31st Day] Monday, April 6, 2009 Journal of the House [31st Day 31st

advertisement

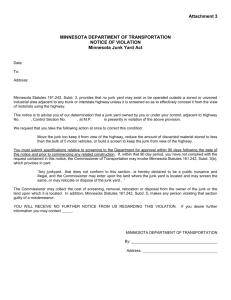

![31st Day] Monday, April 6, 2009 Journal of the House [31st Day 31st](http://s3.studylib.net/store/data/006787155_1-af3226f39f3ee5d75631ceafeb274093-768x994.png)