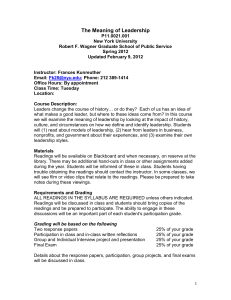

Financial Management of Libraries and Information Centers

advertisement

Financial Management of Libraries and Information Centers (Currently GSLIS 590FM) Fall, 2010 Course Instructor: Robert H. Burger, B.A, M.A., M.L.S., Certificate of Advanced Studies in Librarianship, Ph.D., CPA Introduction The course is designed to familiarize the student with the basic principles of library financial administration, including budgeting and planning within the mission and goals of the organization. It provides an orientation to the variety of financial management techniques appropriate for libraries and information centers, with an emphasis on sources for obtaining financial support, controlling expenditures, creating and controlling budgets, financial decision making and exploring specific financial and budgetary problems for the major operational areas of libraries – public services, technical services, information technology and facilities. Learning Outcomes Upon completion of the course the student is expected to be able to explain basic accounting operations for libraries, describe the basic elements of library financial statements and budgets, develop program budgets, conduct operational analysis for budget forecasting, develop capital budgets, and conduct cost/benefit analyses. Topics include basic accounting principles and operations, analysis of financial statements and budgets, detailed examination of the elements of financial support and expenditures for libraries, different presentations of budget information (line item, program, and capital budgets), managerial accounting (cost benefit analysis, performance measures and operations indicators), financial aspects of capital projects, and fiduciary responsibilities of the library director, trustees, and others having responsibilities for financial administration in the library. The use of Microsoft Excel is assumed and will be used at a level appropriate for someone who has basic knowledge of Microsoft Excel. Presentation methods Individual sessions or parts of a session may be conducted as a lecture, as a seminar focused around a case study or problem, or as a student presentation. Assigned Texts 1 Ruppel, Warren. Governmental Accounting Made Easy, 2nd Edition. Hoboken, NJ : John Wiley & Sons, 2010. Note: Ruppel can be dense and unexciting in places, even for an avid CPA. The instructor will indicate when a cursory reading versus an in-depth reading for Ruppel will be appropriate. Hallam, Arlita W. and Teresa R. Dalston Managing Budgets and Finances: A How-to-doit Manual for Librarians and Information Professionals. New York, Neal-Schuman Publishers, Inc. 2005. (How-to-do-it Manual for Librarians, number 138) Other readings as assigned throughout the semester. Assignments There will be three major graded assignments, corresponding to the three major sections of the course (financial statements of libraries and budgets and budgeting, revenues and expenditures (focusing on specific sections within the library), and cost accounting. There will be other non-graded assignments, designed to enable the student to master the contents of each section. In addition, there will be a final project, the purpose of which is to summarize and consolidate the knowledge you have gained in the course. Final Project See separate document available on course website. Grading Grading will be based on a combination of the three major assignments (20 points each, total 60 points), the final project (20 points) and class participation (20 points, based on in-class participation and completion of non-graded assignments). Schedule Prior to session one, it would be helpful if you read Ruppel, chapter one and chapter 2 (p. 19-29 only), the material of which will be covered during session 1 class. Session 1 Topics Purpose and structure of the course, expected learning outcomes, suggestions on how to achieve the desired learning outcomes, and evaluation. Social and economic context of library financial management, economics of information Financial reporting and standards boards 2 Readings for Session 1 Ruppel, ch. 1 and ch. 2 (p. 19-29 only) Assignment for session 2: Calculating your net worth and figuring out a budget (see link on website) Session 2 Topics Basic accounting for NPOs, Chart of accounts (major accounts and structure), Double entry bookkeeping and accounting processes – the journal, ledger, etc. How a budget and cost analysis produce resolution only as good as chart of accounts allows them to be, Major Accounting standards: GASB, GAAP, FASB Readings for Session 2 Ruppel, ch. 1, ch. 2 (entire), ch. 3 Daubert, Madeline J. “Fundamentals of Accounting” in Financial Management for Small and Medium-sized Libraries, Chicago, ALA, 1993. pp. 36-52. (Available as pdf on course website.) Assignment Due TBA Session 3 Topics Internal control, auditing, records management, financial ratios Readings for Session 3 Gross, Malvern, John H. McCarthy, Nancy E. Shelmon. Financial and Accounting Guide for Not-for Profit Organizations chapter 23 (Internal Control) (pdf) Ruppel, ch. 2 (entire), ch. 3, ch. 4 Assignment Due TBA 3 Session 4 Topics The Budget and its relation to the major financial statements (Balance Sheet and Income Statement) Creating a Budget Types of Budgets Budgetary Process Budget variances with actual revenue and expenditure National Reporting of Revenues, Expenditures and other data Readings for Sessions 4 Hallam and Dalston, Managing Budgets and Finances, pp. 3-68 (ch. 1-3) Read ch. 3 with a jaundiced eye. It is often misleading, unclear, and incorrect. Gross, Malvern et al. chapter 20 (Budgeting) Linn, Mott. “Budget Systems used in allocating resources to libraries” Assignment Due TBA Session 5 Topics Revenue and Support of Library Operations in relation to budgeting Primary revenue support Time Value of Money Annuity concepts Tax revenues, tax rates, tax base Readings for Session 5 Hallam and Dalston, chapters 8 and 9 Ruppel, chapters 5 and 6 Daubert, p. 108-124 Revenues and Sources of Support Assignment Due Major Assignment no. 1 due by 8:00 a.m. of the morning of Session 5 Session 6 4 Topics Visiting Lecturer First Hour Revenue and Support of Library Operations in relation to budgeting II Grants and Grant financial reporting Endowments Entrepreneurial activities Loans and Bonds Trusts, Wills, Gifts Intergovernmental transfers Minor sources of revenue Readings for Session 6 (Yes, same as for Session 5) Hallam and Dalston, chapters 8 and 9 Ruppel, chapters 5 and 6 Daubert, p. 108-124 Assignment Due Final Project Section I draft due by the end of the week after Session 6 (i.e. Friday after Session 6 concludes) Session 7 Topics Expenditures I Administration of expenditures Contracts Personnel (wages, salaries) benefits salary administration employment contracts hourly employees and minimum wage work study arrangements sick and vacation leave travel separation payouts time sheets and internal control 5 Readings for Session 7 Ruppel, chapter 8 NYT article on pensions Assignment Due TBA Session 8 Topics Expenditures II Purchase orders (collections, equipment) Contracts Purchasing regulations Encumbrances and payment Invoice processing Readings for Session 8 Trends and Developments in Managing Acquisitions Budgets Managing the Acquisitions Budget Plain English Collections Budgets Negotiations with Library Materials Vendors Good Negotiations with Vendor Contracts Comparing Consortial and Differential Pricing Models Assignment Due TBA Session 9 Topics Expenditures III Equipment and depreciation Inventory Control Information Technology Facilities Capital Budgets Readings for Session 9 6 Ruppel, chapter 7 Hallam, chapters 5, 6, and 7 Hidden Costs of IT Systems After Costs of Library Construction Measure by Measure: Assessing Viability of the Physical Library Understanding Project Costs and Building Costs Assignment Due TBA Session 10 Topics Managerial accounting Responsibility Centered Management Activity Based Costing Cost centers and managerial cost control Life Cycle Costing Risk Management Readings for Session 10 Smith, G. Stevenson, Cost and Cost Concepts Ellis-Newman. Activity Based Costing in Library Trends, Winter 2003 Assignment Due Major assignment no. 2 due by 8:00 a.m. of the morning of Session 10 Final Project Section I draft due by the end of the week after Session 11 (i.e. Friday after Session 11 concludes) Session 11 Topics Managerial accounting Cost Benefit Analysis Return on Investment Break Even Analysis Differential Cost Analysis Cost estimation with probabilities and sensitivity analysis Cost estimation with learning curve Readings for Session 11 7 Holt and Elliot Measuring Outcomes: Cost Benefit Analysis in Library Trends, Winter 2003 Assignment Due TBA Session 12 Topics Leasing Outsourcing Introduction to Descriptive Statistics Readings for Session 12 Hallam and Dalston, ch. 4 New Leasing Rules Ruffle Leasing Market Outsourcing Library Technical Services Assignment Due TBA Session 13 Topics Forecasting and estimating Statistics Sampling Readings for Session 13 Hiller, Steve and Jim Self “From measurement to management: using data wisely for planning and decision making” Library Trends, 2004:53:1: pp. 129-155. Bookstein, A. How to Sample Badly Assignment Due TBA THANKSGIVING BREAK 8 Session 14 Topics Develop performance measures and operations indicators Data driven decision making Evaluation Long Term Strategic and Financial Planning Change Management and the budget Readings for Session 14 Ruppel, chapter 10 Assignment Due Major Assignment no. 3 due on morning of Session 14 Session 15 Topics Marketing, Advocacy, Reporting and Persuasion Readings Due this session Marketing, a customer focused approach ALA Advocacy tool kits, etc. Assignment Due today draft of section 3 of final project Assignment Due one week after final class Final project 9