2015_Guidelines_For_Productive_Valuations

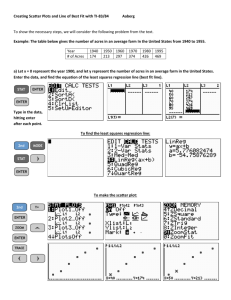

advertisement