LAB 9 - Taskin

advertisement

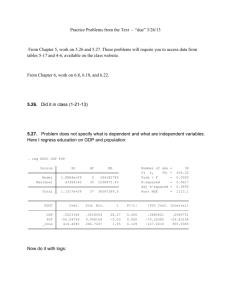

Econ 301 Econometrics Bilkent University Department of Economics Taskin 2013 Lab Exercise 9 Growth regressions: Mankiw, Romer and Weil conducted an empirical study of the Solow Growth Model. According to Solow, exogenously determined savings and population growth in a country determine the steady state level of income per capita. Initial estimates of the model supports the predictions of the Solow model but come up with too large of an effect of the saving and population growth on income. Hence, the authors estimated an augmented version of the Solow model by taking accumulation of human capital as an additional factor. The study brings the simple growth model to the following estimating equation: Eq1. ln( Y / L) a 1 ln s 1 ln( n g ) Where Y/L is the output per labor, s is the saving rate, n is the growth rate of population, g is the growth of technology and δ is the depreciation rate, which we might assume as independent from ε. Data: Penn World Tables of Summers and Heston is the source of the data. The data covers 1960-1985 period with annual observations. The variables are Y/L real GDP in 1985 divided by the working-age population of that year, n is the average growth rate of the working-age population (people between 15 to 64 ages), s is the average share of real investment (including government investment) in real GDP. Three different samples are considered: (1) 98 countries excluding the oil producers, (2) 75 countries, which excludes the very low income group, (3) 22 OECD countries. Cross section is estimated with variables computed as averages for the period 1960-1985; (g and δ is assumed for to be 0.05 for all countries). The data files is presented for you as: NONOIL: Dummy variable for non-oil-producing country, INTER: Dummy variable indicating MRW's intermediate group OECD: Dummy variable for OECD couNTRY GDP60: GDP per working-age population in 1960 GDP85: GDP per working-age population in 1985 GDPGR: GDP growth rate 1960-1985 POPGR: Population growth rate in percent INVEST: Investment as a percentage of GDP SCHOOL: Percent of working-age population in secondary school a) Conduct the estimation of the initial model by estimating the following equation: ln(GDP85i ) a 1ln(investi ) 2 ln( popgri 2 3) ui b) Estimate the restricted model where the coefficient of ln s ( or ln INVEST) is the negative value of coefficient of ln(n + g + d ) . Is this restriction supported by the data? c) What is the implied value of α, which is the capital’s share of income? In the standard computation of this share is 1/3. d) How if human capital is a relevant variable, how do you think its omission affect the properties of the estimated coefficients? e) Estimate the relationship by including the human capital in addition to the physical capital with the following equation: ln(GDP85i ) a 1ln(investi ) 2 ln( popgri 2 3) 3ln(SCHOOL i ) ui f) Estimate a 95% confidence interval for the coefficients b̂1 and b̂ 2 and decide whether there is sufficient evidence that the corresponding coefficient in the first regression is biased.