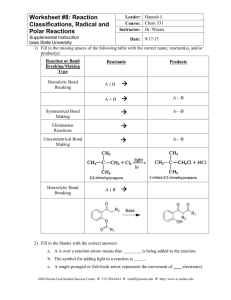

ACCOUNTING SOLUTIONS LIMITED THE BOND MARKET The purpose of this article is to explain the rudiments of the bond market operations for corporate entities as well as government. The rationale behind this is to give the general public a fair idea of bonds. So I have tried as much as possible to remove complex technical issues relating to bonds so that everyone can make informed argument when it comes to bonds. Bonds, generally, have been very grey area for public discourse over the years; no entity from Ghana entered the euro bond market until the Kufuor Government did so in 2007. Subsequent to that, the Mills Government successfully pursued that path and the Mahama Government also recently successfully obtained funds from the bond market. It is therefore imperative that the public is educated on the operations of the bond market. Definition of Bond Market The environment in which the issuance and trading of debt securities occurs is known as the bond market. The bond market primarily includes government-issued securities and corporate debt securities and facilitates the transfer of capital from savers (investors) to the issuers or organizations requiring capital for government projects, business expansions and sometimes ongoing operations. In this article I will explain the following issues with respect to the bond market The difference between the require rate of return on a bond and the interest or coupon rate on a bond. Role of credit ratings on the bond markets. Characteristics of bonds. How lenders determine the expected return on bonds which will eventually determine the interest they will demand on a bond. The circumstance under which a bond is likely to be over-subscribed or undersubscribed. How the market value of a bond is determined for a bond about to be issued and for a bond which have already been issued. SAM ANOKYE - Page 1 ACCOUNTING SOLUTIONS LIMITED Interest or coupon rate This is the actual amount that an investor will receive from the bond. This is determined on the date the bond is issued. The interest or coupon rate is calculated as a percentage of the nominal value of the bond (which is usually $100). For example, a bond with a nominal value of $20m will be made up of 200,000 bonds ($20m / $100). If the bond has an interest or coupon rate of 8% p.a, it implies that the investor will receive $8 per year for each $100 bond. Yield or Return of a Bond The yield on a bond is how much an investor expects to receive with respect to a bond. The yield on the bond is usually determined by the credit rating (risk of default) of the bond and the market return of the bond. The yield on the bond and the coupon rate can be the same (usually on the date of issue of the bond). The interest rate and the return differ when the bond starts trading. The reasons for the difference will be explain and illustrated in this article. Credit Rating This is a rating based on the risk that a borrower (an organization or government) would not be able to meet its obligation under the bond agreement, that is the payment of interest and principal. Credit ratings are determined by credit rating agencies. The main credit rating agencies are Standard & Poor’s, Moody’s and Fitch. How credit ratings are determined will be discussed in a later article. The following credit ratings are available from Fitch and Standard & Poor’s. Fitch/S&P Grade Risk of Default AAA Investment highest quality – zero risk AA Investment high quality – very little risk A Investment strong – minimal risk BBB Investment medium grade –low but clear risk SAM ANOKYE - Page 2 ACCOUNTING SOLUTIONS LIMITED BB Junk speculative – marginal B Junk significant risk exposure CCC Junk considerable risk exposure CC Junk highly speculative- very high risk C Junk in default-very high likelihood of failure Bond Characteristics i. ii. iii. iv. v. vi. Bonds pay all interest or coupon before principal is paid (redeemed) and not interest and principal at the same time. Bonds are usually traded i.e an investor in a bond is not mandated to hold the investment over the life of the bond but can simply sell the bond to another investor before maturity. Most bonds have active market i.e they are bought and sold just like shares on a stock market. The principal of bonds are usually not actually paid from the resources of an organization or government because when the principal is due an organization or government can raise another bond to repay the old principal and continue to pay only interest. This is the reason why bonds are assumed to be irredeemable in financial analysis. If an organization or government wants to redeem its bond before maturity, they are redeemed based on market value i.e. the entity will have to repurchase it in the bond market. The coupon rate remains unchanged throughout the life of a bond with the exception of some euro bonds that are issued at a variable rate. How lenders determine the expected return of bonds The return on the bond is simply how much investors are expecting from a bond. In determining the return of a bond, an investor will first identify the credit rating of the bond; this is usually done with the help of credit rating agencies. The credit rating of a bond is then compared with the return of identical bonds with similar credit rating and duration. Credit ratings of bonds, returns and duration in the bond market can be obtained from credit rating agencies. SAM ANOKYE - Page 3 ACCOUNTING SOLUTIONS LIMITED If the bond is a corporate bond the expected return is made up of the return on government bonds with the same duration as that of the corporate bond plus a default risk premium which is determining by how much returns identical corporate bond (with the same credit rating and duration) investors are receiving above the return from government bonds with the same duration. This can simply be put in a mathematical formula as Return = Return on Government Bond + Default risk premium Corporate Bonds (which has already been issued) Illustration Ashgold Company, has $100m bond already in issue. The bond carries a coupon rate of 5% p.a. The bond is redeemable in four (4) year time at its nominal value. Ashgold is rated AA The following information has been provided. The return on government bonds via Bank of Ghana website is: 1 year 3.54% (This implies the government pays 3.5% interest p.a for a one year bond.) 2 years 4.01% (this implies the government pay 4.01% interest p.a) for a 2 year bond) 3 years 4.70% e.t.c 4 years 5.60% e.t.c Extracts from credit rating Agencies Website (in basis points) Rating 1 year 2 year 3 year 4 year AAA 5 18 29 40 AA 16 30 42 50 A 26 39 50 60 SAM ANOKYE - Page 4 ACCOUNTING SOLUTIONS LIMITED Basis points (100 basis points are equal to 1%) Require i. ii. What is the return on the bond now? What will be the return on the bond if Ashgold credit rating is downgraded to A Will the coupon rate change if Ashgold is downgraded to A What is the current market value of Ashgold bond What will be the market value of Ashgold bond if the credit rating is downgraded to A. iii. iv. v. Solutions i. The current return on Ahsgold bond Return = 5.6% + 50 basis points = 6.10% ii. If the credit rating of Ashgold is downgraded to A Return = 5.6% + 60 basis point = 6.2% iii. If the credit rating of Ashgold is downgraded to A the coupon rate will still remain 5% p.a iv. The market value of the bond can be estimated by identifying the interest and principal that will be received over the remaining life of the bond and taking out the return require by the investor(discounting using the require rate of return) to arrive at the current market value of the bond SAM ANOKYE - Page 5 ACCOUNTING SOLUTIONS LIMITED Year 1 2 3 4 Interest 5 5 5 5 Principal 100 Cash flows 5 5 5 105 Discount factor 6.1% 0.94 0.89 0.84 0.79 Present values 4.7 4.5 4.2 83 Total present values (market value) = $96.4 The current market value of the bond in the bond market will be $96.4 for each $100 of the bond. This means that if an investor wants to sell the bond now every $100 of the bond can only be sold for $96.4. This is because similar bonds are providing a return of 6.1% whiles Ashgold is paying only 5% interest. v. If Ashgold credit rating is downgraded to A, the market value of Ashgold bond will fall further as investors will perceive an additional risk and require a higher return 6.2% (return being provided by bonds with a duration of 4 years and an A credit rating). The investors will now discount interest and principal that is been expected from Ashgold bond by 6.2%. this can be illustrated as follows: Year 1 2 3 4 Interest 5 5 5 5 Principal 100 Cash flows 5 5 5 105 Discount factor 6.2% 0.942 0.887 0.835 0.786 Present values 4.71 4.43 4.17 82.5 Total present market value = $95.8 SAM ANOKYE - Page 6 ACCOUNTING SOLUTIONS LIMITED This shows that if the risk of default of a bond increases resulting in a downgraded credit rating, the market value of the bond (how much the bond can be sold before maturity) reduces. The investor will have to decide whether to sell the bond and avoid future risk of default or hold the bond to maturity and take the risk. The opposite i.e if the credit rating of a bond improves, investors will now require a lower return as shown by the credit rating data and hence the market value of the bond will increase. This will happen because the market will now discount the same interest and principal from Ashgold bond using a lower return. A Bond About to be issued If a company decides to issue a new bond, an investor will decided to subscribe for the bond or not after comparing the terms of the new bond with the returns of similar bonds which are already in issue. This is because bonds are traded activity and an investor can purchase an already existing bond or purchase a new bond. A new bond would be fully subscribed if it pays a return equal to similar existing bonds or a slightly better return than existing bond. If a new bond pays a very high interest compared with a return of similar existing bonds, the new bond would be over-subscribed (investors will rush for the new bond) If a new bond pays interest below the return of similar existing bond, the new bond would be under-subscribed. This can be illustrated as follows Abrante company ltd is about to issue to $50m 3 years bonds with a coupon rate of 4% p.a. The bond will be redeemable at par in 3 years. The Bond is rated AA Solutions Using the earlier information provided by bank of Ghana and Credit rating Agency, first comparing with similar bonds already in issue, the expected return each year on the bond is as follows Years 1 3.54 + 0.16 = 3.7% 2 4.01 + 0.30 = 4.31% 3 4.70 + 0.42 = 5.12% SAM ANOKYE - Page 7 ACCOUNTING SOLUTIONS LIMITED This implies that interest from the bond for first year will be discounted at 3.7% p.a. Interest from the bond for the second year would be discounted at 4.31% and interest from the bond in 3 years’ time would be discounted at 5.12%. The present value of the bond which is the same as its theoretical market value would be estimated as Year interest principal cash flows D.F PV 1 4 - 4 4/1.037 3.86 2 4 - 4 4/1.0431 2 3.68 3 4 104 104 104/1.0512 3 89.53 97.07 The theoretical market value of each $100 of the new bond will be $97.07. If the bond is issued under the current terms, the bond will be undersubscribed because no investor will pay $100 for a bond worth $97.07. The company would be required to increase the interest rate or agree to pay premium on the redemption of the bond. The expected return that investors will require on this bond can be estimated by simply calculating the IRR of the bond. This is simply done by undertaking a try and error to identify the return that if used to discount the current interest and principal, the present value of the bond would be $97.07. This can be illustrated as follows. $ D.F (4%) PV D.F10% Now (year zero) MV (97.07) 1 Y1-Y3 interest 4.00 Year 3 principal 100 (97.07) 1 (97.07) 2.755 11.02 2.487 9.95 0.888 88.80 2.75 SAM ANOKYE - 0.701 PV 75.10 12.02 Page 8 ACCOUNTING SOLUTIONS LIMITED IRR = 4 + 2.75 x 6% 14.77 = 4% + 1.1% = 5.1% This illustration shows that similar bonds which are already in issue are providing a return of 5.1%. An interest of 4% is lower than expected hence the bond should be issued at a discount or interest rate is increased to 5.1% or slightly above or a premium is offered on redemption, else the bond will be under – subscribed. Government bonds The situation of corporate bond is the same with government bonds expect that the return of government bonds based on credit rating is provided by credit rating agencies as a percentage of the nominal value of the bond. Illustration The following credit ratings of government bonds have been obtained from S&P website. S&P rating 1 year 3 year 5 year AAA 3.60 3.72 3.95 AA+ 3.75 3.89 4.15 AA 3.95 4.11 4.40 AA - 4.33 4.60 4.95 Required i. What is the return of a three year French government euro bond if a French government is rated AA+ SAM ANOKYE - Page 9 ACCOUNTING SOLUTIONS LIMITED ii. iii. What is the return of a five year Nigerian government euro bond if the Nigerian government bond is rated A – What will be the return on a one year Ghana government euro bond if the Ghana government bond is rated AA Answer i. ii. iii. The French government bond will have a market return of 3.89% p.a The five year Nigerian government bond will have a return of 4.95% p.a The Ghana government one year bond will have a return of 3.95% p.a SAM ANOKYE - Page 10