25th July 11 Andover 01264 358011 Andover – Fax 01264 361233

advertisement

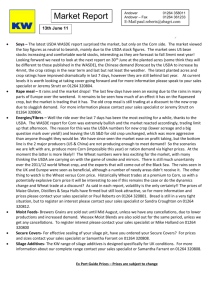

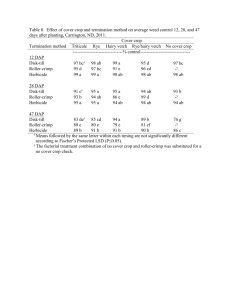

Market Report Andover Andover – Fax 01264 358011 01264 361233 E-Mail paul.roberts@abagri.com 25th July 11 Soya – The main focus for the market is the weather. The US has experienced extreme heat which is causing the crop severe stress, although forecasts through the week kept a lid on prices as they called for cooler and wetter weather. The most important month for the Soya crop is August, however the current temps will cause a loss of acres and yields in a year where there is little room in the S&D for this. Ongoing forecasts will be watched very closely by the market. The other major factor on demand is China and they have said that bean imports will fall over the next 2 years, with the largest drop in 2011. The government also said that they plan to sell 4mmt of reserves in return for a lift on the cap on vegoil prices (but at the moment this is only rumour). Are the Chinese playing a game though, given they have lower domestic bean crops, an increasing population, and higher demand to feed pigs!! The cynics would argue it is all part of the game and we wonder if prices drop then we would we suddenly see buying from the Chinese. I think most of us know the answer. We still maintain at current levels it is worth looking at taking cover going forward and for more information please speak to your sales specialist or Jeremy Strutt on 01264 320804. Rape meal – Like Soya one of the main focuses for the market is the weather (and you thought it was only the British who are obsessed by the weather!). Heat and storms in Canada have reportedly damaged the crop, China is forecast to have a lower Rapeseed crop, but on a positive note the early yield indications from the UK Rapeseed crop have been encouraging. With the maintenance at Erith now completely finished, hopefully it will mean we shall get through the winter with no breakdowns!! The demand for nearby Rape is still proving sluggish and as a result Rape prices have eased meaning it is back looking competitive against Soya. For more information please contact your sales specialist or Jeremy Strutt on 01264 320804. Energies/Fibres – No prizes for guessing the main driver of the Corn market at the moment, yes the weather. The extreme heat in the US has caused a drop in the ratings to the lowest in 4 years (and remember this in a year when we need a good crop), with Europe getting the most favourable conditions. So why has the Corn price stayed unchanged over the last week? First of all there are still very big concerns over the Greek economy (when/will they go bust) and the difficulty the US seem to have in agreeing a deal for their debt ceiling (just as we thought they had sorted it over the weekend, that now looks unlikely). The debt situation is causing the market to be risk adverse thus keeping out of commodities. The latest ethanol figures have shown that there has been a slowdown in demand below market expectations and cooler weather in the forecast (although far from guaranteed). However, the fundamentals still point to a bullish market but the overriding factor keeping a lid on prices currently is the debt/economy worries around the world. Well the weather is also playing its part in the Wheat market with many parts seeing drier warmer weather apart from South Brazil which saw flooding! The Australian weather bureau has forecast ave/below rainfall for the next 3 months. Russia is still taking all the export tenders possible (up to $43 per tonne cheaper than French) but they don’t look like they will get any cheaper. Wheat is still trading below Corn, meaning it is replacing Corn in many rations. So where do we go from here? Like all the markets the debt issues around the globe are weighing heavily as is the weather. Until we see more yield reports on harvests and the debt issues start to subside it is a very difficult market to call, which will probably take its lead from Corn. As with most of the other markets energy and fibre products have remained largely unchanged, although off take remains brisk. For more information and prices please contact your sales specialist or Paul Roberts on 01264 320801. Ex Port Guide Prices – Prices are subject to change Jul-Oct 133 190 192 Rape 156 163 Wheatfeed 142 140 Currency £/$ 1.6326 £/€ 1.1351 The information contained within this report is given in good faith and without liability. Any opinions expressed are subject to change without notice East Anglia 280 Southampton London 148 Teignmouth 145 Portbury Soya Hulls East Anglia 154 Southampton 173 187 283 London EU DDG 34PF Citrus pulp pellets 280 Teignmouth 129 Portbury 285 East Anglia 286 Asa May-Oct Southampton London 283 Teignmouth 281 Portbury East Anglia 125 281 Southampton PKs London 278 Teignmouth Portbury Hi pro Nov-Apr