1.5assesmt

advertisement

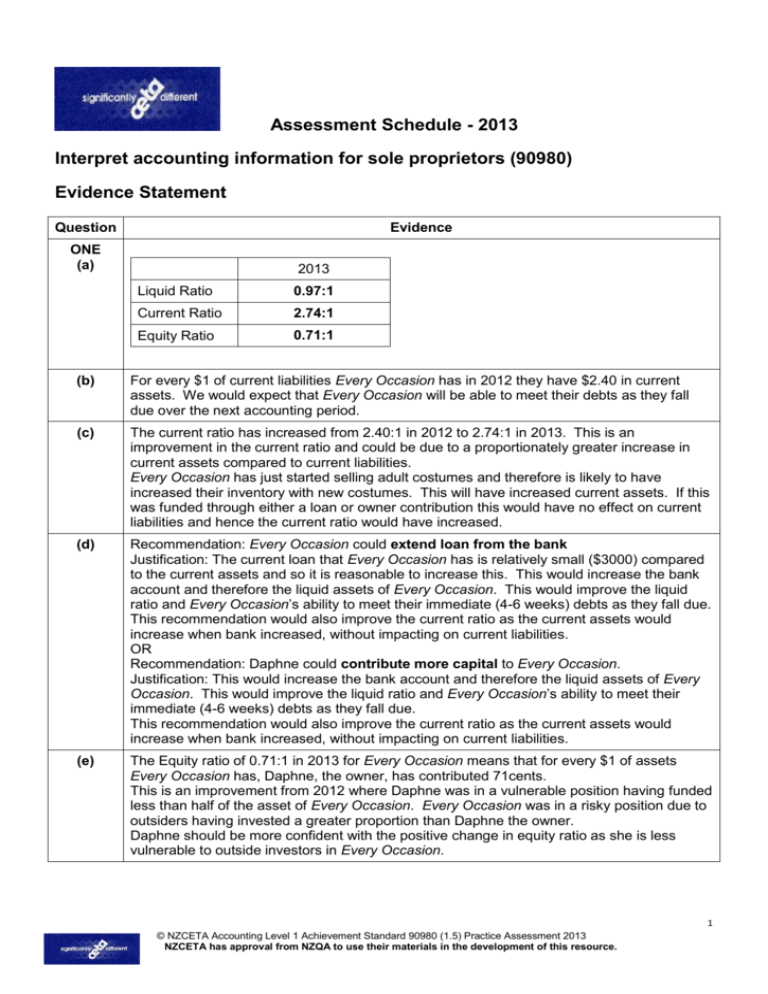

Assessment Schedule - 2013 Interpret accounting information for sole proprietors (90980) Evidence Statement Question Evidence ONE (a) 2013 Liquid Ratio 0.97:1 Current Ratio 2.74:1 Equity Ratio 0.71:1 (b) For every $1 of current liabilities Every Occasion has in 2012 they have $2.40 in current assets. We would expect that Every Occasion will be able to meet their debts as they fall due over the next accounting period. (c) The current ratio has increased from 2.40:1 in 2012 to 2.74:1 in 2013. This is an improvement in the current ratio and could be due to a proportionately greater increase in current assets compared to current liabilities. Every Occasion has just started selling adult costumes and therefore is likely to have increased their inventory with new costumes. This will have increased current assets. If this was funded through either a loan or owner contribution this would have no effect on current liabilities and hence the current ratio would have increased. (d) Recommendation: Every Occasion could extend loan from the bank Justification: The current loan that Every Occasion has is relatively small ($3000) compared to the current assets and so it is reasonable to increase this. This would increase the bank account and therefore the liquid assets of Every Occasion. This would improve the liquid ratio and Every Occasion’s ability to meet their immediate (4-6 weeks) debts as they fall due. This recommendation would also improve the current ratio as the current assets would increase when bank increased, without impacting on current liabilities. OR Recommendation: Daphne could contribute more capital to Every Occasion. Justification: This would increase the bank account and therefore the liquid assets of Every Occasion. This would improve the liquid ratio and Every Occasion’s ability to meet their immediate (4-6 weeks) debts as they fall due. This recommendation would also improve the current ratio as the current assets would increase when bank increased, without impacting on current liabilities. (e) The Equity ratio of 0.71:1 in 2013 for Every Occasion means that for every $1 of assets Every Occasion has, Daphne, the owner, has contributed 71cents. This is an improvement from 2012 where Daphne was in a vulnerable position having funded less than half of the asset of Every Occasion. Every Occasion was in a risky position due to outsiders having invested a greater proportion than Daphne the owner. Daphne should be more confident with the positive change in equity ratio as she is less vulnerable to outside investors in Every Occasion. 1 © NZCETA Accounting Level 1 Achievement Standard 90980 (1.5) Practice Assessment 2013 NZCETA has approval from NZQA to use their materials in the development of this resource. Judgement Statement N1 ONE of Calculates 2/3 analysis measures correctly N2 TWO of Calculates 2/3 analysis measures correctly A3 THREE of Calculates 2/3 analysis measures correctly A4 FOUR of Calculates 2/3 analysis measures correctly Describes the current ratio Explains the current ratio of 2.40:1 Identifies the current ratio has improved Identifies a recommendati on to improve liquid ratio Identifies a recommendati on to improve liquid ratio Describes equity ratio OR Identifies improvement in equity ratio Describes equity ratio OR identifies improvement in equity ratio Describes the trend in current ratio OR describes a cause of the improvement in the current ratio Describes a recommendati on to improve the liquid ratio Describes a recommendati on to improve the liquid ratio Describes the meaning of the equity ratio Describes the meaning of the equity ratio Describes the current ratio Identifies the current ratio has improved Explains the current ratio of 2.40:1 Describes the trend in current ratio OR describes a cause of the improvement in the current ratio M5 TWO of Explains the trend in current ratio with a possible cause M6 ALL of Explains the trend in current ratio with a possible cause Explains a recommendati on to improve the liquid ratio Explains the improvement in the equity ratio related to Every Occasion Explains a recommendati on to improve the liquid ratio Explains the improvement in the equity ratio related to Every Occasion E7 ONE of Fully explains the trend in current ratio for Every Occasion, giving a detailed possible reason E8 BOTH of Fully explains the trend in current ratio for Every Occasion, giving a detailed possible reason Justifies a recommendati on to improve the liquid ratio AND explains the impact on the current ratio Justifies a recommendati on to improve the liquid ratio AND explains the impact on the current ratio N0 – no relevant evidence 2 © NZCETA Accounting Level 1 Achievement Standard 90980 (1.5) Practice Assessment 2013 NZCETA has approval from NZQA to use their materials in the development of this resource. Question TWO (a) Evidence Distribution Cost % Administrative Expense % Finance Cost % Profit for the year % 2013 23.8% 25.2% 1.9% 15.2% (b) For every $1 of sales for Every Occasion in 2012, 3 cents was spent on interest (finance costs) (c) The distribution cost % has increased from 19.4% in 2012 to 23.8% in 2013. This means that Every Occasion spent 23.8 cents on distribution costs for every $1 of sales in 2013. This is an increase of 4.4 cents per $1 of sales. This was due to an increase in distribution costs. This could have been due to more advertising Every Occasion conducted in order to launch their new range of adult fancy dress costumes. The increased spending on advertising would increase distribution costs which would increase the distribution cost %. (d) Recommendation: Every Occasion should find a cheaper insurance company/electricity provider/telecommunications provider (any relevant expense) Justification: If Every Occasion manages to find a cheaper insurance company it will reduce the amount they spend on insurance premiums and hence their spending on administrative expenses. This would result in a reduction in the administrative expense %. A reduction in the administrative expenses would increase the profit for the year for Every Occasion. (e) Percentage change in profit = 36.9% This is a very positive change for Every Occasion as they have increased their profit by over 1/3 from 2012 to 2013. This would be due to either an increase in income or decrease in expenses. For example (ideas) Every Occasion may have a higher mark up on the newly introduced adult costumes which would increase gross profit and profit for the year. Every Occasion may have paid off some of their loan resulting in less interest expense for the year and increase in profit. 3 © NZCETA Accounting Level 1 Achievement Standard 90980 (1.5) Practice Assessment 2013 NZCETA has approval from NZQA to use their materials in the development of this resource. Judgement Statement N1 N2 ONE of Calculates TWO analysis measures TWO of Calculates TWO analysis measures Describes finance cost % Identifies worsening of distribution cost % Identifies a recommendati on to improve the admin expense % Calculates the percentage change in profit Identifies a possible cause of the increase in profit Describes finance cost % Identifies worsening of distribution cost % Identifies a recommendati on to improve the admin expense % A3 A4 THREE of Correctly calculates THREE analysis measures FOUR of Correctly calculates THREE analysis measures Describes the finance cost % Describes the finance cost % Describes the trend in distribution cost % Describes the trend in distribution cost % Describes a recommendati on for improving the admin expense % Describes a recommendati on for improving the admin expense % Calculates the percentage change in profit Identifies a possible cause of the increase in profit Calculates the percentage change in profit Calculates the percentage change in profit Describes a possible cause of the increase in profit Describes a possible cause of the increase in profit M5 M6 TWO of Explains the trend in distribution costs ALL of Explains the trend in distribution costs Explains a recommendati on which would improve the admin expense % for Every Occasion Correctly calculates, explains and gives ONE relevant cause of the improvement in sales Explains a recommendati on which would improve the admin expense % for Every Occasion Correctly calculates, explains and gives ONE relevant cause of the improvement in sales E7 E8 TWO of Fully explains the trend (with a relevant cause) in distribution cost % for Every Occasion ALL of Fully explains the trend (with a relevant cause) in distribution cost % for Every Occasion Justifies a recommendati on to improve the admin expense % for Every Occasion Justifies a recommendati on to improve the admin expense % for Every Occasion Correctly calculates, explains and gives TWO relevant causes of the improvement in sales Correctly calculates, explains and gives TWO relevant causes of the improvement in sales N0 – no relevant evidence 4 © NZCETA Accounting Level 1 Achievement Standard 90980 (1.5) Practice Assessment 2013 NZCETA has approval from NZQA to use their materials in the development of this resource. Question Evidence THREE (a) Percentage change in sales Mark Up % Gross Profit % 2013 11.1% 195.5% 66.2% (b) For every $1 of sales in 2012 for Every Occasion 54.5 cents was left for Gross Profit. This was available to cover expenses and profit for the year. (c) The mark up % for Every Occasion has increase from 120% in 2012 to 195.5% in 2013. This means that on average Every Occasion added more to their cost price of their costumes to get their selling price than they did in 2013. This could have been due to : Every Occasion increasing the selling price of their costumes without an increase in the cost of them. Every Occasion securing a cheaper supplier of costumes without lowering their selling price Every Occasion may have a larger mark up on adult costumes which they are now selling and hence their average mark up has increased. (d) increase selling price Assuming the price rise does not make Every Occasion lose too many customers it will result in an increase in sales income as they are selling a similar quantity at a higher price decrease selling price By lowering the selling price Every Occasion will attract more customers and therefore sell more costumes. Assuming the increase in quantity outweighs the price reduction then sales income for Every Occasion will increase 5 © NZCETA Accounting Level 1 Achievement Standard 90980 (1.5) Practice Assessment 2013 NZCETA has approval from NZQA to use their materials in the development of this resource. Judgement Statement N1 ONE of Calculates 1 analysis measure N2 TWO of Calculates 1 analysis measure A3 THREE of Calculates 2 analysis measures A4 THREE of Calculates 2 analysis measures Describes the gross profit % Describes the gross profit % Describes the gross profit % Describes the trend in mark up % Describes the trend in mark up % Describes the trend in mark up % Describes either option for increasing sales Describes either option for increasing sales Describes a possible cause of the increase in mark up % Describes either option for increasing sales Describes the gross profit % Describes the trend in mark up % OR Describes a possible cause of the increase in mark up % M5 TWO of Explains the gross profit % for Every Occasion M6 ALL of Explains the gross profit % for Every Occasion Explains the trend in mark up % with a possible cause Explains either option for increasing sales Explains the trend in mark up % with a possible cause Explains either option for increasing sales E7 ONE of Justifies either an increase or decrease in selling price with reference to assumption E8 BOTH of Justifies either an increase or decrease in selling price with reference to assumption Fully explains the trend in Mark Up % with a possible cause for Every Occasion Fully explains the trend in Mark Up % with a possible cause for Every Occasion Describes either option for increasing sales N0 – no relevant evidence 6 © NZCETA Accounting Level 1 Achievement Standard 90980 (1.5) Practice Assessment 2013 NZCETA has approval from NZQA to use their materials in the development of this resource. Judgement Statement Score Range Not Achieved Achievement Achievement with Merit Achievement with Excellence 0–7 8 – 14 15 – 18 19 - 24 7 © NZCETA Accounting Level 1 Achievement Standard 90980 (1.5) Practice Assessment 2013 NZCETA has approval from NZQA to use their materials in the development of this resource.