Tech Bulletin 104

advertisement

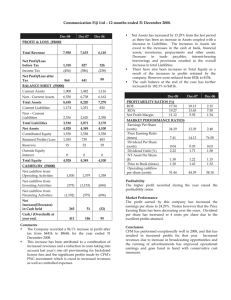

Technical Reference Bulletin No. 104 Check performance regularly If you really want to avoid bankruptcy, try calculating the Z score. he original Z score was created by Edward Altman in the mid 1960’s. It is the most widely used of the many bankruptcy classifications that exist, and it has stood the test of time. To arrive at his formula, Altman looked at the financials of 66 publicly traded manufacturers: 33 had filed for bankruptcy; 33 had not. Out of a selection of 22 financial ratios, he found 5 that could be combined to discriminate between the bankrupt and the non bankrupt companies in his study. Later, Altman created what he calls the four variable version (see Figure 1). Also widely used, this version is appropriate for both public and private firms, and for both manufacturers and service companies. T To get the Z score, you simply take the figures for the four ratios, which Altman calls X1, X2, etc., from your financial statements. Multiply their values by coefficients Altman has derived, and add up the results. The formula, explained in detail below, looks like this: 6.56 (X1) + 3.26 (X2) + 6.72 (X3) + 1.05 (X4) Total score greater than 2.60, things are looking good. If it is less than 1.10 , bankruptcy may well be in sight. Though developed to measure the likelihood of bankruptcy, can be used as a handy measure of overall financial performance. The interesting thing about the Z score is that it is a good analytic tool no matter what shape your company is in. Even if your company is very healthy, for example, if your Z score begins to fall sharply, warning bells should ring. Or, if your company is barely surviving, you can use the Z score to help evaluate the projected effects of your turnaround efforts. To find your company’s Z score, first calculate the four ratios. X1 = Working Capital Total Assets This measure of liquidity compares net liquid assets to total assets. The net liquid assets, or working capital, are defined as current total assets minus current total liabilities. Generally, when a company experiences financial difficulties, working capital will fall more quickly than total assets, causing this ratio to fall. X2 = Retained Earnings Total Assets This ratio is a measure of the cumulative profitability of your company. To some degree, the ratio also reflects the age of your company, because the younger it is, the less time it has had to build up cumulative profits. This bias in favor of older firms is not surprising, given the high failure rate of young companies. When a company begins to lose money, of course, the value of total retained earnings begins to fall. For many companies, this value —and the X2 ratio—will become negative. EBIT X3 = Total Assets This is a measure of profitability, or return on assets, calculated by dividing your firm’s EBIT (earning before interest and taxes) for one year by its total assets balance at the end of the year. Profits are good, assets are bad, liabilities are worse You can use EBIT divided by Total Assets as a measure of how productively you are using borrowed funds. If the ratio exceeds the average interest rate you’re paying on loans, you are making more money on the assets purchased (ie. your loans) than you are paying in interest. included.) Compare your own calculations with industry ratios, and find the ones that are out of line. When you make this comparison, however, I’ve found it’s very natural to excuse low ratios by saying, “We’re different.” Suppose, for example, that your X3 ratio is lower than your Net Worth industry average. You might say, “We’ve made X4 = Total Liabilities a much greater investment in production This ratio is the inverse of the more familiar equipment than our competitors, giving us an advantage.” But if this additional investment debt-to equity ratio. It is found by dividing your firm’s net worth (also known as stockhold- provides a truly competitive advantage, the ers’ equity) by its total liabilities. Non bankrupt other ratios should more than compensate for the low X3 ratio. If not, your competitors may firms maintain more than twice as much equity actually have the advantage because they are able as debt. to achieve similar profits with a smaller investment in assets and correspondingly smaller debt. After you’ve calculated these four ratios, The Z score, you will soon learn, takes a very simply multiply the X1 ratio by its coefficient, shown in the formula, the X2 by it’s coefficient, stern view of your financial statements. To the Z and so on, add the results, and then compare score, profits are good, assets are bad, liabilities are worse, and current liabilities are the total with Altman’s cutoff values, "safe" worst of all. If yours is lower than you would greater than 2.60; "bankrupt" less than 1.10. like, you can improve it considerably by selling The Z score takes a The purpose of calculating your own Z score marginal assets and using the cash to reduce very stern view of is to warn you of financial problems that may current liabilities. This will improve ratio X1 by your financial need serious attention and to provide a guide both increasing working capital and decreasing statements. for action. If your Z score is lower than you assets: it will improve ratios X2 and X3 by would like, then, you should examine your reducing assets: and it will improve ratio X4 by financial statements to determine the reason reducing liabilities. why. In real life, of course, this action can also Start by calculating the scores from previous make perfect sense. Reducing current liabilities periods, comparing them with your current often lowers interest costs and reduced the score. (Graph them if possible.) If the trend is possibility that an unhappy creditor will force down, try to understand what had changed to you into bankruptcy. Reducing assets can often create ratios that are dragging your score down. lower overhead costs and improves your return Monitoring the trend in your Z score can also on the assets invested in your company. help you evaluate your turnaround efforts. Another way to analyze your score is to compare your results with those of other companies. Compare these ratios with your own. You could also refer to the Robert Morris Associates (RMA) Annual Statement About the author: Studies. These studies, to which your banker Charles W. Kyd spent 10 years as CFO for probably subscribes, provide detailed financial high-tech and turnaround manufacturers ratios by Standard Industrial Classification code. and is now a consultant with a Seattle (Ratio X2 cannot be calculated from RMA data, accounting firm. however, because retained earnings aren’t Exchange is a publication of: Private Equity Services 3003 Northup Way Ste.101 Bellevue, WA 98004 206-999-6000