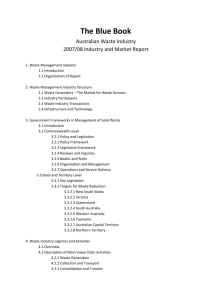

- National Centre for Vocational Education Research

advertisement