Bank Reconciliation Guide - Illinois Education Association

advertisement

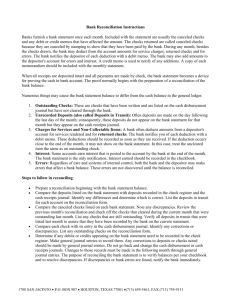

Bank Reconciliation After review by another local officer, the treasurer should receive a bank statement every month for each bank account. The balance on the bank statement may not agree with the balance per the accounting records. The following items usually account for the differences between the bank statement balance and the “book” balance: outstanding checks, deposits in transit, bank service charges/credits, and errors by the bank and/or the treasurer. A bank reconciliation must be prepared monthly to verify that the two independent sets of records (bank statement and checkbook) are in agreement. The reconciliation should then be retained along with the other monthly financial documents. The sample Bank Reconciliation worksheet may be used as follows: Complete the heading with the applicable month and year. Enter the ending bank statement balance at (1) and the ending (month-end) balance of your checkbook at (2). Compare the deposits listed on your bank statement with your record of deposits. Any deposits that the bank has not yet recorded should be listed as a Deposit in Transit (3). Any deposits that may not have been recorded in the accounting records, but are included in the bank statement, should be listed under “Plus: Correction” (4) with a brief description. Compare the amounts of the “Paid or Canceled” checks per the bank statement with entries on the accounting records. Any difference(s) must be recorded as a correction (5) and/or (6). This does not include outstanding checks. If the bank amount is incorrect, note this on the bank reconciliation and notify the bank of the error. Checks that have been written but have not yet cleared the bank by the end of the month are called “outstanding checks”. Compare your listing of checks written with the canceled checks from the bank. Any checks written which are not returned are “outstanding” and should be listed under (7) including check amount and check number. Follow-up should be performed when checks remain outstanding for more than two or three months. You should contact the payee to see if the check was received; if not, a new check should be issued and a “stop payment” order should be given to the bank for the original check. Checks outstanding for a long period of time may be subject to Illinois’ “Abandoned Property” filing requirements. It is best to avoid this, if possible. Identify the amounts of service charge and/or interest included in the bank statement that have not been recorded in the accounting records. This should be noted at (4) or (8) with a description. The transaction(s) should also be recorded in the accounting records. Review the bank statement for additional charges/credits not recorded in the checkbook. List these items at (6). Additional credits should be listed at (5). Total the two sides of the bank reconciliation. The adjusted bank balance and the adjusted checkbook balance (9) should agree. The checkbook balance should be corrected to reflect the adjusted balance. Adjustments would include service charges, other bank charges and credits, and errors made in the checkbook. Bank errors should not be included in the checkbook balance. ______________________________ EDUCATION ASSOCIATION “SAMPLE” BANK RECONCILIATION _________________, 20 ____ Bank Statement Balance Plus: $_ 1 _ Checkbook Balance $ Deposits in Transit Plus: $ 3 _ 2 _ Corrections/Interest Description Amount $________ ___________ $ Total Deposits in Transit $________ Subtotal $________ 4 _ ___________ 5 _ Total Additions $_______ Subtotal $_______ Less: Outstanding Checks Number Amount _______ $ _______ Description Amount ________ __________ $ _______ ________ __________ ____8__ _______ ________ __________ _______ Total Outstanding Checks $ ___________ Total Deductions $ __________ Adjusted Bank Statement Adjusted Checkbook Balance 7 Less: Service Charge/Corrections _ $ ____________ Balance 9 These Amounts Must Agree 6 _ $ __________