PUBLIC SCHOOL BUDGETING

advertisement

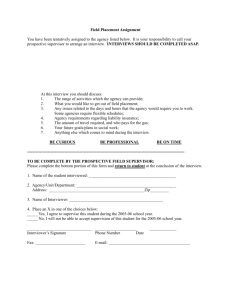

Crosson: Finance Interview 1 Brian Crosson ELPS 6024: Public School Budgeting and Management Fall 2009 Finance Interview Questions Note: Questions are in bold. Answers are in italics. Interview of Finance Director/Superintendent: Conducted on September 22, 2009 with Mrs. Patricia Townsend, Finance Director of Manassas Park City Schools Does the school board establish goals and objectives for the annual budget? Yes. What is the procedure for establishing the goals? The Leadership Team (Superintendent, two Assistant Superintendents, Finance Director) meet to discuss budgetary goals. Those goals are then listed on the budget when it is approved. Does the school system have a budget development calendar? Yes. The calendar of statutory budget-related events is released in November of each year. What software packages are used by the central office and the school to develop and manage the budget? Microsoft Excel. What is the maximum purchase that can be made without either a formal bid or telephone quote for lowest cost? $1,000. What are the procedures that must be followed when submitting a purchase order? For example, if a teacher wanted to make a purchase of $1500, he/she would need three bids. Those bids would be submitted to the school bookkeeper, who would in turn submit a purchase requisition. Assuming the funds would be drawn from an account whose funds are directly controlled by the principal, the requisition would go to the principal who would then decide whether or not to sign a purchase order. If the purchase would use funds coming from another source, the requisition would go to the central office for approval. Once a purchase requisition is approved by the central Crosson: Finance Interview 2 office, it goes to accounts payable and a purchase order is issued. Once a purchase order is issued, the funds are encumbered. For a purchase of over $10,000, there is an added step of Superintendent/Finance Director approval. A purchase of over $30,000 must go to the school board. Sometimes the school will seek bids from a company for a large or bundled purchase. In this case, bids will be returned in a sealed envelope and will be opened on a predetermined time and date. From there, the leadership team will make a decision about which vendor gets the bid. This happened frequently during the construction of new school buildings. Who has been given authority to authorize the issuance of a purchase order? The person responsible for the account from which the money is to be drawn has the authority to issue a purchase order for those funds. That means that there are many people in the district with the authority to issue purchase orders. How is inventory maintained in schools? In the division overall? The school district really only maintains three actual inventories: food, fuel, and fixed assets. The food inventory is maintained by food services, and monthly reports are issued. Fuel is maintained by transportation, and daily reports are issued. Fixed assets are tracked by either IT or Finance. PWCS, for example, keeps a central inventory of school supplies, and each school “buys” its school supplies from that central inventory. MPCS does not do that. Supply purchases are a regular expense. Are purchases entered into inventory when the purchase is received? No. Food and fuel inventories are not maintained in the financial system, but are expensed on a daily basis. Is there a central warehouse or storage facility for purchases? How are purchases distributed? No. Are purchases by telephone permitted? If so, under what circumstances? Yes, using a school purchase card. Are central office or school personnel allowed to use credit cards? If so, which employees and under what circumstances? Crosson: Finance Interview 3 MPCS does not have credit cards. It has purchase cards. Is the cafeteria fund centralized? The central office runs all the cafeterias. Central office does the budget and keeps all the records. Cafeteria managers only manage the actual operations of food preparation and distribution. They have no say in the budget. The cafeteria is not in the business of making money. The goal is to have money coming in equal all expenses. The number of meals consumed is regularly compared to the number of hours worked by the cafeteria workers. If fewer workers are necessary, cuts will be made. If costs go up, prices will go up. The school system receives outside funding for students who qualify for free and reduced lunch. Most of these funds are federal. Some are state. This funding comes in the form of a flat amount per student. Families have to fill out a yearly application to qualify for free and reduced lunch. Almost 50% of MPCS students qualify for free and reduced meals, which is very high historically. MPCS tries to market its meal service to those who qualify for free and reduced lunch but for some reason are not taking advantage of it. There are also some students who know they receive a free lunch, but don’t know they receive a free breakfast as well. One of the marketing strategies has been to hold a raffle for students who participate in breakfast. Free and reduced lunch applications are sent to all homes. Families that were received free and reduced lunch one year, but do not return the application the next year, receive a follow-up letter or phone call. Families new to the district are offered the application at registration and back-to-school nights. Describe the accounting/bookkeeping system used in schools and the division. At the division level, Microsoft’s Great Plains software is used. This was implemented in May of 2008. The budget itself is still prepared in Microsoft Excel. The schools themselves use Heritage software to track school activity money. Crosson: Finance Interview 4 Interview of Principal/Director: Conducted on September 15, 2009 with Mr. Tracy Shaver, Principal of Manassas Park High School How well prepared were you to assume the financial responsibilities in your school? Should more training be provided? If yes, what type? I feel I was very well prepared. I was the only assistant principal in the school before I became principal, so I became intimately familiar with the workings of the school under my principal. I learned all aspects of the job as an assistant principal. There were surprises, naturally, and I did learn a lot from doing. As a new principal, I would have benefited from more understanding of the differences between the types of funds (generally appropriated vs. non-appropriated funds). I learned that appropriated funds are generally more restrictive than non-appropriated funds (activity funds, general school fund). Describe briefly the budget development process in your school. Every budget is based on the previous year’s budget. I submit a budget to the school board office and it’s either approved or revised as needed. I get feedback from the department leaders (athletics needs, instructional supplies), assess needs, and draw up a budget. The process is an ongoing dialogue. How do the PTA (all levels) and Booster (high school only) organizations influence how your non-appropriated funds are spent? How do you prioritize the needs of the various student organizations/teams at your school? Our school PTSO (PTA) has student activity funds, but those are monitored through the school. Decisions about PTSO are made by a majority vote at PTSO meetings. Minutes from meetings determine distribution of funds. I am a member of PTSO, so I try to steer the distribution of funds as equitably as possible. There is no active booster club. All fund-raising activities are handled by coaches, sponsors, and the parents/students they recruit to help. The booster club was disbanded five years ago because the parents on the club were trying to direct funds to favored sports and events, not equitably. When do you have to get bids before you make a purchase? Is this a time consuming process? In general, how much time do you spend weekly working on the financial issues in your school? I don’t personally get bids. That’s handled by Alicia Sowers (bookkeeper) and the activities director, as well as any teachers trying to put in a purchase order. Three bids are needed for any purchase of $1000 or more, unless when there is only one supplier. Crosson: Finance Interview 5 I spend roughly 3 hours a week on finance related issues. I receive a daily folder from the bookkeeper with all purchase orders and checks needing a signature. How much discretion do you have in spending your appropriated funds? Nonappropriated funds? Can money be moved around to purchase what you need for your school? What financial reports do you use when making these types of decisions? I have quite a bit of discretion over appropriated funds. I received $160,000 this year for activities, instructional supplies, athletics, guidance, library, vocational education, and office of the principal. This I can control as-needed. I have very little leeway for non-appropriated funds. Monies raised generally stay with the club or sport that raised them. The exception to this is the general school account, which raises income by such means as vending machines and parking services. General school account funds are generally used for student-focused activities, such as refreshments for open house, banquets, and receptions. I receive a monthly report showing all expenditures and income on all accounts. Does a principal’s ability to “find money” depend on their experience and/or connections? Where do you go to get money you do not have, if a need really exists? Yes. You need to build rapport with those who can make decisions. I think this is easier in a small district such as Manassas Park. If I really need something, I can just call. For example, when our class sizes were getting out of control, I talked to the superintendent and got the go-ahead to hire four new teachers. What has been your most unpleasant financial experience since accepting the responsibility for school finances in your school? The budget cuts the last few years. Although I have very little control over the faculty and staff cuts, it was still difficult. Also, trying to do serve a higher enrollment with less appropriated funds has been hard. What happens to appropriated funds at the end of the year that are not spent? Internal school based (activity) funds? Appropriated funds do not carry over. Non-appropriated funds do. If you could give one piece of advice on school finance to a prospective principal, what would that advice be? I have three. First, get a good bookkeeper. Second, pay attention to school finances. Finally, read all purchase orders and checks you’re signing. Crosson: Finance Interview 6 Interview of Finance Officer/Secretary: Conducted on September 16, 2009 with Mrs. Alicia Sowers, Bookkeeper of Manassas Park High School How well prepared were you to assume the responsibilities of the finance officer/secretary in your school? What type of training did you receive? Should more training be provided? If yes, what type of training would you recommend? I had over 20 years of experience doing the bookkeeping for my family’s company. I am very familiar with proper accounting procedure. MPHS only allotted me with one week of training, but I decided to put in an extra month of training (with the outgoing bookkeeper) for free. One week would not have been sufficient. The previous bookkeeper left extensive notes as well. I believe that more training ought to be offered. There are three bookkeeper in-services throughout the year. How do you keep track of appropriated funds? Non-appropriated funds? Can you show me the documents you review to be sure you are up to speed on the expenditures and balances in all the accounts you are responsible for? Regarding appropriated funds, I write up a budget after recalibrating from last year’s budget. I then give the budget to the principal for changes. I request the necessary funds transfers from the central office. If they approved, the budget is re-issued. Non-appropriated funds are tracked through Heritage Administrative Systems Ledger with accounts payable software. Are your employees allowed to use credit cards? If so, how do you control their use? Are there specific rules/regulations you must follow? If so, what are they? We have no credit cards, but a purchase card that must be paid off at the end of the month. It is a Visa. Teachers have to sign out the card and sign an agreement to stick with legitimate school-related purchases. I don’t like to give out the card. I also use the card for online purchases. I must do a monthly reconciliation using packing slips, invoices, and purchase orders. What is the most chronic problem in your school related to school finances? What do you believe is the solution? The most chronic problem is people not following purchasing/receipt procedures, in particular the procedures regarding the receipt books. They must be filled out correctly and in order. I have had a very difficult time with some teachers simply refusing to follow the instructions. As a result, when they sign out a receipt book, as has already happened 22 times this year, they are required to sign an agreement to adhere to the regulations. That way I feel covered. Crosson: Finance Interview 7 How much money crosses your desk each day? How much money is generated from vending machines and how is the money used? What safeguards are in place to protect cash received? Is documentation required for all financial transactions? What type? It depends on what events are going on at the time. After a football game, perhaps as much as $5,000 crosses my desk. Back-to-school night might result in up to $8,000. Most days are normally less than $1,000. August hardly results in any money going across my desk. Events such as homecoming and prom will create more income. Vending machines commissions are put directly into an account by the vending company. That fund, as well as the parking services account, is the sources of income for the general fund. If the general fund is light, I can transfer money into it from either the parking account or the vending account. Safeguards include receipt books and the proper instructions that accompany them. Also, when a receipt is given out by a teacher, I generate a second receipt as I enter the receipt into the computer. I also have another secretary double-check bank statements. Purchase orders are given another set of information and signatures at the bottom of the page (voucher) when the check is issued. I have an interesting situation in that I’m also the cheerleading sponsor. I really ought to have someone else issue my receipts, but there is currently no safeguard against fraud in this case except my own ethics. How do you prepare for the annual audit? What happens if the audit is not favorable? If an audit is not favorable, I could get fired. The most recent audit revealed a very minor oversight on a purchase order, and this mistake was logged in my personnel file. They used a computer program to randomly check receipts and disbursements, and they happened across this mistake. Are the financial accounts separate for the middle school and the high school? Are revenues earned at the two levels put together for the good of the entire school, or are they kept separate? (Falls Church only) N/A If you could give one piece of advice on school finance to a prospective principal, what would that advice be? Trust no one. Have an open door policy regarding school books. After all, it’s not your money. If anyone gets upset when asked to justify or verify financial records, that’s a Crosson: Finance Interview red light that something is wrong. Cover yourself. Have someone else double check you. Avoid conflicts of interest and the appearance of impropriety. 8