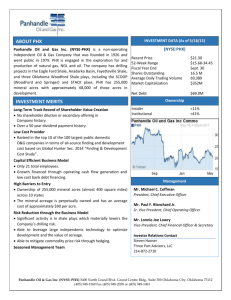

View Presentation Slides - Panhandle Oil and Gas Inc.

advertisement

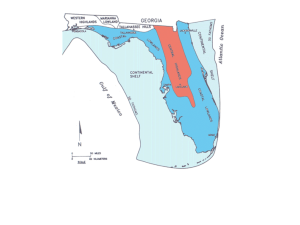

PHX LISTED NYSE® Forward-Looking Statements and Risk Factors – This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include current expectations or forecasts of future events. They may include estimates of oil and gas reserves, expected oil and gas production and future expenses, projections of future oil and gas prices, planned capital expenditures for drilling, leasehold or mineral acreage acquisitions, seismic data, statements concerning anticipated cash flow and liquidity and Panhandle’s strategy and other plans and objectives for future operations. Although Panhandle believes the expectations reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to be correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Factors that could cause actual results to differ materially from expected results are described under “Risk Factors” in Part 1, Item 1 of Panhandle’s 2012 Form 10-K filed with the Securities and Exchange Commission. These “Risk Factors” include the volatility of oil and gas prices; Panhandle’s ability to compete effectively against larger independent oil and gas companies; the availability of capital on an economic basis to fund reserve replacement costs; Panhandle’s ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of oil and gas reserves and projecting future rates of production; the amount and timing of development expenditures; unsuccessful exploration and development drilling; declines in the values of our oil and gas properties resulting in write-downs; the negative impact lower oil and gas prices could have on our ability to borrow; current economic conditions worldwide; future legislative or regulating changes; shortages of oilfield equipment, services and qualified personnel; and drilling and operating risks. As Panhandle does not operate any of the properties in which it has an interest, we have very limited ability to exercise any influence over operations of these properties, associated costs or the timing of drilling on its properties. Do not place undue reliance on these forward-looking statements, which speak only as of the date of this release, and Panhandle undertakes no obligation to update this information. Panhandle urges you to carefully review and consider the disclosures made in this presentation and Panhandle’s filings with the Securities and Exchange Commission that attempt to advise interested parties of the risks and factors that may affect Panhandle’s business. Annual Shareholders Meeting, March 7, 2013 2 Financial Highlights - Fiscal 2012 Year Ended September 30, 2012 2011 Revenue Net income Earnings per share $48,532,317 $7,370,996 $.88 $44,976,651 $8,493,912 $1.01 Net cash provided by operating activities (not including lease bonus received of $7.3 mm) $25,371,196 $29,283,929 Capital expenditures - Drilling - Acquisitions $25,147,306 20,144,121 $22,739,908 4,805,440 Mcfe produced Average Mcfe sales price Long-term debt 10,583,440 $3.86 $14,874,985 8,922,503 $4.87 $0 Annual Shareholders Meeting, March 7, 2013 3 Financial Highlights - Fiscal 2012 Condensed Balance Sheet Current assets Property and equipment Less accumulated DD&A Net property and equipment Other Total assets Current liabilities Long-term debt Deferred income taxes Asset retirement obligation Shareholders equity: Stock and paid in capital Retained earnings Deferred directors’ compensation Treasury stock Total liabilities and equity September 30, 2012 $11,622,845 286,816,134 (165,199,079) 121,617,055 1,946,830 $135,186,730 $7,627,742 14,874,985 26,708,907 2,122,950 2,160,753 84,821,395 2,676,160 (5,806,162) $135,186,730 Annual Shareholders Meeting, March 7, 2013 4 Financial Highlights - First Quarter 2013 Three Months Ended December 31, 2012 2011 $14,180,435 $13,404,333 $2,148,298 $3,412,110 $.26 $.41 Net cash provided by operating activities $7,158,243 $7,745,652 Capital expenditures - Drilling - Acquisitions $6,864,399 $330,000 $6,344,006 $18,783,949 $14,454,757 $14,522,371 3,008,365 2,559,524 $4.24 $4.59 Revenue Net income Earnings per share Long-term debt Mcfe sold Average Mcfe sales price Annual Shareholders Meeting, March 7, 2013 5 12 .31 12 .31 12 .31 12 .31 12 .31 12 .31 12 .29 12 .31 12 .31 12 .31 12 .31 .20 .20 .20 .20 .20 .20 .20 .20 .20 .20 .20 12 11 10 09 08 07 06 05 04 03 02 PHX Stock Price History 40 35 30 25 20 15 10 5 0 Ten-Year Share Price Growth Annual Shareholders Meeting, March 7, 2013 6 Operating Highlights Development of western Oklahoma/Texas Panhandle oil and natural gas liquids rich horizontal Granite Wash, Hogshooter, Cleveland, Marmaton and Tonkawa Focused development of our high quality asset base in three of the nation’s premier resource plays Arkansas Fayetteville Shale Anadarko Basin ‘Cana’ Woodford Shale Southeastern Oklahoma Woodford Shale Southern Oklahoma Woodford Shale Oil Play ~ 3,700 net mineral acres available for participation Annual Shareholders Meeting, March 7, 2013 7 Quarterly Production (Oil & NGL*) Barrels OIL NGL 60,000 50,000 40,000 30,000 20,000 10,000 2 2 01 .2 .31 12 9. 30 .2 01 2 6. 30 .2 01 2 31 .2 3. 12 .31 .2 01 01 1 1 9. 30 .2 01 1 01 30 .2 6. 31 .2 3. 12 .31 .2 01 01 0 1 0 * The Company began accounting for NGL production as a separate product from gas in FY 2012 Annual Shareholders Meeting, March 7, 2013 8 12 .31 . 20 05 3.3 1. 2 00 6 6.3 0. 2 00 6 9.3 0. 2 00 6 12 .31 . 20 06 3.3 1. 2 00 7 6.3 0. 2 00 7 9.3 0. 2 00 7 12 .31 . 20 07 3.3 1. 2 00 8 6.3 0. 2 00 8 9.3 0. 2 00 8 12 .31 . 20 08 3.3 1. 2 00 9 6.3 0. 2 00 9 9.3 0. 2 00 9 12 .31 . 20 09 3.3 1. 2 01 0 6.3 0. 2 01 0 9.3 0. 2 01 0 12 .31 . 20 10 3.3 1. 2 01 1 6.3 0. 2 01 1 9.3 0. 2 01 1 12 .31 . 11 3.3 1. 1 2 6.3 0. 1 2 9.3 0. 1 2 12 .31 . 12 Quarterly Production MCFE GAS Equivalent Oil + NGL 4,000,000 3,500,000 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 0 Annual Shareholders Meeting, March 7, 2013 9 Reserve Statistics – 2012 Exceptional Reserve Growth • Proved reserves at year-end 2012 Fiscal year-end 2012 proved reserves increased to 124.7 Bcfe An 11.7% increase over 2011 • Record 3P (proved, probable and possible) reserves at year-end 2012 Fiscal year-end 2012 3P reserves increased to 442.1 Bcfe A 7.4% increase over 2011 • Year-end 2012 inventory of undeveloped locations 4,180 undeveloped locations • Proved, probable and possible reserve appraisal performed by DeGolyer and MacNaughton Annual Shareholders Meeting, March 7, 2013 10 Proved Reserve Growth Proved Developed Reserves Proved Undeveloped Reserves 140.0 Proved Reserves (Bcfe) 120.0 50.9 100.0 41.2 80.0 60.0 44.6 9.2 12.8 6.4 40.0 3.6 20.0 5.6 27.7 28.7 2005 2006 35.5 41.3 50.3 62.5 67.1 2010 2011 73.8 0.0 2007 2008 2009 2012 Annual Shareholders Meeting, March 7, 2013 11 Probable & Possible Undeveloped Reserve Growth Probable Possible Proved/Possible Reserves, (Bcfe) 400.0 350.0 300.0 250.0 160.9 174.8 200.0 200.1 147.9 150.0 75.0 100.0 50.0 86.1 87.4 87.1 2008 2009 2010 125.1 156.5 0.0 2011 2012 Annual Shareholders Meeting, March 7, 2013 12 Year-End 2012 Reserves and First Quarter 2013 Production and Revenue by Product Gas 100 9% 5% 4% Oil NGL 9% 15% 6% 38% 80 31% 7% 60 91% 40 85% 62% 20 0 Year-End 2012 SEC PDP Reserves First Quarter 2013 Production First Quarter 2013 Revenue Annual Shareholders Meeting, March 7, 2013 13 Acquisition Strategy and Activity Acquisition Strategy ● Focus on acquiring both HBP leasehold and un-leased and leased mineral acreage properties in economically depressed dry gas resource plays as well as appropriately priced oil/liquids rich properties ● Majority of purchases to date have been in the Fayetteville Shale ● Potential to expand into other dry gas plays and oil/liquids rich plays ● The goal is to add extremely low risk and long lived proved, probable and possible reserves which will generate exceptionally attractive long term returns ● This is accomplished by acquiring dry gas reserves below industry replacement cost in the cores of the nation’s lowest cost gas resource plays or acquiring appropriately priced oil/liquids rich properties Annual Shareholders Meeting, March 7, 2013 14 Leasing Strategy and Activity Leasing Strategy (Leasing of PHX mineral holdings to active operators) Lease Company minerals in situations where it is clear that the value generated by the lease bonus and royalty will exceed the potential value of participation with a working interest in wells drilled on mineral acreage ● ● Example: Northern Oklahoma Mississippian Play leased for ~$1.7MM bonus with 3 years primary term, while retaining 3/16ths royalty (proportionately reduced) in each well drilled on PHX minerals Mississippian reserves are extremely variable and difficult to predict PHX minerals were not generally located near viable Mississippian vertical show wells or economic Mississippian horizontal wells Water transportation and disposal expenses make most wells uneconomic for non-operating owners as they do not share ownership with the operators in the profit center disposal systems and are captive to very high disposal fees Produced water is saturated with salt and therefore difficult and expensive to lift from the producing wells leading to higher operating expenses and potential for environmental liability Leasing eliminates the risk of investing capital in uneconomic projects due to low reserves, mechanical failures, low product price or high operating expense ● Will consider leasing in other plays where leasing valuations are compelling Annual Shareholders Meeting, March 7, 2013 15 Southeastern Oklahoma Woodford Shale Diverse mineral ownership across the play Interest (WI or RI) in 17% of all producing wells in the play PHX wells primarily operated by Newfield, Devon, BP and PetroQuest Current production 5.3 Mmcfe per day Reserves Year-End 2012 Proved – 37.6 Bcfe (30.1% of total) Probable – 90.4 Bcfe (57.8% of total) Possible – 72.4 Bcfe (45.0% of total) Mineral ownership generates superior returns Annual Shareholders Meeting, March 7, 2013 16 Southeastern Oklahoma Woodford Shale Current Development Area 6,518 net PHX acres 163 PHX producing working interest wells w/6.1% average NRI 60 PHX producing royalty interest wells 4.4% average NRI in 897 undeveloped WI locations 359 additional undeveloped RI locations Blue outline is Current Development Area Annual Shareholders Meeting, March 7, 2013 17 Arkansas Fayetteville Shale Diverse mineral and leasehold ownership across the play Interest (WI or RI) in 22% of all producing wells in the play PHX wells primarily operated by Southwestern Energy Current production 14.1 Mmcfe per day Reserves Year-End 2012 Proved – 48.2 Bcfe (38.6% of total) Probable – 29.8 Bcfe (19.1% of total) Possible – 46.0 Bcfe (28.6% of total) Mineral ownership generates superior returns Annual Shareholders Meeting, March 7, 2013 18 Arkansas Fayetteville Shale Current Development Area Current Development Area 10,473 net PHX acres 459 PHX producing working interest wells w/3.0% average NRI 4.8% average NRI in 800 undeveloped WI locations 1,205 additional undeveloped RI locations 543 PHX producing royalty interest wells Annual Shareholders Meeting, March 7, 2013 19 Anadarko Basin ‘Cana’ Woodford Shale Diverse mineral ownership across initial play and expansion areas Interest (WI or RI) in 12% of all producing wells in the play PHX wells primarily operated by Devon and Cimarex Current production 2.1 Mmcfe per day Reserves Year-End 2012 Proved – 9.4 Bcfe (7.5% of total) Probable – 34.6 Bcfe (22.1% of total) Possible – 34.5 Bcfe (21.4% of total) ● Mineral ownership generates superior returns Annual Shareholders Meeting, March 7, 2013 20 Anadarko Basin Woodford Shale Reserve Assessment Area 3,545 net PHX acres 57 PHX producing working interest wells w/3.0% average NRI 7 PHX producing royalty interest wells 3.8% average NRI in 437 undeveloped WI locations 330 additional RI locations Blue outline is 3P Reserve Assessment Area Red outline is Core Development Area Yellow outline is Potential Play Extent Annual Shareholders Meeting, March 7, 2013 21 Western Oklahoma and Texas Panhandle Net Acreage The currently active oil and liquids plays within the outlined area include the Granite Wash, Hogshooter, Cleveland and Marmaton ~ 17,100 net mineral acres available for PHX participation ~ 320 net leasehold acres available for PHX participation ~ 8,400 net mineral acres leased in the past with PHX retained royalty 2,743 acres leased from surface to base of Virgilian (Tonkawa Equivalent) Annual Shareholders Meeting, March 7, 2013 22 PHX Drilling Activity in Western Oklahoma and the Texas Panhandle 2012 Wells 2013 Wells Annual Shareholders Meeting, March 7, 2013 23 PHX LISTED NYSE®