AS Micro: Indirect Taxes & Subsidies

advertisement

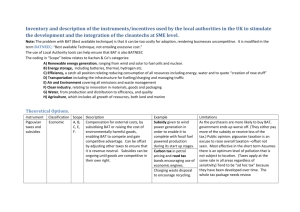

AS Micro: Indirect Taxes & Subsidies Indirect Taxes Indirect Taxes in Markets • An indirect tax is a tax imposed by the government that increases the supply costs faced by producers. • The amount of the tax is always shown by the ver<cal distance between the two supply curves. • Because of the tax, less can be supplied at each price level. • The result is an increase in the market price and a contrac>on in demand to a new equilibrium output. 1. A specific tax is a set tax per unit e.g. a £5 tax per unit sold. 2. An ad valorem tax is a percentage tax e.g. 20% on the unit price. • The main UK indirect tax is VAT -­‐ genera>ng £110bn annual tax • Fuel du<es generate £27bn and tobacco taxes £10bn each year • Taxes such as air passenger duty bring in £3bn of tax each year Exam Tip: Use clear analysis diagrams to show the impact of an indirect tax Examples of Indirect Taxes in the UK Economy VAT Standard rate = 20% Alcohol Du>es Beer tax = 41.5p per pint Landfill Tax £80 per tonne for waste Tobacco Du>es £3.76 per pack + 17% VAT Fuel Du>es Taxed at 58p per litre Air Passenger Duty Bands based on distance Indirect Tax When PED = 0 and PES = infinity Perfectly Elas<c Supply Perfectly Inelas<c Demand All of the tax is paid by the consumer All of the tax is paid by the consumer Price Demand Price Total Tax paid by the consumer S1 + tax P2 S1 P2 S1 + tax Tax Per Unit P1 P1 S1 Total Tax Revenue (paid by the consumer) Q1 Demand Qty Q2 Q1 Qty Indirect Taxes with Different Coefficient of PED If the co-­‐efficient of price elas<city of demand >1, then most of the burden of an indirect tax will be absorbed by the supplier Price Paid by consumer Paid by supplier If the co-­‐efficient of price elas<city of demand <1, most of an indirect tax can be passed on to the final consumer Price S1 + tax S1 + tax S1 P2 Tax Per Unit P2 S1 P1 D P3 P1 P3 Paid by consumer Paid by supplier Demand Q2 Q1 Qty Q2 Q1 Qty Ad Valorem (Indirect) Taxes Value added tax (the standard rate in the UK is 20%) is an example of an ad valorem tax. S1 + tax Price Tax Per Unit P2 S1 P1 Demand Q2 Q1 Quan>ty • The effect of an ad valorem tax is to cause a pivotal shi` in the supply curve • This is because the tax is a percentage of the unit cost of supplying the product. • So a good that could be supplied for a cost of £50 will now cost £60 when VAT of 20% is applied whereas a different good that costs £400 to supply will now cost £470 when the same rate of VAT is applied • The absolute amount of the tax will go up as the market price increases Evalua<on Arguments when Assessing Indirect Taxes Effec>veness of a tax and unintended consequences • Does an indirect tax achieve the specified aims? • Are there unintended consequences of introducing / changing a tax? How much tax revenue is raised? How is it used? • Does an indirect tax generate substan>al tax revenues? • How is the tax revenue used – perhaps for par>cular projects? What is the impact on businesses / compe>>veness? • Might there be a possible loss of jobs and/or capital investment? • Will an indirect tax nega>vely affect compe>>veness and trade? Consequences for equity / the distribu>on of income • Is the tax regarded as equitable / fair? • Who are the main winners and losers? • Does a tax have a regressive effect on lower income groups? Government Subsidies Government Subsidies for Producers and Consumers A subsidy is any form of government support—financial or otherwise—offered to producers and (occasionally) consumers Biofuel subsidies for farmers Solar Panel “Feed-­‐ In Tariffs” Appren>ceship Schemes Aid to businesses making losses Subsidies for wind farm investment Food / fuel subsidies for consumers Child Care for working families Subsidies to the rail industry Basic Subsidy Diagram – For Producers Price A subsidy per unit of output causes an outward shi` of the market supply curve leading to a lower equilibrium price Market Supply pre subsidy Market Supply post subsidy Subsidy P1 P2 Subsidy per unit is shown by the ver>cal distance Market Demand Q1 Q2 Quan>ty / output Showing Total Government Spending on the Subsidy Price Total spending on the subsidy is equal to the subsidy per unit mul>plied by the level of output – shown by the shaded area Market Supply pre subsidy Producer receives this price Market Supply post subsidy P3 P1 P2 Consumer pays this price Market Demand Q1 Q2 Quan>ty / output Jus<fica<ons for Subsidies for Producers Subsidies are a form of government interven>on. They are introduced for a number of economic, social & poli<cal reasons Help poorer families e.g. food and child care costs Encourage output and investment in fledgling sectors Protect jobs in loss-­‐ making industries e.g. hit by recession Make some health care treatments more affordable Reduce the cost of training & employing workers Achieve a more equitable income distribu>on Reduce some of the external costs of transport Encourage arts and other cultural services Effects of Subsidies with Different Price Elas<city Inelas<c market demand Subsidy has a larger effect on the new equilibrium price Price S1 Elas<c market demand Subsidy has a stronger effect on the new equilibrium quan>ty Price S1 Subsidy Subsidy P1 S2 P1 S2 P2 D1 P2 D1 Q1 Q2 Qty Q1 Q2 Qty Evalua<on Arguments when Assessing Subsidies Are the subsidies effec>ve in mee>ng their aims? • Will they achieve the desired s>mulus to demand / consump>on? • Is a subsidy sufficient? Might other incen>ves be needed? Will a subsidy affect produc>vity / efficiency? • Subsidies for investment and research can bring posi>ve spillovers • But firms may become dependent on state aid / financial assistance How much does the subsidy cost and who benefits? • Is a subsidy part self-­‐financing? Will it create more tax revenue? • Or does a subsidy create an expensive extra burden for taxpayers? Does the subsidy help to correct a market failure? • For example – do more people find work with child care subsidies? • Or does a subsidy lead to undesired / unintended consequences? AS Micro: Indirect Taxes & Subsidies