ECON 8010 TEST #2 ANSWER KEY FALL 2014 Instructions: All

advertisement

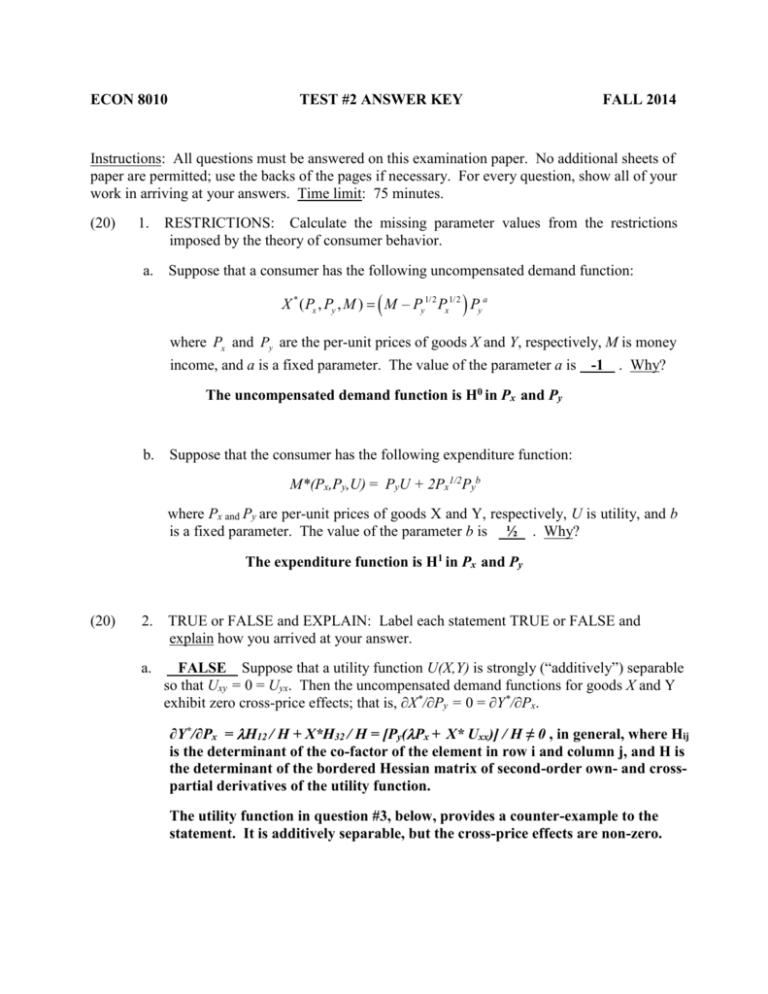

ECON 8010 TEST #2 ANSWER KEY FALL 2014 Instructions: All questions must be answered on this examination paper. No additional sheets of paper are permitted; use the backs of the pages if necessary. For every question, show all of your work in arriving at your answers. Time limit: 75 minutes. (20) 1. a. RESTRICTIONS: Calculate the missing parameter values from the restrictions imposed by the theory of consumer behavior. Suppose that a consumer has the following uncompensated demand function: X * ( Px , Py , M ) M – Py1/2 Px1/2 Py a where Px and Py are the per-unit prices of goods X and Y, respectively, M is money income, and a is a fixed parameter. The value of the parameter a is -1 . Why? The uncompensated demand function is H0 in Px and Py b. Suppose that the consumer has the following expenditure function: M*(Px,Py,U) = PyU + 2Px1/2Pyb where Px and Py are per-unit prices of goods X and Y, respectively, U is utility, and b is a fixed parameter. The value of the parameter b is ½ . Why? The expenditure function is H1 in Px and Py (20) 2. TRUE or FALSE and EXPLAIN: Label each statement TRUE or FALSE and explain how you arrived at your answer. a. FALSE Suppose that a utility function U(X,Y) is strongly (“additively”) separable so that Uxy = 0 = Uyx. Then the uncompensated demand functions for goods X and Y exhibit zero cross-price effects; that is, ∂X*/∂Py = 0 = ∂Y*/∂Px. ∂Y*/∂Px = H12 / H + X*H32 / H = [Py(Px + X* Uxx)] / H ≠ 0 , in general, where Hij is the determinant of the co-factor of the element in row i and column j, and H is the determinant of the bordered Hessian matrix of second-order own- and crosspartial derivatives of the utility function. The utility function in question #3, below, provides a counter-example to the statement. It is additively separable, but the cross-price effects are non-zero. b. TRUE__ If X and Y are Edgeworth-Fisher-Pareto complements (Uxy > 0) and X and Y are each subject to diminishing marginal utility, then the utility function U(X,Y) is quasi-concave. Quasi-concavity ↔ Ux2 Uyy – 2Ux Uy Uxy + Uy2 Uxx < 0 Assuming complementarity (Uxy > 0) and diminishing marginal utility in both X and Y (Uxx < 0, Uyy < 0), along with monotonicity (Ux > 0, Uy >0), we have Ux2 Uyy – 2Ux Uy Uxy + Uy2 Uxx < 0 (–) (25) 3. (+) (+) (+) (–) Suppose that an individual maximizes the utility function U(X,Y) = X1/2 + Y subject to the budget constraint M = Px X + Py Y. a. Derive the uncompensated demand functions for X and Y. The Lagrangean function for this problem is ʆ = X1/2 + Y + (M – Px X + Py Y) The first-order conditions (F.O.C.s) for a maximum of ʆ are ∂ʆ / ∂X = ½ X-½ – Px = 0 ∂ʆ / ∂Y = 1 – Py = 0 M – Px X + Py Y = 0 The first two F.O.C.s imply the tangency condition ½ Px-1 X-½ = = Py-1 Solving for X yields X*(Px, Py, M) = (Py/2Px)2 Substituting X* = (Py/2Px)2 into the budget identity M – Px X* + Py Y* ≡ 0 and solving for Y* yields Y*(Px, Py, M) = M/Py – (Py/4Px) b. Use your answers in part (a) to derive the indirect utility function. V(Px, Py, M) = U(X*,Y*) = (X*)1/2 + Y* V(Px, Py, M) = (Py/2Px) + M/Py – (Py/4Px) V(Px, Py, M) = (Py/4Px) + M/Py (10) 4. Suppose that an individual’s preferences, defined over the two goods X and Y, are homothetic, so that the ratio of uncompensated demands for the two goods is a function only of the price ratio Px/Py and is therefore independent of money income M. Show that the income elasticities of demand for X and for Y are both equal to 1. Differentiating the ratio X*/Y*with respect to M, and noting that [∂(X*/Y*)/∂M) = 0, yields [(Y*∂X*/∂M – X*∂Y*/∂M)]/Y*2 = 0 (∂X*/∂M)/Y* = (X*/Y*2)(∂Y*/∂M) (1/X*)(∂X*/∂M) = (1/Y*)(∂Y*/∂M) Multiplying both sides by M*, we have (M/X*)(∂X*/∂M) = (M/Y*)(∂Y*/∂M) (1) XM = YM Substituting (1) into the Engel Aggregation formula SxXM + SyYM = 1, SxXM + SyXM = 1 (Sx + Sy)XM = 1 Similarly, SxYM + SyYM = 1 (Sx + Sy)YM = 1 But since Sx + Sy = 1, XM = 1 = YM (20) 5. Suppose that a consumer’s preferences are represented by the expenditure function, M*(Px, Py, U) = Py [1 + U + loge(Px/Py)], where Px and Py are the per-unit prices of X and Y, respectively, and U is utility. Derive the compensated demand functions for X and Y. ∂M/∂Px = Xc(Px, Py, U) = (Py/Px) ∂M/∂Py = Yc(Px, Py, U) = U – loge (Py/Px) (5) 6. TRUE or FALSE and EXPLAIN: Label the statement TRUE or FALSE and explain how you arrived at your answer. “In a model with three goods (X, Y, and Z), if Y and Z are net complements then X and Z are net substitutes.” TRUE. S ∙ p = 0 where S is a 3x3 singular, symmetric matrix of own- and crosssubstitution terms, and p > 0 is a 3x1 vector of prices. In the third row of S, S ∙ p = Szx ∙ px + Szy ∙ py + Szz ∙ pz = 0. Szz < 0 by negativity of the own-substitution effect and Szy = Syz < 0 by the assumption that Y and Z are net complements, so it must be true that Szx = Sxz > 0 and, therefore, X and Z are net substitutes.