The Institutions of Federal Reserve Independence

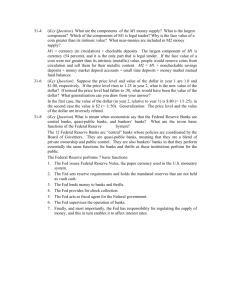

advertisement