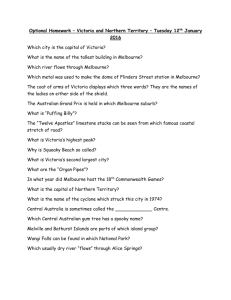

Red meat - Department of Environment, Land, Water and Planning

advertisement