Annex II - European Banking Authority

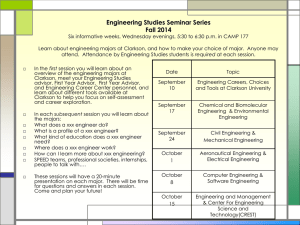

advertisement