VAM payroll and Holiday Pay

advertisement

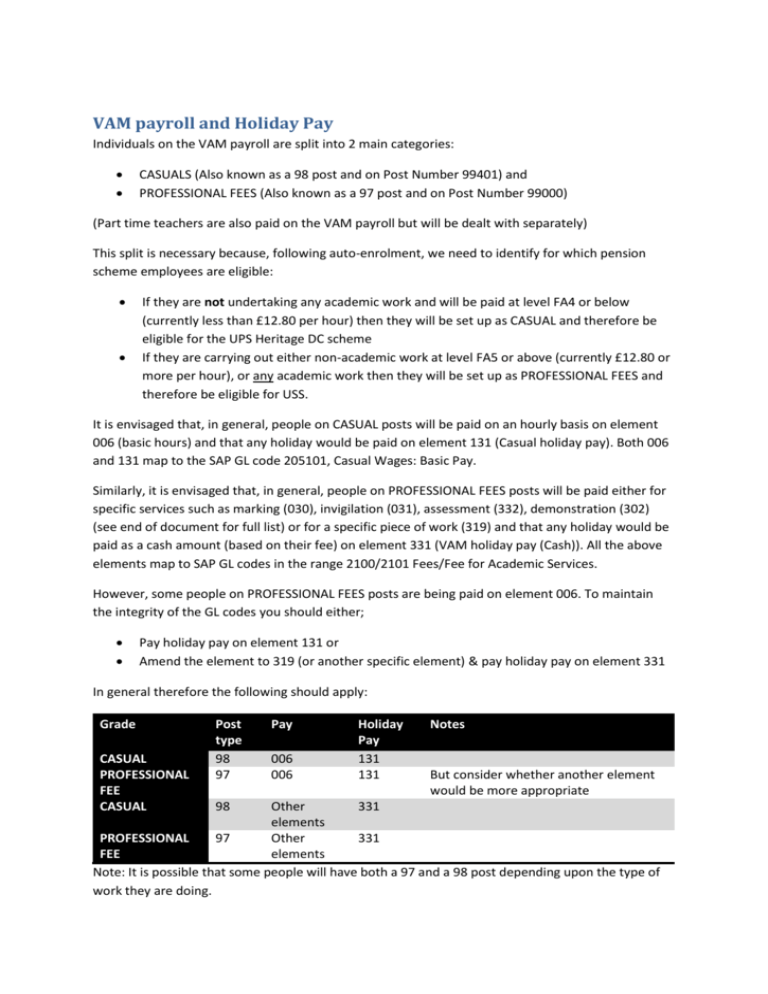

VAM payroll and Holiday Pay Individuals on the VAM payroll are split into 2 main categories: CASUALS (Also known as a 98 post and on Post Number 99401) and PROFESSIONAL FEES (Also known as a 97 post and on Post Number 99000) (Part time teachers are also paid on the VAM payroll but will be dealt with separately) This split is necessary because, following auto-enrolment, we need to identify for which pension scheme employees are eligible: If they are not undertaking any academic work and will be paid at level FA4 or below (currently less than £12.80 per hour) then they will be set up as CASUAL and therefore be eligible for the UPS Heritage DC scheme If they are carrying out either non-academic work at level FA5 or above (currently £12.80 or more per hour), or any academic work then they will be set up as PROFESSIONAL FEES and therefore be eligible for USS. It is envisaged that, in general, people on CASUAL posts will be paid on an hourly basis on element 006 (basic hours) and that any holiday would be paid on element 131 (Casual holiday pay). Both 006 and 131 map to the SAP GL code 205101, Casual Wages: Basic Pay. Similarly, it is envisaged that, in general, people on PROFESSIONAL FEES posts will be paid either for specific services such as marking (030), invigilation (031), assessment (332), demonstration (302) (see end of document for full list) or for a specific piece of work (319) and that any holiday would be paid as a cash amount (based on their fee) on element 331 (VAM holiday pay (Cash)). All the above elements map to SAP GL codes in the range 2100/2101 Fees/Fee for Academic Services. However, some people on PROFESSIONAL FEES posts are being paid on element 006. To maintain the integrity of the GL codes you should either; Pay holiday pay on element 131 or Amend the element to 319 (or another specific element) & pay holiday pay on element 331 In general therefore the following should apply: Grade CASUAL PROFESSIONAL FEE CASUAL Post type 98 97 98 Pay 006 006 Holiday Pay 131 131 Notes But consider whether another element would be more appropriate Other 331 elements PROFESSIONAL 97 Other 331 FEE elements Note: It is possible that some people will have both a 97 and a 98 post depending upon the type of work they are doing. Batch Worksheets The format of PSE means that elements paid at: an hourly rate need columns specifying the rate and the number of hours a cash sum only require a column specifying the total amount Therefore, casual holiday pay (131) needs rate and hours. If you have already calculated the total sum payable, the number of hours can be entered as 1 and the rate as the total to be paid. Batch Worksheet Types Hourly – e.g. element 006 Hourly Holiday Pay – element 131 only (i.e. only payments in conjunction with 006) Tier 4 payments – a separate worksheet is required since we are obliged to record the number of hours worked per week Cash – all payments for a given cash sum, including holiday (331) Common errors Divide the total sum (a) by 1.1207 to calculate the amount excluding holiday pay (b). Holiday pay =a-b. (Do NOT multiply the total sum (a) by 12.07 to calculate holiday pay) All payments should also have a portion of holiday pay. If several payments are being made, this can be rolled up into one total holiday pay. Invalid cost collectors – cost collector must be correct length and valid Incorrect formatting of university number – no leading spaces Common Elements to be used on VAM Batch Worksheets BWS Hourly Element Description For Information: Matching Holiday Pay Element 006 Basic Hours 131 BWS Hourly Holiday Pay Element Description Matching Holiday Pay Element 131 Casual Holiday Pay N/A BWS Tier 4 Element Description Matching Holiday Pay Element 337 Tier 4 Teaching/Research 331 338 Tier 4 Non-academic BWS Cash Element 030 031 034 035 036 040 143 302 311 313 318 319 332 333 335 331 Description Matching Holiday Pay Element Script Marking Exam Invigilation Lecture Fee External Consultancy Ad hoc Teaching Fee Temp PT Teaching On-Line Tutor Demonstration 331 Open Studies Fee Open Day Guide Transcription Fee Assessment Tuition/Training Supervision Holiday Pay (cash) N/A