Redemptions vs. Dividends

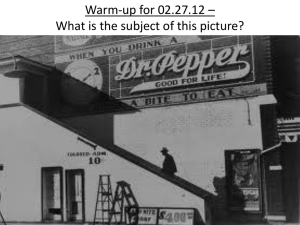

advertisement