Tutorial 5 - City University of Hong Kong

advertisement

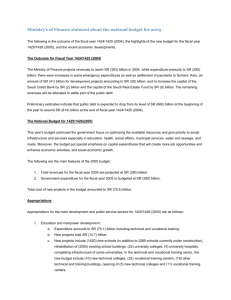

EF3461 The Economies of Mainland China and Hong Kong Tutorial 5 Hong Kong’s Fiscal Policy City University of Hong Kong Dr. Isabel Yan 1. HK’s Fiscal Policy (Li(2003): Ch4) Automatic income stabilizer vs discretionary fiscal policy: Automatic income stabilizer: The automatic mechanism built into the fiscal framework that can reduce the fluctuation of disposable income in the economy. e.g. progressive income tax system (economic upturn pushes individual households into a higher tax bracket) welfare benefit (welfare benefits limits the income reduction during economic downturn) However, automatic income stabilizer can only reduce part of the income fluctuation but cannot eliminate the fluctuation entirely. Discretionary Fiscal Policy: Discretionary fiscal policy refers to the discretionary government policy on government revenue and expenditure that are enacted by the legislature (such as setting tax rates, welfare benefits) in order to promote economic growth. Discretionary fiscal policy can be expansionary or contractionary. • Discretionary reduction in revenue: Expansionary fiscal policy: e.g. Reduce tax rate, less taxable items • Discretionary increase in expenditure: e.g. Increase urban constructions and building of public utilities Contractionary fiscal policy: • Discretionary increase in revenue • Discretionary reduction in expenditure Discussion Question 1 1. Based on the revenue data in table 10.3, answer the following questions. 1a. What is the most important source of revenue for the HK government? Was there a significant decline in this source during 2001-02? 1b. Which sources of revenue declined most drastically since 1998? What do you think are the reasons for the decline? 1c. What do you think is the major problem of HK’s revenue structure? What recommendations will you make to the HK government? 1 Main source Large decline 2 Answers: 1a. The earnings and profits tax (the main direct operating revenue) is the most important source of revenue for the HK government. It accounted for 44.28% of the total revenue in 2001-02. Based on the data, this item remained steady since 1998. However, one major problem of HK’s salary tax structure is that it is T-shaped, which means that a few high income earners shoulder a large portion of the total salary tax. This structure is very unstable because revenue base is too narrow. 1b. The revenue sources that are related to the property market declined most drastically since 1998. These revenue sources include: • Stamp Duty: a government tax levied on certain legal transactions including the purchase of property. When the asset market declined, the revenue from stamp duty dropped. • The investment income from Land Fund: the revenue yield from the Land Fund. • The Capital Work Reserve Fund: it finances the Public Work Program, land acquisitions, capital subventions etc. Between 1986 and 1997, half of the proceeds from land sales were credited to this account and the other half deposited to the Land Fund. After 97, all income from land transacted is to be credited to this Fund. These 3 revenue items (which heavily depend on the performance of the property market) alone account for 30% of HK government’s total revenue in 1997-98. Even in 2001-02, it account for 11% of the total revenue. This again indicates that one problem is that HK’s revenue base is too narrow. 1c. The major problem of HK’s revenue structure is that the revenue base is too narrow. The Advisory Committee on New Board Based Taxes has suggested the following to widen the revenue base: A low rated but board-based goods and services tax (GST) is the best choice for boarding the tax base Lower personal income tax exemptions are recommended A land and sea departure tax is cited as an additional option (The HK government proposed to introduce a land departure tax in financial year 2003) Discussion Question 2 2. Based on the expenditure data in table 10.4, answer the following questions. 2a. What is the biggest expenditure item of the HK government? What had the HK government done to try to lower this expenditure item? 2b. What are the largest subvention items of the HK government? Do you think this is consistent with HK government’s goal of “investing for the future”? 1 Main expenditure Expenditure on education is the largest subvention item 2 Answers: 2a. The personal emolument is the largest expenditure item of the HK government. It accounted for 21.7% of the total government expenditure and 44.5% of the recurrent expenditure in 2001-02. To lower this expenditure item, the civil servant’s pay was cut by 4.5% starting from October 2002. 2b. The largest subvention item of HK is education which means that education and training occupies a high priority in government expenditures. The is consistent with HK government’s theme of “investing in future”. Better educated workforce have better capacity to earn income and hence pay tax. Is HK’s Deficit a Structural Deficit or a Cyclical Deficit? Structural balance (Structural surplus or deficit) the structural budget balance is the hypothetical balance we would have under current fiscal policies if the economy were operating at full employment (or potential output). The structural balance is determined by the discretionary policy of the government (such as setting tax rates, welfare benefits). Cyclical balance (Cyclical surplus or deficit) The deviation of the actual budget balance from its structural balance due to fluctuations in the business cycle. HK’s Actual and Structural Fiscal Surplus/Deficit 100 HK's Actual Balance 80 HK's Structural Balance (for illustration only ) 60 20 -40 -60 -80 2001/02 1999/00 1997/98 1995/96 1993/94 1991/92 1989/90 1987/88 1985/86 -20 1983/84 0 1981/82 Billion HKD 40 structural cyclical actual HK’s Task Force on the Review of Public Finances had found structural deficits in recent years which arose because of the following structural deterioration in HK: (read the Press Release) Poor performance of the property market resulted in low revenue from land premium, stamp duties on property transaction and profits tax. HK’s direct tax declined because some of HK’s businesses moved to the Mainland and elsewhere. This reduced HK government’s tax revenue due to the territorial source tax principle practised in HK (that is, only HK-sourced profits and salaries are liable to tax) Investment income from fiscal reserves had fallen because the persistent fiscal deficits lowered the fiscal reserves The demographic trends raised the expenditure on health and social security expenditure