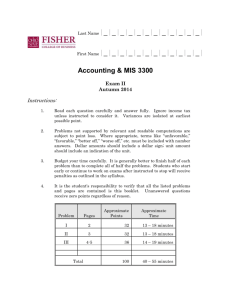

Accounting & MIS 3300

advertisement

Last Name |_|_|_|_|_|_|_|_|_|_|_|_| First Name |_|_|_|_|_|_|_|_|_|_|_|_| Accounting & MIS 3300 Exam II Autumn 2012 Instructions: 1. Read each question carefully and answer fully. Ignore income tax unless instructed to consider it. Unless otherwise stated the income tax rate is 40%. Variances are isolated at earliest possible point. 2. Problems not supported by relevant and readable computations are subject to point loss. Where appropriate, terms like “unfavorable,” “favorable,” “better off,” “worse off,” etc. must be included with number answers. Dollar amounts should include a dollar sign; unit amount should include an indication of the unit. 3. Budget your time carefully. It is generally better to finish half of each problem than to complete all of half the problems. Students who continue to work on exams after instructed to stop will receive a zero on this exam. 4. It is the student's responsibility to verify that all the listed problems and pages are contained is this booklet. Unanswered questions receive zero points regardless of reason. Approximate Points Approximate Time Problem Pages I 2-3 42 18 – 23 minutes II 4 21 8 – 12 minutes III 5 28 11 – 15 minutes IV 6 9 3 – 5 minutes 100 40 – 55 minutes Total Page 2 of 6 PROBLEM I (VERY LIMITED TO NO PARTIAL CREDIT) Required: For each of the following cases, place your answer in the box and provide supporting calculations. Part A. The Alpha Company uses standard costing had the following budget and actual results for 20x1: Units Variable Manuf. Overhead Fixed Manufacturing Overhead Actual 47,000 $800,000 $380,000 Budget 44,000 $766,920 $371,800 Calculate the items listed below: Variable Manuf. Overhead Flexible-Budget Variance Fixed Manufacturing Overhead Spending Variance Fixed Manuf. Overhead Production-Volume Variance Part B. In this, their first year of operations, Beta Company believes they will produce and sell 20,000 units and allows 2.2 kilos of direct material per unit at standard cost of $9.70 per kilo. They allow ¾ hours of direct labor per unit at a standard rate or $24.80 per hour. They purchased 42,000 kilos of direct material for $398,000. They used 36,000 kilos to produce 16,500 units. Direct labor costing $328,000 and using 13,400 direct labor hours was used. Beta’s sold 14,600 units. Beta isolates variance as soon as possible. Calculate the items listed below: Direct Materials Price Variance Direct Materials Efficiency Variance Direct Labor Price Variance Direct Labor Efficiency Variance Page 3 of 6 PROBLEM I CONTINUED Part C. Charlie Company uses standard costing. During 20x1, they expected to manufacture 22,000 units. Their standards allow 1.4 machine hours per unit of output. Budgeted fixed manufacturing overhead is $9.50 per machine hour, and budgeted variable manufacturing overhead is $3.35 per hour. During 20x1, 21,000 units were produced using 30,240 machine hours. Actual fixed manufacturing overhead was $280,000 and actual variable manufacturing overhead was $100,000. Calculate the items listed below: Variable Manufacturing Overhead Spending Variance Variable Manufacturing Overhead Efficiency Variance Fixed Manufacturing Overhead Spending Variance Fixed Manuf. Overhead Production-Volume Variance Part D. Delta Company uses standard costing. Prior to the start of 20x1, they produce a static budget that called for $127,500 in variable and $223,125 in fixed manufacturing overhead, based on 34,000 units. Their standards allow 1.25 machine hours per unit of output. During 20x1, 38,000 units were produced using 50,000 machine hours. Actual total (variable and fixed) manufacturing overhead was $400,000. Calculate the items listed below: Total Manufacturing Overhead Spending Variance Total Manufacturing Overhead Efficiency Variance Total Manuf. Overhead Production-Volume Variance Page 4 of 6 PROBLEM II The Edison Company has the following standards: Direct Materials Direct Labor Manufacturing Overhead 1.2 lbs. @ $14.00 per lb. 2.5 hours @ $19.00 per hr. 80% of direct labor $16.80 47.50 38.00 $102.30 and the following results: Revenues Cost of direct materials purchased Direct Material Price Variance Direct Material Efficiency Variance Direct Labor Efficiency Variance Direct Labor Flexible-Budget Variance $1,450,000 275,480 3,880 U 36,400 U 23,750 U 15,000 U Edison used a denominator level of units of 20,000, actually manufactured 17,000 units, and sold 16,400. Calculate the items requested below: Standard direct labor hours allowed for actual output Actual direct labor hours worked Actual direct labor wage rate Standard pounds of direct materials allowed Actual pounds of direct materials used Actual pounds of direct materials purchased Actual direct materials price per pound Page 5 of 6 PROBLEM III The Finlay Company had the following budgeted amounts for 20x1, its first year of operations: Per Unit Amounts: Selling Price Direct Material Cost per Unit Variable Manufacturing Costs other than Direct Materials Variable Non-Manufacturing Costs (per units sold) Amounts as Totals (not per unit) Fixed Manufacturing Costs Fixed Non-Manufacturing Costs $ 60 12 9 6 $ 15,000 5,500 Lee produces uses normal costing, estimating 1,000 units of production. Finlay actually produced 1,100 units and sold 700. Lee closes production-volume variance, if any, to cost of goods sold. Part A. Produce a variable-costing income statement for 20x1 in good form: Part B. Produce an absorption-costing income statement for 20x1 in good form. Part C. Calculate and present 20x1 throughput-costing net income: Page 6 of 6 PROBLEM IV The George Company had the following information for last year: Month 1 2 3 4 5 6 7 8 9 10 11 12 Customers Revenue 22,586 $ 212,954 30,595 140,599 25,236 146,523 21,845 146,961 32,298 178,390 30,151 127,744 24,214 137,519 23,498 143,197 22,311 171,817 16,568 223,473 15,318 131,356 16,420 120,669 Use the high-low method to determine and present the equation relating revenue to customers: