about phx - Panhandle Oil and Gas Inc.

advertisement

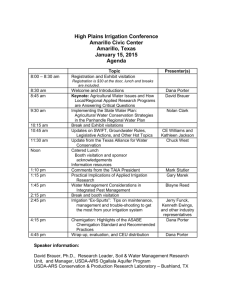

ABOUT PHX ABOUT PHX Panhandle Oil and Gas Inc. (NYSE-PHX) is a non-operating Independent Oil & Gas Company that was founded in 1926 and went public in 1979. PHX is engaged in the exploration for and production of natural gas, NGL and oil. The company has drilling projects in the Eagle Ford Shale, Anadarko Basin, Fayetteville Shale, and three Oklahoma Woodford Shale plays, including the SCOOP (WoodFord and Springer) and STACK plays. PHX has 255,000 mineral acres with approximately 68,000 of those acres in development. INVESTMENTDATA DATA(As (Asof of 5/18/15) 5/7/14) INVESTMENT (NYSE:PHX) Recent Price 52-Week Range Fiscal Year End Shares Outstanding Average Daily Trading Volume Market Capitalization $21.30 $15.68-34.45 Sept. 30 16.5 M 69,389 $352M Net Debt $69.0M Ownership INVESTMENT MERITS Long-Term Track Record of Shareholder Value Creation No shareholder dilution or secondary offering in Company history. Over a 50 year dividend payment history. Low Cost Provider Ranked in the top 10 of the 100 largest public domestic O&G companies in terms of all-source finding and development cost based on Global Hunter Sec. 2014 “Finding & Development Cost Study”. Capital Efficient Business Model Only 21 total employees. Growth financed through operating cash flow generation and low cost bank debt financing. High Barriers to Entry Ownership of 255,000 mineral acres (almost 400 square miles) across 10 states The mineral acreage is perpetually owned and has an average cost of approximately $90 per acre. Risk Reduction through the Business Model Significant activity is in shale plays which materially lowers the Company’s drilling risk. Able to leverage large independents technology to optimize development and the value of acreage. Able to mitigate commodity price risk through hedging. Seasoned Management Team Insider Institutional ≈11% ≈41% Management Mr. Michael C. Coffman President, Chief Executive Officer Mr. Paul F. Blanchard Jr. Sr. Vice President, Chief Operating Officer Mr. Lonnie Joe Lowry Vice-President, Chief Financial Officer & Secretary Investor Relations Contact Steven Hooser Three Part Advisors, LLC 214-872-2710 Panhandle Oil & Gas Inc. (NYSE: PHX) 5400 North Grand Blvd. Grand Centre Bldg., Suite 300 Oklahoma City, Oklahoma 73112 (405) 948-1560 Fax (405) 948-2038 or (405) 948-1063 PANHANDLE’s NON OPERATOR SELECTIVE PARTICIPATION OPTIONS Selective Participation with Working Interest in Most Economically Attractive Opportunities Royalty Interest PHX leases its acreage and receives a non-cost bearing royalty production and income stream from the wells drilled on our mineral acreage. We currently have 3,846 royalty interest wells. Advantage: No Risk Profile 1. No costs or operating expense. 2. May receive cash payment (Bonus) for the lease. Royalty and Working Interest (WI) PHX partners with Top Tier Producers and receives a working interest percentage of production as well as the royalty interest for the wells that are drilled on our mineral acreage. We currently have 2,173 WI wells. Advantage: Low Risk Profile 1. PHX is not responsible for project development costs i.e. Operator pays for the seismic, geological, geophysical, engineering, etc. 2. PHX only pays our percentage of ownership to drill, complete and operate the well. *On Average PHX takes a Royalty and WI on about 70% of the wells it gets proposed. 3P - Reserves Non-proved undeveloped reserves on fee mineral acres and held by production leasehold in the Eagle Ford Shale, Fayetteville Shale, Oklahoma Woodford Shales and Western Oklahoma/Texas Panhandle horizontal plays (superior economics due to royalty retention on mineral acres) ~ 6,000 producing wells, 50% of revenue from gas, 50% from oil and liquids in Fiscal Year 2015 PUD 40% of total proved reserves, principally on fee mineral acreage and held by production leasehold in shale plays Perpetually owned 186,800 open acres, 68,400 producing or leased acres *Proven, probable and possible reserve appraisal performed by DeGolyer and MacNaughton Forward-Looking Statements and Risk Factors – This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include current expectations or forecasts of future events. They may include estimates of oil and gas reserves, expected oil and gas production and future expenses, projections of future oil and gas prices, planned capital expenditures for drilling, leasehold or mineral acreage acquisitions, seismic data, statements concerning anticipated cash flow and liquidity and Panhandle’s strategy and other plans and objectives for future operations. Although Panhandle believes the expectations reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to be correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Factors that could cause actual results to differ materially from expected results are described under “Risk Factors” in Part 1, Item 1 of Panhandle’s 2014 Form 10-K filed with the Securities and Exchange Commission. These “Risk Factors” include the volatility of oil and gas prices; Panhandle’s ability to compete effectively against larger independent oil and gas companies; the availability of capital on an economic basis to fund reserve replacement costs; Panhandle’s ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of oil and gas reserves and projecting future rates of production; the amount and timing of development expenditures; unsuccessful exploration and development drilling; declines in the values of our oil and gas properties resulting in write-downs; the negative impact lower oil and gas prices could have on our ability to borrow; current economic conditions worldwide; future legislative or regulating changes; shortages of oilfield equipment, services and qualified personnel; and drilling and operating risks. As Panhandle does not operate any of the properties in which it has an interest, we have very limited ability to exercise any influence over operations of these properties, associated costs or the timing of drilling on its properties. Do not place undue reliance on these forward-looking statements, which speak only as of the date of this release, and Panhandle undertakes no obligation to update this information. Panhandle urges you to carefully review and consider the disclosures made in this presentation and Panhandle’s filings with the Securities and Exchange Commission that attempt to advise interested parties of the risks and factors that may affect Panhandle’s business. Panhandle Oil & Gas Inc. (NYSE: PHX) 5400 North Grand Blvd. Grand Centre Bldg., Suite 300 Oklahoma City, Oklahoma 73112 (405) 948-1560 Fax (405) 948-2038 or (405) 948-1063