SAPOA Case Study 5-1-13

advertisement

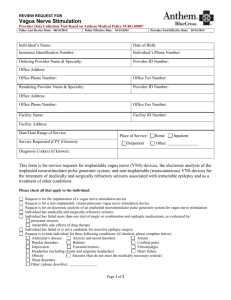

SAPOA Case Study 5-1-13 Santa Ana Police Officers Association (SAPOA) BB&T Insurance Services of California, Inc. Fullerton, CA Background SAPOA wanted to combat rising costs and poor health among their members, while contemplating significantly reducing their traditionally rich benefits program to police department retirees. Frank Marrone of BB&T Insurance Services of Orange County in Fullerton, Calif., developed his relationship with the SAPOA board over the course of several years and helped engender a recognition that while SAPOA could not maintain their current course, they did not have to reduce their benefits program and could actually expand choices – through a solution that was only available through BB&T Insurance Services. SAPOA had a 25-year relationship with their incumbent broker who continued to offer traditional off-the-shelf defined benefit plans, and who did not have access to CarePlus. The incumbent broker could only offer the common market offerings. A presentation was made to the entire SAPOA board by Marrone and several EWSC team experts, who illustrated how the fully insured CarePlus California program, featuring Anthem Blue Cross, could meet their needs. CarePlus – the Exclusive Solution “CarePlus is a great opportunity for me to talk to my clients about bringing real solutions to their annual health care cost increases,” says Marrone. He uses the exclusivity of the solution as the key door-opener. Because it’s different and exclusive, prospects have appeared more open to listening – it’s not the same old story they hear from competing brokers who offer everything that everyone else offers. “…My prospects can get better Anthem rates through CarePlus than they can through Anthem direct, because Anthem will write business with CarePlus as a separate pool.” Marrone discovered that it is easy to focus on rates, because that is how most cases are won or lost. The CarePlus focus is on the opportunity to bring control back to the employer and put more responsibility on the employees to engage in their personal well-being. What is the key differentiator of the BB&T solution? That it’s not available through any agent or broker except BB&T Insurance Services and its associated organizations, like McGriff, Seibels & Williams and Precept. Marrone underscores the fact that CarePlus is not a typical replacement solution because it requires that employers embrace more than a health plan and a rate proposal. “The employer has to commit to a culture of health and become actively involved to engage their employees to take the right steps to achieve the desired objectives – predictable rates and healthier employees.” Not all employers will take this step at this time. But down the road, they will – because the current course of rising health care costs and decreased health of employees is never going to be corrected without the employer and employee working together on health. Page 1 of 2 SAPOA Case Study 5-1-13 Marrone leads his prospecting efforts with a focus on cost control and improved employee productivity. “The greatest value proposition of CarePlus is the ability to predict rates and improve people’s lives. The greatest value proposition of working with BB&T is that this health care solution is only available through us. Period.” SAPOA Took the Step SAPOA understood and was willing to make the commitments necessary to the program, knowing it can bring cost predictability and control through tools in place to ensure and measure success. SAPOA also connected with the wellness message, as many members have health issues that are addressed through the program’s built in population health management tools and systems. Implementation Through Teamwork The targeted CarePlus implementation timeframe is a 12 to 16-week process. Due to the late sale date, SAPOA was installed in only six weeks in order for the plans to be effective on January 1, 2013. Page 2 of 2

![[Product Name] Marketing Plan](http://s2.studylib.net/store/data/005557189_1-d5525c3bac8845a623a2867fdc87f1ed-300x300.png)