Word Document

advertisement

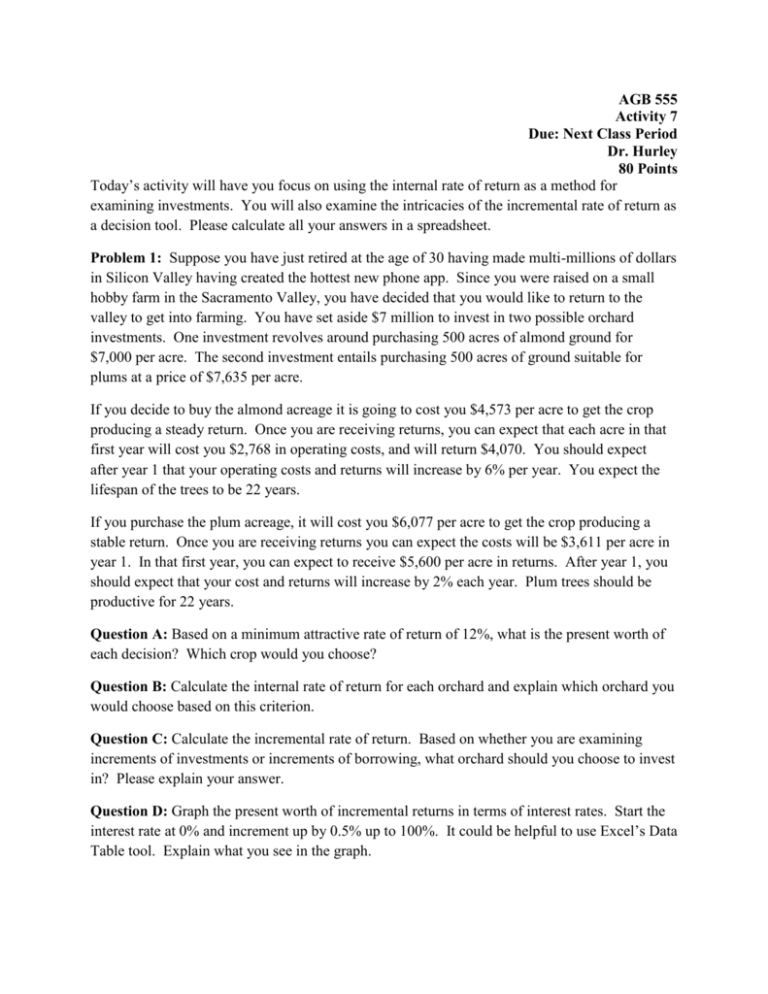

AGB 555 Activity 7 Due: Next Class Period Dr. Hurley 80 Points Today’s activity will have you focus on using the internal rate of return as a method for examining investments. You will also examine the intricacies of the incremental rate of return as a decision tool. Please calculate all your answers in a spreadsheet. Problem 1: Suppose you have just retired at the age of 30 having made multi-millions of dollars in Silicon Valley having created the hottest new phone app. Since you were raised on a small hobby farm in the Sacramento Valley, you have decided that you would like to return to the valley to get into farming. You have set aside $7 million to invest in two possible orchard investments. One investment revolves around purchasing 500 acres of almond ground for $7,000 per acre. The second investment entails purchasing 500 acres of ground suitable for plums at a price of $7,635 per acre. If you decide to buy the almond acreage it is going to cost you $4,573 per acre to get the crop producing a steady return. Once you are receiving returns, you can expect that each acre in that first year will cost you $2,768 in operating costs, and will return $4,070. You should expect after year 1 that your operating costs and returns will increase by 6% per year. You expect the lifespan of the trees to be 22 years. If you purchase the plum acreage, it will cost you $6,077 per acre to get the crop producing a stable return. Once you are receiving returns you can expect the costs will be $3,611 per acre in year 1. In that first year, you can expect to receive $5,600 per acre in returns. After year 1, you should expect that your cost and returns will increase by 2% each year. Plum trees should be productive for 22 years. Question A: Based on a minimum attractive rate of return of 12%, what is the present worth of each decision? Which crop would you choose? Question B: Calculate the internal rate of return for each orchard and explain which orchard you would choose based on this criterion. Question C: Calculate the incremental rate of return. Based on whether you are examining increments of investments or increments of borrowing, what orchard should you choose to invest in? Please explain your answer. Question D: Graph the present worth of incremental returns in terms of interest rates. Start the interest rate at 0% and increment up by 0.5% up to 100%. It could be helpful to use Excel’s Data Table tool. Explain what you see in the graph. Question E: Calculate the modified internal rate of return using both Excel and formulas for your investment given an investment rate of 12% per year and a borrowing rate of 6% per year. Problem 2: Do questions 7-13, 7-77, and 7A-23 (make sure you follow directions on page 266 for this last question).