Budget Guidance Notes

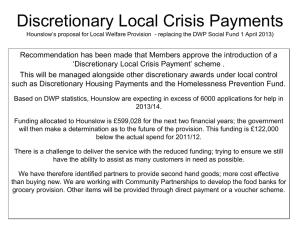

advertisement

2010/11 to 2012/13 REVENUE BUDGET GUIDANCE NOTES 1. INTRODUCTION 1.1 The enclosed notes give guidance to Heads of Colleges & Schools on the budget process for 2010/11 to 2012/13 and the construction of the revenue budgets. Throughout the budget process, further discussions will be held with the Senior College Accountant and College Accountancy teams to finalise the budgets for presentation to the University Court on 29 June. 1.2 The timetable for the various drafts of the budget was approved by UMG on 14 December, and a copy is included at Appendix 1. The initial draft budget will be prepared by Finance. A second draft, which incorporates the provisions within the SFC funding letter and changes advised by Colleges will be prepared in April, and submitted to UMG. 1.3 All budgets will be presented at School level and aggregated into College and University summaries. There may be occasions when information below the School level is required and where practical, the College Accountancy teams will be happy to assist with this. It is good practice for budgets to be built up from the lowest practical level. For some areas this will be the school level, but some budgets, for example, Direct Cost Recovery, will require to be built up on an individual grant basis. 2. BUDGET ASSUMPTIONS 2.1 To enable the first draft of the budgets to be prepared by Finance, planning assumptions have been drafted and agreed by the Operating Board. A copy of the assumptions used is included as Appendix 2. 2.2 These assumptions form the basis for the consistent preparation of the first draft of the budgets. These first draft budgets will then be used to inform the discussions with the Heads of School/College, to establish more detailed budgets. Any changes to the assumptions on costs or income should only be made on the basis of supporting evidence and agreed with Finance, the target performance indicators should reflect the revised assumptions. 2.3 On receipt of the SFC funding letter the income projections for the Colleges will need to be refined, however a working estimate of funding should be possible before the letter is available. 3. RESOURCE ALLOCATION MODEL (RAM) 3.1 The University’s Resource Allocation Model (RAM) is used to allocate SFC funding to Schools/Colleges and also allows for the attribution of costs incurred in providing central services and corporate costs. The items included within the RAM are disclosed below. 3.2 Teaching or “T” grant 3.2.1 Approximately £47M of resources has been allocated to the University in 2009/10 through Teaching or “T” grant. Each discipline is given a Unit of resource by SFC, per full time equivalent (FTE) student, which incorporates both the T grant and fee. There are 12 categories of Units of Resource, and these vary from £16k for a Medical Student to £4k for a Social Science student. Last Updated 02/09/10 3.2.2 The home/EU FTE student numbers are derived from the Student Loads figures based on reports dated 23 February 2010. These FTEs form the basis of the income distribution for the financial year ahead. Generally the student numbers for Home/EU will not be varied unless circumstances dictate a material change in funding i.e. additional funded places. 3.2.3 However, there will be the opportunity to vary the non-fundable fees as it is recognised that student numbers have the potential to change significantly. Any material change to the non-fundable numbers should be supportable, through historical trends, application data or the development and promotion of a new course. 3.3 Research or “R” grant 3.3.1 The Research Excellence Grant is distributed primarily according to performance in the Research Assessment Exercise 2008. The performance of the University is fed into the RAE results across Scotland to give an annual financial sum allocated by SFC, using a revised funding model that places greater emphasis on other activity indicators. A grant of £19M was distributed through the R Grant in 2009/10. 3.4 Contribution to University Surplus 3.4.1 The University’s Strategic Plan includes a commitment to generate a surplus increasing in increments of £0.5M each year to 3% of turnover. 3.4.2 The budget assumptions include a surplus of £5.5M for 2010/11 rising to £6.15M in 2012/13. All Colleges make a contribution to surplus apportioned on the basis of income. 3.5 Contribution to Capital programme 3.5.1 The University sets aside £4m each year as a contribution towards the annual recurrent capital programme, to maintain the current infrastructure of the University. The budget of £3M per annum for Estates is spent based on an indicative allocation of £1M per annum for Health and Safety/ statutory compliance taking into account the views of the University Safety Advisor, £1M per annum for functionality/ modernisation improvements as requested by the colleges and central administration to pick up small projects identified within the school academic planning process, and £1M for condition improvements and sustainability initiatives based on the estate condition survey and the views of the Environmental Forum. 3.5.2 The budget of £1M per annum for DIT is spent as £0.65M per annum on maintaining existing capacity by the renewal of existing infrastructure with the increased spend of £0.35M being allocated in line with the IT strategy presented to the Information Management Committee for tactical investment in small to medium sized projects as requested by the colleges and central administration, typically these projects will be £50-£100k. Institutional capital investment in IT of a more strategic nature would seek funding from the provision made for additional projects as referred to above. 3.6 Contribution to the Strategic Investment Fund 3.6.1 In addition to the University Surplus an additional amount assumed to be £2.5M per annum is set aside for strategic investment purposes. All Colleges make a contribution to this fund apportioned on the basis of income. Last Updated 02/09/10 3.7 Attributing the costs of delivering Central Services 3.7.1 The cost of delivering central services is attributed to the Schools/Colleges based on pre-defined criteria. All criteria are objective, transparent and intended to reflect activity The basis of attributing the services provided centrally for each component of is listed below; Central Service Basis of Attributing Costs Registry Human Resources Student Association Research & Innovation Student Numbers Staff Numbers Student Numbers Information from R&I on time spent per school Combination of basis i.e. Payroll attributed on staff, Systems Administration based on system users Student Numbers Combination of basis depending upon the nature of the service but largely attributed on student and staff numbers Space Occupied Student Numbers Student Numbers Finance Student Support Services DIT & Library Estates External Affairs Life Long Learning 4. INDICATIVE RESOURCE FRAMEWORKS 4.1 Once all the expenditure and income has been attributed using the RAM, the income and expenditure is then summarised into an Indicative Resource Framework (IRF) for each School. These IRFs are then summarised into Colleges and into a University IRF. 4.2 The staff costs are taken from the Payroll models as at February 2010. These include all staff in post, vacancies and known replacements. Each pay line includes allowances for increments, superannuation and National Insurance. 4.3 The operating budgets will be based on the current year operating budgets plus an allowance for inflation, after taking account of changes in activity levels. 4.4 The discretionary budgets are based on the agreed percentage of research grant indirect cost contribution, direct cost recovery, consultancies and knowledge transfer partnerships forecast to be earned in the year. Section 5 includes more detailed guidance on the operation of discretionary accounts. 4.5 Once the final budgets have been agreed, the figures from the IRFs are then taken and uploaded into the financial systems as budgets for the forthcoming financial year. 5. DISCRETIONARY ACCOUNTS DISCRETIONARY BUDGETS – OPERATION & PLANNING 5.1 Introduction 5.1.1 The following is an extract from the University’s Financial Regulations. “Discretionary Accounts are agreed annually at College level and it is a matter for the Head of College to decide the allocation of the College’s budget. Where permission to spend is not obtained through the granting of an allocation, the money held in a Discretionary Account is not lost, but is made available to spend in subsequent years subject to a successful bid being made.” Last Updated 02/09/10 5.1.2 Discretionary Accounts should only be held at school/college/institute or theme level. There should be no individual discretionary accounts as this can result in the discretionary income being considered as taxable income. 5.2 Income & Expenditure from Discretionary Accounts 5.2.1 Discretionary income is generated from a percentage of indirect cost contribution earned on Research Grants & Contracts, Direct Cost Recovery, Consultancies and Knowledge Transfer Partnerships. 5.2.3 These discretionary resources can be accessed, as long as they are used in the furtherance of the objectives of the College. 5.3 Unused Balances 5.3.1 If at the end of the financial year, the discretionary income exceeds discretionary expenditure, the unused balance on the account is transferred to a discretionary reserve. This reserve is not lost, but is held for the use of the school/theme/institute, per the financial regulations above. 5.3.2 It is recommended that significant balances are not built up on discretionary accounts. Reserves should be at a level that allows commitments on expenditure to be maintained during a downturn in discretionary income. 5.4 Planning & Budgeting 5.4.1 As with any other income or expenditure item within the University, we require to plan for discretionary income and expenditure. Discretionary budgets are the same as all other budgets and when we have expenditure which exceeds budget this will directly affect the bottom line of the University. 5.4.2 This is perhaps best explained through an example. In this example School A has £1 million in the discretionary reserves, but a budget is not set up to use this reserve. If all of the discretionary reserve were used for revenue expenditure, the University would have £1 million of expenditure with no matching income and which is unbudgeted. As the University budgets are set with little margin for overspend, £1million could be the difference between an operating surplus and deficit. 5.4.3 An estimate of the discretionary income for the forthcoming financial year will be made, as part of the budget process based on the estimated percentage derived from Research Indirect cost contribution, DCR, Consultancies and Knowledge Transfer Partnerships. Using this income estimate budgets, expenditure will be constructed. 5.4.4 As a general principal, expenditure from the discretionary account should equal the income generated during the course of the year. When this occurs there is no effect on the University’s profit and loss account. 5.4.5 However, it is recognised that this is not always the case with regard to the discretionary accounts and often access to discretionary reserves is required. Therefore any access to discretionary reserves requires to be planned, to ensure that this does not have a destabilising effect upon the University. 5.4.6 This planning should take place in the budgeting period (Feb –May) each year. 5.4.7 Over the course of the three year planning period all themes and schools should have access to their reserves Last Updated 02/09/10 5.5 Commitments on Discretionary Reserves 5.5.1 It has been found that often there have been significant commitments on discretionary reserves to the extent that all the income is committed to staff posts. When this happens there is no flexibility either to respond to new opportunities, or if the income falls, there is an over commitment on the discretionary account which will mean that expenditure exceeds income. 5.5.2 It is recommended that no more than 75% of annual discretionary income is committed in advance, either on staff or operating costs. Last Updated 02/09/10