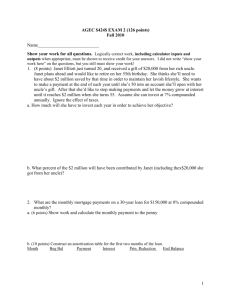

Sample Questions in Exam 3

advertisement

FI3300 – Fall 2006 Exam Two Solutions 5) A $1,000 par value bond has coupon rate of 6% and the coupon is paid semi-annually. The bond matures in 40 years and has a required rate of return of 10%. Compute the current price of this bond. FV = 1000, PMT = (1000 x 0.06)/2 = 30 , N = 40 x 2 = 80, I/Y = 10/2 = 5. CPT, then PV. PV = - $608.07 Current price is $608.07. 6) A $1,000 par value bond sells for $1019.7694. It matures in 20 years, has a 10 percent coupon rate, and pays interest semi-annually. What is the bond’s yield to maturity on a per annum basis (to 2 decimal places)? PV = -1019.7694, FV = 1000, N = 40, PMT = (0.1 x 1000)/2 = 50. CPT, then I/Y = 4.8866 Yield to maturity = 4.8866 x 2 = 9.7732 = 9.77% p.a. 7) ABC Inc. just issued a twenty-year semi-annual coupon bond at a price of $1084.02. The face value of the bond is $1,000, and the market interest rate is 9%. What is the annual coupon rate (in percent and rounded to 2 decimal places)? PV = -1084.02, FV = 1000, I/Y = 9/2 = 4.5, N = 40. CPT, then PMT = 49.5659 Annual coupon rate = (49.5659 x 2)/1000 = 0.0991318 or 9.91% p.a. 8) Winshaw Manufacturing needs to raise $100,000,000 for an expansion project. The CFO is debating whether to issue zero-coupon bonds or semi-annual coupon bonds. In either case the bonds would have the SAME nominal required rate of return, a 30-year maturity and a par value of $1,000. If he issues the zero-coupon bonds, they would sell for $212.56. If he issues the semi-annual coupon bonds, they would sell for $1003.89. What annual coupon rate is Winshaw planning to offer on the coupon bonds? State your answer in percentage terms, rounded to 2 decimal places. [Hint1: Use annual compounding for the zero-coupon bonds and use semi-annual compounding for the semi-annual fixed coupon bonds] 1 FI3300 – Fall 2006 Exam Two Solutions Find the required rate of return on the zero-coupon bonds. FV=1000, N=30, PV=-212.56, PMT=0. CPT then I/Y. The required rate of return on the zero-coupon bonds = 5.2973% p.a. (to 4 decimal places) Use the required rate of return to solve for the semi-annual coupon payment. FV=1000, N=60, PV = -1003.89, I/Y = 5.2973/2 = 2.64865. CPT then PMT. PMT = 26.6166. This is the SEMI-ANNUAL payment. To get the annual coupon rate, multiply PMT by 2 and then divide by the par value of $1000. Then express answer as a percentage. Coupon rate = (26.6166 x 2)/1000 = 0.0532332 or 5.32% p.a. 10) Davidson Company will pay an annual dividend of $6 per share one year from today. The dividend is expected to grow at a constant rate of 15 percent permanently. The market requires 24 percent return on the company. What is the current price of the stock (to 2 decimal places)? Use the constant dividend growth model. D1 = 6, k = 0.24, g = 0.15. Price = 6 / (0.24 – 0.15) = $66.67 12) The price of a stock in the market is $32. You know that the firm has just paid a dividend of $0.75 per share (i.e., D0 = 0.75). The dividend growth rate is expected to be 6 percent forever. What is the investors’ required rate of return for this stock? P = 32, D1 = 0.75 x (1.06) = 0.795. Required rate of return = 0.795/32 + 0.06 = 0.02484 + 0.06 = 0.08484 or 8.48% 13) Brett Creative Media is expected to pay dividends at the end of the next three years of $0.5, $1.5, $2, respectively. After three years, the dividend is expected to grow at a 5% constant annual rate forever. If the required rate of return on this stock is 10%, what is the current stock price? P3 = (2 x (1.05))/(0.10 – 0.05) = 42 At t=3, cash flow is 42 + 2 = 44 2 FI3300 – Fall 2006 Exam Two Solutions Current stock price, P0 P0 0.5 1.5 44 34.75 (to 2 decimal places) 1 2 (1.10) (1.10) (1.10) 3 14) Appleby Administrative Services just paid a $4.00 annual dividend (that is, D0 = 4.00). Investors believe that the firm will grow at 3% annually for the next 2 years and 2% annually forever thereafter. Assuming a required return of 9%, what is the current price of the stock (to 2 decimal places)? Here, you are given the growth rate and you need to work out the dividends. 1) Find t=1 dividend, D(t=1) = 4 x 1.03 = 4.12 2) Find t=2 dividend, D(t=2) = 4 x (1.03)2 = 4.2436 3) Find stock price at the end of t = 2. Use constant growth formula. P2 = (4.2436 x 1.02)/(0.09-0.02) = 61.8353(keep up to 4 decimal places) 4) Cash flow at t= 2 is 61.8353 + 4.2436 = 66.0789 5) Stock price = 4.12/1.09 + 66.0789/(1.09)2 = $59.40 (to 2 decimal places) FCB 2 years ago ABC Co. issued a 10 year, 5% semi-annual coupon bond. Its par value is $1,000. Investors required 10% return rate. If the YTM has not changed since then, what should be the current price? N=8x2=16, FV=1000, PMT=5%x1000/2=25, I/Y=10/2=5, so PV=-729.06 ZCB Par value is $100, the current interest rate in the market is 9%, time to maturity is 15 years. How much is the price? FV=100, I/Y=9, n=15, PMT=0, PV=-27.45 Constant dividend growing model The company just paid $3/share for dividend, and the market expects that the dividend with grow at 1% annually forever. The discount rate is 10%. How much is the stock price? Price=3x(1+0.01)/(0.1-0.01)=33.67 Non-constant dividend growing model 3 FI3300 – Fall 2006 Exam Two Solutions The company just paid $2/share for dividend, and the market expects that the dividend with grow at 5% annually for one year, then 3% for 3 years, and then will be of the same dollar amount forever. The discount rate is 12%. How much will be the stock price after 1 year? D1=2(1+0.05)=2.10 D2=D1(1+0.03)=2.163 D3=D2(1+0.03)=2.22789 D4=D3(1+0.03)=2.2947267 D5=D4=2.2947267 Starting from t=5, all dividend will be the same, so it is a perpetuity, therefore P4=D5/(r-g)=2.2947267/(0.12-0)=19.1227 To find the price at t=1, we need to discount D2, D3, D4, and P4 back to t=1 (Not t=0), therefore, P2=2.163/(1+0.12)1+2.22789/(1+0.12)2+2.2947267/(1+0.12)3+19.1227/(1+0.12)3 =1.93125+1.77606+1.63334+13.61116 =18.9518 4