Tax Credit Expenditure Guidelines

advertisement

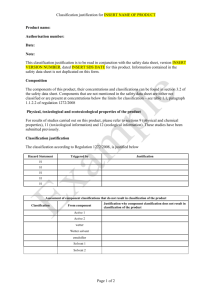

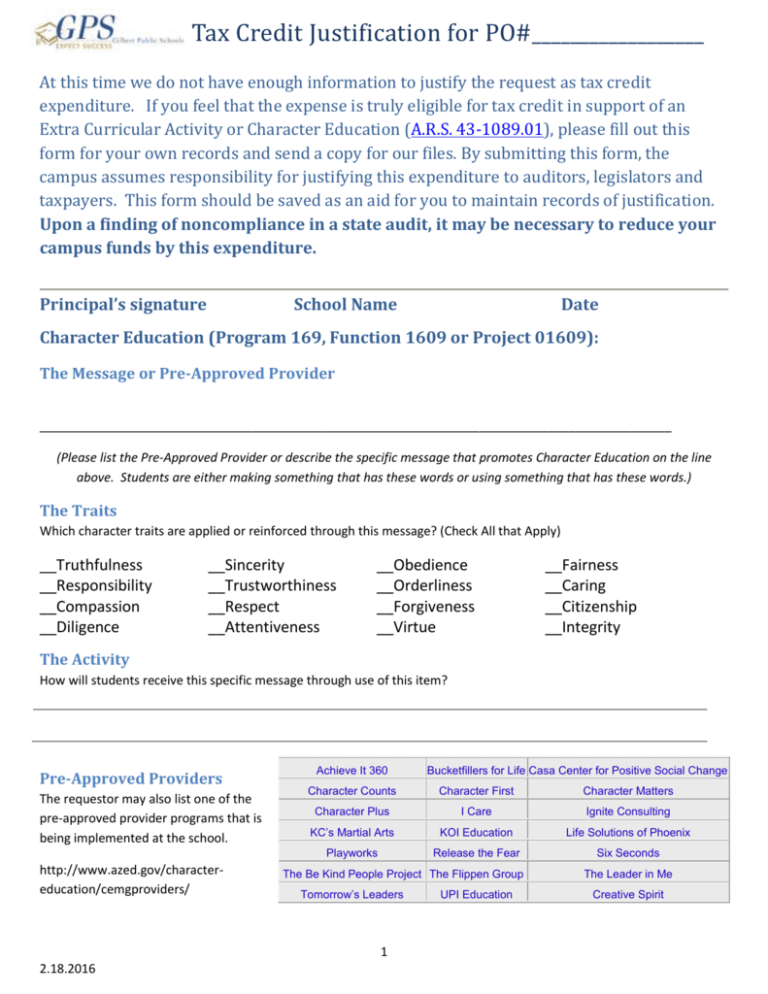

Tax Credit Justification for PO#__________________ At this time we do not have enough information to justify the request as tax credit expenditure. If you feel that the expense is truly eligible for tax credit in support of an Extra Curricular Activity or Character Education (A.R.S. 43-1089.01), please fill out this form for your own records and send a copy for our files. By submitting this form, the campus assumes responsibility for justifying this expenditure to auditors, legislators and taxpayers. This form should be saved as an aid for you to maintain records of justification. Upon a finding of noncompliance in a state audit, it may be necessary to reduce your campus funds by this expenditure. Principal’s signature School Name Date Character Education (Program 169, Function 1609 or Project 01609): The Message or Pre-Approved Provider ____________________________________________________________________________________________ (Please list the Pre-Approved Provider or describe the specific message that promotes Character Education on the line above. Students are either making something that has these words or using something that has these words.) The Traits Which character traits are applied or reinforced through this message? (Check All that Apply) __Truthfulness __Responsibility __Compassion __Diligence __Sincerity __Trustworthiness __Respect __Attentiveness __Obedience __Orderliness __Forgiveness __Virtue __Fairness __Caring __Citizenship __Integrity The Activity How will students receive this specific message through use of this item? Pre-Approved Providers The requestor may also list one of the pre-approved provider programs that is being implemented at the school. http://www.azed.gov/charactereducation/cemgproviders/ Achieve It 360 Character Counts Character First Character Matters Character Plus I Care Ignite Consulting KC’s Martial Arts KOI Education Life Solutions of Phoenix Playworks Release the Fear Six Seconds The Be Kind People Project The Flippen Group Tomorrow’s Leaders 1 2.18.2016 Bucketfillers for Life Casa Center for Positive Social Change UPI Education The Leader in Me Creative Spirit Tax Credit Justification for PO#__________________ Extra Curricular Activity: _______________________________________________________________________________________________________ (Please describe the activity in the line above.) Principal’s signature School Name Date An activity is the action that describes an event of student participation that has a clear start date/time and an end date/time and that is not exclusively for recreational or entertainment value. Activities may be considered extracurricular if they occur either OFF school property or OUTSIDE normal instructional hours (A.R.S.15-901 (A)(1)(b)(i)). Non-graded educational activities during instructional time may also be considered extra-curricular. (A.R.S. 43-1089.01). _____ Food (Object 6609) and Supplies (Object 6610): Allowed as part of an award banquet or travel expenses (including mileage reimbursement) occurring during a field trip. Per governing board policy (DKC-R) the cost must be limited to $12.50 per meal per participant. These expenditures are for student and adult participants, who are providing a required service in support of the activity (which may include teachers, coaches and the required minimum chaperones). Items will need to be broken out by food and supplies. Cost of all supplies ___________ and food __________ Number of participants _________ Total cost per participant _________ ____ Awards / Incentives ______________________________________________________________________ (Please describe the student accomplishment that will be recognized) An award banquet is an event that may include meals that recognizes that past accomplishments of participating students. Per governing board policy the cost of an individual award may not exceed $25.00. Cost of awards _________ Number of students receiving awards ________ Cost of awards per student __________ _____ Purchased Services Does the person who will be providing a service in support of this activity work for the district? _________ If so please submit a PAW for the work and we will close the purchase order. _____Equipment & Capital If the answer to any of the questions in the section below is “NO” then the item will be disallowed. 1. Is this item something that the district would not have purchased as part of the normal operation and maintenance or curriculum? _________ 2. Is it reasonable to conclude that the capital item will be for the exclusive use of that activity or the exclusive use in support of the health and safety needs of that activity? _________ 3. Is the use of the item by someone considered participation in or support of the activity? _________ ______Land Improvements (Function 4xxx is not allowed) Items that are directly or indirectly attached to the ground beyond the length of the activity are considered land improvements and will be disallowed as tax credit purchases. Is this item a land improvement?__________ 2 2.18.2016 Tax Credit Justification for PO#__________________ Extra- Curricular Activity Determination Chart A.R.S. §43-1089.01 defines when the tax credit can be claimed for an extracurricular activity. YES NO YES NO Is the activity school-sponsored? (No separate liability insurance is necessary) 1. Sponsorship implies liability of the school which would require school personnel chaperone. Travel would also need board approval 2. Is the school charging a fee? (Note 1) 3. Is the activity for enrolled students? 4. Is the activity educational? A.R.S. §15-342 (24) defines an extracurricular activity 5. Is the activity optional? (Does it affect grade if not participate?) 6. Is the activity noncredit? ·If the answers are yes to the above six questions, then extracurricular activities fees tax credit monies may be used to support the activity. · If the answer is no to any of the questions, then the tax credit monies may not be used to support the activity. Note 1 – To cover this requirement, a school may publish a nominal participation fee of $1 on their schedule of fees to cover all other extracurricular activities a student may wish to participate in. 3 2.18.2016 Tax Credit Justification for PO#__________________ Other Unallowable Tax Credit Expenditures Advanced Placement Testing Playground equipment Classroom SMART boards (Wickenburg 2010) Short Term Capital Additional Course Fee ($160) 4 2.18.2016 Tax Credit Justification for PO#__________________ Allowable extra curricular activities Advanced placement test / AP Testing / SAT Character Education Field Trips (non credit) Athletics Sports Fine Arts Music Band Orchestra Choir Performing Arts / Drama Academic Competitions Clubs After school enrichment (VIK) Tutoring (South Valley Junior High) Extended Kindergarten (FDK Fees?) 5 2.18.2016 Tax Credit Justification for PO#__________________ Elementary All field trip monies will be deposited at the appropriate grade level. All other programs will go into the general fund. 6 2.18.2016