Will Worksheet for Blended Families

advertisement

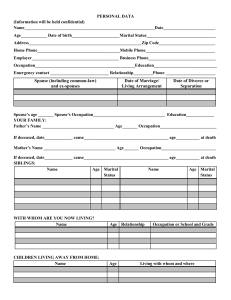

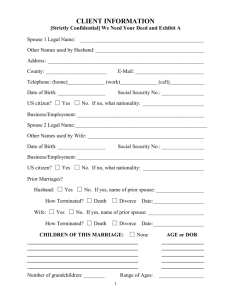

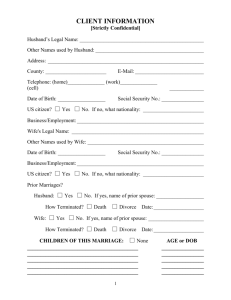

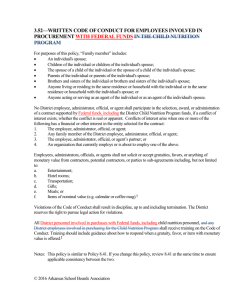

Will Worksheet for Blended Families 1. Your Information a. Your Name: b. Your Birthdate: c. Spouse’s Name: d. Spouse’s Birthdate: e. Date of Marriage: 2. Your Contact Information a. Address: b. Cell Phone: c. Home Phone: d. Email: 3. Prior Marriages-- Wife Husband a. Prior Spouse’s Name: b. Dates of Marriage c. Ended in: Divorce Death Divorce Death Death Divorce Death d. Prior Spouse’s Name: e. Dates of Marriage f. Ended in: Divorce 4. Obligations (alimony, life insurance) Child support payments made: Child support received: Wife Husband Maintenance payments: Maintenance received: Life Insurance: Other: 5. Family Information a. Children of this relationship: Names and birthdates. Also include occupation and spouse’s name and occupation for adult children. Please list all children including legally adopted and deceased children. i. ii. iii. iv. b. Are you considering having any more children? Yes No Unsure c. Wife’s children from previous relationships: Names, birthdates, and father’s name. Also include occupation and spouse’s name and occupation for adult children. Please list all children including legally adopted and deceased children. i. ii. iii. iv. d. Husband’s children from previous relationships: Names, birthdates, and mother’s name. Also include occupation and spouse’s name and occupation for adult children. Please list all children including legally adopted and deceased children. i. ii. iii. iv. e. Grandchildren’s names, birthdates, and parents. i. ii. iii. iv. f. Are you expecting more grandchildren? Yes No Unsure g. Wife’s Siblings’ names and spouses. Please indicate if deceased i. ii. iii. iv. h. Husband’s Siblings’ names and spouses. Please indicate if deceased and/or have children i. ii. iii. iv. i. Wife’s Parents’ and stepparent’s names. Please indicate if they are living or deceased. i. Mother: ii. Father: iii. Other: iv. Other: j. Do you expect to receive a significant inheritance from any of these parents? If yes, please explain: k. Husband’s Parents’ and stepparent’s names. Please indicate if they are living or deceased. i. Mother: ii. Father: iii. Other: iv. Other: l. Do you expect to receive a significant inheritance from any of these parents? If yes, please explain: 6. Disposition of Property This is an area that can be extremely simple or extremely complex. You may want to start by thinking about specific items you want go to certain individuals. These don’t have to be expensive gifts. Perhaps there’s a piece of artwork that your sister has always admired or a ring you have already promised to your daughter. a. Specific Gifts: (use spreadsheet if more than a few gifts) b. Once you have designated specific gifts, you will need to decide who will inherit the bulk of your estate. It can be as simple as “to my husband/wife” or a complex system of trusts and multiple beneficiaries with numerous conditions. Keep in mind that you cannot disinherit your spouse without their permission. Here are some ideas of things you can do. Everything to my spouse Everything to my spouse and children in equal shares XX% to my spouse and the remainder to my children in equal shares XX% to my spouse, XX% to my daughter and XX% to my son Trusts o Income to X for life, then principal to Y o For the care and comfort of X, not to exceed $X,XXX per month/with a minimum distribution of $X, XXX per month o To be used for the education of my children (inclusive of all postsecondary schools, only for four-year institutions, only for MN schools, etc.) o The principal to be distributed when the youngest child turns XX o Multiple trusts with each child receiving the principal of their trust upon turning XX o Income to children for life and then to the Humane Society of MN c. Who do you want the residuary (i.e., whatever is left over) of your estate to go to? The People You’re Leaving in Charge 7. Executor: This is the person or persons who will gather up all of your assets, pay your bills and taxes, and distribute what’s left. a. First Choice: b. Second Choice: c. Third Choice: 8. Personal Guardians for Children (can be different people for each child when appropriate): This is the person who will look after your child and raise them. They do not necessarily have direct access to your child’s inheritance. a. First Choice: b. Second Choice: c. Third Choice: 9. Trustees for Children’s (or other) Trust: This is the person or persons who will manage the trust assets and make distributions according to your instructions. a. First Choice: b. Second Choice: c. Third Choice: 10. Property Guardians for Children: This is the person who will manage your minor children’s assets should you choose to leave them money or property outside of a trust. a. First Choice: b. Second Choice: c. Third Choice: