noheed-paper

advertisement

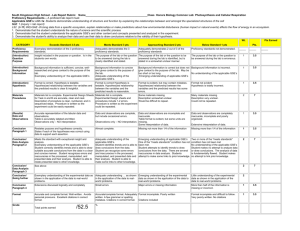

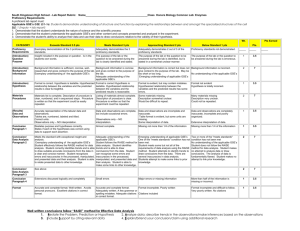

Short-term relationship between stock exchanges before and after financial crisis. Noheed Khan Supervisor Lecturer-School of Management studies The University of Faisalabad Pakistan Abstract: This study consist of three stock exchanges (Karachi stock exchange, German stock exchange, London stock exchange).Granger causality is used to find short term relationship thebe for and after financial. Results indicate. GSE has Granger causality on KSE before the financial crisis it means GSE has interdependency on KSE but after the financial crisis it does not show the Granger causality on KSE it means GSE had the short term interdepency before the financial crisis but after the financial crisis it has not interdepency on KSE.KSE has not Granger causality on GSE before the financial crisis. It means KSE has not interdependency on GSE but after financial crisis KSE has Granger Causality on GSE.It means KSE has interdependency on GSE after financial crisis.LSE has not Granger causality on KSE before the financial crisis. It means LSE has not interdependency on KSE and after financial crisis. LSE has not granger causality on KSE before and after financial crisis. KSE have not short term interdepency on LSE before and after financial crisis.LSE have not short term interdepency on GSE before and after financial crisis.GSE has short term interdepency on LSE before and after financial crisis. Key Words: KSE.LSE GSE, Short term relation, long term relation Introduction: Stock markets are very good indicator for every economy in terms of measuring the economic position of that country, investor are enjoyed the investment in stock market. While behavior of stock market is not easy to understand but it is very important factor that interest rate counts very much effect in terms of investment and saving purpose. Changing in the home mortgages loan, credit interest rates can cause the boom in economies but also take the economies toward risk and sometime this risk convert into recession. Recession hit the world economic industries very hard, many firms are coping to save from the bankruptcy, aftershock occur many merger and acquisition take place. aftershocks creates much variation in stock markets as investor don’t like speculation in market especially in negative prospective, as well as countries tight fiscal policies and tight monetary policies creating crowded out for investor, means that when government borrowing is increased from the central bank then interest rate become high, when interest rate is high its cause the high price in commodity which causes high inflation rate thus it discourages the investor to enter in the market, if we talk about Karachi stock exchange (KSE, 1947) it is establish in 1947 with 200 members/brokers,651 companies listed, four indexes are operating 1. KSE 100 index 2. KSE 30 index 3. KSE all share index 4. KMI 30. While if we talk about German stock exchange (Frankfurt Stock Exchange, 400 years ago,). it is world 3rd largest stock exchange ranking only behind the New York stock exchange & NASDAQ, it is home to public companies. Some characteristics of Frankfurt stock exchange are: There are no restricted shares even for the officers or insider, all share are free trading. No minimum % of free float shareholders. Prospectus is not required There is more liquidity than the all exchanges in the world except the NYSE and NASDAQ. The listing process is much faster than any other stock exchange. With more than 250 international trading institutions and more than 4,500 traders, companies listed on the Frankfurt Stock Exchange have massive exposure to investor capital. Companies listed on the Frankfurt Stock Exchange gain access to the largest capital market conference in Europe, with over 5,500 participants and more than 100 exhibitors every year. If we talk about London stock exchange (londonstockexchange, 17th century ) most successful and dynamic company. 3,000 companies from over 70 countries admitted to trading on its markets. Some characteristics: Live financial broadcasts are transmitted throughout the day from the Exchange's own TV studios. Over 400 firms, mainly investment banks and stockbrokers, are members of the London Stock Exchange Now these three stock exchange performance before the financial crisis and after the financial crisis can gives us very interesting information. Literature review: Financial crisis start at the end of 2007 and it is the worst that the main reason for it home mortgage loan (Mohan, 23 April 2009.) according to his speeech the main reson of fianacial crisis is sub prime mortage sector in usa.large global imbalance ,loose monetary policies.global imbalace cause the current account deficit of us.according to the portes (2009) global macroeconomic imbalances were the major underlying cause of the crisis.policy rate of USA reaches to 1% in 2003.this shows the amercian economyon that time was in asset bubble and loose monetary policy was there on that time.before the fianacial crisis the economeis are going at boom,2001 monetary policy rate of USA was -1% euro area and japan were also in that cue.2002q1 monetary policy rate in USA were -3.5% while euro area -0.6%approx but japan it was 1% .in 2004 monetary ploicy rate in USA was further down into -4%.this showes that asset bubble were on that time ,loose monetary policy cuse d the increase in the demand and due to nomial intrest rate were low ,home mortgae were on the peak, it is point to be noted that large domestic demand of USA are met by China and japan as well some other Asian countaries, which provide the goods and service at lower cost.when domestic demand increased, the current account deficit occur. Taylor (op. cit.) said that the quic increase in the oil and other commodity prices in early 2008 was indeed link to the very sharp policy rate cut in late 2007 after the subprime crisis emerged.another paper in which (Adrian Blundell-Wignall, 2008) mentoned that change in the business model of banks ,mixing credit with equity culture, regulaton in taxes and intrest rate caused the huge inevitable finacial crisis. (Manda, 2010) mentioned the impact of fianacial crisis on stock market in this paper 2004 to 2007 markets were going very efficiently, but at the end of 2007 and at the start of 2008 financial crisis change this and most of the asset pull back .market become very volatile.in this paper author analyzed the volatility of S&P 500 returns, the VIX Index, VIX Futures, VXV Index, and S&P 500 Implied Volatility Skew. The stock market volatility, as measured by the volatility of S&P 500 Index, increased from 13.4% during the Pre-Crisis period to 43.6% during the Crisis (325% of Pre-Crisis level). Even after the S&P 500 Index rebounded from its March 2009 lows, the market volatility reverted only to 20.9%, which is 156% of the Pre-Crisis level. Similarly volatility increase during the pre-crisis level. During the post crisis period volatile was quite lower than that observed in pre-crisis level. Leverage effect during the study period. Crisis and Post-Crisis periods, the relationship between market returns and volatility were different. Another paper demonstrates about the stock market cycle (Sebastian Edwards, etl,2003) life cycle of 4 latin amercain countaries and 2 asisn countaries. In emerging countaries the cycle has short duration and have a large volatility and amplitude.in this paper stock market are : 1. Argentina. 2. Brazil. 3. Chile: 4. Mexico. 5. South Korea 6. Thailand Some researchers, the alleged short term increase in instability may prevent countries from reaping the longer term gains. Market cycles –distinguishing the bull and bear phases – for four Latin American and two Asian countries Empirical results: This paper is consisting of time series tests on daily return of the stock market indices. Three stock exchanges data is collected of different websites and yahoo finance from 1st January 2001 to 4 April 2011.All estimation result are derived from EViews 6.0 software. Summary of Statistics: Table#1 Before Financial Crisis KSE GSE Mean 6877.18 72.4965 Median Std. Dev. Skewness Kurtosis Jarque-Bera 5827.84 3836.66 0.24758 1.77406 106.417 49.51 38.5392 1.05872 3.06071 273.164 LSE 691.39 KSE 684.158 467 428.380 0.91135 2.34540 228.327 461.625 425.086 0.95216 2.42386 247.401 AfterFinancial Crisis GSE LSE 71.8362 684.1582 6 49.1 461.625 38.2500 425.0866 1.09880 0.952167 3.15154 2.423865 303.278 247.4015 Table#1 shows the summary of statistics before and after financial crisis.Above table shows the before financial crisis LSE has the highest return as compare to the KSE and LSE standard deviation is lower then KSE but KSE has low return as compared to the LSE.KSE risk is high as compared to the LSE.After financial crisis KSE,LSE has approximately same retun and same risk.It means after financial crisis .It means after financial crisis KSE,LSE reduce the return and also risk.GSE has higy risk and return befor the financial crisis but it reduce the return after financial crisis as compare to risk.It means before financial crisis GSE was gained the bettter and as compare after financial crisis. Figure#1 Before Financial Crisis Figure #1 shows KSE has highest return before financial crisis.GSE has lowest return befor financial crisis.KSE has highest risk as compared to the other two stock exchanges.GSE has lowest risk and lowest return as compare to the other stock exchanges.After financial crisis improve the return and risk.KSE,LSE have same return but LSE has high risk as compare to the KSE. Table#2 Pairwise Granger Causality Tests Before Financial Crisis Null Hypothesis: F Statistic Prob. GSE does not Granger Cause KSE 5.17519 0.0058 KSE does not Granger Cause GSE 1.77683 0.1695 LSE does not Granger Cause KSE NA NA KSE does not Granger Cause NA NA After Financial Crisis Null FHypothesis: Statistic Prob. GSE does not Granger Cause KSE KSE does not Granger Cause GSE 0.03371 0.9669 3.03861 0.0482 LSE does not Granger Cause KSE KSE does not 1.27307 0.2803 1.09352 0.3353 LSE Granger Cause LSE LSE does not Granger Cause GSE 1.77683 0.1695 GSE does not Granger Cause LSE 5.17519 0.0058 LSE does not Granger Cause GSE GSE does not Granger Cause LSE 1.71661 0.18 5.07814 0.0063 Table#2 Shows the Granger causality befor the financial crisis and after the financial crisis.GSE has Grangercausality on Kse before the financial crisis it means GSE has interdependency on Kse but after the financial crisis it does not show the Granger causality on KSE it means GSE had the short term interdepency befor the financial crisis but after the financial crisis it has not interdepency on KSE.KSE has not Granger causality on GSE before the financial crisis.It means Kse has not interdependency on GSE but after fiancial crisis KSE has Grnger Causality on GSE.It means KSE has interdependency on GSE after financial crisis.LSE has not Granger causality on KSE before the financial crisis.It means LSE has not interdependency on KSE and after financial crisis. LSE has not granger causality on KSE before and after financial crisis. KSE have not short term interdepency on LSE before and after financial crisis.LSE have not short term interdepency on GSE before and after financial crisis.GSE has short term interdepency on LSE befor and after financial crisis. Conclusion: This study consist of three stock exchanges (Karachi stock exchange,German stock exchange,London stock exchange).Granger casuality is used to find short term relation ship thebefor and after financial.Results indicates. GSE has Grangercausality on Kse before the financial crisis it means GSE has interdependency on Kse but after the financial crisis it does not show the Granger causality on KSE it means GSE had the short term interdepency befor the financial crisis but after the financial crisis it has not interdepency on KSE.KSE has not Granger causality on GSE before the financial crisis.It means Kse has not interdependency on GSE but after fiancial crisis KSE has Grnger Causality on GSE.It means KSE has interdependency on GSE after financial crisis.LSE has not Granger causality on KSE before the financial crisis.It means LSE has not interdependency on KSE and after financial crisis. LSE has not granger causality on KSE before and after financial crisis. KSE have not short term interdepency on LSE before and after financial crisis.LSE have not short term interdepency on GSE before and after financial crisis.GSE has short term interdepency on LSE befor and after financial crisis . References: