C31FM_C4 - Heriot

advertisement

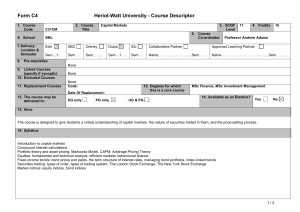

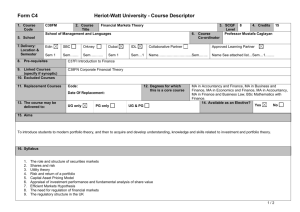

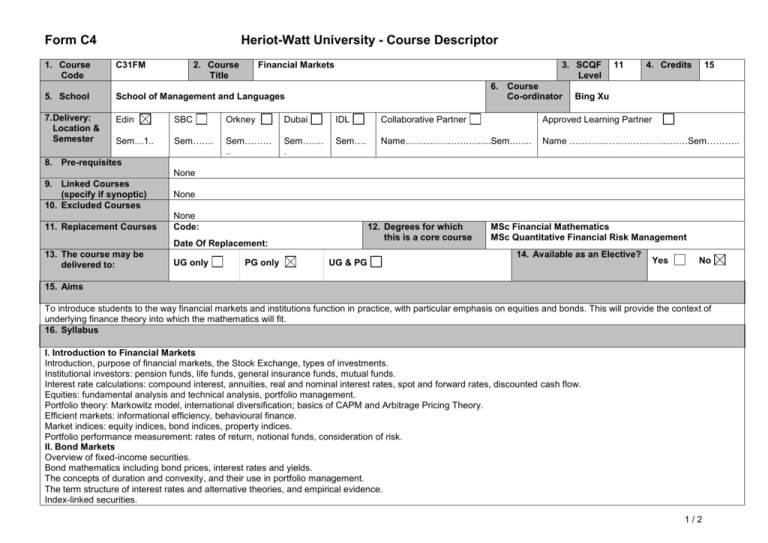

Form C4 Heriot-Watt University - Course Descriptor 1. Course Code C31FM 2. Course Title Financial Markets 3. SCQF Level 5. School School of Management and Languages 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem…1.. Sem……. Sem……… .. Sem……. . Sem…. Name…………………….....Sem..…... Name …………………………………Sem……….. 6. Course Co-ordinator 11 4. Credits 15 Bing Xu 8. Pre-requisites None 9. Linked Courses (specify if synoptic) 10. Excluded Courses 11. Replacement Courses None None Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: UG only PG only UG & PG MSc Financial Mathematics MSc Quantitative Financial Risk Management 14. Available as an Elective? Yes No 15. Aims To introduce students to the way financial markets and institutions function in practice, with particular emphasis on equities and bonds. This will provide the context of underlying finance theory into which the mathematics will fit. 16. Syllabus I. Introduction to Financial Markets Introduction, purpose of financial markets, the Stock Exchange, types of investments. Institutional investors: pension funds, life funds, general insurance funds, mutual funds. Interest rate calculations: compound interest, annuities, real and nominal interest rates, spot and forward rates, discounted cash flow. Equities: fundamental analysis and technical analysis, portfolio management. Portfolio theory: Markowitz model, international diversification; basics of CAPM and Arbitrage Pricing Theory. Efficient markets: informational efficiency, behavioural finance. Market indices: equity indices, bond indices, property indices. Portfolio performance measurement: rates of return, notional funds, consideration of risk. II. Bond Markets Overview of fixed-income securities. Bond mathematics including bond prices, interest rates and yields. The concepts of duration and convexity, and their use in portfolio management. The term structure of interest rates and alternative theories, and empirical evidence. Index-linked securities. 1/2 Form C4 Heriot-Watt University - Course Descriptor 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Personal Abilities Scholarship, Enquiry and Research (Research-Informed Learning) know the principles of the valuation of shares and bonds; be able to apply certain analytical techniques regarding shares and bonds; understand the sources of bond risk and the factors affecting bond prices. have the ability to critically evaluate the performance of an equity fund manager. Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT understand the context within which market professionals work; have some familiarity with the main financial markets and instruments trades; have some familiarity with the investment industry; understand the role of the various institutions involved in financial markets; be able to write a coherent essay in a way which demonstrates that they have understood the material demonstrate the ability to learn independently manage time, work to deadlines and prioritise workloads 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Examination Coursework 2 hours Duration of Exam Diet(s) (if applicable) 80% 20% Examination 2 hours 20. Date and Version Date of Proposal March 2013 Date of Approval by School Committee Date of Implementation September 2013 Version Number 2/2 1