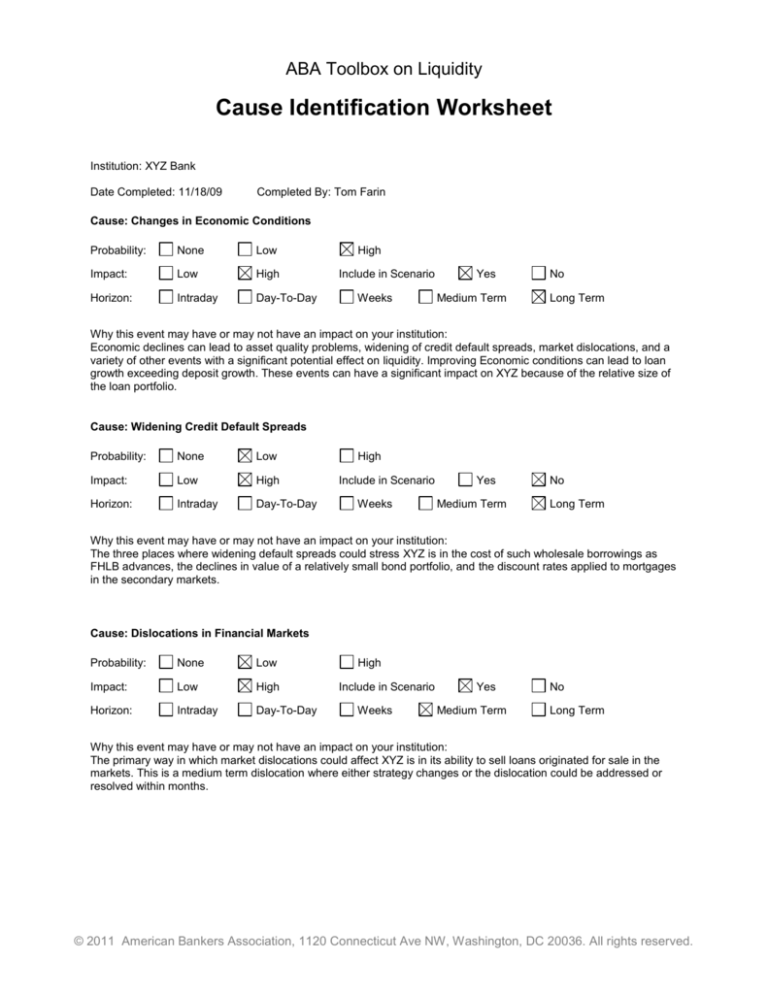

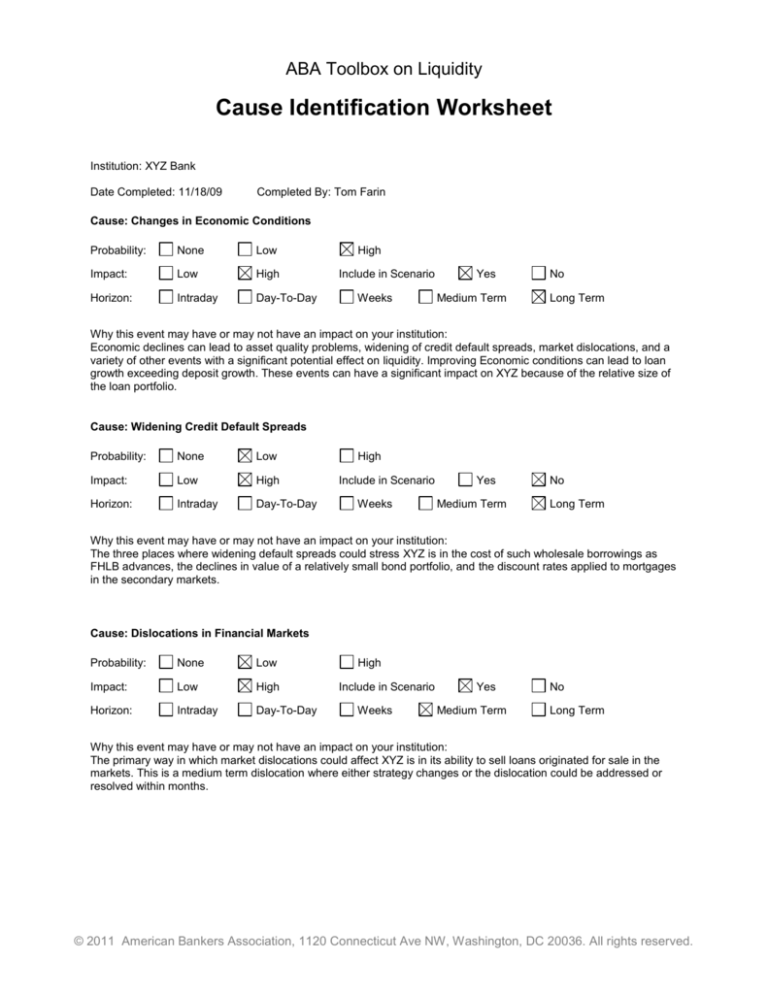

ABA Toolbox on Liquidity

Cause Identification Worksheet

Institution: XYZ Bank

Date Completed: 11/18/09

Completed By: Tom Farin

Cause: Changes in Economic Conditions

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Economic declines can lead to asset quality problems, widening of credit default spreads, market dislocations, and a

variety of other events with a significant potential effect on liquidity. Improving Economic conditions can lead to loan

growth exceeding deposit growth. These events can have a significant impact on XYZ because of the relative size of

the loan portfolio.

Cause: Widening Credit Default Spreads

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

The three places where widening default spreads could stress XYZ is in the cost of such wholesale borrowings as

FHLB advances, the declines in value of a relatively small bond portfolio, and the discount rates applied to mortgages

in the secondary markets.

Cause: Dislocations in Financial Markets

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

The primary way in which market dislocations could affect XYZ is in its ability to sell loans originated for sale in the

markets. This is a medium term dislocation where either strategy changes or the dislocation could be addressed or

resolved within months.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

Cause: Operational or Local Disasters

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

An effective disaster recovery program should limit the effect of such an event to a few weeks at most.

Cause: Interest Rate Risk

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

XYZ runs a relatively matched book from the standpoint of interest rate risk. Therefore, a significant movement in

rates would only have a moderate effect on income and EVE. However, because of a significant mortgage portfolio,

XYZ needs to consider the effect of rate moves on loan and investment cash flows.

Cause: Credit Risk

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

This is XYZ’s greatest area of risk, in that a high percentage of earning assets are loans, and a significant portion of

the loan portfolio is in loans with relatively high levels of credit risk.

Cause: Operational and Legal Risk

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Operational and legal risk could lead to loss of capital through operating losses. Publicity could lead to reputation risk

and loss of confidence in the institution and potentially a run on deposits and loss of access to non-core and nearcore funding.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

Cause: Unplanned Asset Growth

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

This scenario would be driven primarily by a dramatic unanticipated increase in loan demand. It is a high probability

event during economic recoveries, especially when many competitors are still struggling with the effect of asset

quality problems. It also could result from a freeze-up of securitization markets, causing loans originated for sale to

be held in portfolio.

Cause: Declining Financial Institution Equity Prices

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

This would have only a moderate effect on XYZ, as its stock is closely held, primarily by family members. While it

could lead to a potential loss in confidence in the banking system, the effect on XYZ would be low.

Cause: Changes in Agency Credit Ratings

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

XYZ does not issue debt. Its security portfolio is relatively small. However, downgrades in consumer credit could be

a leading indicator of asset quality problems. In addition, downgrades in XYZ ratings could cause issues on the

funding side, as it is heavily reliant on brokered CDs, large CDs and FHLB advances for funding.

Cause: Deterioration in Asset Quality

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Because of the nature and size of its loan portfolio, this is potentially one of the highest impact events XYZ could be

forced to deal with. It should be part of a cascading event scenario as it is one of the areas where XYZ is most

vulnerable.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

Cause: Negative Press Coverage and Other Events

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Local media is very active and to tends focus adversely against banks. Negative events that come to their attention

are likely to be reported. This could lead to reputation risk and potential loss of customer deposits.

Cause: Operating Losses

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Operating losses for XYZ could be caused by credit risk, legal and operations risk, and demise in key business lines.

Operating losses have the potential of causing loss of well-capitalized status and PCA downgrades, negative press

coverage, and rating agency downgrades.

Cause: PCA and CAMELS Ratings Downgrades

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

PCA and CAMELS downgrades could lead to increases in capital requirements, loss of access to brokered CDs,

compliance costs, agency downgrades, negative press coverage and other adverse effects.

Cause: Dislocations in Financial Markets

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Dislocations in financial markets could affect XYZ’s ability to sell loans in the securitization markets, reduce values of

securities, result in increased borrowing cost from sources like FHLBs, affect the value of stock investments in

cooperatives, etc.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

Cause: Loss of Well-Capitalized Status

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Loss of well-capitalized status could cause FHLBs to increase collateral haircuts, cut off access to programs like

CDARS, cause XYZ to no longer be able to fund with brokered CDs, lead to adverse press and loss of confidence,

etc.

Cause: Demise of Business Lines

Probability:

None

Low

Impact:

Low

High

Horizon:

Intraday

Day-To-Day

High

Include in Scenario

Weeks

Yes

Medium Term

No

Long Term

Why this event may have or may not have an impact on your institution:

Our region is a diversified market, not terribly dependent on one industry. XYZ’s balance sheet is diversified among

traditional banking products. It is somewhat dependent on ODP income for its bottom line.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.