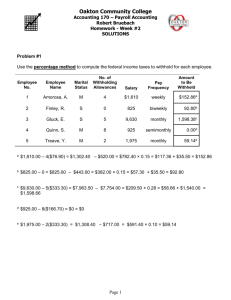

Homework - Week #1 - Oakton Community College

advertisement

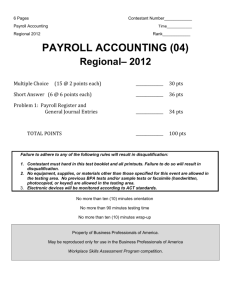

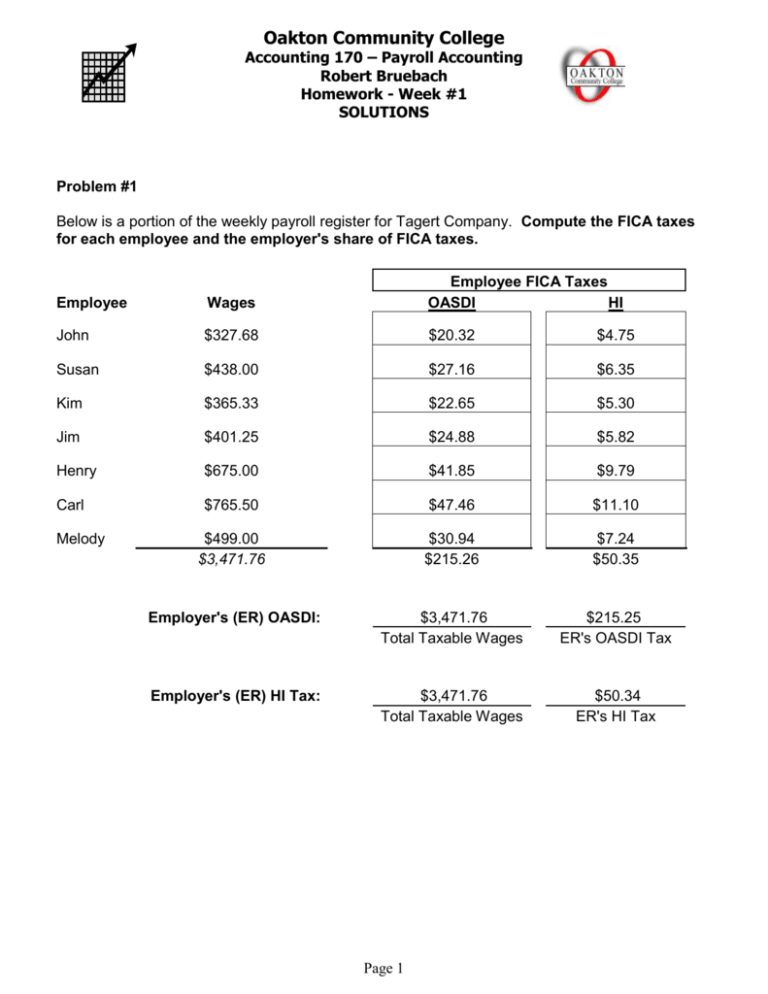

Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #1 SOLUTIONS Problem #1 Below is a portion of the weekly payroll register for Tagert Company. Compute the FICA taxes for each employee and the employer's share of FICA taxes. Employee Wages Employee FICA Taxes OASDI HI John $327.68 $20.32 $4.75 Susan $438.00 $27.16 $6.35 Kim $365.33 $22.65 $5.30 Jim $401.25 $24.88 $5.82 Henry $675.00 $41.85 $9.79 Carl $765.50 $47.46 $11.10 $499.00 $3,471.76 $30.94 $215.26 $7.24 $50.35 Employer's (ER) OASDI: $3,471.76 Total Taxable Wages $215.25 ER's OASDI Tax Employer's (ER) HI Tax: $3,471.76 Total Taxable Wages $50.34 ER's HI Tax Melody Page 1 Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #1 SOLUTIONS Problem #2 During this year, an employee of the Billups Company will be paid a semimonthly salary of $5,200. Compute the FICA taxes for each of the following paychecks: FICA Taxes OASDI HI 8th Paycheck of the Year: $322.40 * $75.40 23rd Paycheck of the Year: $254.20 ** $75.40 24th Paycheck of the Year: $0.00 *** $75.40 * Cumulative earnings as of the 7th paycheck are $36,400. Therefore, the 8th paycheck for $5,200 will not have the employee exceed the $118,500 maximum, so the entire amount of the 8th paycheck of $5,200 is subject to OASDI tax of 6.2%. ** Cumulative earnings as of the 22nd paycheck are $114,400. Therefore, the 23rd paycheck for $5,200 will have the employee exceed the $118,500 maximum, so only a portion ($4,100) of the 23rd paycheck is subject to OASDI tax of 6.2%. ** Since the employee reached the $118,500 maximum with the 23rd paycheck, none of the $5,200 paycheck is subject to OASDI tax for the 24th paycheck of the year. Page 2 Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #1 SOLUTIONS Problem #3 Below is a list of employees and their annual salaries. The employees are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each employee’s pay on November 15th and December 31st. November 15th Name and Title Tate, Jack, President Green, Sue, VP Finance Jones, Al, Sales David, James, Manufacturing Wong, Pam, Personnel Molt, Mary, Secretary Annual Salary $138,000 118,800 69,600 54,000 51,600 49,200 OASDI Taxable Earnings $3,500.00* 4,950.00 2,900.00 2,250.00 2,150.00 2,050.00 OASDI Tax $217.00 306.90 179.80 139.50 133.30 127.10 HI Taxable Earnings $5,750.00 4,950.00 2,900.00 2,250.00 2,150.00 2,050.00 HI Tax $83.38 71.78 42.05 32.63 31.18 29.73 *Cumulative earnings as of October 31st —> $115,000. So, only $3,500 of $5,750 on Nov. 15th subject to FICAOASDI. December 31st Name and Title Tate, Jack, President Green, Sue, VP Finance Jones, Al, Sales David, James, Manufacturing Wong, Pam, Personnel Molt, Mary, Secretary Annual Salary $138,000 118,800 69,600 54,000 51,600 49,200 OASDI Taxable Earnings $0.00 4,650.00** 2,900.00 2,250.00 2,150.00 2,050.00 OASDI Tax $ 0.00 288.30 179.80 139.50 133.30 127.10 HI Taxable Earnings $5,750.00 4,950.00 2,900.00 2,250.00 2,150.00 2,050.00 HI Tax $83.38 71.78 42.05 32.63 31.18 29.73 **Cumulative earnings as of December 15th —> $113,850. So, only $4,650 of $4,950 paid on Dec. 31st is subject to FICA-OASDI. Page 3 Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #1 SOLUTIONS Problem #4 Flextron Corp. pays its salaried employees monthly on the last day of each month. The annual salary for each employee is shown below. Compute the following for the payroll of December 31st. Employee Maggert, June Leonard, Kathy Ferris, Demi Stewart, Sam Wilton, Harriet Hopkins, Louis Singh, Sonja Keith, Karen Pierce, Ted Daven, Maria Totals Annual Salary $ 22,150 18,900 24,000 118,944 20,900 19,500 18,540 56,900 17,850 51,200 OASDI Taxable Wages $ 1,845.83 1,575.00 2,000.00 9,468.00* 1,741.67 1,625.00 1,545.00 4,741.67 1,487.50 4,266.67 $30,296.34 OASDI Tax $ 114.44 97.65 124.00 587.02 107.98 100.75 95.79 293.98 92.23 264.53 $1,878.37 HI Taxable Wages $ 1,845.83 1,575.00 2,000.00 9,912.00 1,741.67 1,625.00 1,545.00 4,741.67 1,487.50 4,266.67 $30,740.34 HI Tax $ 26.76 22.84 29.00 143.72 25.25 23.56 22.40 68.75 21.57 61.87 $445.72 Employer’s OASDI Tax: ($30,296.34 × 0.062) = $1,878.37 Employer’s HI Tax: ($30,740.34 × 0.0145) = $445.73 * Cumulative earnings as of the 11th (Nov. 30th) paycheck are $109,032. Therefore, the 12th paycheck for $9,912 will have the employee exceed the $118,500 maximum, so only a portion ($9,468) of the 12th paycheck is subject to OASDI tax of 6.2%. Page 4 Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #1 SOLUTIONS Question #1 The Self-Employed tax rate for FICA-OASDI is 12.4 %. (12.4% for 2013) Question #2 What are the deposit due dates for a company classified as a Semi-Weekly Depositor? If Payday is Wednesday, Thursday, or Friday, then Deposit Due by the Following Wednesday. If Payday is Sat., Sun., Mon., or Tues., then Deposit Due by the Following Friday. Question #3 What is Form 941? A quarterly report of total FICA taxes (employee and employer portions) and withheld federal income taxes. The form is due by the end of the month following the quarter. Question #4 FICA defines all of the following as employees except: a. vice presidents. b. partners in a partnership. c. superintendents. d. full-time life insurance salespersons. e. payroll managers. Question #5 To be designated a semiweekly depositor, how much in employment taxes would an employer have reported for the four quarters in the lookback period? a. More than $50,000. b. More than $100,000. c. Less than $50,000. d. More than $2,500. e. None of the above Page 5

![20-Jan-15 Year Maximum taxable earnings OASDI tax rate [2] HI tax](http://s3.studylib.net/store/data/008737622_1-9c9a9f87a888df5096400a73b940d298-300x300.png)