Chapter 13

advertisement

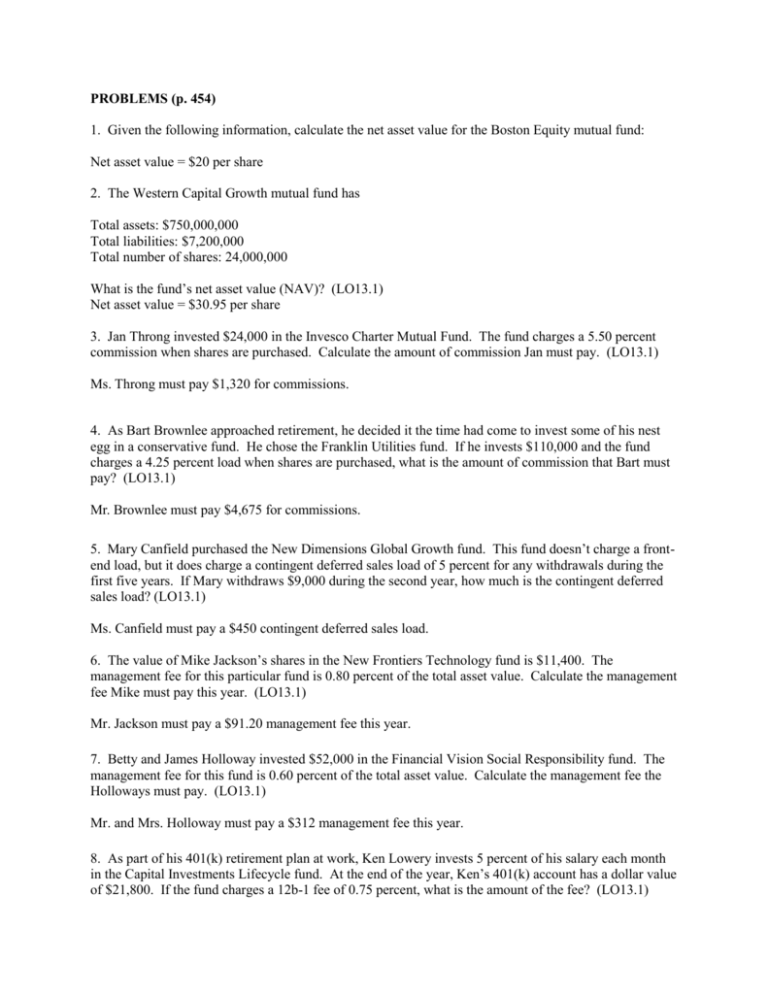

PROBLEMS (p. 454) 1. Given the following information, calculate the net asset value for the Boston Equity mutual fund: Net asset value = $20 per share 2. The Western Capital Growth mutual fund has Total assets: $750,000,000 Total liabilities: $7,200,000 Total number of shares: 24,000,000 What is the fund’s net asset value (NAV)? (LO13.1) Net asset value = $30.95 per share 3. Jan Throng invested $24,000 in the Invesco Charter Mutual Fund. The fund charges a 5.50 percent commission when shares are purchased. Calculate the amount of commission Jan must pay. (LO13.1) Ms. Throng must pay $1,320 for commissions. 4. As Bart Brownlee approached retirement, he decided it the time had come to invest some of his nest egg in a conservative fund. He chose the Franklin Utilities fund. If he invests $110,000 and the fund charges a 4.25 percent load when shares are purchased, what is the amount of commission that Bart must pay? (LO13.1) Mr. Brownlee must pay $4,675 for commissions. 5. Mary Canfield purchased the New Dimensions Global Growth fund. This fund doesn’t charge a frontend load, but it does charge a contingent deferred sales load of 5 percent for any withdrawals during the first five years. If Mary withdraws $9,000 during the second year, how much is the contingent deferred sales load? (LO13.1) Ms. Canfield must pay a $450 contingent deferred sales load. 6. The value of Mike Jackson’s shares in the New Frontiers Technology fund is $11,400. The management fee for this particular fund is 0.80 percent of the total asset value. Calculate the management fee Mike must pay this year. (LO13.1) Mr. Jackson must pay a $91.20 management fee this year. 7. Betty and James Holloway invested $52,000 in the Financial Vision Social Responsibility fund. The management fee for this fund is 0.60 percent of the total asset value. Calculate the management fee the Holloways must pay. (LO13.1) Mr. and Mrs. Holloway must pay a $312 management fee this year. 8. As part of his 401(k) retirement plan at work, Ken Lowery invests 5 percent of his salary each month in the Capital Investments Lifecycle fund. At the end of the year, Ken’s 401(k) account has a dollar value of $21,800. If the fund charges a 12b-1 fee of 0.75 percent, what is the amount of the fee? (LO13.1) Mr. Lowery must pay a $163.50 12b-1 fee this year. 9. When Jill Thompson received a large settlement from an automobile accident, she chose to invest $146,000 in the Vanguard 500 Index fund. This fund has an expense ratio of 0.17 percent. What is the amount of the fees that Jill will pay this year? (LO13.1) Ms. Thompson must pay a total of $248.20 for fees for her mutual fund investment this year. 10. The Yamaha Aggressive Growth fund has a 1.83 percent expense ratio. (LO13.1) a. If you invest $55,000 in this fund, what is the dollar amount of fees that you would pay this year? As an investor, you must pay a total of $1,006.50 for fees this year. b. Based on the information in this chapter and your own research, is this a low, average, or high expense ratio? This is an above average expense ratio. Many financial planners recommend that you choose a mutual fund with an expense ratio of 1 percent or less. 11. Jason Mathews purchased 250 shares of the Hodge & Mattox Energy fund. Each share cost $14.15. Fifteen months later, he decided to sell his shares when the share value reached $16.90. (LO13.4) a. What is the amount of his total initial investment? Mr. Mathew’s total investment is $3,537.50. b. What was the total amount Mr. Mathews received when he sold his shares in the Hodge & Mattox fund, Mr. Mathews received $4,225. c. How much profit did he make on his investment? Mr. Mathews profit earned $687.50 profit. 12. Three years ago, James Matheson bought 200 shares of a mutual fund for $24 a share. During the three-year period, he received total income dividends of 0.70 per share. He also received total capital gain distributions of $0.80 per share. At the end of three years, he sold his shares for $28 a share. What was his total return for this investment? (LO13.4) Mr. Matheson’s total return for this investment was $1,100. 13. Assume that one year ago, you bought 100 shares of a mutual fund for $33 a share, you received a $0.55 per-share capital gain distribution during the past 12 months, and the market value of the fund is now $38 a share. (LO13.4) a. Calculate the total return for your $3,300 investment. Total return for this investment was $555. b. Calculate the percentage of total return for your $3,300 investment. The percentage of total return is 16.8 percent. 14. Over a four-year period, LaKeisha Thompson purchased shares in the Oakmark I Fund. Using the following information, answer the questions that follow. You may want to review the concept of dollar cost averaging in Chapter 12 before completing this problem. (LO13.4) Year Investment Amount February 2008 $1,500 February 2009 $1,500 February 2010 $1,500 February 2011 $1,500 *Carry your answer to 2 decimal places Price Per Share $40.00` $30.00 $34.40 $42.00 Number of Shares* 37.50 50.00 43.60 35.71 a. At the end of four years, what is the total amount invested? At the end of four years, Ms. Thompson has invested $6,000. b. At the end of four years, what is the total number of shares purchased? At the end of four years, Ms. Thompson purchased 166.81 shares. c. At the end of four years, what is the average cost for each share? At the end of four years, the average cost for each share is $35.97. 15. During one three month period Matt Roundtop’s mutual fund grew by $6,000. If he withdraws 35 percent of the growth, how much will he receive? (LO13.4) The amount Mr. Roundtop will receive is $2,100.