11th July 11 Andover 01264 358011 Andover – Fax 01264 361233

advertisement

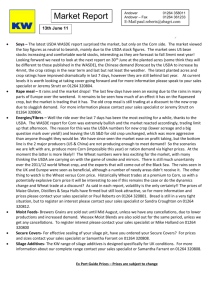

Market Report Andover Andover – Fax 01264 358011 01264 361233 E-Mail paul.roberts@abagri.com 11th July 11 Soya – Well the market has become range bound on no fresh news to excite the market. There are a number of unknowns stopping the market from dropping, but the market needs either the weather to change or China to come back to the market to push it upwards (the weather late in the week favoured the bulls, so new forecasts will be important). The USDA are publishing the latest supply and demand figures tomorrow, but with the market generally losing confidence in the USDA it will be interesting to see how the markets react (if at all). The market is also factoring in that the US will roll old crop beans into new crop but with a growing belief that these will be needed as the chances of early beans reduce. This allied to continued talk of poorer Rapeseed crops around the globe helped Soy to end the week higher. We still maintain at current levels it is worth looking at taking cover going forward and for more information please speak to your sales specialist or Jeremy Strutt on 01264 320804. Rape meal – There is still concern in the market over the forecast reduction in yields of the global Rapeseed crop, which could in turn drive the price of the meal. However, until the combines get into the field it is all speculation and rumour. We are still seeing sluggish demand, caused by the time of year and the fact that Rape still looks expensive against Soya. As mentioned last week, the ADM maintenance shutdown has started, so hopefully this should limit any breakdowns the ageing plant will suffer through the important winter months. But please bear in mind that they will potentially only have limited stocks during this time so would urge you to get and deliveries planned for sooner rather than later. For more information please contact your sales specialist or Jeremy Strutt on 01264 320804. Energies/Fibres – The Corn market spent most of last week in recovery mode after the USDA report fireworks. As said previously the market largely doesn’t believe the figures and has spent time dissecting and analysing! And what did they find? Well there are doubts over the planted acreage and a diminished appetite for trade. That said, there is an increasing thought that the September stocks report could produce yet another surprise, but in the opposite direction to the last report!! The ethanol margins in the States remain high, but if the tax credit is removed (many think it will as Obama needs to save money) then this may temper the consumption. That said livestock prices are high which will encourage use and we have seen large sales to various destinations. The current outlook is also pointing to higher prices with a more threatening weather forecast and the potential Chinese demand (especially as the recent sales were not in the S&D). The Wheat market is looking an increasingly difficult one to call. With the last report from the USDA the market should drop, especially with the Corn figures, but then weather plays its part with dryness in Argentina & Australia and early yield figures from Europe being down 25-30%. There is also concern over the heavy rain being experienced in the Ukraine. And then Russia is indicating yields 30% above last year (but that was an awful year, so they should be!). All we do know is that volatility is the only constant. Maize Gluten and Distillers have remained firm; with currently no signs of a drop (in fact it looks like replacement costs are higher). Soya Hulls have remained in demand, and for more information and prices please contact your sales specialist or Paul Roberts on 01264 320801. Bread is now completely sold out for the summer. This situation is unlikely to change due to very tight supply, but to register an interest please contact your sales specialist or Sandra Croughton on 01264 320812. Moist Feeds- In spite of better and a little more settled weather brewery production has dropped due to being full to capacity with beer. We are obviously all not drinking enough, so perhaps we could all do our bit for the dairy industry!! We do still have limited quantities of Wessex Gold available and for more information please contact your sales specialist or Mike Holland on 01264 320800. We are sold out of Traffordgold for the summer, and prices and availability for the winter will not be released until late September or early October, but to register an interest please speak to your sales specialist or Sandra Croughton on 01264 320812. Secure Covers- For protection of your silage clamp, have you ordered your secure covers and gravel bags? These can be used directly over big bale silage to give effective bird protection. For further details please contact your sales specialist or Samantha Farrant on 01264 320808. Protected Fats- Megalac is looking very good value for money. It is highly digestible, increases milk yield and decreases the risk of acidosis. For more information contact your sales specialist or Kevin Ford on 01264 320805. Ex Port Guide Prices – Prices are subject to change Jul-Oct 135 196 197 Rape 170 175 Wheatfeed 145 148 175 Currency £/$ 1.5970 £/€ 1.1270 Thought for the day “Sometimes you have got to jump off cliffs and grow wings on the way down” The information contained within this report is given in good faith and without liability. Any opinions expressed are subject to change without notice East Anglia 276 Southampton London 148 Teignmouth 148 Portbury Soya Hulls East Anglia 154 278 Southampton 178 191 London EU DDG 34PF Citrus pulp pellets 275 Teignmouth 132 Portbury 279 East Anglia 281 Asa May-Oct Southampton London 278 Teignmouth Portbury 127 275 East Anglia PKs 278 Southampton 275 London Teignmouth Portbury Hi pro Nov-Apr