Grow-New-Jersey-Assistant-Program-Reformated

advertisement

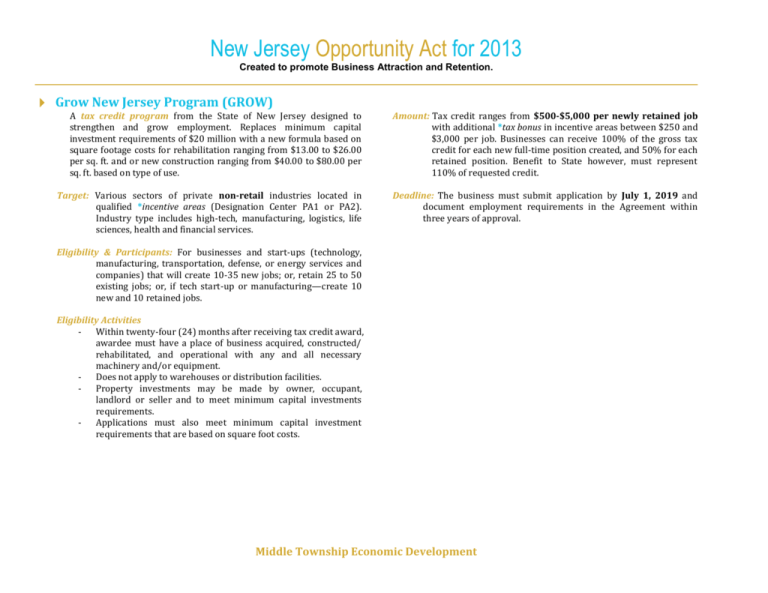

New Jersey Opportunity Act for 2013 Created to promote Business Attraction and Retention. Grow New Jersey Program (GROW) A tax credit program from the State of New Jersey designed to strengthen and grow employment. Replaces minimum capital investment requirements of $20 million with a new formula based on square footage costs for rehabilitation ranging from $13.00 to $26.00 per sq. ft. and or new construction ranging from $40.00 to $80.00 per sq. ft. based on type of use. Amount: Tax credit ranges from $500-$5,000 per newly retained job with additional *tax bonus in incentive areas between $250 and $3,000 per job. Businesses can receive 100% of the gross tax credit for each new full-time position created, and 50% for each retained position. Benefit to State however, must represent 110% of requested credit. Target: Various sectors of private non-retail industries located in qualified *incentive areas (Designation Center PA1 or PA2). Industry type includes high-tech, manufacturing, logistics, life sciences, health and financial services. Deadline: The business must submit application by July 1, 2019 and document employment requirements in the Agreement within three years of approval. Eligibility & Participants: For businesses and start-ups (technology, manufacturing, transportation, defense, or energy services and companies) that will create 10-35 new jobs; or, retain 25 to 50 existing jobs; or, if tech start-up or manufacturing—create 10 new and 10 retained jobs. Eligibility Activities - Within twenty-four (24) months after receiving tax credit award, awardee must have a place of business acquired, constructed/ rehabilitated, and operational with any and all necessary machinery and/or equipment. - Does not apply to warehouses or distribution facilities. - Property investments may be made by owner, occupant, landlord or seller and to meet minimum capital investments requirements. - Applications must also meet minimum capital investment requirements that are based on square foot costs. Middle Township Economic Development New Jersey Opportunity Act for 2013 Created to promote Business Attraction and Retention. Economic Redevelopment & Growth Area (ERG) An incentive grant-funding source to address revenue gaps in both residential and commercial development projects for developers and businesses. Gaps are defined as having insufficient revenues to support the project debt service under a standard financing scenario. - ERG funding can also apply to projects that have a below market development margin or rate of return. ERG Payments made to the developer as reimbursements based on the project’s revenue generators received by the State over a twenty (20) year period. ERG funds can be pledged or assigned as security for private financing. Revenue generated by any project to the State must exceed the reimbursement amount requested for the developer. Net positive benefit to the State must equal a minimum of 110% of the requested grant. Target: A developer with a retail commercial or residential project. Residential Projects – Redevelopment projects that are predominantly residential and include multi-family residential units for purchase or lease, or dormitory units for purchase or lease. Commercial Projects – Redevelopment projects that are predominantly commercial and include retail, and/or office uses for purchase or lease. Eligibility: *Residential and Commercial Projects – EDA will analyze the developer's financing structure to verify a “gap” or financial need. This review may result in assistance between 20% and 35% of total eligible costs. If receiving tax credits, the Minimum Total Project Cost are at least $10,000,000 if the project is a disaster recovery project or located in a municipality with a population less than 200,000 according to the latest federal decennial census. Amount: Residential Projects (that generate tax revenue) – No grant amount can exceed the following limits: - $40,000,000 per project if located in: Deep Poverty Pocket or Distressed Municipality. - $20,000,000 per project if located in an ERG incentive area, and outside a Deep Poverty Pocket and Distressed Municipality. Commercial Projects – The term of each approved state redevelopment incentive grant agreement may extend for up to 20 years: - The annual percentage amount of reimbursement shall not exceed an average of 75% of the annual incremental state revenues. Deadline: Must be filed by July 1, 2019. Project Types: * Residential Projects that do not generate tax revenues may also qualify for tax credits that can be assigned to lenders for project financing: - If receiving tax credits, the term of each approved state redevelopment incentive grant agreement will be up to 10 years: and, Middle Township Economic Development