Click to

advertisement

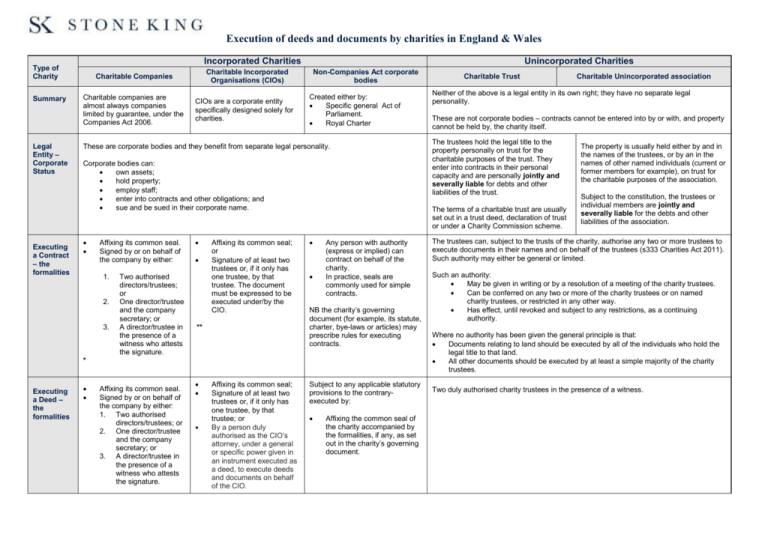

Execution of deeds and documents by charities in England & Wales Incorporated Charities Type of Charity Summary Legal Entity – Corporate Status Executing a Contract – the formalities Charitable Companies Charitable companies are almost always companies limited by guarantee, under the Companies Act 2006. Unincorporated Charities Charitable Incorporated Organisations (CIOs) CIOs are a corporate entity specifically designed solely for charities. Non-Companies Act corporate bodies Created either by: Specific general Act of Parliament. Royal Charter These are corporate bodies and they benefit from separate legal personality. Corporate bodies can: own assets; hold property; employ staff; enter into contracts and other obligations; and sue and be sued in their corporate name. Affixing its common seal. Signed by or on behalf of the company by either: 1. 2. 3. Two authorised directors/trustees; or One director/trustee and the company secretary; or A director/trustee in the presence of a witness who attests the signature. Affixing its common seal; or Signature of at least two trustees or, if it only has one trustee, by that trustee. The document must be expressed to be executed under/by the CIO. ** Any person with authority (express or implied) can contract on behalf of the charity. In practice, seals are commonly used for simple contracts. NB the charity’s governing document (for example, its statute, charter, bye-laws or articles) may prescribe rules for executing contracts. Affixing its common seal. Signed by or on behalf of the company by either: 1. Two authorised directors/trustees; or 2. One director/trustee and the company secretary; or 3. A director/trustee in the presence of a witness who attests the signature. Affixing its common seal; Signature of at least two trustees or, if it only has one trustee, by that trustee; or By a person duly authorised as the CIO’s attorney, under a general or specific power given in an instrument executed as a deed, to execute deeds and documents on behalf of the CIO. Subject to any applicable statutory provisions to the contraryexecuted by: Affixing the common seal of the charity accompanied by the formalities, if any, as set out in the charity’s governing document. Charitable Unincorporated association Neither of the above is a legal entity in its own right; they have no separate legal personality. These are not corporate bodies – contracts cannot be entered into by or with, and property cannot be held by, the charity itself. The trustees hold the legal title to the property personally on trust for the charitable purposes of the trust. They enter into contracts in their personal capacity and are personally jointly and severally liable for debts and other liabilities of the trust. The terms of a charitable trust are usually set out in a trust deed, declaration of trust or under a Charity Commission scheme. * Executing a Deed – the formalities Charitable Trust The property is usually held either by and in the names of the trustees, or by an in the names of other named individuals (current or former members for example), on trust for the charitable purposes of the association. Subject to the constitution, the trustees or individual members are jointly and severally liable for the debts and other liabilities of the association. The trustees can, subject to the trusts of the charity, authorise any two or more trustees to execute documents in their names and on behalf of the trustees (s333 Charities Act 2011). Such authority may either be general or limited. Such an authority: May be given in writing or by a resolution of a meeting of the charity trustees. Can be conferred on any two or more of the charity trustees or on named charity trustees, or restricted in any other way. Has effect, until revoked and subject to any restrictions, as a continuing authority. Where no authority has been given the general principle is that: Documents relating to land should be executed by all of the individuals who hold the legal title to that land. All other documents should be executed by at least a simple majority of the charity trustees. Two duly authorised charity trustees in the presence of a witness. Interests in Land *Non exempt charities - the charity directors/trustees are required to give certain certificates (conveyances, transfer, leases and other documents) disposing of an interest in charity land. The trustees/directors and not the company are required to provide the certificates. The trustees/directors should co-execute the document containing the relevant certificate as well as the charitable company. This can be done by two duly authorised directors under s333 Charities Act 2011 (see above). ** When dealing with interests in land the trustees of a CIO are required to give certain certificates (conveyances, transfer, leases and other documents) disposing of interests in land. The trustees must co-execute a disposition or charge containing the relevant certificate. The trustees can authorise any two or more trustees to sign on behalf of all the charity trustees under s333 Charities Act 2011 (see above). © Stone King LLP March 2015 March 2015