Lecture notes: Kolstad Ch 7

Demand for Environmental Goods Ch. 7

Put dollar value on environmental good.

The problem with Demand functions for environmental goods is that there are typically no “markets”.

No observations on prices and quantities with market transfers on items like “clean air”,

“avoid extinction of species XY”. This problem is very different than with rival goods (Coca Cola) where you obtain the price at a supermarket.

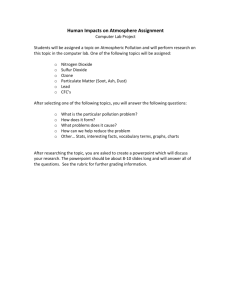

Overview of Methodologies of Measuring Demand.

Side note: Ch. 7 to 10 is useful not only in the field of env. econ, but also in other ‘fields”, especially marketing. Imagine you will work for BMW as an economist, and the management will ask you how to price the new model Super-Turbo-ABC that will be released next year. Should you just use the MC of

Super-Turbo-ABC to determine the optimal sales price of the new BMW model? Probably not! In fact, you can do much better if you know the demand function for that particular BMW model (in order to

‘exploit’ along the demand curve). The point is, there does NOT yet exist market data on the BMW

Super-Turbo model. This is the same for env. goods. So the methodologies to “estimate” these kind of demand functions are similar.

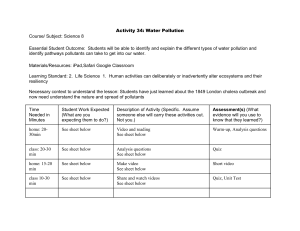

Some definitions to remember for Environmental Goods.

WTP is analogous to CS + the rectangle under the MWTP line.

Note: The MWTP line is the “Hick’schen” demand, hence where we hold utility constant), hence V(P,Y,Q1) = V(P,Y-WTP,Q2), with Q2>Q1.

Two Figures summarizing relationship between WTP, Income and the Preferences regarding the

Environmental Good, Q

MWTP is analogous to price.

Damage of pollution = WTP to avoid pollution (=pollution abatement). = - WTP for pollution

MD = MWTP to avoid pollution = - MWTP for pollution

1

“Damage function”, typically convex. Damages can contain not only “health damages”, but also a) changes in the housing prices, b) years of life lost, c) psychological costs of being in a dirty environment, d) noise level e) etc.

The sum of these values (a) to (e) (minus subtracting possible double counting) is the total damage. We say this this total damage is also equivalent the total WTP to avoid pollution).

Figure on relationship between WTP and Damages.

2

Another categorization of environmental goods

(Remark: we learned about the categorization scheme from Field and Field which is according to the characteristic of the pollutant (global vs. local, point source vs. nonpoints source etc.). This here below is a new second categorization according to ‘value’ criteria. Each pollutant can be in multiple categories.)

In order to obtain the TOTAL value of the env. good it is useful to categorize the env. good into “use values” and “non-use values”, i.e. the types of Environmental Goods of how people perceive damages

(or benefits of pollution abatement):

Use Value

Consumption of env. good which includes o Current use ( I am currently visiting a park) o Expected use (I will visit the park next year) o Possible use (I might (or might not) visit the park within the next 20 years

Non use value o Existence Value (value of knowing of some rare species in the Himalaya, although I never eat the species, or visit the Himalaya) o Altruistic Value (well being of other people that currently live) o Bequest Value (well being of other people that will live in the future)

At Exxon Alaska oil spill non-use values were very important in quantifying overall damage.

Question: Recorded hospitalization costs from Ozone exposure: What type of ‘value’ is damaged, (use or non-use?).

Answer: Current Use value.

3

Categorization of Methods

Revealed Preferences vs. Stated Preferences:

Debate on ‘method’ of how to derive $ value on nonmarket good

Revealed: looks at behavior of agents

i.e. house prices as function of local air pollution

advantage: actual (revealed) preferences

Disadvantage: confounders!

Cannot capture non-use values.

Good at identify MWTP. But not good at identifying WTP

Stated (hypothetical scenario)

WTP / WTA studies (contingent valuation)

Can capture use and non-use values: Exxon Alaska Oil Spill (example Michael Hanemann vs. McFadden in lawsuit of Exxon)

Future development: Marketing

Good at identifying WTP (not only MWTP as in revealed).

Controversial because of absence of ‘real choices’ -- > lack of ‘realism’ that could be necessary to obtain accurate information.

Further split up RP into “Hedonics” and “Household Production”

Hedonics Price = f(Characteristics): Huge Econometric exercise

Wage = f(Characteristics)

Application: VSL used by the EPA and DOT

Household production is further split up into

Defensive Expenditures o Not going outside on high ozone day o Noise insulation o Medication expenses on high air pollution days.

Travel Cost Method o Mainly for estimating values of recreational parks, skiing, ice-climbing sites etc.

4

o

Stated Preference Studies:

Dominant approach: Contingent Valuation “value contingent on there being a market”

Other approaches are (these can be mix of SP and RP). o lab experiments with students o Field Experiments o Referenda

Figure of Categorization of Methods:

5

Benefits transfer (“Poor man’s approach to benefits estimation”). Example in the book, box on page

141. 1990 Oil spill in LA area. In litigation (law suite), they agreed not to make new RP or SP study.

Instead researchers could take studies from Hawaii, Florida, Rhode Island and estimate, under some adjustments (population density, alternative beaches, cost of living etc.) a value of 1$ to 12$ per day for lost beach use in LA.

6

Chapter 8: Hedonic Price Methods:

Hedonics means relating the price of a good to its characteristics.

Three Examples: a) Price of computer = f(RAM, CPU, hard-drive) b) Price of the house as a function of house and neighborhood characteristics (square foot, distance to city center, number of restrooms, local air pollution, crime rate).

This can be statistically estimated by

P = a

0

+ a*square foot + b*distance to city center + c*number of restrooms +d*local air pollution

+ e*crime rate + epsilon

Here d is the MWTP to decrease air pollution by one unit. c) Wage of the worker = w = f(risk level of accident)

This wage hedonics can be used to estimate the Value of Statistical Life.

EPA actively uses VSL to determine optimal level of pollution thresholds using CBA.

7

We first start by looking at the simplest case. Price of Agricultural Land.

Case 1: Assumption: Crop produced is in a competitive market, where individual farmers are “price takers”.

Valley with factory, upwind one clean plot and one dirty downwind plot.

Plot the function: P = a

0

+ b*airpollution

Question: is price difference (b) the MWTP by downwind farmer to clean up the air?

Answer:

Trick: if air pollution variable is not in units but a ‘dummy’, such that

P = a

0

+ b*dummy{air pollution} then b = WTP by farmer!

8

Question: is WTP by downwind farmer = the total damage of the factories air pollution?

Answer:

(Sum of WTPs is total Damage!)

Fig. of partial damage functions that sum to total damage

Case 2: Assumption: Crop produced is in a local market of the valley (perishable vegetables), where individual farmers are NOT price takers.

Question: Is Price difference (b) in equation

P = a

0

+ b*dummy{airpollution} the WTP by downwind farmer to clean up air pollution?

Answer: No! Because, with clean air production increases price of vegetable drops consumer benefits. Upwind farmer loses because of drop in price of output. So also price of upwind parcel will change etc. The point is there are many adjustments taking place that will bias the estimate of the WTP.

The coefficient b is no longer equal to the WTP by the downwind farmer to clean up the air.

Lessons learned from Case 1 and Case 2: In order to attribute the coefficient b as the price of the environmental good, we MUST have a situation where all other variables (price of the vegetable, wage of the worker etc.) keep constant!

9

In small area: (several blocks of a city), typically house price increase with amenity value (less pollution).

I.e. House price decrease closer to highways (Zillow.com).

estimation of WTP relatively straight forward

In Macro-scale, however, multiple adjustments take place. Typically house price are HIGHER in polluted areas (i.e. Manhattan). Why?

So conditioning on other variables (population density, crime rate, job-opportunities) is crucial, otherwise we get the wrong ‘sign’.

Roback Model

(Figure 8.2 only in Bonus question, if you are interested (voluntary). However, intuition is important):

Note on macro scale, adjustments take place on both wage and housing prices. In other words, amenities can be capitalized in either wages or housing values.

Example: Estimate amenity value of “nice climate”. Everyone wants to live in coastal CA.

Question: Are then wages and house prices higher or lower in CA?

Answer: wages should be ceteris paribus lower, but house prices higher.

See powerpoint. ( utility constant, horizontal axis: nice climate, consumtion upward sloping, QOL first positive, then negative).

Figure:

Vertical axis: $

Horizonal axis: ‘nice climate ’

Nominal wage: downward sloping

Nominal housing: costs: upward sloping

Real wages downward sloping and STEEPER then nominal wage

Hence, if we make cross-city comparisons, we MUST use real wages.

If we use within city comparisons, we simply use nominal wages (for VSL) or nominal property values.

There is no need to adjust for cost of living.

10

Explain term “equilibrium sorting”. Basically it is the description that deaf people can more easily live close to the airport. So in P=a +b noise + epsilon, b will be lower than the MWTP for noise because of sorting. However if we have a ‘sudden’ new airport, and rents go down immediately, then b approximates MWTP better because there is less time for ‘equilbrium sorting’.

Hedonic Price Theory

Assumption: Everyone has same Utility.

Fig. 8.5

Fig. 8.6

Fig. 8.7.

Fig. 8.8.

Defensive Expenditures

Spend Money against Environmental BAD.

Idea: let pollution increase. If the investments into pollution abatement by residents go up (defensive expenditures rise), then this dollar amount can be used as a lower bound for the WTP to avoid pollution.

Examples:

-increased air condition from global warming

-Insulation costs (double pane windows) because of noise of highways

-Not going outside on high ozone day

-Medication expenses on high air pollution days.

Question: Is OBSERVED defensive expenditure D(Q,P) equal to WTP?

Answer?

11

Question: is it upper or lower bound?

Answer:

This means: what we observe in the market place (changes in defensive expenditures) will ALWAYS understate the true marginal willingness to pay to avoid pollution. Hence the observe D is a LOWER bound on the WTP!

Model:

Max U(Q,X) s.t. X+D(Q,P) = Y

Fig. 9.1 to 9.3.

Intuition WHY observed D is lower bound of WTP: First look at budget constraint.

Thought experiment:

Question: How would Y would need to increase in order that Utility keeps constant if P rises from P

1

to

P

2

?

Answer: Mathematically by D p

(see Fig. 9.1)

In reality: if P increases, then D increases, but that must reduce X. Hence Utility overall decreases (see

Fig. 9.3).

Mathematical intuition: MWTP = D p

, but in market place we do NOT observe partial derivative D p

, we only observe total derivative dD/dP (hence where both Q and P adjust)

Stated Preferences

Note: U.S. Government assigned NOAA Panel (including Nobel Price Winners of Economics) to provide

‘best practice’ recommendations.

Since then, contingent Valuation consists of the six components:

1.

Define market scenario a.

Be as realistic as possible. b.

Be reminded that substitutes exist in order not to overvalue the good. c.

Scope problem (i.e. WTP to protect 1 tree, 10 trees, 1000 trees, million hectar of trees in amazon).

2.

Choose elicitation method a.

Direct monetary question on WTP

12

b.

Yes/No on fixed WTP (but starting point bias), so randomize over staring points.

3.

Design market administration a.

Mail survey b.

Telephone c.

Internet survey d.

In person survey e.

Pretesting the survey

4.

Design sampling a.

Draw population b.

Draw sample within population

5.

Design experiment: a.

Randomize over above options b.

Use interviewer dummy

6.

Estimate Willingness to Pay function a.

Take ECONOMETRICS if interested

Very clear examples are provided in the book on p. 204ff.

Max. WTP or Min. WTA?

WTA is greater or equal WTP because

WTP is limited by income

Limited substitution between environmental good and x.

Kahnemann: endowment effect. Psychological costs (= - happiness) of losing is larger than happiness from winning the same amount.

Conditions under which WTP = WTA

See Fig.

13