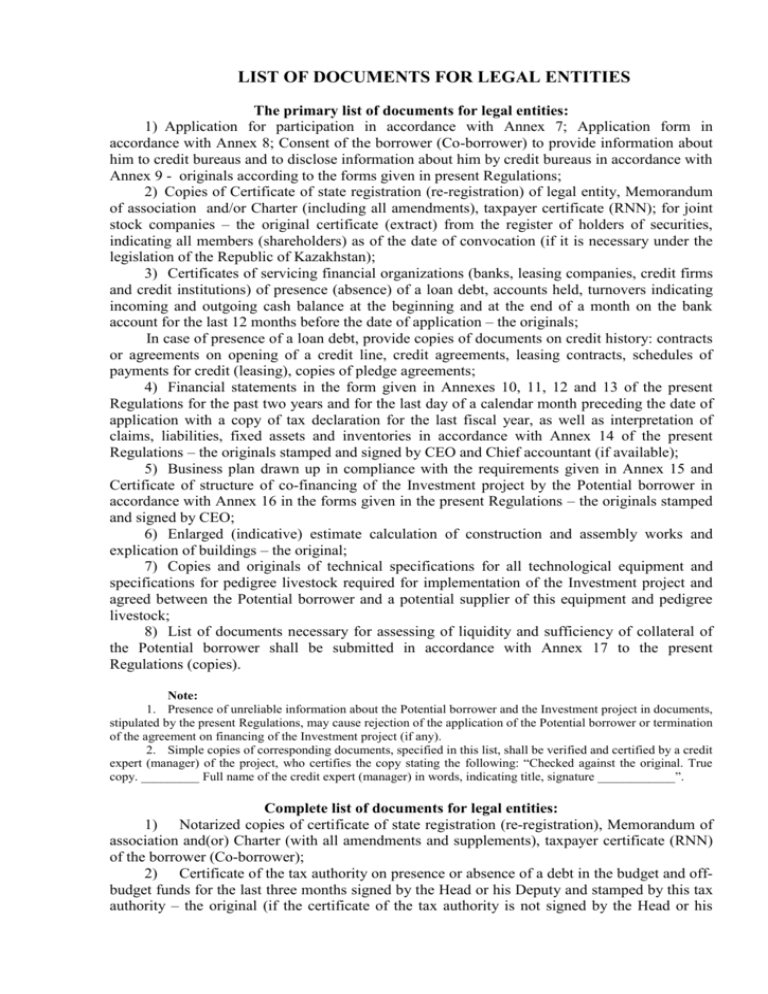

List of documents proving necessary decisions by authorized bodies

advertisement

LIST OF DOCUMENTS FOR LEGAL ENTITIES The primary list of documents for legal entities: 1) Application for participation in accordance with Annex 7; Application form in accordance with Annex 8; Consent of the borrower (Co-borrower) to provide information about him to credit bureaus and to disclose information about him by credit bureaus in accordance with Annex 9 - originals according to the forms given in present Regulations; 2) Copies of Certificate of state registration (re-registration) of legal entity, Memorandum of association and/or Charter (including all amendments), taxpayer certificate (RNN); for joint stock companies – the original certificate (extract) from the register of holders of securities, indicating all members (shareholders) as of the date of convocation (if it is necessary under the legislation of the Republic of Kazakhstan); 3) Certificates of servicing financial organizations (banks, leasing companies, credit firms and credit institutions) of presence (absence) of a loan debt, accounts held, turnovers indicating incoming and outgoing cash balance at the beginning and at the end of a month on the bank account for the last 12 months before the date of application – the originals; In case of presence of a loan debt, provide copies of documents on credit history: contracts or agreements on opening of a credit line, credit agreements, leasing contracts, schedules of payments for credit (leasing), copies of pledge agreements; 4) Financial statements in the form given in Annexes 10, 11, 12 and 13 of the present Regulations for the past two years and for the last day of a calendar month preceding the date of application with a copy of tax declaration for the last fiscal year, as well as interpretation of claims, liabilities, fixed assets and inventories in accordance with Annex 14 of the present Regulations – the originals stamped and signed by CEO and Chief accountant (if available); 5) Business plan drawn up in compliance with the requirements given in Annex 15 and Certificate of structure of co-financing of the Investment project by the Potential borrower in accordance with Annex 16 in the forms given in the present Regulations – the originals stamped and signed by CEO; 6) Enlarged (indicative) estimate calculation of construction and assembly works and explication of buildings – the original; 7) Copies and originals of technical specifications for all technological equipment and specifications for pedigree livestock required for implementation of the Investment project and agreed between the Potential borrower and a potential supplier of this equipment and pedigree livestock; 8) List of documents necessary for assessing of liquidity and sufficiency of collateral of the Potential borrower shall be submitted in accordance with Annex 17 to the present Regulations (copies). Note: 1. Presence of unreliable information about the Potential borrower and the Investment project in documents, stipulated by the present Regulations, may cause rejection of the application of the Potential borrower or termination of the agreement on financing of the Investment project (if any). 2. Simple copies of corresponding documents, specified in this list, shall be verified and certified by a credit expert (manager) of the project, who certifies the copy stating the following: “Checked against the original. True copy. _________ Full name of the credit expert (manager) in words, indicating title, signature ____________”. Complete list of documents for legal entities: 1) Notarized copies of certificate of state registration (re-registration), Memorandum of association and(or) Charter (with all amendments and supplements), taxpayer certificate (RNN) of the borrower (Co-borrower); 2) Certificate of the tax authority on presence or absence of a debt in the budget and offbudget funds for the last three months signed by the Head or his Deputy and stamped by this tax authority – the original (if the certificate of the tax authority is not signed by the Head or his Deputy, provide copies of documents confirming the authority of a person who signed the certificate); 3) Decision of the authorized body of the Potential borrower to obtain financing in “KazAgroFinance” JSC indicating the amount of such financing, as well as the amount of own co-financing – the original; 4) A copy of certificate of registration of VAT; 5) The notarized original of the card with specimen signatures of officials authorized to sign and stamp; 6) A copy of document certified in accordance with the requirements of the Company, confirming the authority of a person authorized to sign credit and collateral documentation on behalf of the borrower; 7) Decision of the authorized body of the Potential borrower to establish the Executive body and to elect the Head of the Executive body (if the Executive body is collegial) – a copy, stamped by the legal entity; 8) Entities subject to statutory audit shall submit copies of audit reports, based on results of the audit of annual financial statements for the last 2 years, licenses of auditing organizations that conducted the audit; 9) Statistical reports in the form 1-cx “Report on the activities of agricultural facilities and farms” for the last 2 (two) years – a copy with a note of the statistical authority, or certificate of the district (municipal) department of statistics – the original; 10) If the main activity of the Potential borrower is animal breeding, it is required to submit: - Statistical reports in the form 24-cx “Report on the state of animal breeding” for the last 2 (two) years and for the last 3 (three) months before the date of application; - Statistical reports in the form 10-cx “Feed consumption” for the last 2 (two) years. 11) If the main activity of the Potential borrower is plant cultivation, it is required to submit statistical reports in the form 29-cx “Report on the harvest of crops from all lands” for the last 3 (three) years; 12) Decision of the local executive body to provide the land(s) with private property rights or temporary paid land use rights for keeping farm (farming), leasing contract (sale and purchase contract) for the land(s) and act for the right of private property or temporary paid land use, as well as the original certificate of land rights registration of the body of justice; 13) Certificate of absence of insolvency (bankruptcy) proceedings in courts, as well as proceedings in which the Potential borrower acts as a plaintiff, defendant (to be made in free form and signed by the Head); 14) Original documents on intention of a credit institution or another entity to provide the Potential borrower with financial resources for co-financing the Investment project; 15) Notarized copies of licenses, permits confirming the right to carry out licensable business activities, performance of related work (if activity carried out by the borrower/pledger/Guarantor subject to be licensed under the legislation of the Republic of Kazakhstan); 16) A positive opinion of an investment adviser (if engaged); 17) Notarized copies of educational diplomas of employees, as well as documents proving work experience; 18) Copies or originals of documents confirming readiness and the actual possibility of delivery of technological equipment and pedigree livestock by potential borrowers, necessary for implementation of the Investment project, indicating possible dates of delivery, installation periods, as well as value and payment terms; 19) Copies and originals of documents issued by the potential supplier of technological equipment, confirming the suitability of facilities of the Potential borrower for installation of technological equipment necessary for implementation of the Investment project (if the equipment installation is planned in the existing facilities); 20) Certificate of the body of justice which reflects information on the initial registration, all effected re-registrations and reasons for them, changes in charter, as well as size of share capital and the founders; 21) Copies of documents confirming payment of share capital (except for JSC); 22) Copies of identity documents of the founders (shareholders, participants), holding more than 10 % of participating interest (shares) and the Head of the legal entity; 23) List of documents necessary for assessing liquidity and sufficiency of collateral of the Potential borrower shall be provided in accordance with Annex 17 to the present Regulations; 24) Technical and economic assessment of the construction value at the stage of investment, enlarged estimate calculations of the construction value, preliminary calculations reflecting complete structure of the upcoming construction and installation works and expenses, mandatory coverage of issues relating to engineering services and communications indicating capacity consumption (taking into account the needs of capacity from suppliers of the equipment); 25) Joint stock companies shall additionally submit the following documents for legal expertise: 1) A copy of the prospectus of issue of shares; 2) A copy of certificate of state registration of securities; 3) A copy of notification of approval of the report on results of issuance and placement of shares; 4) Original certificate (extract) from the register of holders of securities indicating all members (shareholders) as of the date of convocation (if it is necessary under the legislation of the Republic of Kazakhstan); 5) A copy of the contract-order for provision of services for maintaining the register system (with amendments and supplements, if any). Note: 1. Presence of unreliable information about the Potential borrower and the Investment project in documents stipulated by the present Regulations may cause rejection of the application of the Potential borrower or termination of the agreement on financing of the Investment project (if concluded). 2. Simple copies of corresponding documents specified in the present list shall be verified and certified by a credit expert (manager) of the project, who certifies the copy stating the following: “Checked against the original. True copy. _____________ Full name of the credit expert (manager) in words, title, signature __________”. 3. Copies of the above-mentioned documents which are subject to the corresponding requirement for notarization shall be notarized not earlier than 1 month before the date of application. If the requirements of the present Regulations do not expressly state that a document maybe presented in copy and/or notarized, this document shall be presented in the original (the original). 4. If documents which are required to be signed by the Head of the Potential borrower according to the present list, have been signed by another person, it is required to submit the original power of attorney proving the authority of the person who has signed the documents. 5. If the Potential borrower has affiliates, it is required to submit documents of the affiliates specified in Subparagraphs 3, 4 of Paragraph 22 and Subparagraphs 1, 2, 4, 8, 9 of Paragraph 32 of the present List. In case the affiliates carry out activities in livestock breeding and/or plant growing, submit documents specified in Subparagraphs 10, 11 of Paragraph 32 of the present List. In addition, submit copies of identity cards and taxpayer certificate (RNN) of the Heads and the Founders who have share in the authorized capital of more than 10 % or shareholders holding more than 10 % of shares. If the affiliate is an individual, submit copies of identity card and taxpayer certificate (RNN). 6. If there are any amendments and supplements to charter of economic partnerships, it is necessary to present documents relating to these issues (deals on transfer of ownership of participating interest and documents on payment for such deals). 7. In case of reorganization, provide documents relating to reorganization (merger, affiliation, division, separation, transformation). 8. If the legal entity is in the process of reorganization, it is required to submit the decision of general meeting of members on reorganization, dividing balance, transfer deed and other documents confirming the reorganization of the legal entity. List of documents required for taking decision by the Credit Committee of the Company to start financing: 1) Design estimates for planned work and/or documents containing basic parameters of planned activities indicating estimated costs; 2) Permission for construction and installation works; 3) Decision of the relevant executive body to allot the land for construction purposes or title documents to the land which is under construction; 4) Opinions of the authorized state bodies (environmental review, opinion of Sanitary Epidemiological Station); 5) Original reports of independent appraisal companies on assessment of collateral (determining and proving its market value). List of documents proving necessary decisions by authorized bodies of borrowers/guarantors and/or consent of other persons or bodies to effect a deal of loan/pledge/guarantee: 1) Decision of the authorized body of the pledger – the legal entity (members of the farm) to provide collateral to secure fulfillment of obligations of the borrower with granting the right the pledgee to sale the pledged property unjudicially; 2) Decision of the authorized body of the Guarantor – the legal entity (members of the farm) to provide a full Guarantee to secure fulfillment of obligations of the borrower; 3) Notarized consent of the pledger’s spouse to pledge the property and to sale nonjudicially; 4) Notarized consent of the Guarantor’s spouse to provide full Guarantee; 5) Notarized consent of all owners of the pledged property to pledge the property and to sale it non-judicially (if the property is in joint ownership); 6) A notarized copy of marriage certificate, if the pledger is married; 7) Notarized application of the pledger that he was not married at the time of purchase of the property which is supposed to be pledged and is not married at the time of transfer of the property as collateral; 8) The consent of the guardianship body to transfer the property as collateral and to sale it non-judicially (only in cases when minor children are owners (co-owners) of the property to be pledged); 9) The periodical with announcement of shareholders/founders, creditors and interested parties to convene a meeting or a message about a transaction, if necessary. Note: It is essential that documents reflecting decisions of authorized bodies of legal entities and members of the farm (borrowers/pledgers/Guarantors) were bound, numbered, stamped by the legal entity or the farm. Signatures of members of the authorized body of the Potential borrower or members of the farm in these documents shall be notarized.